Summary:

- The number of children and teenagers in the United States diagnosed with type 2 diabetes could rise by as much as 675% by 2060, which boosts the market.

- The dividend per share has risen steadily at 7.2% per year, and management is shareholder-friendly by buying back shares, further boosting the dividend per share.

- In terms of valuation, I think the stock is a bit pricey compared to historical numbers and when considering the Fed’s interest rate hikes.

- Several analysts expect a decline in earnings per share for 2023, which makes the P/E ratio a bit expensive, at 24.

- The stock is certainly worth to buy because of its strong management, growing revenue and free cash flow, but I will wait until the share price is a bit lower in 2023.

hapabapa

Introduction

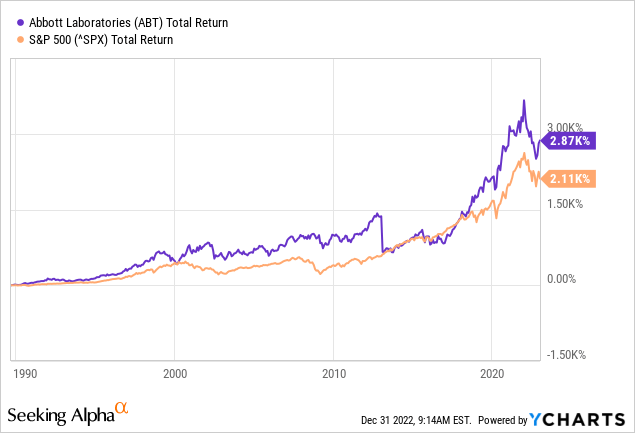

Abbott (NYSE:ABT) did good business during the corona pandemic by providing Covid tests. The stock has done well over the past 5 years, as its annual return is 15.6%.

Abbott’s shares generate income and equity returns. The dividend per share has been growing steadily for years, and the large profits during the corona pandemic were used to repurchase shares, further increasing the dividend per share.

The stock is expensive on average on forward valuation, which is why I prefer to wait for a better entry point.

Strongly Financial Results

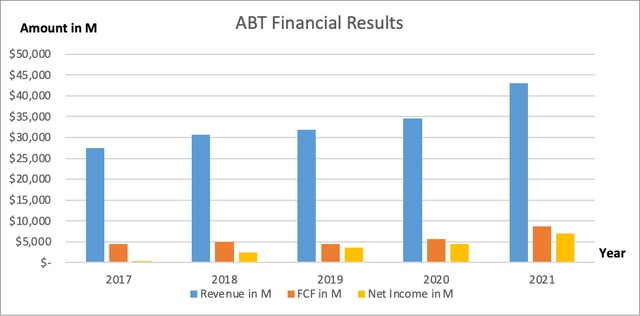

Abbott Financial Results (SEC and author’s own graphical visualization)

Abbott has grown strongly in recent years. From 2017 to 2021, sales increased 12% annually and free cash flow rose sharply, averaging 18% per year.

In the third quarter, sales amounted to $10.4 billion, down 4.7% from the same quarter last year but up 1.3% when adjusted for currency fluctuations. Earnings per share of $1.15 fell 18%, but were above analysts’ expectations.

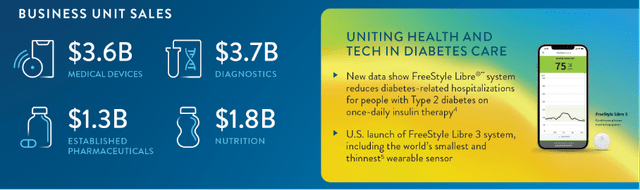

Business Unit Sales (Abbott 3Q22 Investor Presentation)

The temporary shutdown of production of infant formula products at Abbott’s Sturgis, Michigan plant in February impacted sales of Abbott’s Nutrition and Pediatric Nutrition products around the world. Abbott started production again in the facility during the third quarter.

Therefore, the Nutrition segment declined 10% organically in the current quarter compared to last year. For the coming quarters, Nutrition segment sales should increase due to the restart of production.

The decline in Food segment revenues was partially offset by strong growth in the Established Pharmaceuticals segment, as Established Pharmaceuticals segment revenues increased 12% year over year.

Looking ahead, Abbott has a steady stream of new products to increase revenues for the coming years, according to the annual report:

- The first handheld rapid test for concussions.

- NeuroSphere Virtual Clinic, a technology that allows doctors to remotely program our devices that treat chronic pain and movement disorders such as Parkinson’s disease.

- New formulations and flavors of our nutritionals Glucerna, Ensure, PediaSure, Pedialyte and Similac, including our new 360 Total Care formula with a blend of five HMO prebiotics

- Next-generation TriClip device to repair heart valves.

- Navitor, our latest generation transcatheter aortic valve replacement

- (TAVR) system to treat aortic valve stenosis and the Portico TAVR system for transcatheter aortic valve replacement.

- A number of new medicines, including Brufen Rapid, our fast-acting ibuprofen, and Influvac Tetra, our vaccine for four different strains of influenza in multiple countries.

- New tests across our whole family of Alinity diagnostics systems.

- Jot Dx, our insertable monitor to detect abnormal heart rhythms.

- Our Ultreon software to help interventional cardiologists see inside heart vessels and act on the insights it provides.

- Skypoint, the latest generation in our Xience family of coronary stents.

- Over-the-counter versions of our BinaxNOW and Panbio COVID tests for self-testing.

- And two new Amplatzer cardiac devices: Amulet, which helps reduce the risk of stroke in people with atrial fibrillation; and Talisman to treat people with a small opening between the upper chambers of the heart that puts them at risk of recurrent ischemic stroke.

Also, the number of children and teenagers in the United States diagnosed with type 2 diabetes could rise by as much as 675% by 2060, which boosts the market for diabetes devices. Abbott’s CGM and its other diabetes devices are poised to capitalize on this expanding market.

Abbott increased their earnings per share forecast for the full year of fiscal 2022, but 16 analysts on the Seeking Alpha ABT ticker page reduced their estimates for 2023. They anticipate a 14% drop in EPS.

Although the company’s performance remains strong, the earnings decline for 2023 should be temporary and could provide a good buying opportunity if the stock price goes lower.

Looking at the balance sheet, Abbott’s financial position has strengthened over time. The balance sheet is strong with a debt-to-equity ratio of just 0.46, down from 0.9 in 2017. As the company’s free cash flow improved, net debt fell sharply over time, from $18.5B in 2017 to $6.8B today. This indicates that the company has a healthy financial balance sheet.

In addition to strong growth in revenues, free cash flow and net income over the past 5 years, Abbott’s management is shareholder-friendly, as the company has been buying back shares and increasing its dividends for years.

Strong Growth In Dividend Per Share

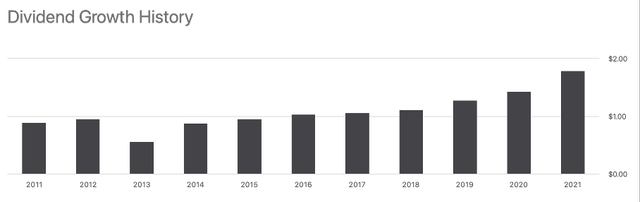

In addition to distributing dividends, the company also buys back shares to increase the dividend per share. Currently, the dividend rate stands at $2.04 (a dividend yield of 1.9%). The dividend per share has increased at an annual rate of 7.2% during the past decade. In 2021, many shares were repurchased, causing the dividends per share to rise significantly.

Dividend Growth History (Seeking Alpha ABT Ticker Page)

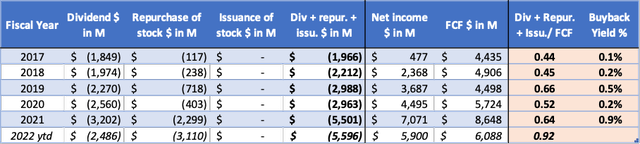

In 2021, a massive amount of $2.3B was allocated on repurchasing shares (buyback yield = 0.9%), an increase of nearly $1.9B from the previous year. Yet, dividends and share repurchases in 2021 were only 64% of free cash flow. Currently, total return to shareholders is 92% due to significant share repurchases this year and the decrease in free cash flow.

ABT Cash Flow highlights (SEC and author’s own calculations)

Wait For A Better Entry Point

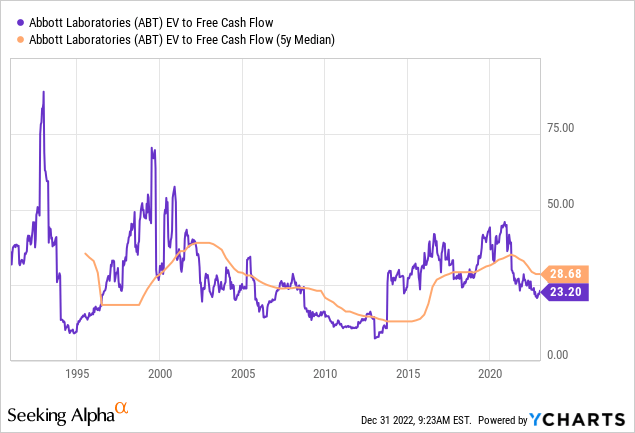

Lastly, we arrive at the stock’s valuation. To account for both debt and cash when valuing stocks, I use the enterprise value-to-free cash flow ratio.

In the past 30 years, this ratio has seen a lot of swings, with 2012 being the most recent time it was extremely favorably valued. The stock’s current EV/FCF ratio of 22.9 is below its historical average of 28.7 and indicates that the stock is trading at a discount relative to its historical values.

Taking a broader perspective, we find that the stock’s valuation is somewhat pricey. Many analysts from the Seeking Alpha ABT ticker page expect lower EPS in 2023 compared to 2022. The forward PE ratio is expected to be 24 (earnings yield = 4.2%), which is somewhat pricey compared to the Fed’s interest rates projection of 5%. Investors can choose safe government bonds with 5% yield or an investment in Abbott with 4.2% earnings yield, which grows over time in normal economic times.

Conclusion

Abbott is a stock that investors buy for its income and equity returns. The dividend per share has risen steadily at 7.2% per year, and management is shareholder-friendly by buying back shares, further boosting the dividend per share.

The company experienced strong sales growth of 12% per year over the past 4 years. Free cash flow also grew strongly, averaging 18% per year. The balance sheet has improved significantly, as the debt-to-equity ratio is just 0.46, down from 0.9 in 2017.

Third-quarter results were mixed, as headwinds from foreign exchange rates led to declining revenues. The nutrition segment also saw falling revenues, but the company released a positive outlook as infant formula production was restarted. This should boost revenue for the coming quarters.

In terms of valuation, I think the stock is a bit pricey compared to historical numbers and when considering the Fed’s interest rate hikes. Several analysts expect a decline in earnings per share for 2023, which makes the PE ratio a bit expensive, at 24. The EV/FCF ratio is at a favorable level of 23 compared to historical figures. The stock is certainly worth to buy because of its strong management, growing revenue and free cash flow, but I will wait until the share price is a bit lower in 2023.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.