Summary:

- We remain bearish on Microsoft’s post-earnings results.

- We downgraded the stock to a sell earlier this year, driven by our belief that the company will be pressured by weaker IT spending in 1H23.

- Amid the AI boom, we recommend investors be wary where others are greedy. We don’t expect Microsoft’s partnership with OpenAI to materialize meaningfully in 1H23.

- We also believe the stock is relatively expensive, trading at 7.5x EV/C2024 sales versus the peer group average of 4.5x.

- We expect the company still has more downside ahead before the stock can recover meaningfully. We recommend investors stay on the sidelines for the near term.

Drew Angerer

We continue to be sell-rated on Microsoft (NASDAQ:MSFT) post-earnings results. We downgraded Microsoft stock to a sell earlier this year. We continue to believe the company is under pressure in the near term due to macroeconomic headwinds creating a weaker IT spending environment. Our current note is focused on analyzing Microsoft’s 2Q23 earnings in relation to the company’s position within the cloud computing space and its extended partnership with OpenAI’s ChatGPT amid global hype about Artificial Intelligence (AI).

Consistent with our beliefs in early January, Microsoft’s 2Q23 earnings report did not reflect strong growth trends from the company’s investment in OpenAI nor a significant uptick in its fastest-growing segment, Intelligent Cloud. Microsoft’s 2Q23 reported a total revenue increase of 2% Y/Y, recording the lowest rate since 2016. The company’s net income also fell from $18.77B in the year-ago quarter to $16.43B this quarter. In the near term, we continue to expect Microsoft’s financials to face churn from softer cloud computing demand and a weaker IT spending environment across its other segments: More Personal Computing and Productivity and Business Processes. We believe Microsoft is taking measures to advance its cloud and AI growth opportunities, but we continue to be bearish on the stock in the near term. We expect Microsoft to be under pressure for the first half of the year and see the stock dipping further toward $200 before it provides a favorable entry point.

Still, not the time to buy

We believe Microsoft’s cloud and AI plans are materializing slower than investors would have liked. Microsoft’s latest quarter, 2Q23, reflects the slowdown on cloud computing fronts and still requires time to reflect meaningful returns from the company’s investment in OpenAI. We expect flat revenue growth to continue for Microsoft due to macroeconomic headwinds in 1H23. The following breaks down Microsoft’s earnings by segment and analyzes the persisting weaker spending environment that drives our bearish sentiment:

1. Microsoft’s three core segments:

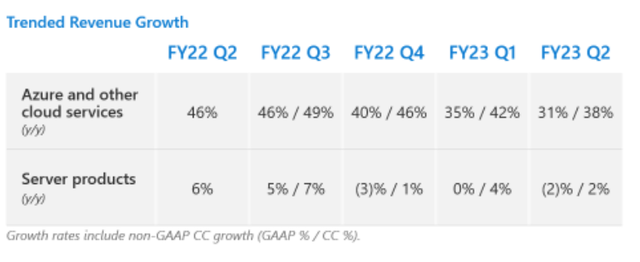

Microsoft’s Intelligent Cloud segment is seeing revenue growth slow down compared to a year ago. Azure and other cloud services reported a 31%/38% Y/Y growth this quarter, compared to 46% in 2Q22. We believe weakness from consumer spending lagged to reflect meaningfully on cloud computing demand until 2H22. Hence, we believe major cloud providers, Amazon’s (AMZN) AWS and Alphabet’s (GOOG) Google Cloud and Microsoft, are now feeling the grunt of softer cloud spending. The following table outlines Microsoft’s Intelligent Cloud segment’s revenue growth.

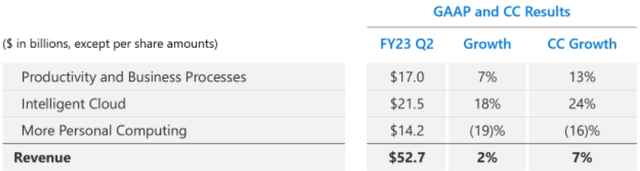

We believe Microsoft’s Intelligent Cloud segment still has more downside ahead before it can regain revenue growth sustainably. We also don’t expect Microsoft’s other two segments to be able to boost total revenue growth in 1H23. The More Personal Computing segment’s operating income dropped 47% Y/Y and represented a revenue decline of 19%. Microsoft’s Productivity and Business Processes segment is also struggling with slower revenue growth in 1H23, reporting a 7% growth this quarter, compared to 9% growth a quarter prior. We expect Microsoft’s core businesses will continue to be pressured by a weaker spending environment in the first half of the year. We expect things will get worse before they get better for Microsoft; we recommend investors wait on the sidelines for the downside from the weaker spending environment to be factored into the stock.

The following table outlines Microsoft’s three core segments’ revenue growth this quarter.

2. Microsoft’s partnership with OpenAI’s ChatGPT:

We’re constructive on Microsoft’s recent, more serious venture into the AI space, but recommend investors be cautious about expecting significant returns from Microsoft’s investment into OpenAI in the near term. Since our last note on the company, Microsoft formally announced it’s in the third phase of its long-term partnership with OpenAI; Microsoft has invested $10B in OpenAI and extended its multibillion-dollar investment in a multiyear deal that will place the company as OpenAI’s exclusive cloud provider. The company is also rumored to challenge Alphabet by integrating ChatGPT into its Bing Search results and even potentially utilizing language AI tech in PowerPoint, Word, and Outlook apps. OpenAI has already triggered a more public AI arms race, with Alphabet coming up with its own version of ChatGPT called “Bard,” which hasn’t been off to the best start. We expect Microsoft’s partnership with OpenAI to be a major long-term growth driver, but continue to believe that the partnership will not be meaningfully reflected in Microsoft’s earnings in the near term.

Valuation

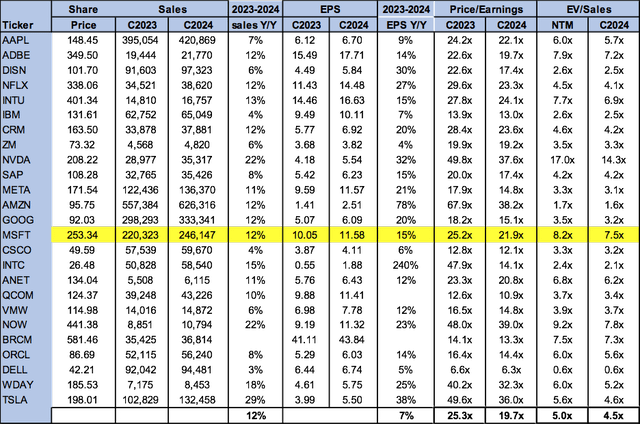

We don’t believe Microsoft is cheap, trading above the peer group average. On a P/E basis, the stock is trading at 21.9x C2024 EPS $11.58 compared to the peer group average of 19.7x. The stock is trading at 7.5x EV/C2024 sales, versus the peer group average of 4.5x. We recommend investors hold off on buying the stock yet, as we expect more downside ahead in 1H23.

The following table outlines the company’s valuation compared to the peer group.

Word on Wall Street

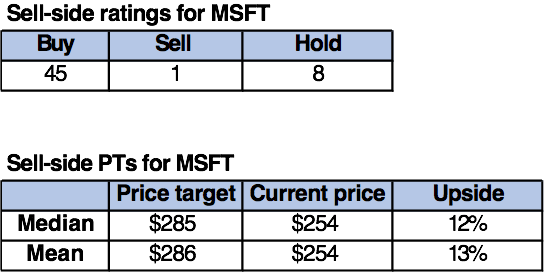

Wall Street is overwhelmingly bullish on Microsoft. Of the 54 analysts covering the stock, 45 are buy-rated, eight are hold-rated, and the remaining are sell-rated. We believe Wall Street’s bullish sentiment is driven by Microsoft’s rapid venture into AI and its leading position within cloud computing. While we’re bullish on the stock in the long run, we believe the company still has some downside in the near term before it can recover meaningfully.

The following tables show MSFT’s sell-side rating and price targets.

TechStockPros

What to do with the stock

We continue to be sell-rated on Microsoft. In the long run, we’re bullish on Microsoft, as we believe the company is on the brink of two major growth markets: cloud computing and AI. However, we don’t believe the company provides a favorable entry point at current levels. We believe Microsoft’s 2Q23 earnings results highlighted a persisting weaker spending environment, and hence, we expect Microsoft’s financials to continue to be under pressure during the first half of the year. We expect the stock to creep lower to its 52-week-low of $213.43. We will continue to monitor the stock closely to see how the company maneuvers macroeconomic headwinds, with its layoffs of 10,000 employees being the latest of the sort. We recommend investors wait on the sidelines for the downside to get priced in.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.