Summary:

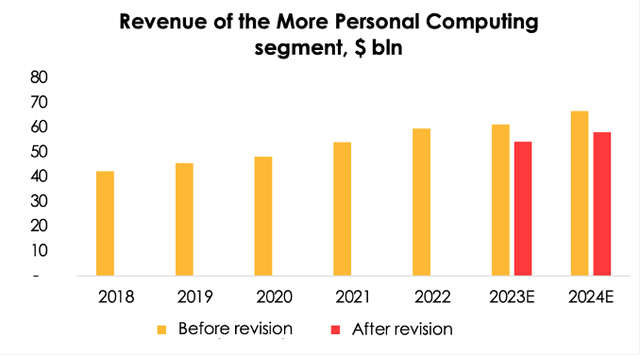

- Revenue totaled $52.7 bln (+2% y/y) compared with our estimate of $58.8 bln. The results were down 10% from our forecast due to a lower revenue in the PC segment.

- The company’s EBITDA totaled $24.1 bln (-6.6% y/y), also missing our forecast for $29.3 bln. The difference is attributable to the lower revenue.

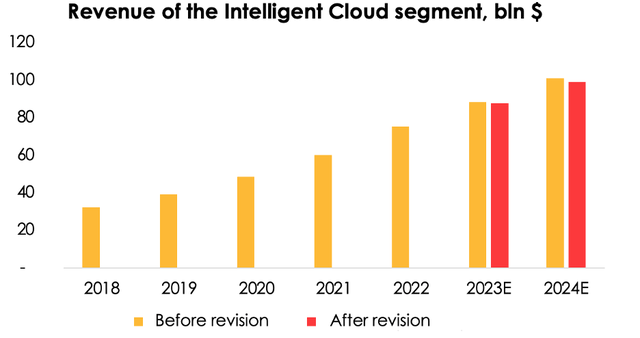

- During the conference call, the management for the first time acknowledged the cloud computing segment had slowed toward the end of 2022 and said they expected it to continue slowing.

- Worldwide PC shipments slumped by 29% y/y. Consumers are starting to extend the PC replacement cycle amid rising basic costs, even as retailers offer significant discounts to stimulate sales.

- It is too early to invest in the company just yet, as Microsoft has been valued fairly by the market now. Rating is HOLD.

Jean-Luc Ichard

Investment Thesis

We expect the PC and laptop market to decline further, which will reduce demand for Microsoft’s (NASDAQ:MSFT) OEM products. The deal to buy Activision (ATVI) will most likely fall through as it’s opposed by other major players such as Sony (SONY) and by FTC. The slowdown in the cloud segment – the main driver for the future growth of financial results – is also having an adverse effect on the performance of MSFT shares. We expect the slowdown to continue. And the recent major investment in ChatGPT, despite all the popularity, will take quite a long time to bring any significant money to the company.

We believe it’s too early to invest in the company just yet, as Microsoft has been valued fairly by the market now.

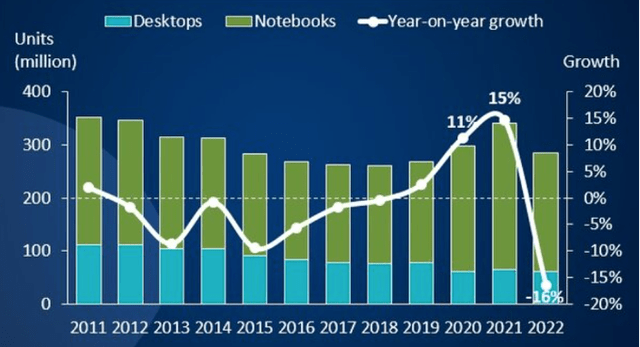

PC market

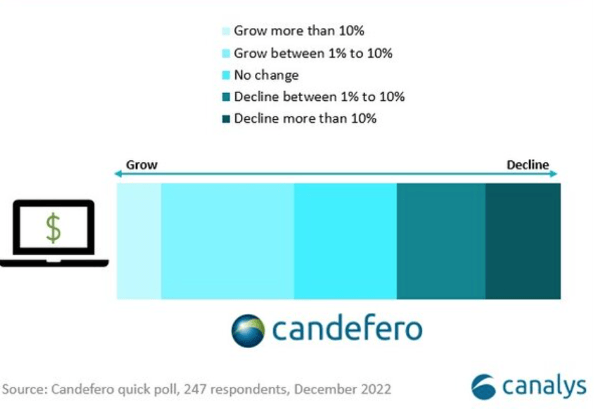

Worldwide PC shipments slumped by 29% y/y to 65.4 mln units in 4Q 2022, according to Canalys, while over the full year 2022 they dropped by 16% y/y to 286 mln units. Notebook shipments underwent a larger decline relative to desktop PCs, down by 30% y/y to 50.1 mln units in 4Q 2022 and by 19% y/y to 223.8 mln units over the full year 2022. Consumers are starting to extend the PC replacement cycle amid rising basic costs, even as retailers offer significant discounts to stimulate sales.

The PC market will also come under pressure from the weakening demand by corporate customers amid considerable workforce reductions. According to Canalys, about 60% of respondents in a recent poll of its channel partners said they expect their PC business revenue to remain unchanged or decline in 2023.

Canalys

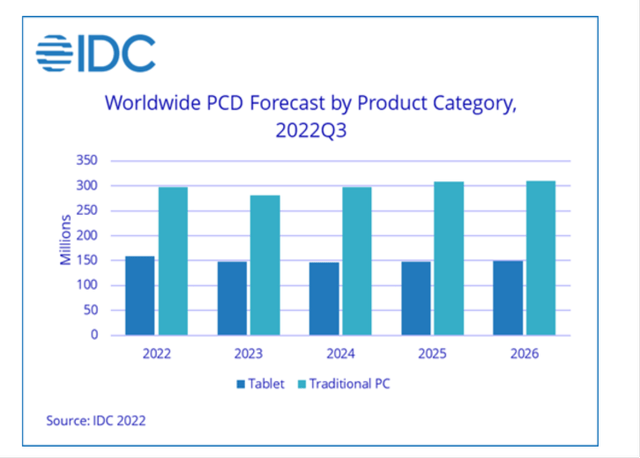

We base our forecasts on the IDC outlook for worldwide PC shipments. According to IDC, worldwide PC shipments will continue to fall, declining by 5.3% y/y in 2023 amid a depressed demand. Physical shipments of PCs are set to decline by an average of 0.5% per year through 2026 due to high excess inventory and longer PC refresh cycles.

Therefore, we have lowered the revenue forecast for the More Personal Computing segment from $61.2 bln (+3% y/y) to $54.4 bln (-9% y/y) for 2023, and from $66.7 bln (+9% y/y) to $58.1 bln (+7% y/y) for 2024 due to a stronger-than-expected contraction of the PC market. The lower physical PC shipments will also hit the sales of the Windows software.

Cloud

During the conference call, the management for the first time acknowledged the cloud computing segment had slowed toward the end of 2022 and said they expected it to continue slowing in 2023. That’s why, we have also reduced the beta of the segment’s growth to the market growth from 0.8x to 0.7x for the forecast period to 2024. Therefore, the projected growth of the cloud computing segment has been cut from 17.2% y/y to 16.4% y/y for 2023 and from 14.4% y/y to 12.2% y/y for 2024.

Activision Blizzard acquisition goes awry

As a reminder, the US Federal Trade Commission blocked Microsoft’s proposed acquisition of Activision Blizzard (the deal was valued at $70 bln).

The FTC said (as per clause 96 of its administrative complaint), that the acquisition could substantially limit competition and open the way to the monopolistic dominance of Microsoft in the relevant markets. Following the acquisition, Microsoft’s rivals could lose access to Activision Blizzard’s games, while consumers would potentially face higher prices and a reduced choice of games.

As we noted in a special issue on the matter, that stripped MSFT of potential $4 bln in EBITDA in 2024 (4% of the total EBITDA), as well as $3 bln in FCF in 2024 (5% of the total FCF).

We believe the failure to conclude the Activision Blizzard deal is neutral for MSFT. NetEase recently tore up the 14-year deal with ATVI, meaning the company is losing the Chinese market. Such deals are the only option for international studios to distribute their games inside China.

Valuation

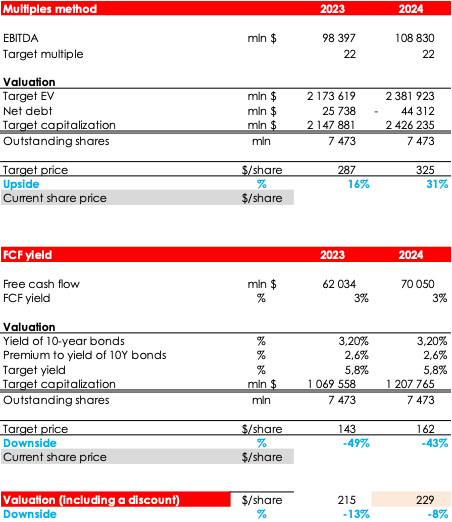

Based on the new assumptions, we are maintaining the rating for the shares at HOLD. The downside is 8% and fair value price is 229. We are evaluating MSFT target price based on 2024 EV/EBITDA multiples & FCF Yield methods (average price between methods are taken).

Invest Heroes

Conclusion

We have a negative view on MSFT in terms of its future PC and Cloud segments results, and we would not recommend buying the stock right now. Under current conditions, Microsoft does not look like a great instrument with positive prospects. Since the stock generally follows the patterns of the major indices, we would wait for a general market decline to buy. Current rating for the stock is HOLD.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.