AT&T: The Narrative Should Start Shifting To Dividend Growth

Summary:

- In recent years, the actions of AT&T have left many investors jaded and hesitant, thereby creating a poor narrative.

- As everyone knows, their bungled Time Warner acquisition and subsequent spin-off saw their once cherished dividends cut.

- I suspect this poor story laced with disappointments contributed to their lackluster share price performance across recent years.

- When looking ahead, their results for 2022 and guidance for 2023 sees a potential reset as they hopefully move towards a narrative of dividend growth.

- When combined with their deleveraging, this should help remove one of the bear cases, and thus, I believe that maintaining my strong buy rating is appropriate.

No-Mad/iStock via Getty Images

Introduction

The prospects of weaker economic conditions have been lingering since the middle of 2022 when it seemed there was a recession knocking, although, in the case of the beaten down AT&T (NYSE:T), their shares were already priced for a depression, as my previous article highlighted. Despite the subsequent months being anything but smooth, right now, their shareholders are enjoying a bright spot as the market digests their results for 2022 and accompanying guidance for 2023 that is seen as a potential reset after years of disappointments. When it comes to share prices, I feel the narrative is quite important because a poor story surrounding a company can easily scare away conservative investors, regardless of their prevailing financial performance.

The Changing Of The Narrative

I feel a material issue hampering their share price during recent times is their narrative or story, so to speak because, from a strict financial aspect, they generate very desirable amounts of free cash flow that seemingly, could never be translated into a more respectable share price. To this point, even after the recent rally, their current market capitalization is approximately $142b and thus still sees a very high free cash flow yield of circa 10% given their free cash flow of $14.1b during 2022, as per their fourth quarter of 2022 results announcement.

Admittedly, their unfavorable narrative stems from the actions of management throughout recent years. Most notably, racking up debt and fighting the government to acquire Time Warner, only to subsequently spin it off into Warner Bros. Discovery (WBD) a few years later whilst simultaneously cutting their once cherished dividends. Given the lackluster share price performance of the latter since the spin-off, it is not difficult to see why many shareholders are jaded and hesitant of trusting AT&T. Whilst painful, this is now in the past and when looking ahead, their shareholders can look forward to higher results in 2023 that hopefully will draw a line in the sand to mark the beginning of a new era for their narrative as memories of their disappointments fade into the past.

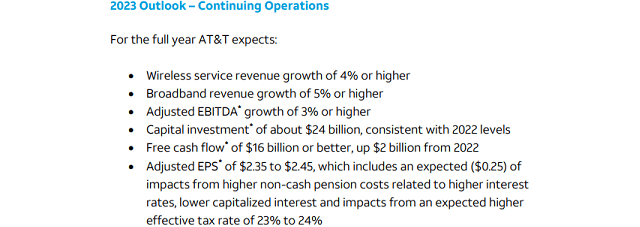

AT&T Fourth Quarter Of 2022 Results Announcement

When looking at their guidance for 2023, it sees strong forecasts right across the board from revenue to EBITDA and free cash flow with everything poised to see year-on-year growth. In my eyes, it is particularly positive to see their free cash flow growing by $2b when combined with broadly flat capital expenditure, thereby showing the cash-generating strength of their company improving without having to pull back on investments. Naturally, different investors may have different views on what is the most important part of their guidance, but either way, this is still positive, especially with each part of their guidance stating “or higher” afterward. As a result, if anything, this actually raises the prospects for pleasant surprises to help cement a new narrative of growth, which should one day translate into their dividends.

Since their existing dividend payments only amount to circa $8b per annum, the prospect of generating free cash flow of $16b or better indicates they should see coverage of around 200% during 2023. In the short term, this leaves ample free cash flow for deleveraging, whereas, in the medium to long term, this sees ample scope for dividend growth as their debt burden eases.

On this topic of their supposedly burdensome debt, it is easy to see why it scares investors whenever someone mentioned their net debt, which ended 2022 at a massive $132.2b. In absolute terms, this obviously starts sounding more like the GDP of a small or developing nation, but relatively speaking, it is not nearly as scary when considering their adjusted EBITDA was $41.5b during 2022. This leaves their net debt-to-adjusted EBITDA at 3.19, and whilst not a low result by any means, it nevertheless is only moderate and still manageable. Since they are a massive company that generates ample free cash flow, I do not feel this leverage is troublesome, but alas, others seemingly do not share this view, and regardless, they are focused on deleveraging, as per the commentary from management included below.

“We will use our free cash flows to pay out our dividend and to pay down debt as we continue to progress towards our target of 2.5x net debt to adjusted EBITDA, which we anticipate will take place in early 2025.”

-AT&T Q4 2022 Conference Call.

Despite having ample scope to fund higher dividends right now and forecasting stronger financial performance in 2023, management is staying intent on finally putting to rest the narrative surrounding their supposedly burdensome debt that bears often highlight. In particular, they wish to push their net debt-to-EBITDA down to 2.50 versus its present result of 3.19, which is expected to be reached in early 2025. Even though this may feel like a distant point in time, it is already approaching the two-year mark from when they first announced their spin-off of WarnerMedia, and at least in the meantime, their existing circa 5.50% dividend yield pays shareholders to wait.

Thanks to their ability to generate ample excess free cash flow after dividend payments and prospects for higher earnings, they should have no issues deleveraging as the years pass. Admittedly, only time will tell whether they reach this goal on time, but if nothing else, they should have no issues making progress, and thus, at worse, it should be a case of when, not if.

Conclusion

Finally, after years of being weighed down by their poor Time Warner acquisition, subsequent spin-off, and worst of all, the associated dividend cut, I expect the narrative surrounding their shares should start shifting towards growth, and eventually, dividend growth as they leave this disappointing era in the past. Even though this is certainly not a simple overnight change but rather a gentle change across time, it nevertheless is helped along by deleveraging. The lower their net debt goes, the less of a distraction their supposedly burdensome debt becomes, further helping change the narrative surrounding their shares, and thus, I believe that maintaining my strong buy rating is appropriate.

Notes: Unless specified otherwise, all figures in this article were taken from AT&T’s SEC filings, all calculated figures were performed by the author.

Disclosure: I/we have a beneficial long position in the shares of T either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.