Summary:

- The GPT-3 technology used by the Microsoft-backed chat isn’t that unique and unrepeatable filler, as far as I can tell from various sources.

- However, the cost of a mistake has given ChatGPT and Bing extra hype push that may help it suck up some of Google’s search engine market share.

- Regardless of how the battle continues, for today, MSFT has the Edge [forgive the pun] – it’s time to use your dry powder that I wrote about accumulating last time.

Yongyuan Dai

Intro & thesis

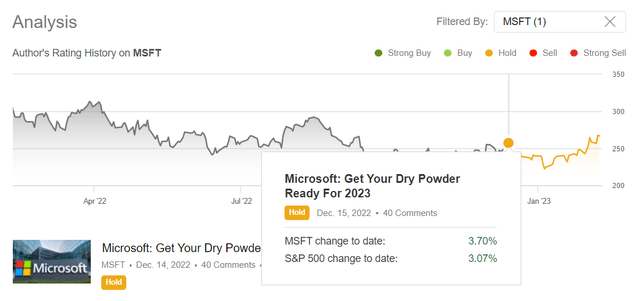

To date, I have only written 1 article on Microsoft (NASDAQ:MSFT) on Seeking Alpha – in mid-December 2022, I recommended investors get their dry powder ready for 2023 after a potential sell-off:

Seeking Alpha, author’s NSFT coverage

The stock came under some pressure after my call – much weaker than I had originally expected. After that, MSFT slowly started to grow again.

A lot of interesting things have happened in the recent past that Microsoft investors should be aware of. This time, my thesis is simple: the GPT-3 technology used by the Microsoft-backed chat isn’t that unique and unrepeatable filler, as far as I can tell from various sources. But while others were postponing their releases of analogous search solutions, the cost of a mistake has given ChatGPT and Bing extra hype push that may help it suck up some of Google’s (GOOG) (GOOGL) search engine market share.

Actually, ChatGPT is not that unique in its filler

I have already talked about this in my recent bullish article on Google – “Google Stock: Layoffs Change It All” – but I’ll recap it again here so that as many people as possible understand that OpenAI has no competitive advantage over what the other big tech companies are developing.

According to a recent research report from UBS analysts [Lloyd Walmsley and Karl Keirstead], Google is not trailing behind OpenAI in terms of technology. In fact, their research and evaluations have revealed that Google’s PaLM [Pathways Language Model] technology is top-notch, but the company has not yet made it publicly accessible in the same way that OpenAI has.

You could see for yourself how bitter the current AI race looks. According to Fortune, Alphabet and Baidu both revealed their own versions of the popular ChatGPT on Monday. Sundar Pichai [Alphabet’s CEO] released a blog post that provided more insight into their AI program, called Bard, which is based on its Language Model for Dialogue Applications (LaMDA) and is only available to a select group of testers.

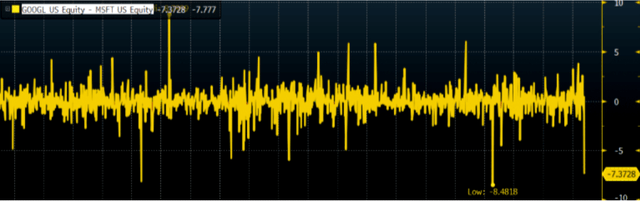

On Wednesday, Google hosted an event where Bard was introduced. According to media reports [Goldman Sachs, proprietary source], there is still some work to be done to make the technology a usable tool – quite the opposite of ChatGPT, whose work has not been so critically evaluated so far [at least I could not find any]. It has heavily weighted on GOOGL stock, which experienced one of the largest 1-day drawdowns in its history:

The Market Ear citing Goldman Sachs

It seems to me that Google tried to rush an unfinished product to market and took a reputational risk – the market began to doubt that the company could compete on a level playing field with OpenAI’s development. However, in my opinion, one should not forget how huge Google’s pipeline is so far.

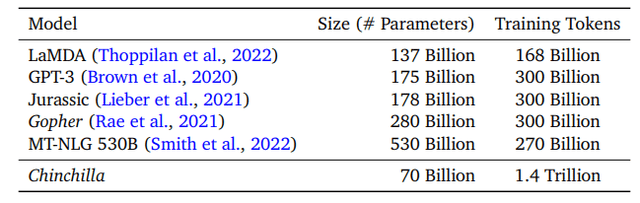

Since acquiring DeepMind in 2014, the company has hired a lot of talent and invested significant sums in AI. In an attempt to optimize the performance of LLM [Pathways Language Model] models that require simultaneous scaling of model size and training model [not just the model size], Deepmind developed Chinchilla, whose main goal was to outperform other LLMs such as Gopher and GPT-3 in several language benchmarks, including tasks that measure Massive Multitask Language Understanding, Beyond the Imitation Game benchmark, and an ethics-based benchmark.

As Eray Eliaçık writes [February 2, 2023], training previous language models has shown that if one wants to double the size of a model, one has to double the number of training tokens used. This concept was applied to the training of Chinchilla AI by DeepMind. Although Chinchilla AI costs about the same as Gopher, it has 70 billion parameters and is trained with four times as much data. On a variety of evaluation tasks, Chinchilla outperforms other language models such as Gopher (with 280 billion parameters), Megatron-Turning NLG (530 billion parameters), Jurassic-1 (178 billion parameters), and GPT-3 (175 billion parameters) and achieves remarkable results [from DeepMind’s research paper]:

So Chinchilla AI looks like a revolutionary improvement in terms of performance and efficiency compared to other peers, whose list is actually getting longer and longer every day – ChatGPT from OpenAI is just the tip of this huge iceberg.

Dataconomy.com

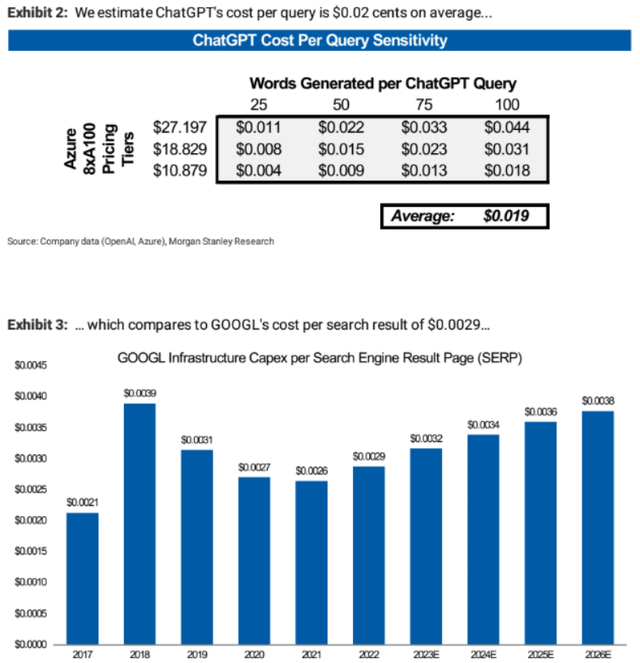

As I wrote in a previous article about Google, using ChatGPT to generate queries costs OpenAI about 7 times as much as good old Googling, according to Morgan Stanley analysts:

Morgan Stanley [January 10, 2023]

Okay… Then why am I bullish on MSFT?

Everything you have read above is definitely the limiting factor for the expansion of Microsoft’s Bing search solutions. However, if we look at the big picture from an investor’s perspective with a horizon of a few years [at least], I think MSFT now seems to be a pretty attractive investment in terms of risk-reward ratio.

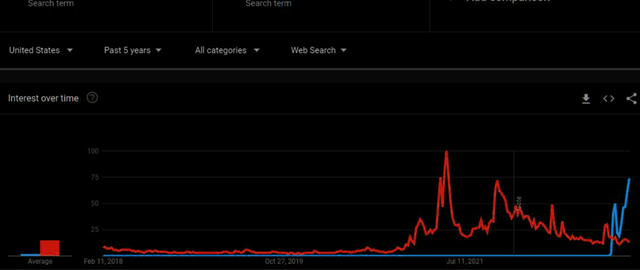

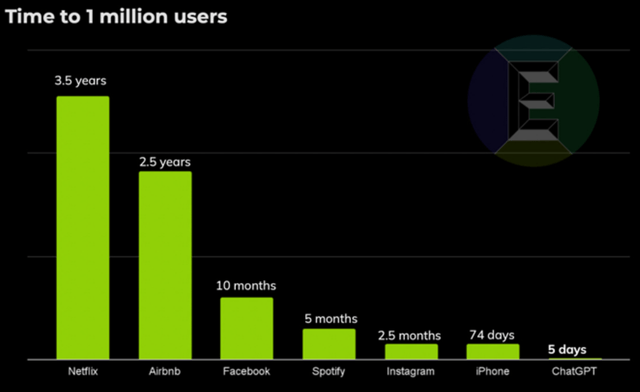

First, as the first mega-cap company to make the new AI tool a reality and not just a distant-tantalizing future, MSFT has launched a grandiose PR campaign that has been languishing for over a month now. Who would have thought that ChatGPT would become the new “crypto” in terms of popularity?

Not to mention how fast the Chat attracted its first 1 million users compared to other techs.

The Market Ear citing Exponential View

Tim Knight from Slope of Hope calls ChatGPT the NFT of 2023, and it’s hard to disagree with that statement when we look at the graphic above.

Intentionally or not, MSFT has created great hype and made ChatGPT a flagship to which the broad mass of users will involuntarily compare all other new AI-driven tools, even if they are much faster and more optimized (like Google’s Chinchilla).

In terms of business practice, this is certainly positive for MSFT, because a) investment in OpenAI will only grow in valuation [read – on paper] once the project is commercialized [apparently OpenAI is not far from that] and b) after the words of MSFT’s CEO on Tuesday about “the new Bing” powered by ChatGPT, this search engine will likely attract most of those who now use the Chat only as an editor or illustrator [depending on the need].

From this assumption follows my second point – the expansion of Bing’s market share. This is a key point that many have now thought about. Kevin Roose of the New York Times believes that the relaunch of Bing is particularly significant for Microsoft, which has struggled for years to gain a foothold in search. He still has to get used to his feeling that Bing looks good now.

According to Statista, as of December 2022, Bing holds about 8.95% of the global desktop search market share, while Google accounts for 84.08%. Yahoo, Baidu, Yandex, and others collectively occupy less than 7%. Based on MSFT’s Q2 FY2023 quarterly filling, the firm’s “Search and news advertising” segment made $3.223 billion in revenue for the quarter – that’s 6.11% of total sales. “Google Search & other” for comparison generated 57.44% for Google in FY2022.

Microsoft, which is essentially a monopolist in the operating system market, covets the bread and butter of another monopolist while it has a good basis for developing competitiveness. At the same time, MSFT is not losing much in either case – if Google copes with ChatGPT, then Bing’s share will likely stay the same and the $11 billion of MSFT’s investment in OpenAI will be just a drop in the bucket for the tech giant [spread across multiyear period]; if Bing gains at least 2-5% of Google’s market, then it will be an absolute game changer for both companies – MSFT will expand and better diversify its revenue and Google’s stock will fall more often like it did on Wednesday. Personally, I think a borderline scenario is more likely, where MSFT’s Bing will win back 2-3% of the market, but Google will roll out Chinchilla or something else from DeepMind very soon, stopping the process of user migration. As you can see, in any case, Microsoft has an absolutely unique advantage in my argument – that’s why I see a favorable risk-reward in MSFT compared to other mega-capitalized tech companies.

Risks to my thesis

The fact that Google’s Bard turned out to be an incomplete model does not change the company’s desire to protect its market share from Microsoft – the war for a place under the sun has just begun, and ChatGPT, given its non-uniqueness that I wrote about above, runs the risk of losing all the hype and not helping MSFT in this consumer race.

Other players in the market – not just Google – have also caught on quickly and are now introducing AI-driven tools to support their search solutions. So the competition, in my opinion, is the biggest risk to Bing from MSFT.

In addition, now is not the best time to make huge investments – against a backdrop of rising interest rates, CAPEX/R&D as large as $10 billion is quite impressive. It saves that MSFT has more than $130 billion on its balance sheet and that this additional $10 billion will be spent gradually.

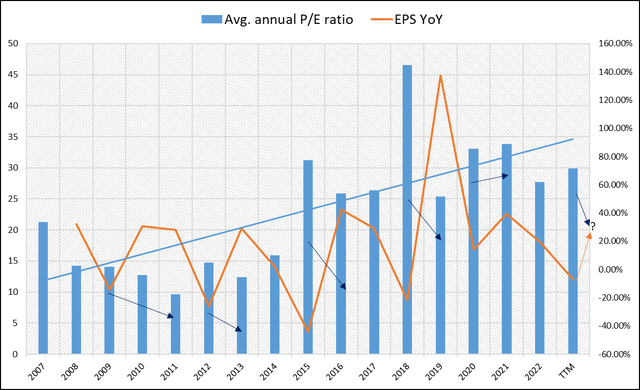

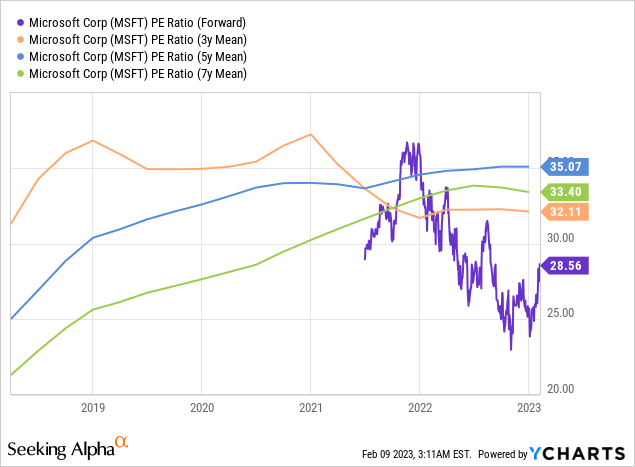

I am also puzzled by MSFT’s valuation, which seems quite high today. The company has a P/E GAAP (FWD) of about 29x, which I think is a very generous estimate. If we look at the historical relationship with EPS growth rates, we find an interesting correlation: almost every EPS expansion led to a multiple contraction in the future (and vice versa).

Author’s calculations, based on Seeking Alpha

The same thing happens now when we compare the current valuation with the long-term averages:

If MSFT’s EPS growth does not reach double digits in FY2024 or remains negative in FY2023 – both options are contrary to analysts’ consensus estimates – then the multiple contraction will likely continue, and MSFT runs the risk of hitting a new low along with the rest of the market.

The verdict

Despite the abundance of obvious risks, I believe the new version of Bing changes the way we should evaluate Microsoft’s prospects. While most of the threats to Google may be overblown as I wrote in my last article on the company, I believe MSFT now has a better risk/reward ratio for medium to long-term investors.

It is best to have both Google and Microsoft in your portfolio, as it is likely that the frontrunner in the AI search race will be decided between these two companies. For today, however, MSFT has the Edge [forgive me the pun] – it’s time to use your dry powder that I wrote about accumulating last time.

Thank you for reading!

Disclosure: I/we have a beneficial long position in the shares of MSFT either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Struggle to navigate the stock market environment?

Beyond the Wall Investing is about active portfolio positioning and finding investment ideas that are hidden from a broad market of investors. We don’t bury our heads in the sand when the market is down – we try to anticipate this in advance and protect ourselves from unnecessary risks accordingly.

Keep your finger on the pulse and have access to the latest and highest-quality analysis of what Wall Street is buying/selling with just one subscription to Beyond the Wall Investing! Now there is a free trial and a special discount of 10% – hurry up!