Summary:

- Microsoft’s expected -7% EPS growth for the Dec ’22 quarter is the first y.y decline expected for EPS since the Sept. 2015 quarter.

- Street consensus is expecting fiscal ’24 – ’27 to return to mid-teens EPS and revenue growth, which all depends on Azure. Watch Azure guidance, it’s MSFT’s most important metric today.

- Azure and the cloud are MSFT’s growth engine today.

- Azure and cloud guidance exiting the Sept ’22 quarter was very conservative.

- The big positive coming into the earnings release is the tempered expectations for the rest of ’23. No one is expecting much from the software giant.

Jean-Luc Ichard

With Microsoft’s (NASDAQ:MSFT) fiscal Q3 ’23 financial results scheduled to be released on Tuesday, January 24th, 2023, after the market close, investors will get their first look at the SP 500 mega-cap’s earnings results for the December ’22 quarter.

Microsoft still comprises 5.4% of the SP 500’s market cap as of Friday, January 20, 2023 and is the 2nd largest stock in the SP 500 by market cap in the SP 500, behind only Apple.

Sell-side consensus expectations for the fiscal Q2 ’23 quarter for the enterprise-software giant are for $2.30 in EPS on $52.9 billion in revenue for expected year-over-year (y.y) growth of -7% and 2% respectively.

That represents a significant slowing from the fiscal 2021 and 2022 pace, all of which could already be discounted in the stock price.

Full-year fiscal ’23 estimates today expect Microsoft to earn $9.55 in EPS on $212.2 billion in revenue for expected growth in the next 6 months of 4% in EPS and 7% in revenue.

Satya Nadella, Microsoft’s CEO said two weeks ago that the slowdown would likely last another 2 years, however the interesting aspect to that is that sell-side estimates expect a return to double digit, mid-teens EPS and revenue growth by fiscal 2024 (starts July 1 ’23.)

One metric I’ve watched over the year for Microsoft is the comparison between revenue growth and operating income growth. This provides an interesting take on pre-Covid growth, what happened during the pandemic and then the return to more normal growth rates since the pandemic:

MSFT TTM rev vs TTM operating income (valuation spreadsheet )

Peak revenue in late ’21 was 21% revenue growth vs 31% operating growth. Obviously, this is now in the process of returning to a more-normal growth rate.

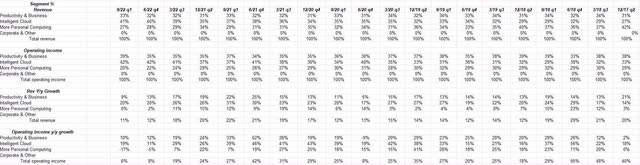

Microsoft by segment

Microsoft by segment (Valuation spreadsheet / earnings reports )

The importance of this table shows the growth in Intelligent Cloud (IC), the primary product of which is Azure.

If this spreadsheet were expanded to reach back to the start of the last decade or 2010 to 2104, readers would see that the Intelligent Cloud was just 20% or less of total revenue and operating income when the last decade started.

Obviously, readers can see the growth in the IC since.

When the September ’22 quarter was reported in early November ’22, MSFT reported +42% growth in Azure and then guided to +36% – +37% for the December ’22 quarter for the key cloud product.

In addition, bookings in the Sept ’22 quarter fell to +16%, versus the +35% in the June quarter of ’22.

MSFT valuation

Part of the longer-term problem is that the stock never looks cheap. Trading around $240 per share coming into earnings, MSFT sports a 25x multiple for expected 4% EPS growth in fiscal ’23.

The “average” PE looking 3 years out from ’23 is around 18x, so the stock is trading closer to 1x PEG looking at ’24 – ’27 EPS estimates, with mid-teens revenue growth, but that’s assuming the Intelligent Cloud segment and Azure can sustain the present growth rates.

MSFT does have a 4% free-cash-flow yield and the ability to repurchase an enormous amount of stock, with the stock trading down $100 per share since its peak in 2021 at $345. But management likely won’t do that and the dividend will continue to grow nicely at its 10% annual clip, although with a yield of just over 1% the dividend yield isn’t meaningful.

However, the dividend as a % of FCF dollars is now below 30% – MSFT could hike the dividend to a greater degree, or like they did in 2002, pay-out a special dividend, but that is unlikely. Before Ballmer left, he said the special dividend payout was – in Microsoft’s terms – a poor use of capital.

Summary/conclusion

Expectations are very subdued coming into MSFT’s fiscal Q2 ’23 earnings release on Tuesday night, January 24, 2023. That’s always a plus, but personally, I expect an inline quarter and rather subdued guidance since that has been the posture of Satya Nadella the last few months.

It seems unusual that Satya Nadella would say two weeks ago that the growth slowdown would last 2 years, and then be optimistic on the call Tuesday night.

However, the fall in the dollar in the 4th quarter of ’22 should help MSFT at the margin, as well as the rest of large-cap tech. This blog post from December 26th ’22 showed how large-cap tech companies were impacted by the unusually strong dollar in calendar ’22 and Microsoft was no exception.

Microsoft saw a 500-bp headwind from the strong buck in the Sept ’22 quarter.

The other positive for MSFT is that for calendar ’23 financial results face easier compares from the strong demand driven spike in fiscal ’21 and then early fiscal ’22. The December ’21 compare is actually not that difficult, while it is a tough compare for larger mega-cap tech companies.

In the September ’22 quarter MSFT caught some grief from analysts after lowering depreciation expense by extending the useful life of some servers, which is a quality of earnings issue, but given MSFT’s cash and free-cash-flow generation, it’s worth noting but not a serious issue.

MSFT is still a large holding for clients, but I’m not expecting much in the quarter or from guidance. The fact is expectations have come down so much for the software giant, I think the stock could outperform after getting shellacked in 2022: MSFT fell 28% in 2022 versus the SP 500’s 18% decline, however, I do not believe that this market environment is a replay of 2000 to 2002, when the Nasdaq fell 80%.

Morningstar still sports a $320 fair value on the stock. Leaving MSFT at a bigger discount to intrinsic value than it’s probably traded at in the last few years.

Watch Azure guidance by the Microsoft management team. It will likely be subdued, but it’s not expected to be dire, and it’s MSFT’s most important metric looking forward.

Over the next few weeks post earnings, I’ll be watching to see if the 2024 – 2027 EPS and revenue growth rates change negatively.

Disclosure: I/we have a beneficial long position in the shares of MSFT either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.