Summary:

- After the recent re-financing moves, the bankruptcy possibility looks now to be in the rearview mirror.

- The credit de-risking sent the stock a lot higher, but further growth should track closer the operational improvements in dayrates and utilization.

- The dayrate outlook is great, but 10 of Transocean’s 39 rigs remain cold stacked; the company’s base case implies 2 re-activations, but there is no specific news yet.

- Transocean owns a majority of the cold stacked ultra-deepwater drillships worldwide, so statistically there should be a call on its fleet, especially after Valaris already re-activated some of its rigs.

- I retain my long position in Transocean’s common shares but took profits on my LEAPS.

leskas/iStock via Getty Images

Investment thesis

Transocean Ltd. (NYSE:RIG) made two back-to-back re-financing moves that should take the bankruptcy risk off the table:

Transocean commences $500M senior secured notes offering

Transocean unit commences $1.75B senior secured notes offering

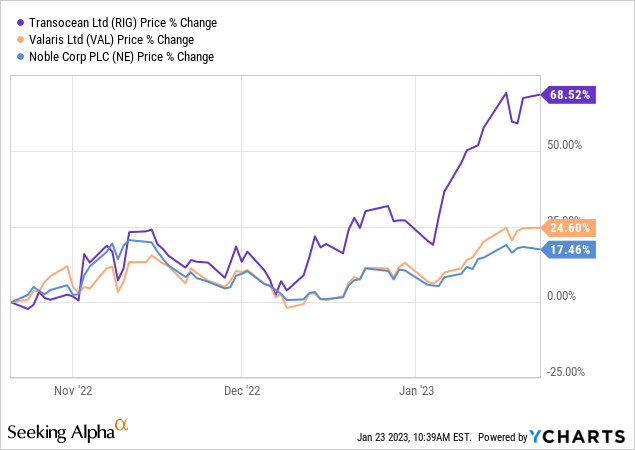

Predictably, the stock has rallied quite a bit and outpaced competitors Valaris (VAL) and Noble (NE):

This was by no means a “free lunch” for RIG shareholders, but rather a compensation for the risk that Transocean wouldn’t be able to extend its financing. As I wrote an year ago:

Within the drilling space, RIG is highly levered, so if the segment recovers, RIG will offer new investors the greatest bang for the buck.

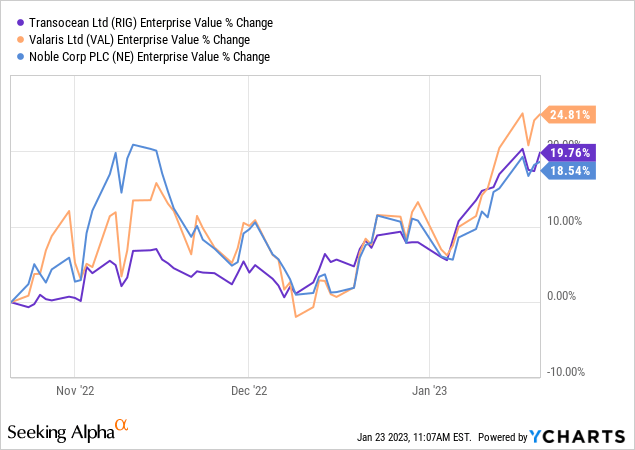

If we look at enterprise values instead, i.e. removing the financial leverage effect, Valaris actually outperformed Transocean over the last three months:

Understanding the contribution of leverage is important because, now that RIG has been de-risked and its “torque” is diminished, future stock price gains should be driven more by operational than financial factors.

These operational factors are of course dayrates and utilization. Dayrates are in the $400k zone now, and may very well reach the all time highs of $600k, which would still be much less on inflation-adjusted basis compared to 2012-2014. Going from $400k to $600k will also have a disproportionate effect on RIG’s cash flows due to “operating leverage” as the main cost input – the drillships themselves – is fixed. However, the same can be said of Valaris, Noble or any other driller.

Where RIG may have some further operational “torque” is the fact that 10 of its 39 rigs are cold stacked. Re-activating a stacked rig is quite expensive and all of the RIG / VAL / NE managements have pretty much said there won’t be any speculative re-activations without a firm customer contract. Nonetheless, Valaris has shown recently that, when the market is tight, customers may even be willing to fund upfront some of the re-activation cost, as Equinor (EQNR) agreed to do with the DS-17 rig.

Moreover, if we look at the ultra-deepwater drillships, of the 17 cold-stacked rigs tracked by Woodmac, 9 are Transocean rigs. As Valaris, Noble and others don’t have as many stacked rigs, statistically Transocean should benefit the most from future re-activation calls. On the other hand, if we don’t see rigs re-entering the market, the dayrates may perhaps even go above $600k; as I discussed in a prior article the utilization-dayrate relationship is non-linear:

As utilization rates increase, dayrates may initially not move much as long as there are idle rigs sitting on the side. However, once utilizations get close to 85%-90%, an “inflection point” seems to occur that can send dayrates much higher.

The fleet can also increase if newbuilt rigs enter the market, but the new construction costs appear even more prohibitive than the re-activation capex, and the drillers’ CEOs have stated no one has plans to order new rigs right now. So, the drillers’ cash flows stand to gain from either higher dayrates or more rigs working.

I remain bullish on RIG, but, now that bankruptcy has come off the table, I have taken some gains.

Credit update

While Transocean’s receipt of $515 million from the Titan secured financing was probably largely expected, the placement of $1.175 billion in 2030 senior secured notes seems like a bigger deal. The 2030 notes extend a number of the company’s earlier maturities, albeit at a higher interest rate of 8.75%, compared to the debt that will be retired.

The reaction in the credit market has been positive. Here is how pricing changed on Transocean’s debt maturities that will now stand behind the new 2030 notes (based on Refinitiv data):

| Maturity | Option-adjusted spread, 01/20/2023 | Option-adjusted spread, 01/04/2023 |

| 15-Apr-2031 | 900 bps | 1,127 bps |

| 15-Mar-2038 | 760 bps | 854 bps |

| 15-Dec-2041 | 950 bps | 1,129 bps |

Moody’s has rated the new 2030 notes a “B” and has upgraded Transocean’s issuer rating. Credit rating agencies tend to move behind the curve, so the upgrade also makes me think that the worst is officially over for Transocean.

Operational economics

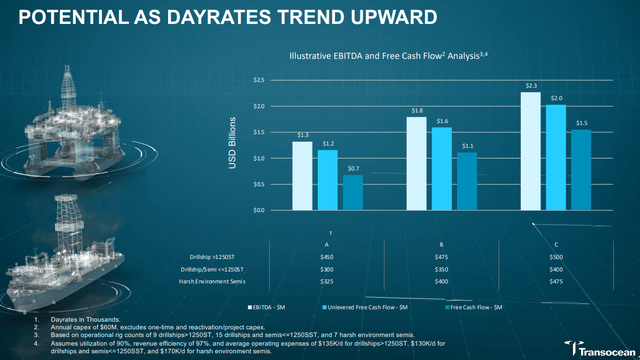

Transocean’s recent presentation summarizes what the company see as its bull case:

Transocean Investor Presentation

If dayrates for the higher end rigs approach $500k, Transocean is looking at $1.8 to $2.3 billion in annual EBITDA; let’s call it $2 billion. Seeking Alpha’s enterprise value calculation stands at $10.59 billion, so we are looking at a 5x EV/EBITDA multiple. I find this reasonable.

What Transocean mentions in the fine print is that these scenarios assume 31 working rigs that are 90% utilized. Since there are 26 rigs working now (10 stacked, 3 idle), that implies 5 more rigs need to get work. The rigs currently listed as “idle”, i.e. available to work, include:

- Deepwater Orion, recently awarded a contract in Brazil to commence in Q4 or 2023;

- Dhirubhai Deepwater KG2, idle since January 2022

- Deepwater Nautilus, idle since October 2022

Logically, these three idle rigs would be put to work first. That leaves two more to come out of the cold stacked fleet. The harsh-environment semi-submersibles Transocean Leader and Henry Goodrich were built in respectively 1987 and 1985, although they received upgrades in more recent times. Just because of the age factor, I would think one of the ultra-deepwater drillships has better prospects of working again.

The UDW stacked fleet

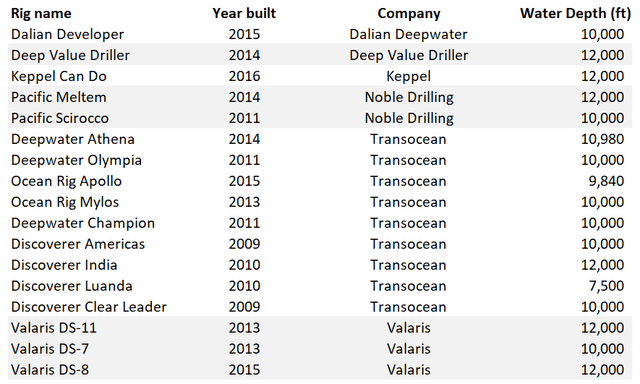

While Transocean’s stacked fleet may not stand out technically, RIG has more than 50% of the currently stacked UDW drillships:

Woodmac; FSRs; Author’s research

Valaris already re-activated some its floaters, so obviously it has fewer rigs that it can re-activate in the future. I would think going forward RIG has higher chances of getting a re-activation just because it has a broader choice of rigs it can bid to customers.

Further, because Transocean has relatively more stacked rigs than Valaris or Noble do, if the economics makes re-activations profitable, Transocean may stand to gain more from its higher operating leverage, similarly to how its financial leverage has allowed it to outperform the other two companies.

What does management say

Transocean has acknowledged that it does bid its stacked rigs; Jeremy Thigpen during the Q3 call:

As the supply of high-specification floaters remains extremely limited, we anticipate there will be more opportunities to begin reactivating our cold stacked fleet. As always, we will continue to prudently examine all opportunities to place our cold stacked RIGs back into the market and thoroughly assess each potential reactivation on a case-by-case basis to ensure that each creates value for the company and our shareholders.

CFO Mark Mey:

We’ve said consistently, I think, over the last 4 or 6 quarters that we will reactivate RIGs to contract. Hence, you have not seen us do this. With the most recent Petrobras tenders, we have built in some of our cold stacked RIGs. And there’s a good possibility that we’ll be able to achieve 1 or 2 of those rigs on contract. Those contracts at those rates and mobilization fees will allow us to fully pay back the cost to reactivate the rig long before the end of the contract. So we’re very comfortable doing this and balance sheet leverage or not is not going to be habit us from activating rigs.

In other words, management is actively looking for re-activation opportunities, but it has to be paid by the customer; there won’t be speculative re-activations. The management of Noble and Valaris have expressed similar sentiment, and neither company is rushing to the shipyards with newbuild orders either.

Risks

We seem to be in a multi-year capex long cycle, so I don’t think there are as many fundamental economic risks in the short term, even if oil prices go lower. As Schlumberger’s (SLB) CEO Olivier Le Peuch said during the company’s Q4 earnings call:

The combination of long-cycle oil capacity expansion projects, offshore deepwater resurgence and strong gas development activity will be a key driver for the multiyear duration of this cycle.

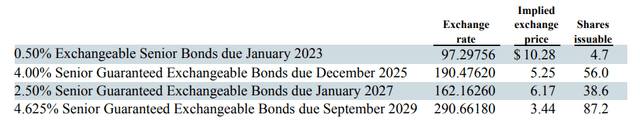

However, some of the hard refinancing choices Transocean had to make along the way in order to survive may still pressure the equity. In particular, RIG has several bonds that are exchangeable for shares:

In total, it appears these bonds can result in up to 186.5 million new shares getting issued; that represents about 25% of the current 721.9 million share count, and some of these are already in the money. Since the debt will also go away, this doesn’t mean earnings per share will fall by 25% too, but it is a factor that investors should be mindful of.

Takeaway

There is always some residual risk, but I would contend that the re-financing announcements earlier this month largely took bankruptcy off the table. This is good news for investors who were already long as the credit de-risking resulted in an impressive bull run over the last three months.

However, on the flip side, now that we are out of the bankruptcy zone, the stock price will probably grow at a rate more consistent with that of Valaris and Noble, which were already de-risked for their (new) shareholders by virtue of their restructurings. Transocean still remains more levered, so operational improvements should have a multiplier effect on the equity, but the biggest move up happens at the margin, when a company goes from a restructuring candidate to a going concern, and that has already happened.

On the operational side, I think Transocean would have a bit more torque than Valaris or Noble, just because it owns a majority of the world’s cold stacked drillships. If the market continues to tighten and there is a call on these stacked rigs, Transocean has relatively more to gain.

I retain my long position in Transocean’s common shares, but I closed out my LEAPS call options.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Disclosure: I/we have a beneficial long position in the shares of RIG, SLB either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: My articles, blog posts, and comments on this platform do not constitute investment recommendations, but rather express my personal opinions and are for informational purposes only. I am not a registered investment advisor and none of my writings should be considered as investment advice. While I do my best to ensure I present correct factual information, I cannot guarantee that my articles or posts are error-free. You should perform your own due diligence before acting upon any information contained therein.