Microsoft: Get Your Dry Powder Ready For 2023

Summary:

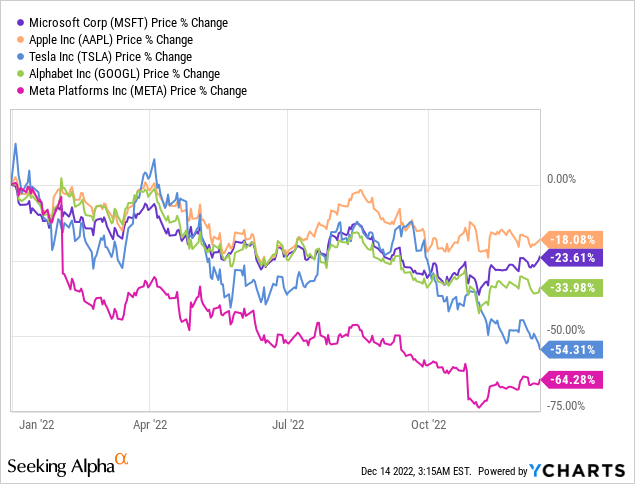

- I consider Microsoft Corporation one of the most stable in its niche, but at the same time still quite expensive to buy now, even after a 23% YTD drawdown.

- The company is among the candidates for more modest EPS growth and a lower net margin compared to what is currently priced in.

- I expect analysts to keep revising their price targets in the next few quarters based on even lower EPS numbers or multiples.

- Microsoft’s ChatGPT early investment is really promising. I also like the company’s development in the gaming space.

- We’ll all need a lot of dry powder to buy the dip in Microsoft stock somewhere in mid-2023. But now, the stock is a strong Hold for me.

Introduction & Thesis

Jean-Luc Ichard

While reviewing various research reports, I came across a recent report from Goldman Sachs that was sent to bank clients on December 5, 2022. In it, the analysts look at the tactical positioning of mutual funds (x-axis) and hedge funds (y-axis) and conclude that FAAMG companies are currently underweight:

Goldman Sachs, 2023 US Equity Outlook [December 5th, 2022], author’s notes![Goldman Sachs, 2023 US Equity Outlook [December 5th, 2022], author's notes](https://static.seekingalpha.com/uploads/2022/12/14/49513514-1671005118274807.png)

That is, demand for these stocks from institutional investors has fallen for one reason or another. Recently, I have already published individual articles on some of these companies, in particular:

- “Some Say Google Insiders Are Buying Heavily, We Say Don’t Follow“;

- “Apple Stock: You Have Been Warned“;

- “Meta Should Slow Down Its METAbolism, Sell-Side Says“; and

- “Tesla: Accounting And Valuation Concerns“.

However, I’ve never touched Microsoft Corporation (NASDAQ:MSFT) before here on Seeking Alpha, although MSFT is one of the most stable mega-cap stocks together with Apple (AAPL):

I consider Microsoft one of the most stable in its niche, but at the same time still quite expensive to buy now, even after a 23% YTD drawdown. In my opinion, we will still have a good opportunity to buy MSFT near the bottom – my analysis suggests such an opportunity in 2023. Therefore, I strongly recommend that you get your dry powder ready until then.

Why do I think so?

I suggest dwelling on the above Goldman Sachs report for a while and analyzing it in more detail. As I understand it, the chart you saw above is based on the inflows and outflows of 2 groups of institutional investors – a positive difference in the total flows indicates a tactical overweight, and a negative indicates an underweight.

The “bad news” applies to all FAAMG companies at once – why are you reading specifically about MSFT now?

The point is that MSFT is the most important company for most institutional investors (hedge funds). As the same GS report shows, provided that this position is among the 10 largest holdings, it reaches 8% of the total portfolio on average:

Goldman Sachs, 2023 US Equity Outlook [December 5th, 2022], author’s notes![Goldman Sachs, 2023 US Equity Outlook [December 5th, 2022], author's notes](https://static.seekingalpha.com/uploads/2022/12/14/49513514-16710069121667004.png)

At the same time, the company is among the candidates for more modest EPS growth and a lower net margin compared to what is currently priced in:

Goldman Sachs, 2023 US Equity Outlook [December 5th, 2022], author’s notes![Goldman Sachs, 2023 US Equity Outlook [December 5th, 2022], author's notes](https://static.seekingalpha.com/uploads/2022/12/14/49513514-16710074610608304.png)

From this, I conclude that in the scenario where Microsoft fails to meet investors’ expectations of upcoming earnings (in the next quarter or even a few quarters later), the stock could be affected by a massive exit of hedge funds from their positions.

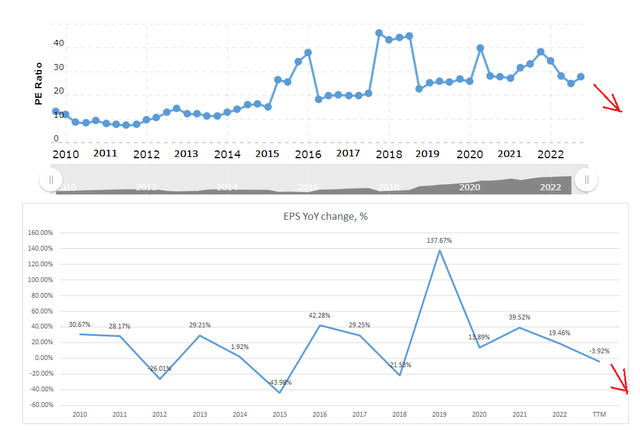

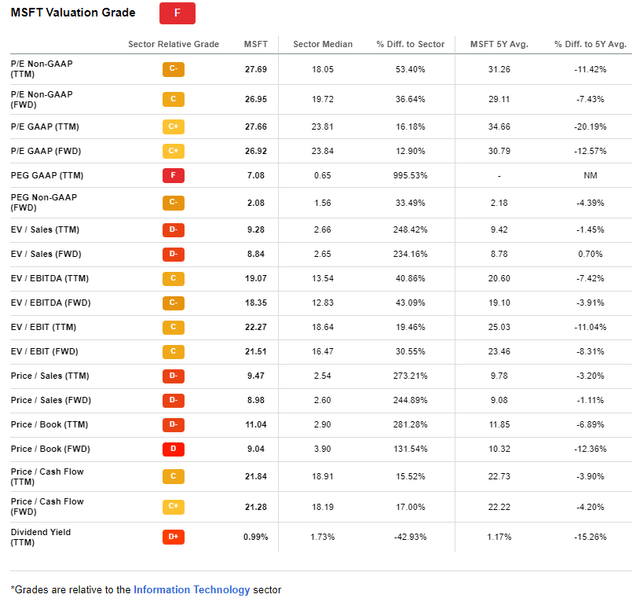

Lower earnings will demand more modest multiples from the company for a less rosy future – in any case, I think there is room to move down in MSFT valuation multiples today:

Author’s calculations, based on macrotrends.net and roic.ai

2018 was notable for MSFT despite falling EPS (it fell over 22% YoY). That year, the company experienced frenetic growth in its cloud segment, launched Windows 10, and acquired GitHub – all of which combined to allow the stock to grow >35% while maintaining an unnaturally high P/E of 40-45x.

In 2015, although layoffs and the phone business weighed heavily on Microsoft’s financial results (EPS declined 44% YoY), it was the company’s success in the cloud that helped its share price rise 20%. Some acquisitions pointed to a potentially bright future for the company – and that allowed MSFT to justify the increase in its multiple from an average P/E of 15.9x in 2014 to 31.2x in 2015.

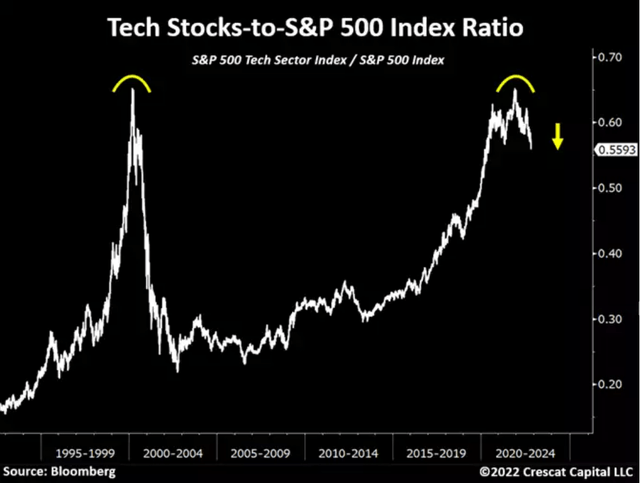

I rightly expect 2023 to be like no other. However, my impression is that MSFT stock, which along with other biggest technology companies takes up too large a share of the overall market, is likely to shrink as liquidity is blown away in the market – this picture looks too unsustainable to remain relevant in the event of downward revisions to EPS numbers:

Crescat Capital Goldman Sachs, 2023 US Equity Outlook [December 5th, 2022], author’s notes

![Goldman Sachs, 2023 US Equity Outlook [December 5th, 2022], author's notes](https://static.seekingalpha.com/uploads/2022/12/14/49513514-16710126621894996.png)

In my opinion, most of the company’s multiple is not due to upside potential – EPS growth of only 17.5% is projected for the next 2 years – but to the liquidity that the Fed has pumped into the market over the past few years. Why? Because when the company was growing at 20-30% per year (in terms of earnings per share), its average annual P/E ratio was only 15-20x, and now it’s 27.7x, making the company grossly overvalued compared to the entire IT sector:

Seeking Alpha, MSFT, Valuation

The issue of market liquidity was recently addressed by Tony Pasquariello, global head of hedge fund client coverage at Goldman Sachs [below is his Dec. 9 note]:

I can’t see the argument for lasting, significant upside: with QT and negative earnings revisions just starting to really kick in — alongside money market rates that are assuredly heading higher — we’re going into 2023 with a stock market that charges an 18 multiple for the prospect of … 0% earnings growth.

MSFT’s EPS has been revised 36 times in the last 3 months – all revisions have been to the downside. I expect analysts to keep revising their price targets in the next few quarters based on even lower EPS numbers or multiples – this is not just a problem for MSFT, but for the entire stock market. In any case, the macroeconomic models [provided by Alf from The Macro Compass, November 24, 2022] indicate the inevitability of this process:

Alf from The Macro Compass [November 24, 2022]![Alf from The Macro Compass [November 24, 2022]](https://static.seekingalpha.com/uploads/2022/12/14/49513514-16710146534760742.png)

Therefore, I must recommend selling the rips in MSFT stock (or at least holding the stock) for the next 6 months and not adding at current levels.

Bottom Line

In the very long term, I remain optimistic because of Microsoft’s unique market position – more than 70% of OS’s market share and more than 1/5 of the whole cloud market share allow the company to invest intelligently and diversify accumulated cash flows into technologies such as OpenAI’s ChatGPT, which surprised everyone just a few days ago. SA fellow Livy Investment Research even called this technology the company’s “prescient investment,” which it most likely is.

I also like the company’s development in the gaming space – becoming the market leader with a projected long-term CAGR of 9% looks quite interesting as this growth can be leveraged through synergies from the integration of the company’s other products.

However, I expect a sharp decline in earnings per share in 2023 – or at least a P/E multiple contraction to reflect slowing growth [compared to the 2021-22 high base] – so MSFT will likely become undervalued again sometime in mid-2023. Then we’ll all need a lot of dry powder to buy the dip – but now, Microsoft stock is a strong Hold for me.

Thanks for reading!

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Struggle to navigate the stock market environment?

Beyond the Wall Investing is about active portfolio positioning and finding investment ideas that are hidden from a broad market of investors. We don’t bury our heads in the sand when the market is down – we try to anticipate this in advance and protect ourselves from unnecessary risks accordingly.

Keep your finger on the pulse and have access to the latest and highest-quality analysis of what Wall Street is buying/selling with just one subscription to Beyond the Wall Investing! Now there is a free trial and a special discount of 10% – hurry up!