Summary:

- Activision deal is up in the air but expect Microsoft to pull it off.

- 14th consecutive annual dividend increase is extremely likely.

- Microsoft can handle almost any “What If” scenario with its ecosystem.

- Technical setup keeps improving.

Jean-Luc Ichard

Seeking Alpha comment streams sometimes offer as much entertainment as the article or news item. Commenters come in all forms: subscribers, authors, market place contributors, and sometimes even SA Editors. If there is one thing many SA readers agree on, it is the collective skepticism of Wall Street analysts and their recommendations. When an investment firm downgrades an addictive product with pricing power at the peak of inflation, your doubts are indeed validated. Hence, I was a bit surprised to agree with this analyst news item on Microsoft (NASDAQ:MSFT) over the weekend. And with the same investment firm in question, Morgan Stanley (NYSE:MS).

I wanted to take this opportunity to explain further why I agree with the Morgan Stanley analyst in this case as despite a 25% fall YTD, Microsoft heads into 2023 as a strong bet.

The Activision Flip Flop

If you are confused on where the Activision Blizzard (NASDAQ:ATVI) merger stands right now, you are excused. The flip-flop is not due to either of the two companies involved but the regulatory cloud hanging over the deal. In just the last week or so, we’ve seen the following:

- Activision dipping on rumored FTC challenge

- News outlets downplaying the FTC challenge

- Microsoft being ready to go to court if needed

- Rumor that a rift at FTC may provide the path for the deal to get done

The FTC needs to prove its presence and challenge massive acquisitions. However, with little question of national interest or security concerns, I fully expect the Activision deal to go through in 2023. Microsoft is offering concessions that will likely appease the regulators over the main plaintiff Sony’s (SONY) concerns. Regardless, Microsoft’s deep pockets will come in handy in case of a legal contest. Bottomline, we fully expect the deal to close given how much the company has put into this deal and how Microsoft CEO Satya Nadella feels about Gaming:

“Gaming has been key to Microsoft since our earliest days as a company. Today, it’s the largest and fastest-growing form of entertainment, and as the digital and physical worlds come together, it will play a critical role in the development of metaverse platforms.“

14th Annual Dividend Increase

In September, Microsoft announced its 13th consecutive annual dividend increase as covered here. Given that the forward payout ratio is sitting at a comfortable 28%, investors can once again expect a generous double digit increase from Mr. Softie. That would place the new quarterly dividend at nearly 75 cents per share.

The new Microsoft is not famous for its dividend yield (rightly so) but it is far too easy to forget that anyone who bought the pre-Satya Nadella Microsoft shares is now sitting at a nice 10% yield on cost as the stock was stuck in the $20s forever. But looking into the future, Microsoft’s robust fundamentals and cash flow should convince investors that the stock is well on its way to becoming a dividend growth champion, if not one already. As an example of how ridiculously strong Microsoft’s ability to cover and increase dividend is, consider this:

- Microsoft has about 7.5 Billion shares outstanding.

- At the current quarterly dividend rate of 68 cents per share, Microsoft needs $5.1 Billion per quarter to meet its current commitment to shareholders.

- In the last five years, Microsoft’s worst quarter from a free cash flow perspective generated nearly $32 Billion. Enough said.

But What If?

But what if the economy continues weakening? What if inflation continues eroding corporate profits? What if the competitors catch up with Microsoft’s Cloud dominance? All these are valid questions. But, in its 4 decade existence (and excellence) as a public company, Microsoft has been through

- the 1987 stock market crash as an infant

- the 2000 dotcom crash as a teenager

- the 2007 financial crisis as a young adult

- the 2020 COVID crash as a mature adult at his/her peak

It may not be an overstatement to say the 4 events above killed thousands of companies. What does not kill you makes you stronger. The Morgan Stanley upgrade rightly labels Microsoft as “strong and durable”. If there is no recession, Microsoft’s Azure (The Strong) will continue shining. If there is a rain in the Cloud (sorry for the pun!), the company has its productivity and business apps (The Durable) to fall back on. As a long-term fan of Apple (AAPL), I recall the days when Steve Jobs and Bill Gates fundamentally disagreed on the “ecosystem” concept. It is now astonishing to see Microsoft not only trying to become a one-stop shop but also excelling in all aspects of its ecosystem while trying to add more crown jewels to it. Refer the “Microsoft Ecosystem” in this article.

Technical Indicators

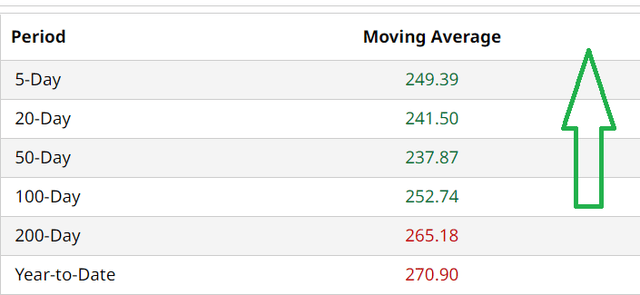

From a technical perspective, Microsoft has taken out all moving averages except the most important one, the 200-Day moving average, which is now just 4% away. Despite the recent accumulation and momentum, Microsoft appears far from overbought using the Relative Strength Index (RSI) metric. A RSI of 62 is in the sweet spot with enough room left to roll along on the bullish side.

MSFT Moving Average (Barchart.com)

Conclusion

It is not an understatement to say Microsoft is a stock for all seasons. After a 25% fall, the stock is more fairly valued now and is actually one of the best large cap tech performers this year if you put things into context. It is not a steal here by any means but quality is rarely cheap. Even if you don’t agree with this particular Morgan Stanley analyst’s price target of $307, Microsoft has a general median price target of $290, which should net investors a 15% total return including dividends. Microsoft remains a “buy on weakness” juggernaut that will lead technology stocks on the next runup.

Disclosure: I/we have a beneficial long position in the shares of MSFT, AAPL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.