Summary:

- Our analysis delved into Microsoft’s Copilot development, which aligns with the company’s AI integration strategy, as we explored the potential benefits.

- We identified Copilot’s common advantages across Microsoft’s segments, scrutinized pricing strategies, and estimated revenue opportunities across each of its segments.

- Copilot’s impact across various segments is significant, as we calculated a revenue opportunity of $56 billion by 2028 which translates to 12% of total revenues by then.

FinkAvenue

In the previous analysis of Microsoft Corporation (NASDAQ:MSFT), we focused on the company’s cloud business outlook with revised cloud market projections at a 5-year average growth of 23% continuing to be driven by data volume growth. We believe Microsoft’s strategic partnerships with Oracle, OpenAI, and Salesforce are seen as advantageous for capitalizing on the expanding cloud market whereas the company’s development of custom Arm-based chips could generate cost savings and enhance Microsoft’s competitiveness. Additionally, we highlighted Microsoft’s breadth of cloud services and AI-related offerings strength, projecting a factor score 1.14x higher than the market growth as we believe it is well positioned to continue gaining market share and a forward average cloud revenue growth of 28.5% supporting Microsoft’s total growth.

In this analysis, we delved into the development of the company’s Copilot and its alignment with Microsoft’s overarching strategy to integrate AI across its product and service portfolio. Additionally, we explored the potential advantages this initiative could bring to Microsoft. Initially, we identified and consolidated the key benefits offered by various Copilot products to users across different segments of Microsoft’s offerings. We also scrutinized the pricing strategy for both announced and forthcoming Copilot products, while estimating the potential user base to gauge revenue prospects for each product. Furthermore, we investigated potential integration avenues for Copilot within Microsoft’s segments that are not currently in its development pipeline, and projected the revenue opportunity should Microsoft choose to incorporate Copilot into these segments as well.

Copilot Productivity Boost

In our previous analysis, we explained that we believed Microsoft is a company that is a pioneer in innovation in AI across Software & Services. We highlighted its focus on complementing its AI product developments into its main segments such as Office and Server Products segments. Additionally, we explained the company’s exclusive partnership with OpenAI as their cloud service provider and also the integration of their GPT-4 technologies across Microsoft products. Copilot is an AI assistant powered by Microsoft Prometheus model which leverages GPT-4. In the company’s latest earnings briefing, Copilot had been mentioned repeatedly 52 times as management emphasized its ongoing developments and future plans. Copilot represents one such product development that highlights the company’s move to continue to integrate AI across its products and services as explained by management in the quote below.

With Copilots, we are making the age of AI real for people and businesses everywhere. We are rapidly infusing AI across every layer of the tech stack, and for every role and business process to drive productivity gains for our customers. – Satya Nadella, Chairman & CEO

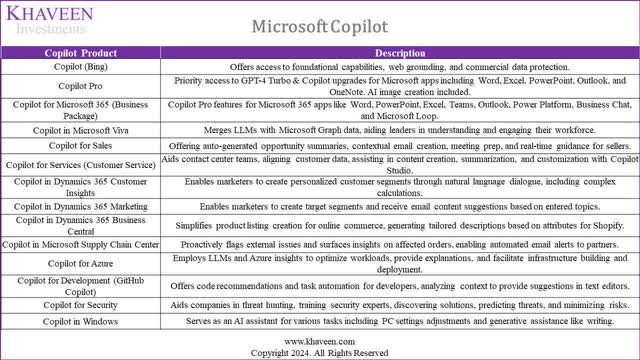

We analyze Copilot’s unique benefits to each Microsoft product based on the company’s segments below.

Company Data, UC Today, ZDNET, Khaveen Investments

Overall, based on these Copilot products analyzed, we highlighted the common benefits and value provided to customers including saving time/increasing efficiency, personalized content generation, increasing productivity and streamlining communication.

Saving Time/Increasing Efficiency

One of the functionalities of Copilot for Microsoft 365 is helping users draft a document in Word “saving hours in writing, sourcing, and editing time”. In PowerPoint, Copilot can save time by generating design ideas based on content from another document. In Teams, Copilot can save time by summarizing key points in meetings.

Furthermore, one of the benefits of Copilot in Dynamics 365 Sales is it allows sellers to save time on clerical tasks such as writing email responses or creating an email summary with “details from the seller’s CRM such as product and pricing information”.

In Azure, Microsoft is developing Copilot Azure. A benefit of it is that it increases the efficiency of cloud customers’ workloads on Azure by optimizing processes and resources “with AI orchestration and analysis”. It also allows customers to troubleshoot by summarizing issues and causes with recommendations for solutions.

Additionally, Microsoft is also developing Copilot for Security which offers various benefits such as increasing efficiency by automation of “analysis, investigation, and remediation processes for faster and more efficient threat management”.

In Windows, Microsoft has introduced Copilot for Windows which provides benefits such as saving users’ time by helping them adjust their Windows OS settings.

Personalized Content Generation

Office Products also includes Microsoft Viva, an employee training resource platform, Microsoft introduced Copilot which helps in enterprise goal management. For example, Copilot allows employees to save time by “summarizing the status of OKRs, identifying blockers, and suggesting next steps”. Copilot for Viva also helps users in content generation as it “can suggest drafting OKR recommendations based on existing Word documents, such as an annual business plan or a product strategy paper”.

In Search and News Advertising, Microsoft also has Bing AI which has been rebranded to Copilot for Bing with several updates providing benefits such as personalized results based on user queries for various topics as well as generating content such as summaries, emails and itineraries.

In Azure, Microsoft is developing Copilot Azure. One of the features is that it creates personalized solutions for each user’s workload based on their cloud environment. For example, the configuration of cloud services for each customer’s applications and environment is based on their firm’s policies.

Moreover, another benefit of Copilot for Windows is it allows users to get personalized feedback on any query and image generation.

Increasing Productivity

Additionally, a Microsoft study highlighted that Copilot for Microsoft 365 improved productivity by 70% and also “365 users were 29% faster in a series of tasks like searching, writing, and summarizing”.

Under Server Products and Cloud Services, this includes GitHub Copilot, an AI assistant for programmers. The benefits of GitHub Copilot are that it provides coding suggestions and recommendations which allows coders to increase productivity by 55% according to a Microsoft study based on the SPACE Framework

Streamlining Communication

In Viva, Copilot also helps users in enhancing collaboration and communication by offering “suggestions for collaborating on shared documents, scheduling meetings, and facilitating smooth information exchange”.

Furthermore, Copilot includes the Artificial Intelligent Business Chat that has access across the Microsoft platform including “calendar, emails, chats, documents, meetings and contacts”, allowing users to streamline communications with other people in their organization.

Conclusion

All in all, we believe the introduction of Copilot and integration across various products by Microsoft highlights Microsoft’s commitment to infuse AI capabilities across its entire business. We believe the common benefits of Copilot which are saving time/increasing efficiency, personalized content generation, increasing productivity, and streamlining communication provide value to customers such as enterprises allowing them to benefit from reduced costs with time savings and increase in sales with higher productivity. In particular, we believe the company’s segments that are most significant with Copilot integration include its Office Products we previously highlighted its market leadership (89% market share) in office productivity software as it could solidify its competitiveness as well as in the cloud where Azure (25% market share) has been closing the gap with market leader AWS.

Current Copilot Revenue Opportunities

In this section, we examined the Copilot products under each of the 5 revenue segments that have been introduced or are currently still in development. These segments are Office Products, Dynamics, Server Products and Cloud Services, Windows and Search and News Advertising.

Office Products (Productivity and Business Processes)

| Copilot Revenue Opportunity ($ mln) | Price ($/month) | Total Users (mln) | Adoption % Estimate | Revenue 2024 | Revenue 2025 | Revenue 2026 | Revenue 2027 | Revenue 2028 |

| Copilot Pro | $20 | 381 | 37% | 6,769 | 13,538 | 20,308 | 27,077 | 33,846 |

| Copilot for Microsoft 365 (Business Package) | $30 | 18.9 | 55% | 747 | 1,493 | 2,240 | 2,986 | 3,733 |

| Copilot in Microsoft Viva | $12 | 20 | 55% | 317 | 634 | 950 | 1,267 | 1,584 |

| Total | 7,833 | 15,665 | 23,498 | 31,330 | 39,163 |

Source: Company Data, Khaveen Investments

For Office Products, this includes Copilot Pro, Copilot for Microsoft 365 and Copilot in Microsoft Viva. In terms of monetization, both Copilot Pro and Copilot for Microsoft 365 were launched in Jan 2024 and November respectively for its consumer and business markets. Both of these products are charged as an add-on monthly subscription and require an existing Microsoft 365 license. However, Copilot Pro which is for Microsoft 365 Consumers users is priced slightly cheaper than Copilot for Microsoft 365 at $20 per month compared to $30 per month for each user for Copilot for Microsoft 365. Additionally, Microsoft Viva Copilot is similar to an add-on on a monthly subscription and requires an existing Microsoft Viva license.

We estimated the revenue opportunity for Copilot Pro based on its pricing of $20 per user per month and total users which we estimated at 381 mln. We calculated this based on 400 mln paid Office 365 users subtracted by an estimated number of business license customers of 18.9 mln (342,774 companies with an estimated average number of users per company of 5.5). Out of the 381 mln users, we assumed an adoption rate of 37% (by 2028) based on a survey by market research firm Suzy of consumers willing to pay for generative AI. Whereas for Copilot for Microsoft 365 revenue, we based it on its pricing of $30 per user month and our estimate of business users (18.9 mln) and adoption rate of reaching 55% gradually by 2028 based on McKinsey’s study of AI adoption by businesses. Finally, for Copilot in Viva, we based it on its pricing of $12 per user per month and the total Viva monthly active user base of 20 mln with a 55% adoption rate. In total, we estimate its revenue of $7.8 bln in 2024 for the Office Products segment.

Dynamics (Productivity and Business Processes)

| Copilot Revenue Opportunity ($ mln) | Price ($/month) | Total Users (mln) | Adoption % Estimate (2028) | Revenue 2024 | Revenue 2025 | Revenue 2026 | Revenue 2027 | Revenue 2028 |

| Copilot for Sales | $40 | 3 | 55% | 132 | 264 | 396 | 528 | 660 |

| Copilot for Services (Customer Service) | $50 | 3 | 55% | 165 | 330 | 495 | 660 | 825 |

| Copilot in Dynamics 365 Customer Insights | $45 | 3 | 55% | 149 | 297 | 446 | 594 | 743 |

| Copilot in Dynamics 365 Marketing | $45 | 3 | 55% | 149 | 297 | 446 | 594 | 743 |

| Copilot in Dynamics 365 Business Central | $45 | 3 | 55% | 149 | 297 | 446 | 594 | 743 |

| Copilot in Microsoft Supply Chain Center | $45 | 3 | 55% | 149 | 297 | 446 | 594 | 743 |

| Total | 891 | 1,782 | 2,673 | 3,564 | 4,455 |

Source: Company Data, Khaveen Investments

For Dynamics, the carious Copilot products for Dynamics 365 include “Sales, Services, Customer Insights, Marketing, Business Central and Supply Chain Center”. Microsoft Dynamics 365 is the company’s suite of enterprise software that is priced separately for each product. Microsoft has so far launched Copilot for Sales and Services. Both of these are subscription add-ons that are charged monthly separately with Sales and Services priced at an average of $40 ($50 as an add-on and $ an additional $30 as part of the Enterprise package) and $50 per user per month for each user respectively. However, Microsoft has yet to announce the pricing for the rest of the Copilot products such as Customer Insights, Marketing, Business Central and Supply Chain Center.

We estimated the revenue opportunity for Copilot in Dynamics based on each of its products. For pricing, we used the announced monthly pricing for Sales and Services of $40 and $50 per user and the average of the Sales and Services for the remaining Dynamics products which had yet to be announced by Microsoft. For the user base, Microsoft Dynamics 365 has 20 mln monthly active users. We estimated the users for each product dividing equally by a total of Dynamic products at 3 mln each. We assumed an adoption rate gradually reaching 55% by 2028 based on McKinsey’s AI adoption in businesses study. In total, we estimate a revenue opportunity of $891 mln for Dynamics reaching $4.5 bln by 2028.

Server Products and Cloud Services (Intelligent Cloud)

| Copilot Revenue Opportunity ($ mln) | Price ($/month) | Total Users (mln) | Adoption % Estimate (2028) | Revenue 2024 | Revenue 2025 | Revenue 2026 | Revenue 2027 | Revenue 2028 |

| Copilot for Azure | $27 | 8.1 | 55% | 289 | 577 | 866 | 1,155 | 1,443 |

| Copilot for Development (GitHub Copilot) | $10 | 100 | 55% | 1,320 | 2,640 | 3,960 | 5,280 | 6,600 |

| Total | 1,609 | 3,217 | 4,826 | 6,435 | 8,043 |

Source: Company Data, Khaveen Investments

For Server Products and Cloud Services, this includes Copilot for Azure and Copilot for Development (GitHub Copilot). Copilot for Azure is currently in a free preview, but Microsoft stated it will update its pricing information in the future. On the other hand, Copilot in GitHub is the earliest Copilot launched in 2021 and is priced at $10 per month per GitHub user.

We estimated the revenue opportunity for Copilot in Azure based on our calculated average monthly user pricing of all of its announced products ($27) and monthly active Azure user base of 8.1 mln. Furthermore, we used the announced Copilot pricing for GitHub ($10) and a total GitHub user base of 10 mln. Factoring in an adoption rate reaching 55% by 2028 based on McKinsey’s AI adoption by businesses study, we calculated a revenue opportunity of $1.6 bln reaching $8 bln by 2028.

Windows (More Personal Computing)

| Copilot Revenue Opportunity ($ mln) | Price ($/month) | Total Users (mln) | Adoption % Estimate (2028) | Revenue 2024 | Revenue 2025 | Revenue 2026 | Revenue 2027 | Revenue 2028 |

| Copilot for Security | $27 | 0.393 | 55% | 1.2 | 2.3 | 3.5 | 4.7 | 5.8 |

| Copilot in Windows | $0 | 1,400 | – | 640 | 659 | 679 | 699 | 720 |

| Total | 654 | 687 | 721 | 755 | 790 |

Source: Company Data, Khaveen Investments

In Windows, this includes Copilot for Security which is still in development with pricing details not yet announced but can be accessed in preview under the Early Access Program which is invitation only for each user. Furthermore, Copilot for Windows began rolling out in September 2023 to Windows 10 and 11 users but is free of charge. Instead, we expect Copilot in Windows to benefit the company indirectly in terms of maintaining its competitiveness in the OS market where it has maintained its long-standing market dominance with a 73% market share as of January 2024.

To estimate the revenue opportunity for Copilot Security, we used our calculated average pricing for all announced Copilot products ($27) and our estimate of the user base for Microsoft Defender of 0.393 mln (3,144 companies with average size of 50) as well as assuming an adoption rate of 55% by 2028. For Windows Copilot, as it is free, we estimate the indirect revenue contribution to Microsoft. We believe Copilot increases its competitiveness in the OS market and could lead to share gains for Microsoft. We estimate its prorated share gain of 2.98% in the 3 months following the launch of Copilot for Windows in 2023 which we assume to continue through 2028. Based on this, we estimated its Windows license unit sales increase and factored in our calculated average Windows revenue per estimated device sold of $120.40 to calculate the revenue contribution to Microsoft’s Windows segment. In total, we estimate a revenue opportunity of $654 mln reaching $790 mln by 2028.

Search And News Advertising (More Personal Computing)

| Copilot Revenue Opportunity ($ mln) | Price ($/month) | Total Users (mln) | Adoption % Estimate (2028) | Revenue 2024 | Revenue 2025 | Revenue 2026 | Revenue 2027 | Revenue 2028 |

| Copilot (Bing) | $0 | 100 | – | 33.71 | 33.80 | 33.90 | 33.99 | 34.09 |

Source: Company Data, Khaveen Investments

In Search and News Advertising, this includes Copilot for Bing which has been rebranded from Bing Chat AI previously and is available to all Bing users for free. Thus, instead of revenue monetization from Bing Copilot, we expect it to indirectly benefit the company by increasing its search engine competitiveness. According to GS Stat Counter, Bing’s search engine market share has increased slightly to 3.4% in January 2024 from 3% in Feb 2023 when it was first launched but it still is dominated by Google (GOOG). With an increase in users for its search engines, we expect this to benefit Microsoft with higher digital ad revenue due to the increased search engine traffic.

As Copilot in Bing is free, we estimate an indirect revenue contribution by calculating the net increase in search engine market share (0.28%) in the 1 year following its Copilot launch less its 5-year average 1-year change in market share, which we assumed as its incremental user growth. Based on the increase in Bing user visit growth and ARPU of $9.69, we calculated a minor revenue contribution of around $33 mln.

Outlook

| Copilot Revenue Opportunity ($ mln) | 2024F | 2025F | 2026F | 2027F | 2028F |

| Office Products | 7,833 | 15,665 | 23,498 | 31,330 | 39,163 |

| Dynamics | 891 | 1,782 | 2,673 | 3,564 | 4,455 |

| Server Products | 1,609 | 3,217 | 4,826 | 6,435 | 8,043 |

| Windows | 654 | 687 | 721 | 755 | 790 |

| Search and news advertising | 33.7 | 33.8 | 33.9 | 34.0 | 34.1 |

| Total | 11,020 | 21,385 | 31,751 | 42,118 | 52,485 |

| Growth % | 94.1% | 48.5% | 32.6% | 24.6% |

Source: Company Data, Khaveen Investments

Overall, we believe the announced Copilot products could benefit Microsoft primarily through upselling opportunities as most of its Copilot products are add-ons on top of existing product licenses such as Microsoft 365, Microsoft Viva, Dynamics 365 and Azure. Additionally, while Copilot in Windows and Bing is free, we see it increasing Microsoft’s competitiveness in the OS and search engine markets and leading to incremental user growth and contributing to their product revenues. In terms of our revenue opportunity estimates, we see the largest opportunity in the Office Products segment due to the Copilot integration in both consumer and business Microsoft 365 product licenses, where Microsoft could leverage its massive installed base of 400 mln paid users and derive revenues up to $37.6 bln by 2028. Additionally, under Office Products, we also estimated a $1.6 bln revenue opportunity by 2028 for Viva, leveraging its installed base of 20 mln Viva users. Another major segment is Server Products & Cloud Services where we believe Microsoft could leverage its Azure and GitHub user bases to derive $8 bln in revenues. Both these segments are the largest segments to Microsoft, thus highlighting the significance of Copilot to Microsoft.

Future Copilot Revenue Opportunities

In the previous section above, we analyzed and derived our revenue opportunity estimates for Microsoft’s current existing Copilot products that had been already introduced or are currently in development for its 5 revenue segments. In this section, however, we examined the possibility of future development of Copilot for its remaining 4 revenue segments which are LinkedIn, Enterprise Services, Devices and Gaming. Firstly, we identified all products in each segment and examined possible Copilot developments for each product.

LinkedIn (Productivity and Business Processes)

For its LinkedIn segment, this includes only its LinkedIn social networking platform allowing business professionals to connect. We believe the company could develop a Copilot product suitable for LinkedIn providing its common values of saving time and generating personalized content. For example, Copilot’s functionality of generating personalized job ads could help recruiters and firms attract talent. Moreover, it could also assist users in generating and recommending replies to users’ message inboxes. It may also help businesses advertise or market by scheduling and automating posts on the site.

Various existing AI tools have some functionality of Copilot such as drafting and creating posts and job descriptions such as Jasper, Taplio, Anyword, StoryLab and Simplified. Thus, we believe that Microsoft can emulate similar features if they introduce Copilot for LinkedIn.

Additionally, while Microsoft has not announced a Copilot for LinkedIn in development, we believe Microsoft’s commitment towards infusing AI across LinkedIn is witnessed by the introduction of several new AI features in LinkedIn such as AI-powered writing suggestions to create posts. Also, AI-created job descriptions have been tested throughout the year and are currently available for enterprise customers. We estimate a probability factor for Copilot on LinkedIn of 25% based on an equally weighted average of 2 metrics which are the expected benefits if Copilot is introduced score (50%) and news of Copilot product development score (0%).

| Copilot Revenue Opportunity ($ mln) | Price ($/month) | Total Users (mln) | Adoption % Estimate | Revenue 2024 | Revenue 2025 | Revenue 2026 | Revenue 2027 | Revenue 2028 | Probability |

| Copilot in LinkedIn | $27 | 67 | 55% | 597 | 1,194 | 1,791 | 2,388 | 2,985 | 25% |

Source: Company Data, Khaveen Investments

We estimate the potential revenue opportunity for Microsoft Copilot for LinkedIn. For pricing, we assumed it based on the average Copilot pricing per user per month from the second point and the number of companies on LinkedIn of 67 mln. Moreover, we assumed an adoption rate of 55% based on McKinsey’s AI in business adoption and a probability factor of 25%.

Enterprise Services (Intelligent Cloud)

Under this segment, it includes Microsoft Enterprise Support Services as well as Nuance Professional Services which “assist customers in developing, deploying, and managing Microsoft server solutions, Microsoft desktop solutions, and Nuance conversational AI and ambient intelligent solutions, along with providing training and certification to developers and IT professionals on various Microsoft products” based on its annual report. For its Microsoft Enterprise Support Services, this includes Microsoft Unified which is a subscription to Microsoft support services that also includes its Services Hub platform that consists of resources for enterprises to manage their Microsoft products support activity as well as learn and stay updated on Microsoft products.

We believe Copilot could be integrated here to help enterprise users save time by locating, searching and directing for the services that they are looking for and generate personalized results to customer support requests based on their requirements and consumption of Microsoft products.

While Microsoft has not announced Copilot being developed for Services Hub and we could not find news of Copilot-related developments in this area, we believe the integration of Copilot could be feasible as there are currently already various AI tools for customer support service including AI chatbots and self-service portals with offerings from companies such as Watermelon Pulse, Zendesk, HubSpot, Intercom and Dixa. We derived a probability factor of 25% based on a weighted average of Copilot potential benefit score (50%) and news of Copilot product development score (0%).

However, Nuance which was acquired by Microsoft, had introduced its own copilot called Dragon Ambient eXperience Copilot which is an “AI copilot for automated clinical documentation, the application uses conversational, ambient, and generative AI to enable more physicians to significantly streamline the creation of medical documentation, improving clinical efficiency, reducing burnout, and freeing their time to focus on delivering high-quality care”. Thus, we do not account for Copilot integration for Nuance.

| Copilot Revenue Opportunity ($ mln) | Price ($/month) | Total Users (mln) | Adoption % Estimate | Revenue 2024 | Revenue 2025 | Revenue 2026 | Revenue 2027 | Revenue 2028 | Probability |

| Copilot in Enterprise Services | $27 | 18.9 | 55% | 168 | 336 | 504 | 672 | 840 | 25% |

Source: Company Data, Khaveen Investments

We estimate the potential revenue opportunity for Microsoft Copilot for Enterprise Services. For pricing, we assumed it based on the average Copilot pricing per user per month from the second point and the number of business Office users of 18.9 mln. Moreover, we factored an adoption rate based on McKinsey’s AI business adoption of 55% and our estimated probability factor score of 25%.

Devices (More Personal Computing)

In Devices, this includes “Surface, HoloLens, and PC accessories”. The company’s Surface is its PC product line which has Windows OS that already has Copilot integrated. Whereas for HoloLens, Microsoft’s AR headset is targeted for applications in manufacturing, engineering, healthcare, and education. We believe the integration of Copilot in HoloLens could benefit users as a virtual assistant to generate personalized information and answer queries as well as provide and display information in real-time. For example, its competitor Oculus (META) has a Virtual Travel Assistant that utilizes ChatGPT which answers queries with information regarding the location that the user is virtually in.

Recently, Microsoft introduced Copilot for Dynamics 365 for industrial applications which integrate with HoloLens to “answers via hologram, text displays, and voice response”, highlighting the potential for further product development for HoloLens. Furthermore, Microsoft had also developed various AI models into HoloLens 2 to “track people’s hand motions and eye gaze” and “help fit a personalized 3D model to the customer’s hands, enabling the precise tracking required to allow instinctual interaction with holograms”. We estimate a factor score probability of 63% based on a weighted average of Copilot potential benefit score (25%) and news of Copilot product development score (100%).

| Copilot Revenue Opportunity ($ mln) | Price ($/month) | Total Users (mln) | Adoption % Estimate | Revenue 2024 | Revenue 2025 | Revenue 2026 | Revenue 2027 | Revenue 2028 | Probability |

| Copilot in HoloLens | $27 | 0.38 | 37% | 5.62 | 11.24 | 16.86 | 22.48 | 28.10 | 63% |

Source: Company Data, Khaveen Investments

We estimate the potential revenue opportunity for Microsoft Copilot for HoloLens. For pricing, we assumed it based on the average Copilot pricing per user per month from the second point and the number of HoloLens sold of 0.38 mln. Moreover, we based the adoption rate on the consumer rate of AI study by market research firm Suzy reaching 37%. In total, we derived a minor revenue opportunity increasing to $28 mln by 2028.

Gaming (More Personal Computing)

Finally, the Gaming segment consists of “Xbox hardware and Xbox content and services” as well as video game publishers such as its Activision acquisition. Microsoft has a Co-Pilot feature which allows users to share a controller and is different from its AI Copilot which it has not integrated with.

We believe the company could develop Copilot for Xbox to help users save time with the functionality of Copilot to adjust users’ Xbox hardware settings and personalize their console similar to its Windows Copilot as well as troubleshoot and suggest fixes for any hardware and software issues. Additionally, Sony (SONY) had been reportedly developing an AI tool that includes functionalities such as tracking time spent by users to help manage their time. Also, it was reported that Microsoft is developing AI tools for gaming developers on Xbox with AI design copilot integrated into games. Therefore, we derived a total probability factor score of 75% based on a weighted average of Copilot potential benefit score (25%) and news of Copilot product development score (100%).

| Copilot Revenue Opportunity ($ mln) | Price ($/month) | 2023 Xbox Units Sold | Adoption % Estimate | Revenue 2024 | Revenue 2025 | Revenue 2026 | Revenue 2027 | Revenue 2028 | Probability |

| Copilot in Xbox | $0 | 3.14 | – | 11.5 | 11.7 | 11.9 | 12.1 | 12.3 | 75% |

Source: Company Data, Khaveen Investments

For the revenue estimation for Copilot, however, we expect it to be free as it targets consumers, and we expect its functionalities similar to Copilot for Windows which is free. However, we expect this to benefit Microsoft indirectly by increasing its product attractiveness compared to competitors and could gain market share in the gaming console market against Sony and Nintendo. We assumed its share increase based on our share increase estimates in Windows and Bing in the second point of 1.6% and average revenue per device sold of $300 based on Xbox pricing to derive a total indirect minor revenue contribution reaching $12 mln by 2028.

Outlook

| Future Copilot Revenue Opportunity ($ mln) | 2024F | 2025F | 2026F | 2027F | 2028F |

| Enterprise Services | 168.0 | 336.0 | 503.9 | 671.9 | 839.9 |

| Devices | 5.6 | 11.2 | 16.9 | 22.5 | 28.1 |

| Gaming | 11.5 | 11.7 | 11.9 | 12.1 | 12.3 |

| 597 | 1,194 | 1,791 | 2,388 | 2,985 | |

| Total | 782 | 1,553 | 2,324 | 3,094 | 3,865 |

| Growth % | 98.6% | 49.6% | 33.2% | 24.9% |

Source: Company Data, Khaveen Investments

All in all, we analyzed potential integrations for Copilot across segments that Microsoft has not yet announced including Gaming, LinkedIn, Enterprise Services and Devices which we believe could be feasible providing common benefits such as saving time and generating personalized content. This also underscores our view of Microsoft to infuse AI capabilities across its entire product stack. We estimate Copilot in these segments could generate $3.8 bln in revenue opportunity by 2028 with LinkedIn as the largest $2.8 bln, as we believe the company could leverage its large installed base as 67 mln companies are on LinkedIn. This is followed by Enterprise Services as we see Microsoft leverage its installed base of enterprise customers to provide AI-assisted IT consulting services. In contrast, we see a smaller revenue opportunity for Devices and Gaming as HoloLens has a relatively small installed base of 0.38 mln, and we see Gaming benefitting only indirectly as a free subscription while increasing its competitiveness and market share in the gaming console market.

Risk: AI Product Development by Competitors

We believe one of the risks to Microsoft relating to Copilot is the product development and introduction of similar AI assistants by its competitors. For example, in productivity software and application development software, Google has introduced Duet AI for Google Workspace and Duet AI for Developers with Copilot-like functionalities and benefits such as generating personalize content in Google Docs and emails in Gmail as well as saving time by generating summarizes and suggestions in coding. However, we believe one major advantage of Microsoft is its leadership and massive installed base of users across Software & Services which could support its competitive strength against other competitors.

Valuation

| Microsoft Revenue ($ mln) | 2024F | 2025F | 2026F | 2027F | 2028F |

| Total Copilot Revenue Opportunity | 11,802 | 22,938 | 34,075 | 45,212 | 56,350 |

| Microsoft Total Revenue (Excl Copilot) | 253,839 | 290,295 | 333,178 | 377,474 | 422,640 |

| Microsoft Total Revenue (Excl Copilot) Growth % | 19.8% | 14.4% | 14.8% | 13.3% | 12.0% |

| Microsoft Total Revenue with Copilot | 265,641 | 313,234 | 367,253 | 422,686 | 478,990 |

| Microsoft Total Revenue with Copilot Growth % | 25.4% | 17.9% | 17.2% | 15.1% | 13.3% |

| Copilot Share % of Total Revenue | 4.4% | 7.3% | 9.3% | 10.7% | 11.8% |

Source: Company Data, Khaveen Investments

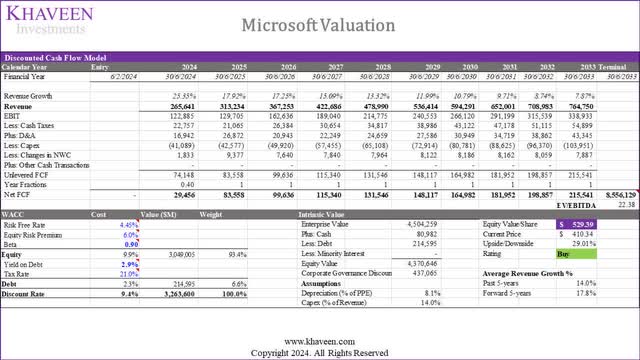

We updated our revenue projections for Microsoft with our previous projections and accounted for the additional Copilot revenue opportunity estimates through 2028. Based on the table, we see Copilot generating a significant revenue of up to $56 bln by 2028, gradually reaching 11.8% of its total revenue as adoption rises. In 2024, our model shows an increase in the total company’s total growth by 5.6% to 25.4% from 19.8%, highlighting the potential growth boost from Copilot integrations across the entire Microsoft products and services stack as part of its strategy in exclusive partnership with OpenAI which we previously highlighted benefits Microsoft with opportunities to leverage its GPT-4 LLM. As mentioned, we see the majority of its revenue opportunity from its Office Products and Server Products segments, which we believe Microsoft’s leadership in AI in Software & Services as explained previously could allow it to execute and achieve its revenue opportunity.

Khaveen Investments

Based on a discount rate of 9.4% (company’s WACC), we obtained an upside of 29% based on its 5-year historical EV/EBITDA of 22.38x.

Verdict

All in all, we believe Microsoft’s introduction of Copilot underscores its commitment to infusing AI capabilities throughout its business. Copilot’s integration across various products brings common benefits like time savings, increased efficiency, personalized content generation, enhanced productivity, and streamlined communication. We believe Copilot is particularly impactful in Microsoft’s Office Products and cloud segments and expect Copilot integration to solidify its market leadership. We see Copilot as upselling opportunities through add-ons to existing licenses, such as Microsoft 365, Microsoft Viva, Dynamics 365 and Azure. While Copilot in Windows and Bing is free, we believe it enhances its competitiveness, contributing to user growth and product revenues in OS and search engine markets. We estimate a total revenue opportunity of its announced Copilots at $56 bln by 2028 with the Office Product segment contributing the largest opportunity of $39 bln supported by Microsoft’s massive Office installed base of 400 mln paid users as well as in the Server Products and Cloud Services segment, where we estimated a $8 bln revenue opportunity leveraging its cloud market strength and GitHub user base. Additionally, we envision Copilot’s future integrations in Gaming, LinkedIn, Enterprise Services, and Devices, and estimated a further potential $3.8 bln revenue opportunity by 2028.

Overall, we maintain our Buy rating on Microsoft, but with a higher price target of $529.39 compared to $448.14 previously due to higher growth expectations spurred by Copilot with a higher 5-year forward average (17.8% vs 15% previously). We believe the integration of Copilot across its entire stack could provide a boost in growth, accounting for up to 12% of its total revenues by 2028 which we believe could be achievable for the company due to its AI leadership across Software & Services and leveraging its exclusive partnership with OpenAI to integrate the leading GPT-4 LLM across Microsoft’s products.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of MSFT either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

No information in this publication is intended as investment, tax, accounting, or legal advice, or as an offer/solicitation to sell or buy. Material provided in this publication is for educational purposes only and was prepared from sources and data believed to be reliable, but we do not guarantee its accuracy or completeness.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.