Summary:

- Microsoft Corporation will be reporting its Q2 results after market close tomorrow, 1/24.

- Its revenue is likely to amount to $51.2 billion.

- But in addition to the top line, also pay close attention to Microsoft’s segment financials, its recurring revenue growth momentum, and its management’s revenue outlook.

- Microsoft stock is not a screaming buy at the time of this writing.

Cristina Ionescu

All eyes will be on Microsoft Corporation (NASDAQ:MSFT) when it reports Q2 FY23 results after the market close tomorrow (1/24). The software giant announced a massive tranche of layoffs recently and investors will be anxiously watching to see if this decision was driven by a severe revenue hit to the business. But in addition to tracking the top line figure, investors must also watch Microsoft’s recurring revenue growth, Azure revenue growth, segment financials, and its management’s outlook for the quarter ahead. These items will provide a fuller view of Microsoft’s near-term prospects and are likely to influence where its shares head next.

Gauging Operating Performance

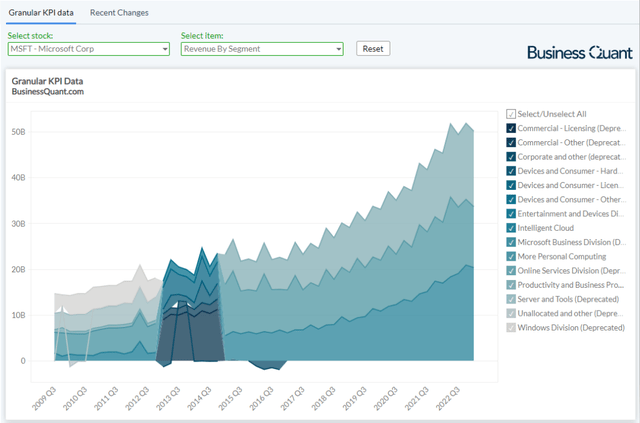

Let me start by saying that Microsoft’s top brass, especially under Satya Nadella’s leadership, has done a terrific job at turning the business around. What was once considered a stagnating legacy business merely a few years ago has now become a monstrous software giant that has posted 26 consecutive quarters of revenue growth (year-over-year basis) with a negligible amount of cyclicality to its revenue. This is a commendable feat and an enviable position to be in.

With credit given where it was due, we’ve to also realize that macroeconomic conditions across the globe are challenging and enterprises have been cutting their discretionary spending for the time being in order to be financially frugal. So, as investors, the first order of business should be to monitor how Microsoft’s business has been affected by these recessionary pressures.

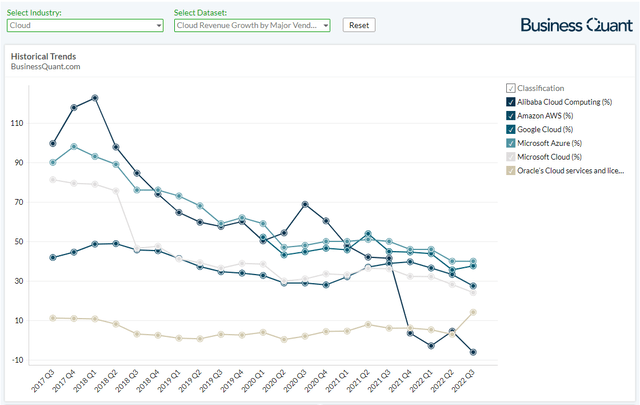

For this, we can start by monitoring Microsoft Azure’s revenue. This Infrastructure-as-a-Service (or IaaS) and Platform-as-a-Service (or PaaS) behemoth caters to thousands of enterprises across the globe of all scales and sizes. Note in the chart below how Azure has outperformed other prominent cloud platforms in terms of revenue growth over the past many quarters. I do expect the entire industry’s revenue growth to decelerate in Q4 CY22, or Microsoft’s Q2 FY23, but I also expect Azure to once again outperform its peers in terms of revenue growth due to its relatively smaller size, global footprint, and a massive range of offerings.

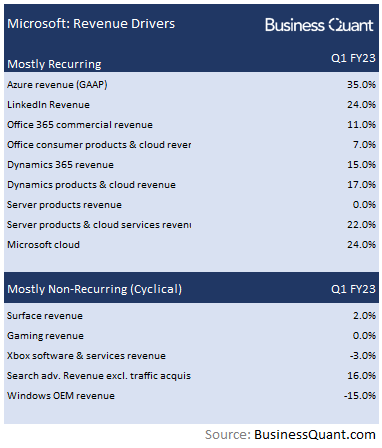

Secondly, pay attention to Microsoft’s recurring revenue growth momentum. The software giant has been growing rapidly and reducing the cyclicality in its revenue, thanks to its rollout of subscription models to more and more offerings across its product portfolio. While this lowers the initial cost of ownership for customers, it ensures the company earns a stable stream of recurring revenue from its customers, across multiple products, often over a longer span of time. I personally expect Microsoft to post robust revenue growth in its recurring businesses in the next 4-8 quarters at least, and Q2 FY23 should be no different, but rampant subscriber cancellations due to strained consumer budgets could play spoiler this time around.

BusinessQuant.com

These two items (Azure and recurring revenue businesses) have been the mainstay of Microsoft’s continued financial success over the past decade, even during tumultuous times. Although I expect these businesses to continue growing at more or less the same pace in Q2 FY23 as well, spending cuts by enterprises and consumers alike can cause unforeseen aberrations in Microsoft’s growth story and fuel bearish speculation amongst investors. So, keep close tabs on these items to see if Microsoft is able to function as usual or if it’s succumbing to the harsh macroeconomic environment.

With that said, let’s now shift attention to Microsoft’s financials.

Financial Expectations

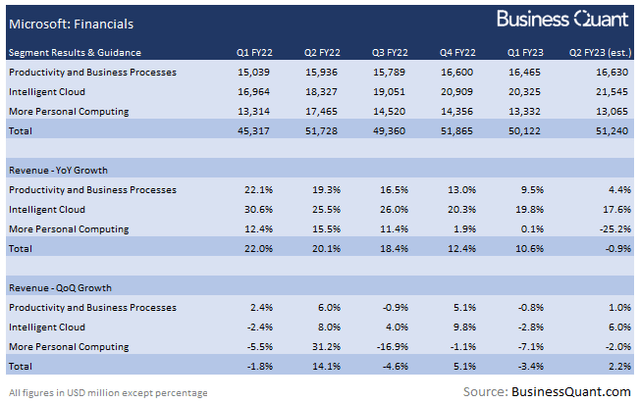

See, Microsoft classifies its revenue in 3 reporting segments, namely Intelligent Cloud, More Personal Computing, and Productivity and Business Processes. Its intelligent cloud division is the largest in terms of revenue, accounting for a little over 40% of the software giant’s top line last quarter. This segment includes the sales contribution of Azure, amongst other rapidly growing cloud products, and so it’s likely to post a relatively elevated pace of revenue growth. My guesstimate is that the segment will post a year over year revenue growth of around 17.5%, decelerating from near-20% in Q1 due to the macroeconomic slump, and its revenue will amount to $21.5 billion.

Microsoft’s Productivity and Business Processes division includes the sales contribution of enterprise licenses and popular work-from-home apps such as Skype and Teams. With layoffs happening across the globe, companies returning to the in-office mode and stronger dollar weighing down on foreign currency license sales, I expect this segment to remain revenue challenged in the next few quarters at least. As far as Q2 FY23 is concerned, I estimate this particular segment to post revenue of roughly $16.6 billion, marketing a 1% increase year-over-year.

Lastly, Microsoft’s More Personal Computing segment has the most lumpy and cyclical revenue stream as it includes the sales contribution of one-time Windows licenses (OEM, Pro, non-Pro), surface devices and Xbox consoles, amongst other offerings. With strained consumer budgets and discretionary spending down across the globe, I expect this segment to register a year-over-year revenue decline of roughly 25%, with the revenue figure amounting to roughly $13 billion for Q2 FY23.

This brings us to a company-wide revenue estimate of $51.2 billion in Q2 FY23, which would be up 2.2% sequentially but down 0.9% sequentially. But for the record, my estimate is slightly more conservative than the Street’s revenue consensus of $52.39 billion.

Having said that, also pay close attention to Microsoft management’s revenue outlook for the quarter ahead. We’re already a month into its Q3 FY23 and they would have insights about whether the recession is intensifying or if it’s business as usual for the software giant. This, in my opinion, will significantly influence investors’ sentiment pertaining to Microsoft’s near-term prospects.

Final Thoughts

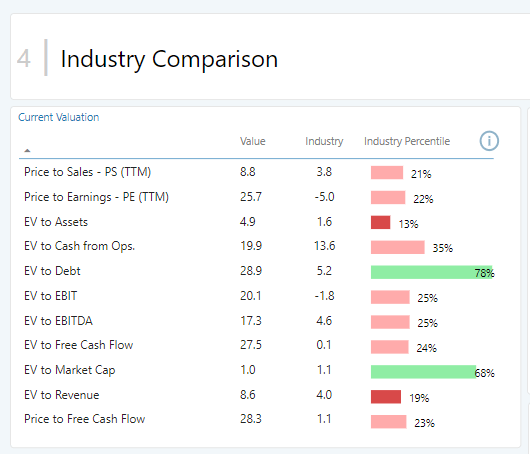

Microsoft’s shares are trading at a stark premium compared to industry levels, on numerous parameters. Therefore, I don’t think the stock is an attractive buy at its current levels and, so, I rate it as a “Hold” for the time being. Investors may want to wait for potential price corrections before buying into the stock.

BusinessQuant.com

But as far as its Q2 FY23 is concerned, investors may want to closely watch its segment financials, the revenue growth momentum amongst its recurring businesses and listen in on its management’s outlook for the quarter ahead. These items will provide well-rounded insights about the state of Microsoft’s performance and are likely to influence where its shares head next. Good Luck!

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.