Summary:

- Nvidia’s revenue and op income trajectory has been spectacular in the past decade except performance drop due to demand softness in recent two quarters.

- Despite the financial hit due to inventory management, NVDA’s fundamentals remain intact.

- Nvidia’s business risk in China is manageable, given the substituting products it offered to China’s customers, and the developing stage of local GPU players.

- My valuation of $225 is based on 45x P/E and $5.0 2024E GAAP EPS.

BING-JHEN HONG

For investors looking for exposure to secular growth in AI, Cloud Computing, Influencer Marketing, and EV, NVIDIA Corporation (NASDAQ:NVDA) could be an attractive target.

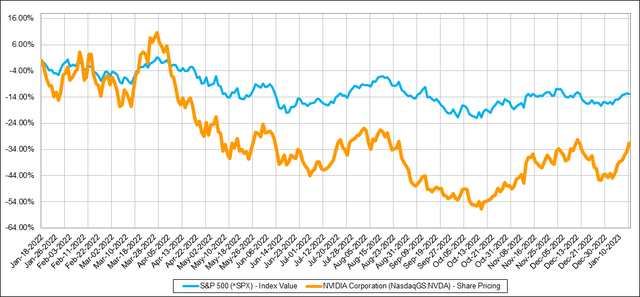

NVDA price has dropped by over 30% in the past 12 months after experiencing a selloff in H2-22. Investors were concerned about its growth degradation due to PC gaming and China’s demand softness. I think NVDA’s risk in China could be manageable given the critical role NVDA has already played in various industries in China and the very developing capabilities of China’s local GPU players. This article begins with an overview of NVDA’s business segments and fundamentals, dives into the China’s market, and wraps up with a quick valuation and conclusion.

NVDA Overview

NVDA produces designing graphics processing units (GPUs), system on chip units (SoCs), application programming interface (APIs), and software. It is a global leader in AI hardware and software, and supercomputers and cloud computing.

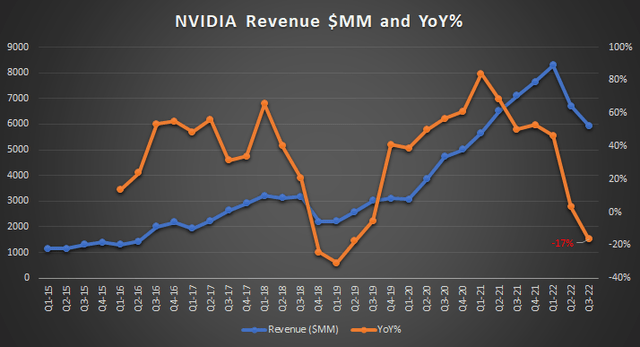

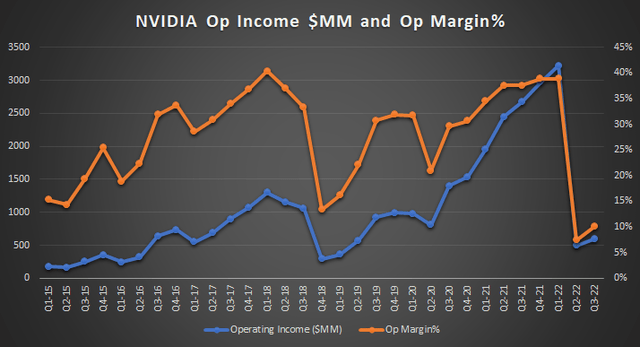

NVDA generates revenue from four segments: Gaming ($12.5B, 46% of total FY22 revenue), Data Center ($10.6B, 40%), Professional Visualization ($2.1B, 8%), and Automotive ($0.6B, 3%). Its revenue trajectory has been spectacular in the last decade except the recent softness due to PC gaming demand decline. Likewise, NVDA generated ~$3B in Op Income quarterly except the significant drop in the last two quarters due to excess inventory charges driven by demand softness in data center (esp. in China) and gaming.

Company filings Company filings

Because of the H2 sell-off, NVDA stock price has decreased by 32% within a one-year period, as compared to a 13% decrease for S&P 500.

NVDA’s Fundamentals

Admittedly NVDA has realized the importance of demand forecasting and inventory management, and soft demand was also real in 2022. However, as the economic environment recovers, I would expect NVDA to continue delivering solid results because of its leader position in Core technology, and rapidly growing CPU/GPU/DPU demand from various sectors. NVDA’s pace of innovation is incredibly strong with its multi-year investment in R&D talents ($7B R&D expense TTM, and ~5,000 R&D engineers according to ValueInvestorsCentral) and technology. It operates in a space with very high barrier to entry, and broad exposure to nearly all industries that are pursuing AI & Cloud powered disruptions. Several charts are included here to show NVDA’s success.

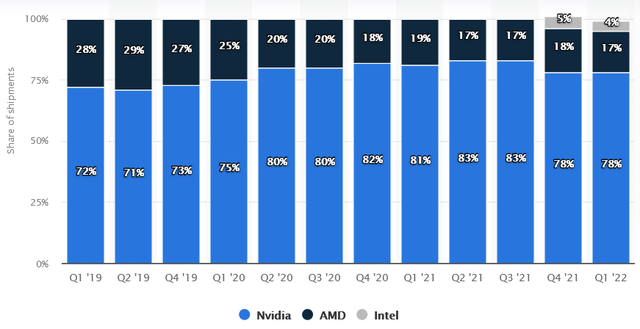

PC discrete GPU market share by vendor 2022 | Statista

PC discrete GPU market share by vendor 2022, Statista

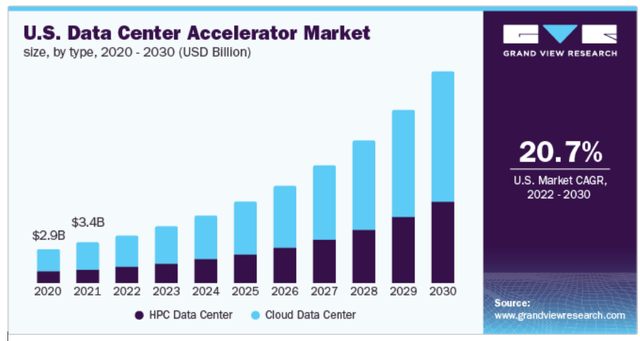

According to GrandViewResearch, the global data center accelerator market size is expected to expand at a CAGR of 20.7% from 2022 to 2030. “Growth is driven by factors such as the growing deployment of data centers & cloud-based services. Additionally, the increasing adoption of technologies such as artificial intelligence (AI), internet of things (IoT), & big data analytics is boosting the data center accelerator market growth.”

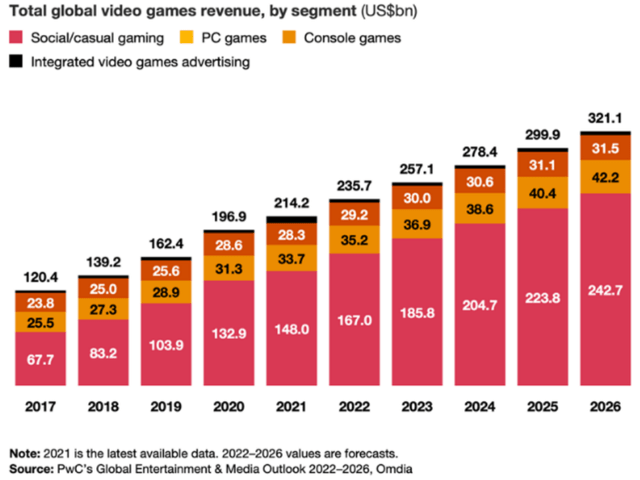

According to PwC, the global video games revenue will grow from $214B in 2021 to $321B in 2026.

Finally, self-driving vehicles could be the next big thing. According to NVDA at 2022 GTC, the company disclosed that they had $11B (+37% YoY) with automotive partners. This means NVDA will grow this segment from $0.6B today to a multi-billion dollar business in a couple of years. NVDA’s customers include BYD, the world’s second-largest electric vehicle maker, and a few other tier-1 EV vendors in China, and most of the global auto brands.

NVDA’s Business Risk in China

In this section, I mainly discussed the risk NVDA is facing with the China market. Overall, my opinion is that although this is not an ideal situation, NVDA will be able to fare well considering the development stage of China’s GPU players, and the critical role NVDA plays in the success of a variety of technology and automotive companies.

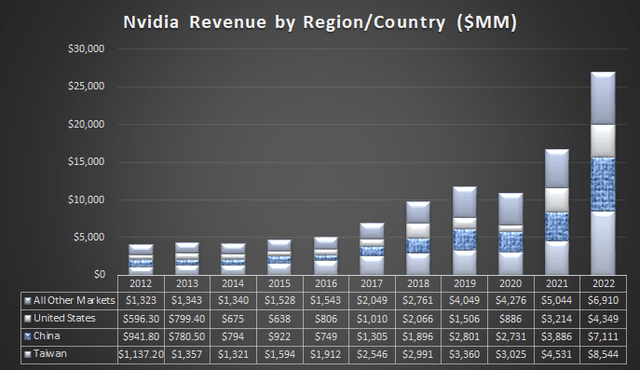

According to Verified Market Research, “GPU Market size in China was valued at $35B”. China is a massive market, and also about one fourth of NVDA’s revenue share. NVDA is one of the critical enabler of technology advancement in China. BAT (Baidu (BIDU), Alibaba (BABA), and Tencent (OTCPK:TCEHY)), and a lot of other tech companies have had a variety of AI and machine learning products built upon NVDA’s GPUs. According to South China Morning Post, “ByteDance’s (BDNCE) enterprise cloud service, Volcengine, has cut the training period for an image-recognition, AI model from 5 days to 3 days; Alibaba Cloud’s Sinian computing platform has beat a Google-held record by recognizing 1.078 million images per second in offline scenarios; and China’s largest server maker Inspur’s NF5488A5 model has been hailed as a world-class product in medical image segmentation, speech recognition and natural language processing.” In automotive industry, nearly all China-based EV enterprises are using A100 to build their Self-driving training centers.

The following figure shows NVDA’s revenue distribution by region/country.

However, on 8/26/22 NVDA announced that the US government imposed export limitation for advanced GPU products that are widely used in AI and HPC to address risks related to military use of NVDA’s GPUs in China. NVDA’s A100 and H100 are on the list. This was a hit for both NVDA, and it’s major China customers who had to find substitutes because 1) almost all Cloud Computing players in China are using A100; 2) there has not been a great substituting product from any of the domestic GPU makers in China; 3) although the China’s stock market reacted very positively and local GPU players claimed it was a key milestone for the GPU ‘localization’ in China, realistically it would take a while for China’s GPU brands to build comparable products.

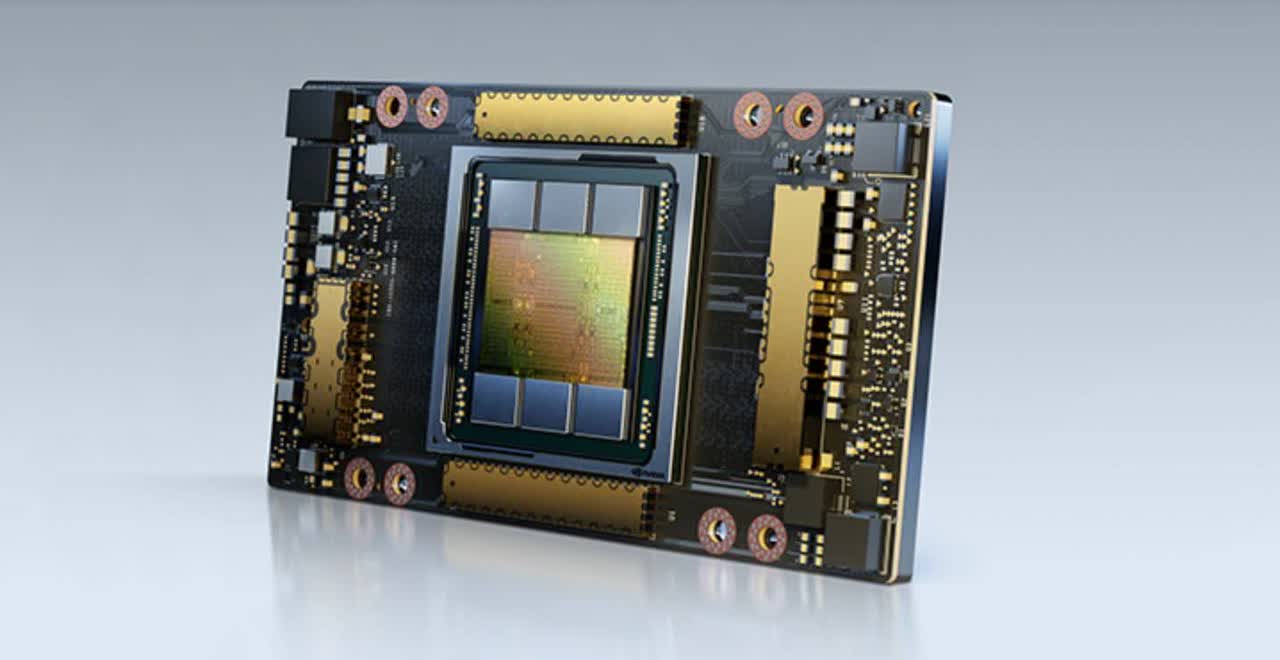

Company website

And NVDA, upon the announcement, communicated that it would actively explore the best substituting solutions. Within one quarter, NVDA quickly rolled out their own substituting product A800 to get around restrictions the US government imposed, and this to some extent still represents the best offering to China’s customers. Therefore, I am optimistic about NVDA’s capability to grow its customer base and usage in China.

NVDA’s Valuation

In my forecast, I assumed 1) demand to gradually recover to pre H2-22 levels, 2) data center revenue growing at ~15% YoY, 3) automotive growing into $2B business by 2024, and 4) operating margin getting back to FY21 level (~40%). As a result, GAAP EPS would be $5.0 in FY24, more than doubled their EPS in FY23.

Applying 40x P/E (40x is where Tesla (TSLA) stock is currently traded at), NVDA will be $200 (+15% from the current price). Applying 45x P/E (which to me is a fair valuation), NVDA will be $225 (+29% from the current price).

Conclusion

Nvidia is a high-conviction buy because 1) it is a leader of the very core technology today; 2) it benefits from the explosive growth of AI across nearly all verticals; and 3) its investment in Automotive and Metaverse will pay off in the long run.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.