Tesla Stock: The Asset Bubble Is Bursting

Summary:

- Tesla, Inc. stock has corrected substantially but is still expensive.

- The net profit margin should decrease due to car price caps.

- Many large automakers have been producing electric vehicles for a while. So, Tesla has strong competition here.

- Bubbles have burst in history before.

- It is likely Tesla won’t be an exception.

jetcityimage/iStock Editorial via Getty Images

Tesla, Inc. (NASDAQ:TSLA) stock has recently been highly pressurized. Interestingly enough, I predicted this very situation in 2020 when everyone rushed to buy the electric vehicle (“EV”) company. Yet, my knowledge of the stock market was substantially inferior to that of renowned market experts that recommended this stock at the time.

In short, as a company, Tesla, Inc. is much smaller and has poorer performance indicators than those of its peers. At the same time, Tesla’s market cap is equivalent to that of several car-making giants put together. So, Tesla stock crashed but is still well above what it should trade for. Let me explain my thesis in some more detail.

TSLA stock bubble

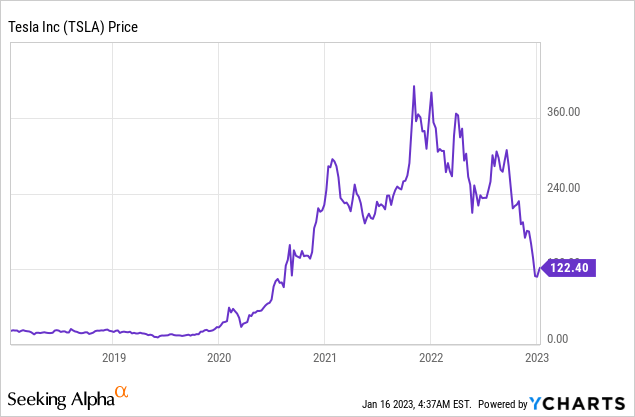

In 2020, I wrote quite a short and simplistic article about Tesla’s stock and the fact it was overvalued. TSLA stock, however, was particularly popular when the company was loss-making. It started appreciating at the end of 2019, and stopped doing so in 2022 when the Fed began tightening its monetary policies.

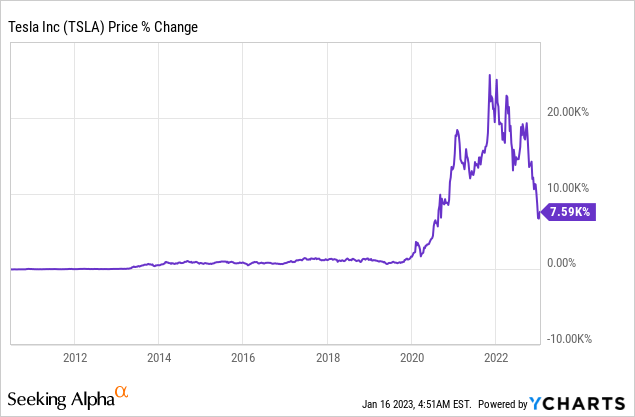

In my view, Tesla, Inc. stock still has not reached its bottom. If we take the stock price history, TSLA is trading 7,590% above what it used to trade for about a decade ago!

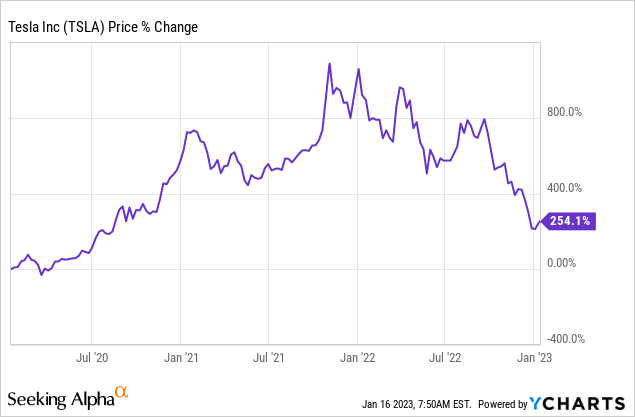

Taking a more recent time period, let us review TSLA’s stock price for the last 3 years.

In spite of the 2020 pandemic that made the stock market go down and the 2022 correction, TSLA shares are still trading 254% up compared to the levels seen just three years ago. So, from that perspective alone, Tesla stock is not a value play.

Later on, I will explain exactly why Tesla, Inc. stock is still overvalued and inferior to its competitors as far as its fundamentals are concerned. In other words, Tesla stock is still an asset bubble.

Asset bubbles are easy to spot. When everyone starts talking about a particular asset, it is surely overvalued. It reminds me of Joseph Kennedy, the father of the U.S. president John Kennedy, and the shoe-shine boy. In 1929, just before the Great Depression, the stock market was doing extremely well. There was a frenzy and the stock prices reached their all-time highs. Particularly popular were fashionable companies working in the car-manufacturing, radio and electricity industries. So, in 1929, Joseph Kennedy wanted his shoes to be polished and was astonished to be given tips by the shoeshine boy on what stocks to buy. Kennedy immediately rushed to sell all his securities. The Great Depression happened and the markets collapsed. This was not surprising since there was a very big asset bubble. When many amateur investors get interested in buying a particular asset class, this is a strong sign of overvaluation.

There have been asset bubbles in history before. Just think of “tulip mania.” In the 17th century Netherlands, everyone was eager to buy bulbs of tulips, very rare and precious flowers at the time. The bulbs were being traded like investment assets. When the bulb frenzy reached its peak, one single rare bulb cost as much as a sound house! I am sure many speculators at the time would have gotten really angry when anyone expressed concerns about paying so much for a tulip bulb. A similar thing was happening to TSLA stock. Right now, it seems to be on a downtrend. But still, Tesla, Inc. stock is not cheap enough.

Tesla’s news

Here is why Tesla stock is trading cheaper than it used to but not cheap enough. The company’s profit margins have been reduced thanks to the car price cuts. The latest round of discounts are 6% to 20% for Model 3, Model Y and other models sold in the U.S. and Europe. Not to mention TSLA lowered prices in the Chinese market by 13% to 24%, including recent moves earlier this month.

Some might argue this should be beneficial for car sales. But that is not the case. First, general consumer demand is decreasing due to the economic slowdown. Secondly, there are plenty of substitutes for Tesla’s EVs thanks to the rising competition.

Another important factor was Elon Musk’s decision to sell a substantial part of his stake. According to him, of course, this was done to partly finance his Twitter deal. Just a quick reminder, in December last year, Musk sold nearly $3.6B worth of Tesla stock. However, TSLA’s founder promised not to sell any more shares for another two years. It might not seem like too much since Musk’s stake is worth more than $57 billion as of the time of writing. And yet, this was still a reason for investors to get concerned.

At the same time, these two pieces of news are not the only reasons to avoid TSLA.

The sectors Tesla operates in

Tesla has been positioned as a highly innovative company with plenty of growth potential. But let us have a closer look at how it makes money.

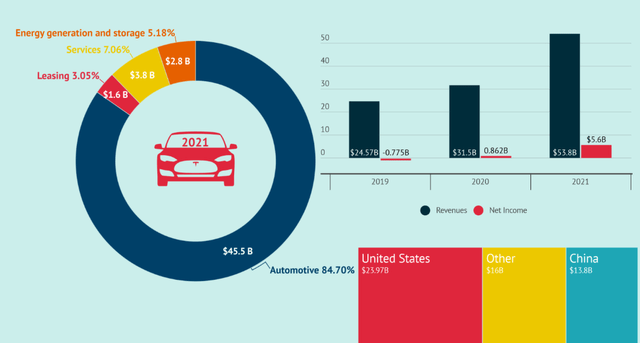

I decided not to take the latest quarterly figures. After all, quarterly earnings are volatile and depend on seasonality. So, here is Tesla’s 2021 data.

As we all know, most of Tesla’s revenues comes from selling EVs. At the same time, everyone praises Tesla for their innovations. Meanwhile, non-automotive business, including energy generation and storage, were accountable for just 15.29% of the company’s revenues in 2021. Otherwise, almost 85% of Tesla’s sales were due to vehicles. So, as obvious as it sounds, Tesla is an electric vehicle business. We will focus some more on this.

The automobile industry

The carmakers are not going through their best days. The interest rates are rising. Recently published macrostatistics also showed the car sales fell substantially. After all, buying a new car is not the top priority for everyone. This is especially true of EVs. In most countries traditional fossil fuel cars are not prohibited just yet. And it is still more rational to buy a used traditional car than an EV. So, electric vehicles are luxury goods many people will be unable to buy if we face a recession soon.

Not to mention the fact the day-to-day operating expenses rose, most importantly the labor and energy costs. So, the profit margins of many automakers, including Tesla, should fall as well.

Moreover, the automobile industry is highly competitive, and a few giants are already quite successful in the field of electric vehicles, which is a serious threat to Tesla.

Comparison to peers and valuations

I decided to first compare Tesla to the largest automakers. You might consider this to be inappropriate, but some of the largest carmakers have been producing electric vehicles for a while. So, in that respect, we can consider these companies to be direct competitors of Tesla.

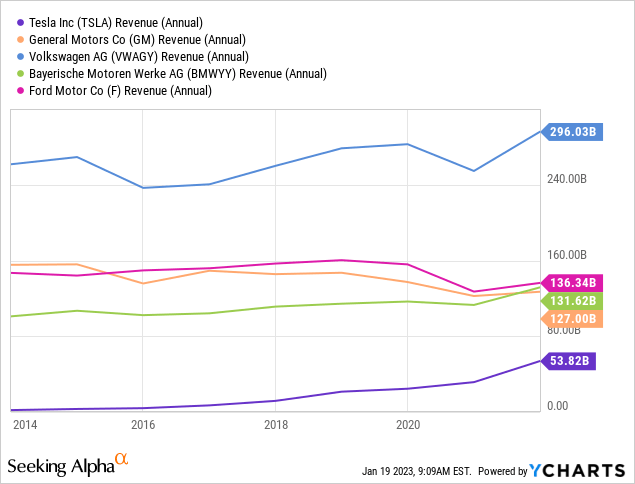

Among them are General Motors (GM), Volkswagen (OTCPK:VWAGY), Bayerische Motoren Werke AG (OTCPK:BMWYY) and Ford Motor (F). As you can see from the diagram above, all of the companies’ revenues mentioned above are higher than those of Tesla. Not to mention, the other carmakers’ sales histories seem to be much more stable than that of Elon Musk’s company. Sure, you might argue that Tesla is a relatively new and growing business compared to the other automakers. Yes, but it is more of a risk to buy a high-growth company since it cannot boast much stability.

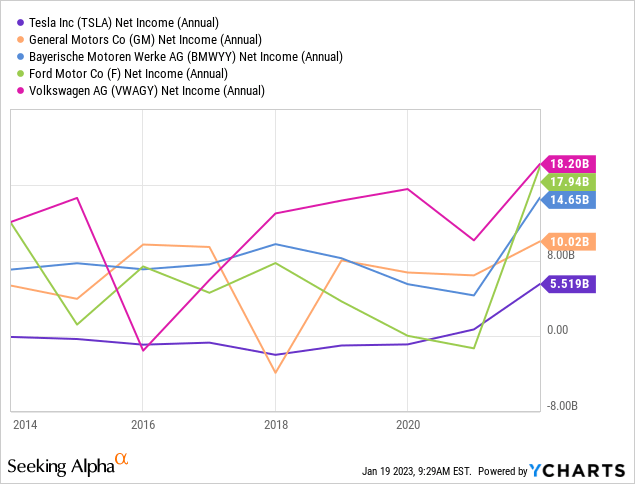

Obviously, Tesla’s net profit is also the lowest one of all the automakers mentioned above. At the same time, its net profit margin is about 10%, just a bit lower than BMW’s 11% and Ford’s 13%. And yet, giants GM and VW are less efficient than Tesla.

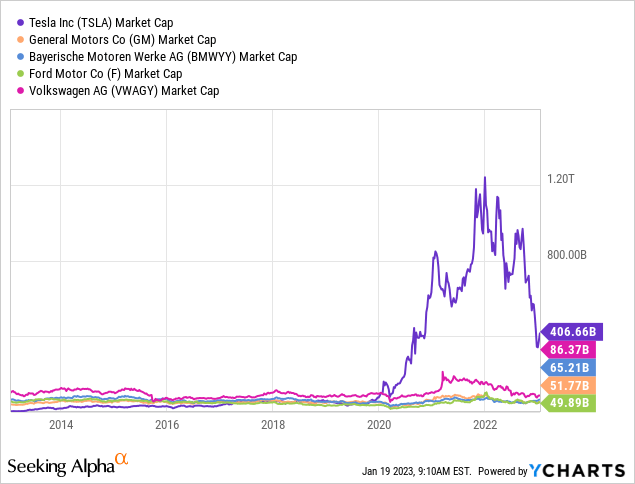

But still, as far as its market cap is concerned, Tesla is nowhere near a value investment compared to its peers.

One might expect that this should somehow be reflected in the companies’ market caps. But the opposite is true.

Tesla is the highest one of the five companies. In fact, in spite of its stock price fall, it is the most valuable automaker in the world!

|

Company name |

Market cap-to-sales |

|

Tesla |

7.55 |

|

General Motors |

0.41 |

|

Volkswagen |

0.29 |

|

BMW |

0.50 |

|

Ford |

0.37 |

Source: Prepared by the author.

I prepared a table above looking at some of the major automakers’, including Tesla’s, market capitalization-to-sales ratios. As you can see above, GM, BMW, Volkswagen and Ford have this indicator below 1, whilst Tesla’s is equivalent to well over 7.

To partly justify Tesla’s market cap, I would like to add that Tesla has great expertise in the field of artificial intelligence. The company bets that it can massively produce self-driving Tesla cars, which would most probably be popular with wealthy customers. The company also has very good autonomy algorithms and sensors. But other automakers also work on self-driving cars, including Volkswagen.

Tesla’s artificial intelligence (AI) and automation technologies could also be useful for production in factories in the future. The Tesla Bot, which is not due to be launched until 2027 (but will certainly be used internally sooner), can help automate production processes in factories and thereby reduce costs. The goal is for the factories to operate without humans. This could lead to Tesla cars becoming significantly cheaper than rival products, as workers are the biggest cost driver for car manufacturers.

But as you can see from what I have mentioned above, there are plenty of assumptions to be made. Tesla’s valuations assume that everything would go according to the management’s plans, I think.

Risks

There are certainly risks to buying Tesla and there are risks for those investors who want to short sell the company’s stock.

Here are the risks for the short-sellers:

- TSLA is a highly volatile stock. It is also very popular among investors. So, it is not certain when everyone will get disappointed with the company even though you might think it is overvalued and does not have a very bright future.

- A recession might not come this year. I wrote a bearish analysis for S&P 500 but all is possible. The Fed might ease the monetary policies, which will be a positive for almost every single company.

- You might also get the timing wrong.

Here are the risks for the bulls:

- The competition in the electric vehicle industry is high and growing.

- The management was even forced to offer big discounts, which is not very good for the company’s already quite moderate net profit margins.

- Tesla’s credit rating is B3 according to Moody’s. This is quite a low credit rating for the most valuable carmaker.

- The stock is still highly overvalued in spite of the recent correction.

- TSLA shares are also volatile.

- There might be a recession, which could be very dangerous for Tesla, given its debt and dependence on consumer demand for luxuries like electric vehicles.

Conclusion

Tesla, Inc. is a very popular company on the stock market. Its co-founder and CEO Elon Musk is a highly charismatic person, whilst the company itself is associated with green energy, innovation and technologies. But objectively there are not many Tesla, Inc. fundamentals to be very positive about. The price caps on most of the goods it sells are there and these are substantial, whilst the current net profit margin is about 10%, quite sound but not sky-high. The competition, meanwhile, is quite intense since large and established automakers have been producing EVs for some time. In spite of the stock price correction, Tesla, Inc. is not a value play just yet.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.