Summary:

- Lucid Motors is an electric vehicle maker, with a strong focus on serving the luxury consumer.

- The company’s flagship vehicle, the Lucid Air, has received positive reviews for its performance and technology.

- Reflecting on the increasing demand for electric vehicles, paired with solid fundamentals, I view Lucid as an attractive investment opportunity.

- Personally, I value Lucid shares at a base-case target price of $9.32/share.

David Becker/Getty Images News

Thesis

Lucid Motors (NASDAQ:LCID) is an electric vehicles maker, with a strong focus on serving the luxury consumer. The company’s flagship vehicle, the Lucid Air, has received positive reviews for its performance and technology. Reflecting on the increasing demand for electric vehicles, paired with solid fundamentals, I view Lucid as an attractive investment opportunity. Personally, I value Lucid shares at a base-case target price of $9.32/share (approximately 19% upside), based on 2030 deliveries equal to 200,000, an average sales price per car of $110,000, and a 10% net profit margin.

For reference, LCID stock is down almost 80% for the past twelve months, as compared to a loss of about 11% for the S&P 500 (SPY).

About Lucid Group

Lucid Motors is an American electric vehicle manufacturer founded in 2007 and based in Newark, California. The company specializes in developing luxury electric cars and has only recently started delivering its first production vehicle to customers (2021), the Lucid Air. The Air is a luxury sedan that offers a combination of performance, range, and technology, making it a strong Tesla (TSLA) contender in the EV market, in my opinion. Lucid Air offers a range of up to 517 miles on a single charge, making it the longest-range electric car currently on the market. The Air also boasts a top speed of 168 mph and can accelerate from 0 to 60 mph in just 2.5 seconds.

As of Q3 2022, Lucid has delivered 1,398 vehicles to customers as compared to a production of only 2,282. However, the company boasts over 32,000 reservations, with a potential sales pipeline of more than $3.2 billion. Although Lucid Motors has yet to turn a profit, given heavy investments in R&D and manufacturing as well as supply chain infrastructure, the company has a solid financial position and is well-positioned to scale up production of the Air and expand the company’s product portfolio. As of Q3 2022, Lucid reported $3.34 billion of cash and cash equivalents on the balance sheet and a net cash position of approximately $1 billion. Notably, the September quarter balance sheet does not yet account for the $1.5 billion raised in late 2022.

Lucid Motors enjoys the support of an exceptionally strong investor community. The company’s largest investor is the Saudi Public Investment Fund, which invested about $1 billion in the company in 2018 and another $915 million in late 2022. Other notable investors in Lucid Motors include, amongst others:

- Michael Klein, a financier and founder of M. Klein and Company

- LeEco, a Chinese technology company

- Venrock, a venture capital firm

- T. Rowe Price, an investment management firm

- Fidelity Management & Research Company, an investment management company

- China Environmental Fund, a Chinese investment fund

- China Development Bank, a Chinese state-owned development finance institution

- Samsung Ventures, the venture capital arm of Samsung Group.

EV Market Opportunity

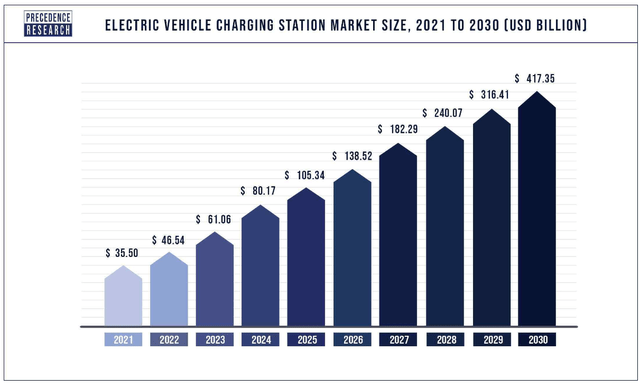

With many EV makers selling off sharply, including Lucid, Tesla, NIO (NIO), XPeng (XPEV), and Rivian (RIVN), the market for electric vehicles has most certainly lost lots of its post-covid appeal. However, the change of sentiment does not necessarily change the market thesis: In fact, the EV market is expected to grow significantly in the coming years, driven by increasing consumer demand for sustainable transportation and government regulations to reduce carbon emissions. According to a report by Precedence Research, the global EV market is projected to reach $417.35 billion by 2030, growing at a CAGR of close to 35% from 2021 to 2030.

In my opinion, Lucid is well-positioned to take advantage of this growth, given the company’s strong brand image and technology backdrop. Moreover, Lucid is also attractive given the company’s premium industry positioning: Lucid’s luxury EV offerings target the high-end consumer of the market, which are less price-sensitive and more willing to pay for premium features. Additionally, the company’s focus on range and performance is expected to attract consumers who are looking for electric cars that can compete with traditional gasoline-powered vehicles.

Estimating Lucid’s 2030 Potential and Valuation

Now the most important question: what would be a reasonable valuation anchor for LCID? Without a doubt, different analysts will value LCID differently, and price target will vary significantly. But here is how I would approach the task.

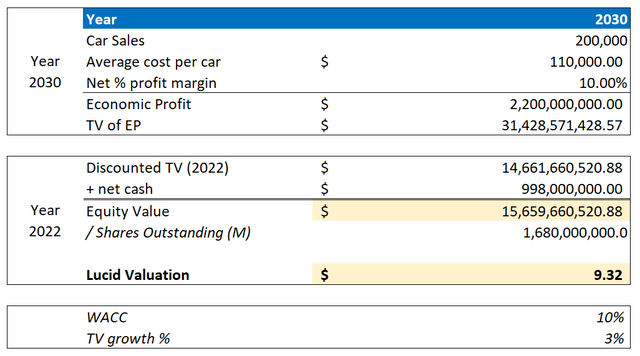

First, I want to acknowledge that LCID is a high-growth company. And accordingly, I want to base my analysis not on current numbers, but on what I believe could be achieved in 2030. That said, for the base-case, I anchor my valuation on an estimated 200,000 car sales in 2030, and an average sales price per car of $110,000. Furthermore, I assume a net profit margin of only 10%. Notably, this is below both Tesla’s 2022 net profit margin of 15% and Porsche’s 2022 net profit margin of close to 14%. Thus, in my opinion, 10% is a very reasonable assumption if one considers increased economies of scale. (Note that I expect sales volume to be almost 10x.)

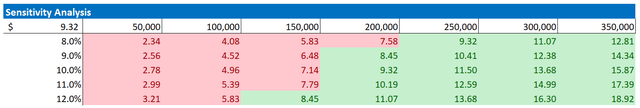

Personally, I believe 200,000 cars sold is not unreasonable, given Lucid’s technology advantage in the EV market and strength of brand. It is about one-third lower than what Porsche is currently selling. However, readers should feel free to challenge my assumption – see sensitivity table below.

Based on this, I calculate a $2.2 billion annuity, with a 2030 present value equal to $31.4 billion. This number discounted back to early 2023, assuming a 10% rate and adding a $998 million billion of net cash, gives an equity value of $15.7 billion, or $9.32/share.

Author’s Assumptions; Author’s Calculations

What if we vary the net profitability margin and number of car sales? I have enclosed a sensitivity table that shows the result of different combinations. For reference, red cells show upside as compared to LCID’s current valuation, and green cells show upside.

- Upside case $18.92/share

- Downside case $2.34/share

Author’s Assumptions; Author’s Calculations

Risks

Lucid investors should most certainly monitor the competitive environment in the market for EVs, as leading carmakers are already starting to cut prices. Moreover, investors should consider that sentiment towards risk assets (especially EV stocks) remains depressed. And given multiple macroeconomic headwinds, LCID stock may suffer from share price volatility even though the company’s fundamentals remain unchanged.

Conclusion

In conclusion, Lucid Motors is a company with a product offering, a large market opportunity, and a solid financial position. The company’s focus on luxury electric vehicles, range, and performance, is expected to attract consumers looking for premium electric cars. Moreover, I argue that Lucid’s strong investor base, notably the Public Investment Fund of Saudi Arabia, gives the company an excellent support backdrop to push for production ramp-up and business growth. Personally, I value Lucid shares at a base-case target price of $9.32/share (approximately 19% upside). My argument is based on 2030 deliveries equal to 200,000, an average sales price per car of $110,000 and a 10% net profit margin.

Disclosure: I/we have a beneficial long position in the shares of TSLA, XPEV either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Not financial advise.