Summary:

- After a 45% run in two months, Meta Platforms may have run too far too fast.

- Technicals, price targets, Seeking Alpha quant ratings, and estimates support this claim.

- Fundamentally, Meta is challenged on its bread-and-butter territory while new avenues are still unproven.

- Cost-cutting measures, while welcome, may not be good enough to be the sole savior.

Justin Sullivan

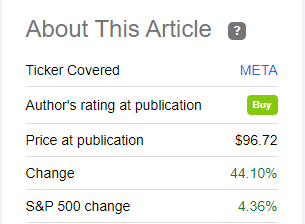

I wrote this article on Meta Platforms, Inc. (NASDAQ:META) the day after the company announced its layoff in November. The article argued that the bottom may have been in for META stock as it finally appeared like “The Zuck” Mark Zuckerberg acknowledged that the laws of the economy applied to him as well. Thankfully for me and anyone who followed the recommendation to buy, Meta Platforms, Inc. stock has since gone up by 44% compared to the market’s 4% as shown below.

Meta Performance (seekingalpha.com)

Good, But Why?

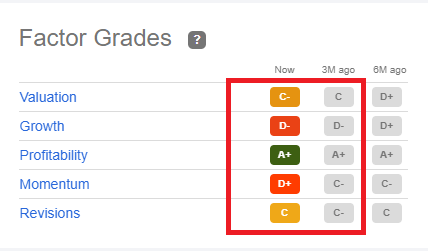

This situation is akin to a stranger walking to you and handing you something nice that you did not expect. You think “Good. Thanks. But, why?” I still like Meta, and I am planning to do every single share as of now. The near-50% run cannot be brushed off as a normal occurrence, especially since we did not have any fundamental news like great earnings to back up this run. As shown below, all the fundamental indicators have remained the same or got a tag worse (valuation and momentum) as shown by the Seeking Alpha quant ratings below.

SA Ratings (seekingalpha.com)

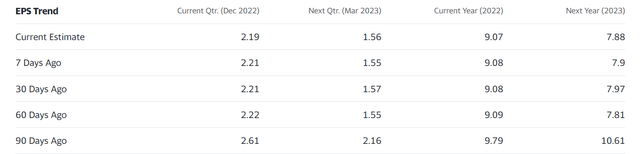

Estimates have only changed marginally (sometimes to the upside and sometimes to the downside) over the last 60 days, as shown below. Overall, nothing fundamentally has changed to justify a near 50% jump in 2 months.

Meta Estimates (Yahoo Finance)

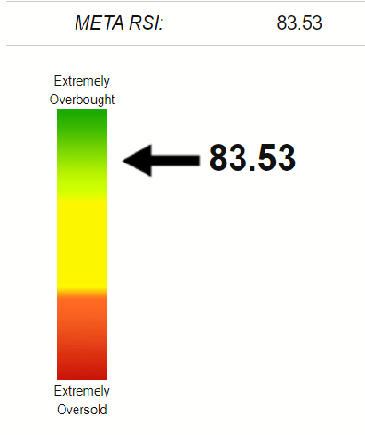

Technically Overbought

From a technical perspective, the Relative Strength Index (“RSI”) is an often-watched and used momentum indicator. While it is nice for your stock to have momentum behind it, too much of a good thing can be bad too. Anything above 70 is considered overbought, and Meta is now well above that mark as shown below. The faster they go, the quicker they fall.

META RSI (www.stockrsi.com)

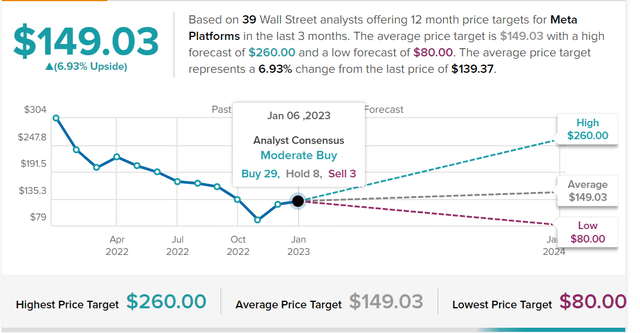

Meta Platforms, Inc. Price Target

Taken with a pinch of salt, analyst price targets can be handy. After all, the big boys play a huge role in the price action – in the short term, at least. A median price target of $150 suggests that the upside room here is not as pronounced as it was when Meta Platforms, Inc. stock was at $96 in November. At $139, the stock is trading at a forward multiple of 15 based on 2023’s expected EPS of $9. But if we are to use 2024’s forward EPS instead, the forward multiple jumps to a more pricey 18. Let us not even get into the 2025 and beyond with the current expectations of a 15% YoY decline in EPS.

While a multiple of 18 may not look too bad on paper, investing is all about choices. If one can buy a much stronger stock like Apple Inc. (AAPL) at 20 times 2024 earnings, why would Meta at 18 times earnings make sense? It made sense when the stock was at $96, but not at nearly $140.

Meta Price Target (www.tipranks.com)

Questionable Business Fundamentals

In a recent survey of 43 multinational companies, 30% of the respondents mentioned their advertising spending will decrease in 2023 and perhaps beyond while 75% said their budget is under heavy scrutiny. Here is one more study that concluded that 2023’s global ad spending will see a slower growth rate compared to 2022. Although digital advertising is still taking share away from offline ads, it is safe to say with more powerful entrants like Amazon.com, Inc. (AMZN), Meta is no longer certain of its once unassailable position at the top of the advertising food chain.

But what about cost-cutting and Metaverse, you might ask? Those may be mutually exclusive if you think about it. Without additional spending, it is hard to see Metaverse take off in the long run. Without ad growth or cost-cutting, it is hard to see Meta please investors in the short to medium term. This conundrum is acknowledged by Venture Capitalist Jim Breyer, an early Facebook investor, as covered here by Seeking Alpha.

Conclusion

“The Zuck” may still win the long term, and I am actually taking his side on this still murky bet. I mean, after one look at the kids these days and how much time they spend on their phones, video games, and newer forms of glorious consumption, it is easy to make the case for Meta Platforms, Inc. and other big players to make a dent in this already crowded space.

But, while the price was right for me to stand firmly behind Meta Platforms, Inc. at $96, but at $140 and none of the fundamental concerns alleviated, the price isn’t right for me right here, right now. As shown above, neither the technicals nor price targets lend much credibility to any undervaluation thesis. Meta Platforms, Inc. is a firm hold here, and I may be tempted to trim a little should this run take the stock beyond $150.

If you say Meta Platforms, Inc. was in the $300s just a little while ago, remember that just because a stock was at a particular price before, it doesn’t mean that it can and will go to that price in the future. Expectations change. Reality changes. And sometimes the future may never be as good as the past was. Just ask Cisco Systems, Inc. (CSCO) investors.

Disclosure: I/we have a beneficial long position in the shares of META, AMZN, AAPL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.