Summary:

- Microsoft Corporation’s fiscal Q2 2023 results were solid, although growth was down to just 2% due to lower consumer spending.

- Not all segments performed poorly, as the intelligent cloud segment with Azure still saw solid growth and outperformed expectations.

- It was the Q3 2023 outlook from management that caused for some concern among analysts and investors, as Microsoft sees a softening in demand for Azure services.

- Microsoft has solid revenue growth drivers in place due to its exposure to secular trends such as cloud, gaming, and AI.

- I downgrade my rating on the company from strong buy to buy with a price target of $280 based on current FY24 EPS expectations.

jewhyte/iStock Editorial via Getty Images

Introduction

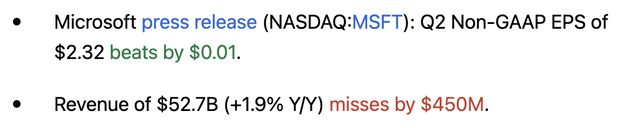

Since Microsoft Corporation (NASDAQ:MSFT) released its fiscal Q2 2023 results on January 24, 2022, there has been a storm of opinion raging around across all platforms, including Seeking Alpha. Everyone seems to have a different view, as some Wall Street analysts have lowered their price targets and others remained bullish. Seeking Alpha contributors reflect the same spread of opinions, with strong sell ratings, strong buy ratings, and everything in between written over the last week.

Meanwhile, Microsoft missed revenue expectations by only $450 million while EPS came in roughly in line with estimates. The share price moved higher at first driven by solid results from the Azure segment, or at least better than expected results. Once the earnings call started and Microsoft released its outlook, which guided for a weakening of the cloud and Azure platform growth, the share price dropped to negative numbers again. After falling 3% on the next trading day, we are now (a few days later) up by more than 2% since before the earnings release. So, it looks like the Microsoft share price reflected the mix of opinions shown by contributors and analysts alike.

I covered Microsoft back in October and called Microsoft my highest conviction stock. Since then, Microsoft has delivered a total return of 10%, outpacing the S&P 500 (SP500) gain of close to 7%.

Back in October, I rated Microsoft a strong buy as the business outlook was strong and the company is exposed to several secular growth drivers such as cloud, gaming, and personal computing. Of course, by now, we could add AI to these growth drivers. This is what I concluded:

Microsoft remains my number one stock pick, even after the recent quarterly results as I still see great upwards potential and the long-term investment thesis remains incredibly strong. Microsoft has opened itself up to multiple high-growth sectors like Cloud and Gaming. It already has a strong position in the cloud by leveraging its Azure platform with its 21% share in global cloud computing and offering more abilities to its customers than other platforms like AWS. Microsoft is strengthening its position in gaming by acquiring Activision Blizzard and once given the green light, will become the third-largest enterprise in the gaming segment by revenue. The acquisition will open a door for Microsoft into other high-growth markets such as the Indian gaming market. All this growth is being supported by its legacy businesses in personal computing and other offerings such as Microsoft Office 365 and Windows, which remain massive income sources and cash machines with an incredible moat around them.

Enough has happened since then and while most growth drivers remain unchanged, the weak growth outlook for cloud computing and decreasing likelihood of approval for the Activision Blizzard (ATVI) acquisition could challenge some of the expected growth. At the same time, Microsoft added a new growth driver by focusing on AI development and investing a large amount in ChatGPT developer OpenAI.

Within this article, I will revisit my investment thesis and discuss several important changes and developments. Most importantly, I will take a look at the latest earnings results to see how Microsoft is doing and see how this impacts the FY23 outlook and expectations for the years beyond.

Let’s get to it!

Quarterly review

For its fiscal 2Q23 Microsoft reported revenue of $52.7 billion, showing growth of just 2% YoY and very different from the solid double-digit growth rates we witnessed over the last couple of years. The growth rate for Microsoft reflects the current economic weakness and drop in consumer spending. Still, not all business segments lacked in growth. Yes, all of them saw a slowdown compared to previous quarters, but most still reported positive and decent growth rates.

Revenue for the Productivity and Business Processes segment was $17 billion and still increased 7% YoY (13% on constant currency). Unsurprisingly it was dynamics products and cloud services that saw the fastest growth for this business segment as this saw growth of 13% (20% on constant currency) driven by dynamics 365 growth of 21%. Dynamics 365 is a cloud-based customer relationship management (CRM) and enterprise resource planning (ERP) solution offered by Microsoft. This product category has been growing at a rapid pace as the cloud capabilities of the product are easy to integrate by businesses and in times when consumer spending is falling and businesses need to maximize customer contact, these solutions from Microsoft become increasingly important to drive sales and margins for all sorts of businesses. Strong continued growth for this product was therefore not surprising.

In addition to strength in dynamics, LinkedIn also saw 10% revenue growth, and Office commercial products and cloud services revenue increased by 7% YoY. The one setback in this business segment was Office consumer products which saw a 2% decrease in revenue which reflects the decrease in consumer spending. Still, this was up 3% on a constant currency and total subscribers grew to 63.2 million.

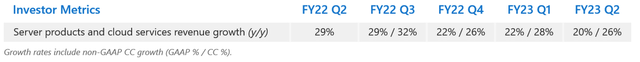

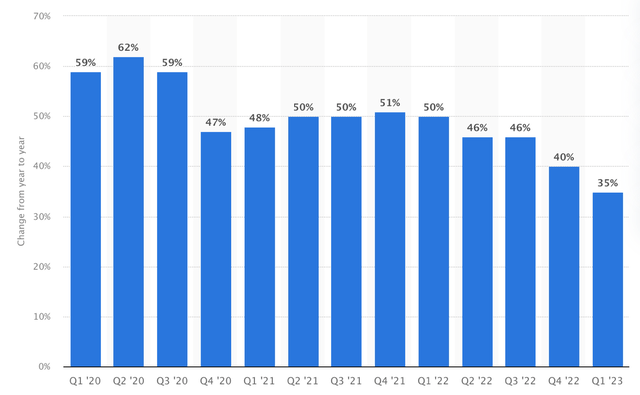

Then we move on to most likely the segment that got the most attention from both investors and analysts – Intelligent Cloud. Revenue for the segment was $21.5 billion, representing growth of 18% YoY (or 24% on constant currency). Growth was primarily driven by Azure growth of 31% or an impressive 37% on constant currency. Azure growth has been slowing down as illustrated below, but still came in higher than expected by analysts and this caused the initial jump in share price aftermarket. Azure continued to perform rather strongly and shows the strength of Microsoft in the cloud industry. It will be most interesting to see how both Alphabet (GOOGL) and Amazon (AMZN) will do for their respective cloud segments, as this will give a better idea of just how strong Microsoft’s Azure really is.

Intelligent cloud segment growth (Microsoft) Microsoft Azure growth rates (Statista)

The big disappointment for the quarter was the More Personal Computing segment, but this was to be expected as the personal computing industry has been hit significantly by lower consumer spending, as already witnessed in the results of PC makers Dell (DELL) and HP (HPQ), but also results for AMD (AMD) and Intel (INTC). This business segment of Microsoft saw revenue decrease by 19% YoY to $14.2 billion. Still, revenue did increase compared to the previous quarter which could indicate that the worst is behind us. Yet, the latest quarter included the holiday period which might have boosted sales for the segment ever so slightly. Windows OEM and devices were hit the hardest as revenue for both fell by a staggering 39% YoY. This matches the decline in PC sales worldwide. Xbox content and services decreased by 12% YoY as also gaming suffers from consumer weakness.

The one highlight for this segment was search and advertising revenue, as this grew by 10% YoY or 15% on constant currency. Microsoft is remarkably strong in the advertising segment lately, and with advertising competitors seeing much slower, or negative, growth YoY, Microsoft is well-positioned to take market share. The advertising market continues to be an underrated growth opportunity for Microsoft, and the Netflix (NFLX) partnership proves this.

With revenue growth weakening, the same could be expected of net income and EPS, and this is exactly what happened. Net income was $17.4 billion and decreased 7% YoY, resulting in EPS of $2.32, decreasing 6% YoY. So, why were net income and EPS reporting negative growth while revenue was still slightly positive? By looking at the income statement we can see that gross profit was still showing positive growth of 5% YoY. The problem was that total expenses consisting of R&D, Sales and marketing, and general and administrative costs increased by a much faster 17% YoY, much outpacing both revenue and gross margin growth, which then resulted in lower net income and EPS. I believe this should be of no worry to investors as this is simply the result of near-term economic headwinds and is not causing any trouble right now. Once these headwinds disappear Microsoft should also quickly increase its margins again and EPS growth will most likely largely outpace revenue growth by then. As a result, free cash flow also dropped by 43% YoY to just $4.9 billion.

Overall, the quarterly financial results of Microsoft did not disappoint me and with most eyes focused on cloud growth, it was satisfying to see that this segment continued to report solid growth rates, outperforming expectations by wall street. Also, the continued growth in the Productivity segment shows the strength and importance of the products offered by Microsoft. I expect growth to remain under pressure, but to remain relatively resilient. Weakness in More Personal computing was as expected and heavily impacted by lower consumer spending. I actually don’t believe the results offered many surprises to investors or analysts alike which nowadays should be seen as a good thing.

Growth driver revisit

Cloud computing – Azure

With Microsoft being one of the leaders in the fast-growing cloud industry, the cloud is expected to be a solid revenue driver for Microsoft and the resiliency of the cloud business against an economic downturn has caused investors to increasingly focus on this segment alone. I discussed the cloud opportunity extensively in my initial coverage on Microsoft back in October and I concluded the following:

According to Fortune Business Insights, the global cloud computing market size is expected to grow at a 17.9% CAGR through to 2028. The total market size in 2028 will be $791.48 billion and therefore creating a massive opportunity for Microsoft. Microsoft has an incredibly strong cloud platform in the form of Azure and is well-positioned to even increase its market share as it has been doing over the last few years. This is a strong secular tailwind for Microsoft.

I believe not much has changed since then as Microsoft continues to be a leader in the cloud industry, only behind Amazon’s AWS. The one thing that could be said is that in the near term, the cloud computing industry might not be as resistant as initially thought and so this segment might show some softer growth rates over the coming quarters. Microsoft has guided for the intelligent cloud segment to report revenue of $21.7 to $22 billion for 3Q23. According to Wedbush analyst Dan Ives, this indicates that, indeed, demand for Azure is softening, with guidance only pointing to the low 30% range. Considering the current economic climate, growth of 30% YoY does not sound bad at all and maybe we investors have become somewhat spoiled by the staggering performances from Microsoft and its peers over the previous couple of years.

Quite a few other wall street analysts expressed their worries surrounding the current outlook for Azure and expect the situation to get worse over the next several months and call the Azure slowdown “concerning.”

While I agree that an Azure slowdown will not help Microsoft in the near term, I also believe investors should not be overly focused on this near-term weakness. Yes, it could cause the share price to have a tough time over the next several months as current weakness could very well limit upside potential. Still, according to Precedence Research, the global cloud computing market is projected to grow at a 17.43% CAGR until 2030 to hit a market size of $1.6 trillion. New advanced technologies such as AI, VR/AR, ML, IoT, and data analytics require large amounts of cloud computing capacity and the rapid continued adoption of cloud computing services in healthcare and manufacturing industries will drive demand. For any long-term investor, cloud growth should be the least of your worries when considering an investment in Microsoft. Microsoft is a leader in cloud computing services and is well-positioned to benefit.

Gaming – the Activision Blizzard acquisition

I have written a whole separate article on the gaming opportunity for Microsoft, and I highly recommend reading this one to go in-depth into the opportunity ahead. This is what I concluded back then:

Scrutiny over the Activision acquisition remains a difficult one to judge as it seems less likely every week that the acquisition will be approved. Microsoft continues to do everything in its power to cooperate with the regulators, but the question will be whether it is enough. The acquisition will open a lot of new doors for Microsoft, but I don’t believe it is a make-it-or-break-it situation as Microsoft already has a strong position and plenty of other opportunities in the gaming market. Growth in the gaming segment will not depend on just this acquisition. Cloud gaming is a large future opportunity on which Microsoft is acting well so far. The general growth of the gaming market will be an additional driver of growth as Microsoft already holds a strong market position through its Xbox platform.

The gaming opportunity is massive for Microsoft and with the gaming market expected to grow at a CAGR of 13.2% until 2028 according to Business Fortune Insights, Microsoft is expected to see strong growth over the next 5 years.

But just as I concluded back in December, the likelihood of the acquisition of Activision Blizzard does not seem to get any better. The acquisition is causing regulatory hurdles in both the UK and the U.S. Regulators in the UK were originally supposed to pass a clear verdict by March 2023, but this has been postponed to the 26th of April 2023. This seems to be primarily due to the regulators needing more time to consider the proposed concessions by Microsoft – like 10-year deals to keep Call of Duty on PlayStation and to offer the franchise to Nintendo consoles. As I mentioned in my previous article, the primary incentive for the acquisition is not to make these big game titles an Xbox exclusive, but the acquisition positions Microsoft more favorably to develop new Xbox games, better position itself in cloud gaming, and expose the company to the faster growing mobile gaming industry (primarily in India).

To make things worse, the FTC requested a block on the deal in December, arguing that it would gain an unfair competitive advantage over its rivals by acquiring Activision. According to Reuters, a secondary verdict could take until the start of 2024 to be completed.

Microsoft continued to do everything in its power to get the deal through, but this seems to get tougher and tougher. Whether the deal will come through I believe is a tough one to call right now. Microsoft remains confident it will, but it might have to make even more concessions to persuade regulators to approve the deal at which point management should question whether the deal still makes sense. Plenty of analysts and investors have never been a fan of the acquisition. I agree that it is tough to see the value of Activision for Microsoft considering the deal would cost Microsoft $69 billion while only very slightly contributing to total revenue.

Whether Microsoft will acquire Activision Blizzard remains to be seen, but I continue to believe that the gaming segment will see strong growth over the next 5 years, with or without Activision, as Microsoft has a strong position through its Xbox platform and investments in cloud gaming.

AI – Investment in OpenAI

The next major wave of computing is being born, as the Microsoft Cloud turns the world’s most advanced AI models into a new computing platform. We are committed to helping our customers use our platforms and tools to do more with less today and innovate for the future in the new era of AI

These are the words of Satya Nadella on the earnings release of Microsoft’s 2Q23. Microsoft is heavily investing in AI and it does this by leveraging the expertise of ChatGPT developer OpenAI. So far, I have not talked about the AI opportunity for Microsoft in previous articles, but a $10 billion investment in OpenAI makes it hard not to talk about it when considering investing in Microsoft.

I believe this part of the earnings call transcript, where CEO Satya Nadella talks about the AI opportunity, pretty much summarizes it all:

The age of AI is upon us, and Microsoft is powering it. We are witnessing non-linear improvements in capability of foundation models, which we are making available as platforms.

And as customers select their cloud providers and invest in new workloads, we are well positioned to capture that opportunity as a leader in AI.

We have the most powerful AI supercomputing infrastructure in the cloud. It’s being used by customers and partners, like OpenAI, to train state of the art models and services, including ChatGPT.

Just last week, we made Azure OpenAI Service broadly available, and already over 200 customers – from KPMG to Al Jazeera – are using it. We will soon add support for ChatGPT, enabling customers to use it in their own applications for the first time.

AI is a massive business opportunity and Microsoft has been actively investing in it for many years proven by its $1 billion investment in OpenAI back in 2019. Now with the $10 billion investment in OpenAI, Microsoft is accelerating its AI development and as stated above, plans to integrate the functionalities designed by OpenAI (and found in ChatGPT) into its own suite of products. The most obvious integration will be in its Azure cloud platform for commercial customers, but I believe we will soon also start to see Microsoft integrating AI functionalities in its Bing search engine and Office 365 package. Integrating new functionalities into its products will allow Microsoft to increase prices (possibly in the way of an upgrade package), offer new services, and make its products more attractive beating competitors such as Google. The integration of AI in Dynamics products could also bring a full stack of new possibilities to improve business processes and customer contact (CRM/ERP) to Microsoft enterprise customers, challenging leader Salesforce (CRM) in this space.

According to Precedence Research, the AI industry is expected to grow at a rapid 38.1% CAGR until 2030 to reach a market size of a whopping $1.6 trillion.

The burgeoning demand for the artificial technology among the various end use verticals such as automotive, healthcare, banking & finance, manufacturing, food and beverages, logistics, and retail is expected to significantly drive the growth of the global artificial intelligence market in the forthcoming years. Technological innovations have been always an important part of the majority of the industries.

AI is a massive growth industry and Microsoft is positioning itself well by investing in one of the frontrunners in high-end AI technology and bringing AI advanced functionally as one of the first to customers. Also, according to Forbes, OpenAI will soon release a paid version of ChatGPT called ChatGPT professional which could turn out to be a success, although pricing has not been released yet.

If Microsoft were to successfully integrate advanced AI capabilities as one of the first, this could gain them a lot of market share across several of its products and could make Microsoft the main beneficiary of the growing AI industry. Honestly, if Bing were to get you better and easier search results without having to scroll through multiple pages looking for your answer, wouldn’t you use it over Google? I would!

Balance sheet & Dividend

Microsoft has a very healthy balance sheet and continues to generate large amounts of cash. Total cash decreased from the start of the fiscal year in July from $104.75 billion to $99.51 billion today. And while a decrease in total cash on the balance sheet is not so great, this is primarily due to the company returning large amounts of cash to shareholders and paying off debt. Long-term debt fell by $3 billion over the same time period to $44 billion, which means Microsoft still holds a significant net cash position.

Microsoft returned $9.7 billion to shareholders in the form of share repurchases and dividends in 2Q23, a decrease of 11% compared to the second quarter of the fiscal year 2022. Still, returns were very decent.

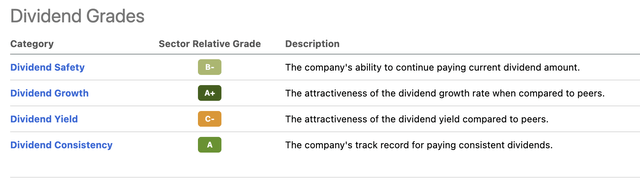

As for dividends, Microsoft currently yields 1.12% with a payout ratio of below 30%. Microsoft has been increasing its dividend for 18 straight years and has a 5-year growth rate of close to 10%. This means that the dividend is safe and sustainable. I expect Microsoft to keep increasing the dividend over the coming years and the growth rate to remain in the area of 10%. Microsoft could be an excellent company for dividend investors thanks to its solid dividend yield, strong increases, and dividend safety in combination with cash flow growth.

It is, therefore, no surprise that Microsoft gets high grades regarding its dividend from Seeking Alpha Quant ratings as shown below.

Outlook & Valuation

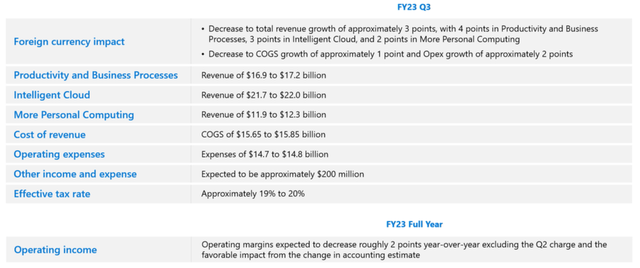

Maybe most important for both investors and analysts was the outlook for next quarter from Microsoft. I already discussed the outlook for the cloud segment that did not fare well with analysts and caused for the share price decline aftermarket and during the next trading day. At the midpoint of guidance, the following growth rates are expected:

- Productivity and Business Processes revenue growth of 8% YoY

- Intelligent cloud revenue growth of 14.4% YoY

- More Personal Computing revenue decrease of 16.6%

- Total revenue expected of $51 billion at the midpoint of guidance, or 3% revenue growth.

Microsoft Outlook 3Q23 (Microsoft)

The growth outlook is not great. Wall Street analysts earlier expected 3Q23 revenue of $52.42 billion, but these have now been revised down slightly to $51.09 billion and are pretty much in line with management’s expectations. EPS is forecasted to be $2.23 and grow by 0.66%. This results in fiscal FY23 expectation of 5.43% revenue growth combined with EPS growth of 1.19%. Analysts expect both revenue and EPS to accelerate again by the final fiscal quarter of FY23, or by the second half of 2023.

I believe current analyst estimates correctly reflect the tough situation of Microsoft right now and I agree with the slightly upbeat guidance by the second half of 2023 as we should expect the economy to slightly recover (or bottom) over the next several months. Still, this will very much depend on the strength of the economy and the question of whether we will avoid a recession. If we were to enter a recession, this could still impact 4Q23 revenue expectations for Microsoft and drive the share price lower as a result. This would also impact my target price calculated below.

In addition to this, another risk to the current expectations is a further slowdown of the intelligent cloud segment, especially Azure. As this one continues to be the primary growth driver for Microsoft, even softer demand than currently anticipated could result in a downbeat quarter with slower growth or even negative growth.

Also, the acquisition of Activision Blizzard continues to be an uncertainty to investors and could become a drag on share price growth if no clarity is on the horizon. This is something to keep in mind when considering an investment in Microsoft. Still, the most important to any investment is the valuation.

Microsoft is currently valued at a forward P/E of 26x based on FY23 EPS estimates. This valuation is 10% below its 5-year average of 29. Analysts are guiding for revenue and EPS growth to return to double digits by FY24 until FY26. I believe that based on these growth estimates, business strength, incredible AAA-rated balance sheet, and the multiple secular growth drivers Microsoft is exposed to, a P/E of 26x is warranted for this high-quality company. Also, I expect revenue and EPS growth to come in higher than current analyst estimates until 2026, but to stay conservative I will go with current expectations.

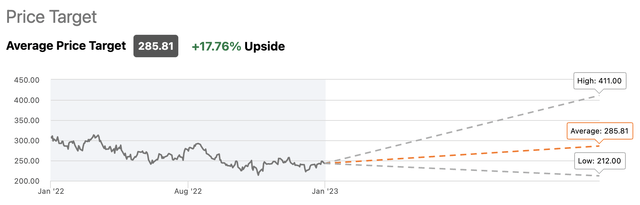

Based on FY24 EPS of 10.78 and a P/E ratio of 26x, I calculate a price target of $280 per share. With a current share price of approximately $244 per share, this leaves us with a 15% upside potential.

For comparison, the current average price target from 51 wall street analysts is $285 which offers close to an 18% upside from its current share price.

Conclusion

Microsoft Corporation delivered a mixed bag with its most recent earnings release, resulting in the share price increasing by 4%, to then move down again to -3% the next trading day. At first sight, the numbers looked decent and cloud performance was once again strong. It was the outlook that upset investors and made analysts worry. This was primarily due to unexpected soft demand for Azure services.

Revenue growth is expected to remain in the low single digits for the next quarter, after which analysts see a slight recovery to higher growth as the economy bottoms in the first half of 2023.

As a long-term investor in Microsoft, I try to look through all near-term weakness and use the opportunities to increase my position in the company. Microsoft is an excellent company with a great growth runway due to its exposure to secular growth trends like cloud computing, gaming, and now also AI.

AI could become the largest growth driver for Microsoft if all is executed well, but right now I choose to stay careful. AI is highly interesting and could be a significant growth driver, but it isn’t yet. I am curious to see how Microsoft is going to integrate AI capabilities into its products and drive additional revenue growth through it.

While near-term growth isn’t great, I continue to believe in the long-term prospects for Microsoft, and the company continues to be my highest conviction stock and largest personal holding.

Based on current FY24 EPS estimates I calculate a Microsoft Corporation price target of $280, leaving investors with a 15% upside potential from a current share price of approximately $244 per share. Considering the strength of Microsoft Corporation, I believe this offers enough upside to warrant a buy rating for the stock. I do downgrade my rating from a previous strong buy to a buy, as the share price has increased by over 10% and the near-term outlook is somewhat disappointing, resulting in a lower price target.

I rate Microsoft a buy and recommend investors to look through the near-term weakness.

Disclosure: I/we have a beneficial long position in the shares of MSFT either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.