Summary:

- Visa operates the world’s most popular payment processing network.

- The company reported solid financial results for Q1 FY23 as it beat both revenue and adjusted earnings growth estimates, despite a tough economy.

- Visa bought back ~$3 billion in shares in the quarter, which likely shows management is confident about the company’s strategy and stock valuation.

- Visa is undervalued intrinsically according to my discounted cash flow valuation model.

hatchapong

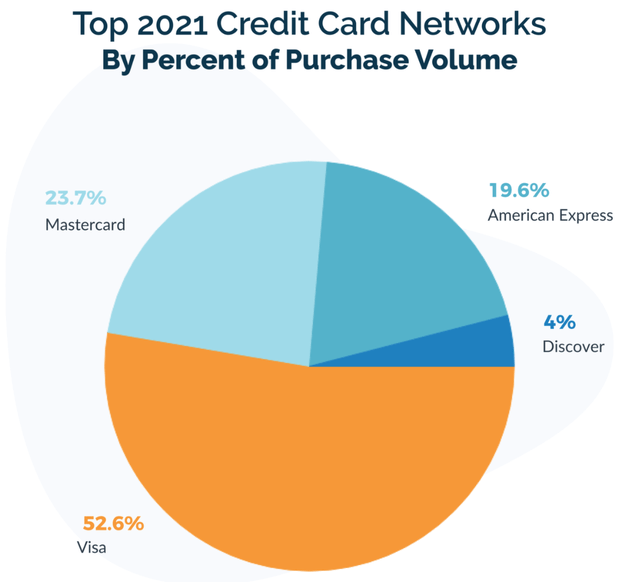

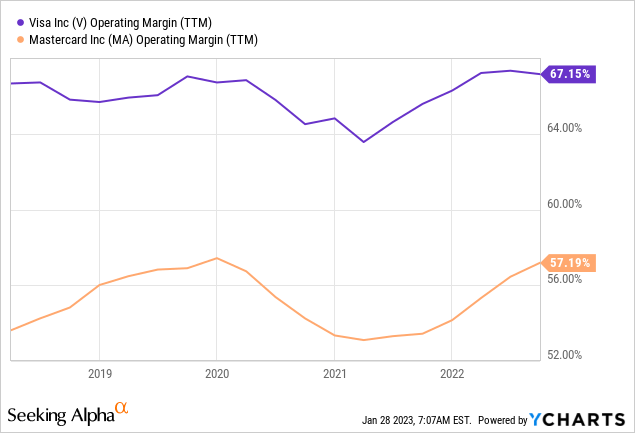

Visa (NYSE:V) is one of the greatest financial companies in the world and one of the “big two” card network providers along with Mastercard (MA). The company had over a 52% market share of the payment volume market (in 2021) and is a true leader in the industry. Visa also has a super high operating margin of over 67%, which is above competitor Mastercard at ~52%. In addition, the company has continued to produce strong financial results in the first quarter of 2023, as it beat both top and adjusted bottom-line growth estimates. Critics of Visa would say the company can be disrupted by Cryptocurrency. However, Visa has embraced the new technology and has partnerships with over 60 crypto companies, including the most popular exchange in the U.S., Coinbase (COIN) for its crypto card. In this post I’m going to break down Visa’s latest financial results and its valuation via my advanced model, let’s dive in.

Visa Market share by Payment Volume (SEC Filings Upgraded Points)

Solid Financials

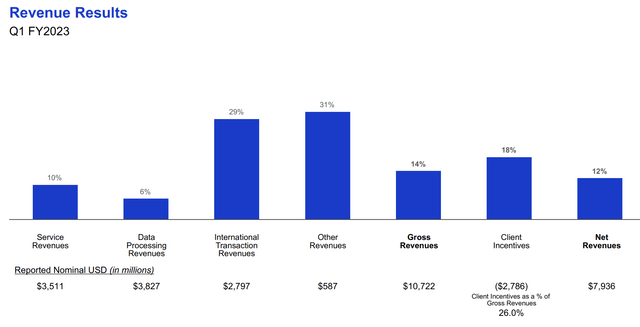

Visa reported strong financial results for the first quarter of fiscal year 2023. Its net revenue was $7.94 billion, which beat analyst estimates by $238 million and increased by a solid 12.42% year over year. This growth rate was slightly less than the 18.72% growth rate reported last quarter but this was to be expected given the macroeconomic environment.

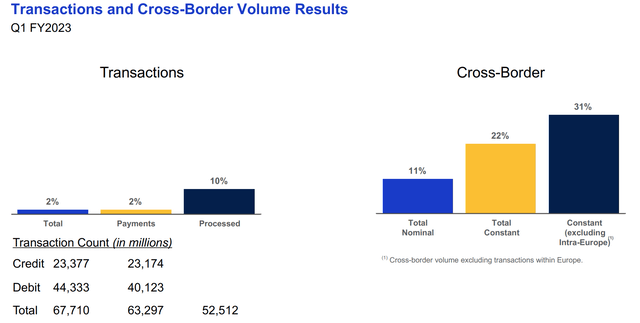

Breaking its revenue down by segment, service revenues increased by 10% year over year to $3.5 billion. This was followed by data processing revenue at $3.827 billion, up 6% yearly. International transaction revenue was a standout performer, with revenue of $2.797 billion reported, up a solid 29% year over year. This was driven by a sharp increase in cross-border payments which increased by 31% year over year, excluding intra-Europe.

Transactions and Cross Border (Q1,FY23 report)

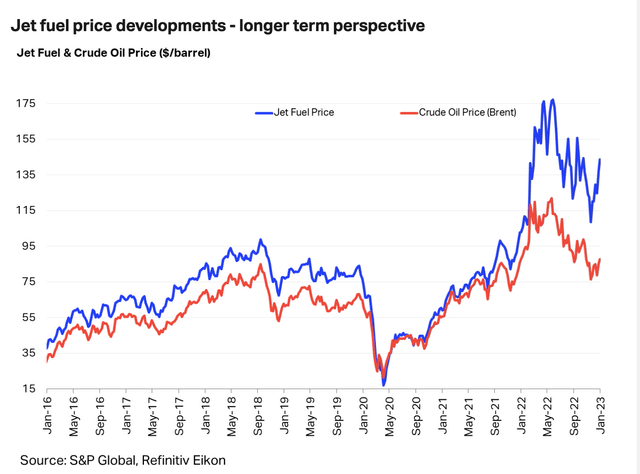

International transaction revenue growth was also driven by strong “travel-related” cross-border volumes, helped by the FIFA world cup which hosted ~2.45 million spectators in Qatar. In addition, the lifting of restrictions in China helped to cause a surge in payment volume. Overall I believe these are positive signs and we are still seeing positive effects from the pent-up demand in 2020 and the “travel reopening” of 2021. The price of jet fuel has also declined from its peak of over $175/barrel to ~$145/barrel, which is a positive sign for the cost of flights. I personally noticed recently that flight prices were higher than a couple of years ago and I expect jet fuel prices are a key culprit. As inflation is on a downward trend, I expect fuel prices to adjust to levels only slightly higher than pre-pandemic long term. This should be a positive factor that will likely cause a surge in travel.

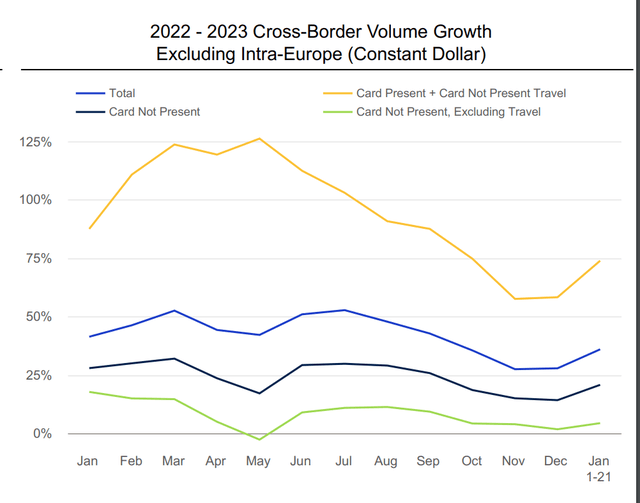

Keeping on the travel subject, Visa has recently scored three key partnerships with major travel providers. This includes the Qatar Airways Privilege Club, which has signed a huge 10-year partnership with Visa, for a series of co-branded payment initiatives. The partnership with Visa means that as Qatar Airways launched more co-branded credit cards, they will use Visa, as the exclusive payment processor. As mentioned prior Qatar previously hosted the FIFA world cup, which really did help put the country on the map. Therefore I forecast a continued increase in tourism to the middle east region. Over in the U.S., Visa also scored a partnership with JPMorgan Chase, to become the exclusive payment network for their co-branded credit card. In Australia, Visa Credit partnered with HSBC to create a credit card with the Star airline alliance. The beautiful thing about this deal is it combined several Star Alliance airlines with a single credit platform, which was a world first. These partnerships position Visa as a travel leader and the exclusivity of many of the deals, give them a competitive advantage over competitors such as Mastercard in certain regions. Mastercard does have deals with Dubai-based Emirates airlines, Air Canada and Jet Blue. Therefore it looks as though the travel world has divided, but there are still plenty of opportunities for both players. The chart below is really for extra information, but notice the slight upward lift in January, which broke the prior downward trend. This could have been driven by the holiday period payment volume prior, but either way, it is a sign of positive momentum to come.

Cross Border 2 (Q1,FY23 report)

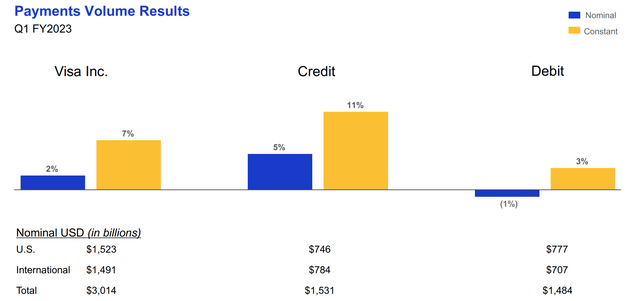

Moving onto overall Payment volume, Visa reported 7% year-over-year growth to $3 billion on a constant currency basis. This was mainly driven by Credit which increased by 11% year over year to $1.5 billion. It should be noted Visa has experienced foreign exchange headwinds from the strong U.S dollar, which has impacted growth, hence the “constant currency” reporting.

Consumer payments reported solid growth with a series of deals and co-branding partnerships. Visa, renewed its partnership with Bank of America (BAC) and launched a new range of premium rewards credit cards. The company also renewed its deals with Capital One and Commerce Bank. In addition, to renewing its partnership with retail Costco, which is surprisingly the largest independent payment solutions provider in the United States. Costco has over 4 million cardholders across debit and prepaid, and has recently signed a new agreement for credit.

Globally, Visa reported strong growth in “Tap to Pay” penetration which reached 72%, excluding the U.S. and Russia. This is a major deal, as the less friction one can make a transaction, the better the user experience and increased likelihood of adoption. Over in the U.S., “tap to pay” has lagged for a variety of reasons and only has ~30% penetration. Therefore, this offers a huge potential runway of growth to increase mainstream adoption and thus payment volume due to the ease of use. Tap to Pay contactless payments are often used for low-volume transactions and thus offer a great alternative to cash. Nobody wants to put their pin code in for a $5 purchase, and tap to pay solves this issue. Over in the U.K. where I live, there were 1.3 billion contactless transactions in 2021, and it’s immensely popular (I personally use this daily). Across the main cities in the U.S, San Francisco, New York City, and San Jose, Tap to Pay is already above 50% penetration. In addition, 65% of Costco’s in-store transactions were completed with this method.

Tap to Pay Sign (NFC world)

Visa also reported strong “new flows” with growth of over 20% year over year, on a constant currency basis. This was driven by B2B payment volume growth and Visa Direct transactions. Visa Direct enables the real-time delivery of funds directly to someone’s account, using their card credentials. This has many applications including instant peer-to-peer payments to friends and paying off a Visa credit card debt. In the first quarter of fiscal year 2023, Visa Direct reported a staggering 1.9 billion transactions, which increased by a rapid 33% year over year. The company also scored a key partnership with the Standard Chartered Bank in Hong Kong and recently launched in Malaysia. Visa Direct also enables driver payments for food delivery provider DoorDash. In addition, Visa launched a Peer to Peer program in South Africa with one of the largest banks in the country [FNB] to help enable 10 million customers with instant payments. Visa Direct has huge potential and is set to disrupt traditional peer-to-peer payment methods which can often take multiple days using banks and be expensive. In Bangladesh, Visa also announced bKash, which enables around 65 million customers to make “wallet to cash” real-time bank transfers. Given Bangladesh is an emerging country, with a population of 169 million, just over half of the U.S. population (331.9 million), this platform has huge growth potential.

Value Added Services

Visa has an interesting business segment called “value-added services” which also offers huge potential. In Q1, FY23, the company reported $1.7 billion in revenue, which increased by a rapid 20% on a constant currency basis.

Visa acquired CyberSource in 2010 for $2 billion as it aims to help accelerate the use of electronic payments globally. Cybersource offers a payment platform and a Fraud Decision Manager which has experienced strong growth, doubling the number of transactions on the platform over the past three years. In Q1, FY23, the number of transactions increased by the low teens, which was solid.

Another notable value-added service is Open Banking Platform Tink, which was acquired by Visa in Q1 of 2022. The company recently scored a huge agreement with BNP Paribas bank, to be its main open banking platform for millions of customers across Europe. The global open banking market is forecast to grow at a rapid 26.9% compounded annual growth rate [CAGR] and thus Tink is poised to benefit from this growth trend.

Profitability and Expenses

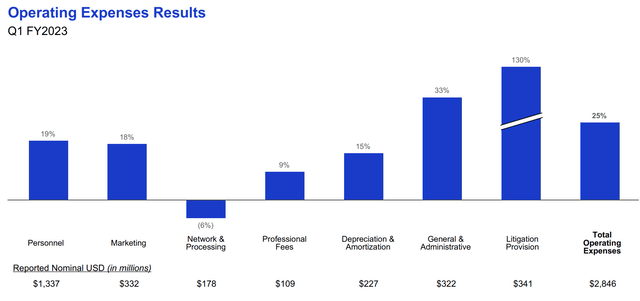

For Q1,FY23, Visa reported solid earnings per share [EPS] of $1.99, which was in line with analyst expectations and increased by 8% year over year. On a non-GAAP basis, earnings per share [EPS] was $2.18, which beat analyst expectations by $0.17. Its overall net income was $4.2 billion, which increased by 6% year over year. It should be noted this included $341 million cost related to a litigation provision. In addition, the company reported $106 million in net losses from its equity investments. This may seem terrible but let’s put this into context. The entire equity market has experienced a devaluation since we entered a rising interest rate environment. The positive news is by the equity market and economy tend to be cyclical by nature, thus I expect a rebound long term.

In Q1,FY23, operating expenses increased by 25% year over year to $2.8 billion. Again, this was driven by a 130% increase in its litigation provision and the devaluation of previously acquired assets. If we exclude these items, operating expenses only increased by 15% year over year, which is much more manageable. This was driven by a 19% increase in personnel costs, which I don’t deem to be a major negative, as its people are really an investment. General & administration expenses increased by 33% year over year to $322 million, over time I would like to see this decline, which should be possible given Visa effectively offers a scalable payment processing network.

Visa has a solid balance sheet with $18.9 billion in cash, cash equivalents, and short-term investments. The company does have fairly high total debt of ~$20 billion, but the vast majority of this looks to be long-term debt. Visa has a 0.78% dividend yield which isn’t amazingly high, but better than nothing given the company is still growing at a steady rate.

Moving forward in the second quarter, management has guided for “sustained” domestic payment and processed transactions volume. In addition, to the continued impact of the exit from Russia. For cross-border payments, management is expecting a continued travel recovery, with a rebound in mainland China. Operating expenses growth is also expected to “moderate” throughout 2023, which is a positive sign.

Valuation

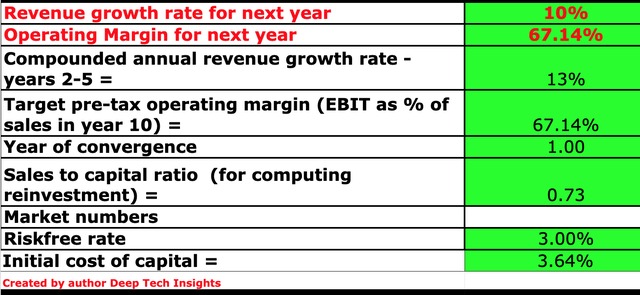

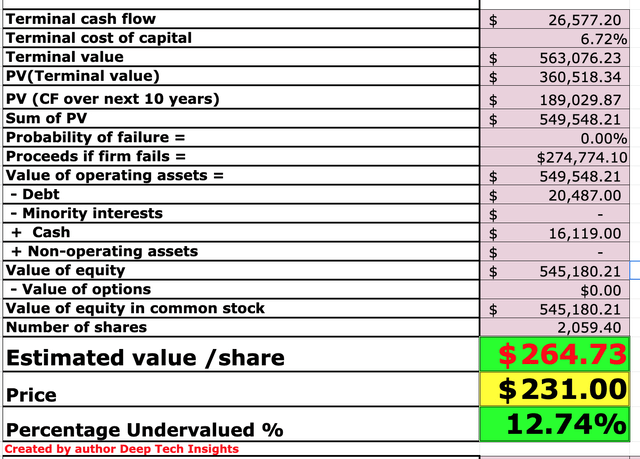

In order to value Visa, I have plugged its latest financials into my discounted cash flow model. I have forecast 10% revenue growth for “next year”, which in my model I am referring to the next four quarters. This growth rate is slightly below the 12.42% growth rate generated previously and is fairly conservative, due to the forecasted recession I will discuss in the “Risks” section. In years 2 to 5, I have forecast 13% revenue growth per year, as I expect payment volumes to improve along with economic conditions. In addition, to continued growth in Visa Direct, Tap to Pay and Value-added Services.

Visa stock valuation 1 (created by author Deep Tech Insights)

I have kept the operating margin constant, at a super high level of ~67% in the trailing 12 months. To put how great this margin is into perspective, the average operating margin for the software industry is ~23%. Visa also has a higher margin than its main competitor Mastercard which operates at “just” a 57% margin.

Visa stock valuation 2 (created by author Deep Tech Insights)

Given these factors I get a fair value of $264/share, the stock is currently trading at ~$231/share and thus the stock is ~13% undervalued, according to my model.

As an extra data point, Visa trades at a forward price-to-earnings ratio = 28x, which is not exactly cheap relative to the information technology sector average of 24. However, it is approximately 12.92% cheaper than its 5-year average which interestingly enough is similar to my valuation model difference.

Risks

Recession/Lower Payment Volume

As mentioned in the introduction, Visa effectively operates a “toll road” model in which it captures a percentage of every transaction where its network is used. Given many analysts have forecast a recession in 2023, consumers are likely to curb discretionary spending which will impact Visa.

Final Thoughts

Visa is a high-quality company and has one of the greatest business models on the planet. The company has continued to produce solid financial results and keep high margins, despite tough macroeconomic headwinds. I believe the company’s established relationships with a large number of banks and financial institutions, means Visa has a huge upsell opportunity with its Value Added Services. Its stock is currently slightly undervalued at the time of writing and thus Visa looks to be a great long-term investment.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.