Summary:

- Microsoft stock’s 17% run in two weeks is hard to justify, despite the AI lure.

- Google’s domination in search and browser goes deeper than just those two products.

- The more lucrative and open the market, the more the competitors.

- Use your Natural Intelligence when evaluating stocks.

Jean-Luc Ichard

I love my Microsoft Corporation (NASDAQ:MSFT) shares. Love them. As proof, my last six articles on Microsoft all had “Buy” ratings. Since my most recent article about two weeks ago, the stock has moved up a mammoth 17%. And we are talking about a company that was already nudging towards $2 Trillion market cap. I own shares in both Microsoft and Alphabet, Inc. (GOOG) and in equal weight almost. If forced to own just one out of the two, I’d go with Microsoft. But I am finding it hard to justify the runup in Microsoft’s stock price over the last couple of weeks. But, let’s look at the recent events that brought us here.

Why The Buzz Now?

- In case you’ve been living under a rock the last few months, ChatGPT, an AI backed chat app, has taken over the World by storm.

- Microsoft jumped onto the ChatGPT excitement by first announcing a plan to invest in ChatGPT and then even managed to do the unthinkable – get excitement around Bing by integrating AI with its search engine.

- Google, for its part, issued an “all hands on deck” memo to get behind its own AI efforts.

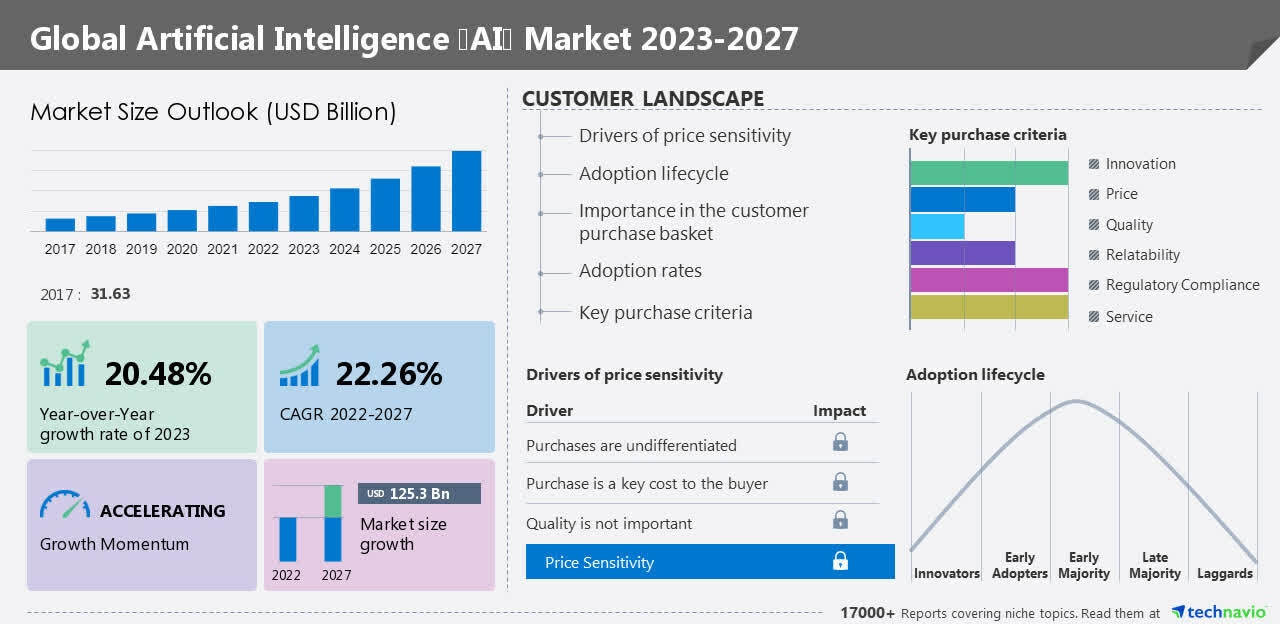

- Why all the sudden fuss you might ask? Well, tech companies need to strike while the iron is hot. ChatGPT started making a lot of noise out of nowhere on the global front but the AI market’s potential is nothing new. This situation reminds me of a famous Warren Buffett quote “We continue, nevertheless, to hope for an elephant-sized acquisition.” Buffett made this quote when asked about the slow-down in acquisitions. The mega-cap technology companies are in a similar situation now as they need elephant-sized markets to be able to grow meaningfully. As shown below, the market is expected to double by 2027 (grow by $125 Billion). In short, it is lucrative even for these Trillion-dollar giants to go after.

AI Global Market (prnewswire.com)

The Counters

As good as the market opportunity may seem, there are clear and present roadblocks for Microsoft to navigate through.

Current Reality

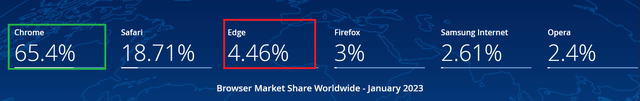

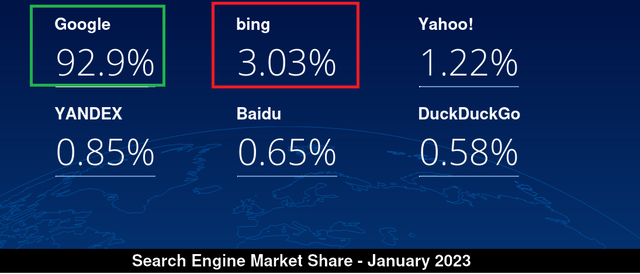

While Alphabet, Inc’s stock is taking it in the teeth right now due to the threat to its core business (search), don’t expect the company to concede their crown so easily. The company is already releasing several features to counter the competitive threats. The overall market share in both the browser and search markets are a no-contest right now. While that means Google stands to lose and Microsoft stands to gain, let’s not forget the inherent strengths and ability to cross-leverage its own products and services that Google has in these areas: indexing, YouTube, and Google Ads to name a few. The gap in market share here between Google and Microsoft is so enormous that it needs to be underscored again.

Browser Marketshare (gs.statcounter.com) Search Engines Market Share (gs.statcounter.com)

Competitive Landscape

The same report I referenced above for the AI market share also lists out the key competitors here. I am naming just the few high-profile companies listed on U.S Exchanges or is well-known globally:

Advanced Micro Devices Inc. (AMD), Alphabet Inc., Amazon Web Services Inc. (AMZN), Apple Inc. (AAPL), Baidu Inc. (BIDU), Huawei Technologies Co. Ltd., Intel Corp. (INTC), International Business Machines Corp. (IBM), Microsoft Corp., Nuance Communications Inc., NVIDIA Corp. (NVDA), Oracle Corp. (ORCL), Qualcomm Inc. (QCOM), Tesla Inc. (TSLA), and Wipro Ltd. (WIT).

That’s an impressive list to say the least. Now, not all these companies maybe competing for the exact same thing. For example, the chipmakers will be collaborating with the software companies to bring more AI tools to the market. But it is obvious that the space is already crowded and it is just getting started (in terms of public interest).

Nothing New

Wait. I just said AI is “just getting started” and am I immediately contradicting myself by saying “Nothing New”? No. AI trained chat systems and other capabilities aren’t new but the buzz generated by ChatGPT is. Readers may recall the buzz generated by IBM’s Watson in 2010 but it did not make the expected dent in the universe nor in IBM’s fortunes. Obviously, today’s Microsoft and Google are different breed of animals but so are the market and public expectations. If Google’s stock can get slaughtered 8% due to an inaccurate response during a demo, you know the expectations are enormous here.

Tip of The Iceberg or Is It A Different Tip?

News items about Google and Microsoft are all about AI the last few days and weeks. Being the contrarian that I am, I wonder if this is the tip of the iceberg in terms of the market opportunity or is it the modern Tulip tip (bulb) mania? It is not just the mega-caps going after this market but also start-ups powered by ex-employees of the same mega-caps.

What’s An Investor To Do?

Microsoft would do well to take a leaf out of Meta Platforms Inc.’s (META) recent playbook. Mark Zuckerberg thought he was onto something huge instantly by changing the company’s name and by splurging on Metaverse related expenses. The market rewarded in kind, aided by the economic conditions. If Microsoft takes the same approach and gets too aggressive with its AI expenses, a similar backlash is to be expected (but to a lesser extent).

As great as the prospects of monetizing Artificial Intelligence might look, don’t forget your Natural Intelligence when evaluating stocks. Do not let emotions get the better of you. A forward multiple of 30 with an expected earnings growth rate of 12% gives Microsoft a Price-Earnings/Growth (“PEG”) of 2.50, which is quite rich for my taste. I am downgrading the stock to a “Strong Hold” here. No stock is worth chasing, not even the ones promising new realms of intelligence.

On the contrary, I added to my Google holdings utilizing this 8% drop.

Disclosure: I/we have a beneficial long position in the shares of AAPL, AMZN, GOOG, IBM, META, MSFT, NVDA, QCOM, TSLA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.