Summary:

- The annual revenue for Intel was $63.05 billion in 2022 as compared to $79.02 billion in 2021.

- The share price of Intel has emerged bearish pennant indicating further downside.

- INTC stock is likely to experience bearish pressure; however, $20 is a significant level to accumulate long-term positions.

Justin Sullivan

Intel Corporation (NASDAQ:INTC) is a multinational technology company that specializes in designing and manufacturing computer hardware and related products. The company’s stock price is a measure of its financial performance and an indicator of market sentiment toward the company. Intel’s stock is widely traded on various stock exchanges around the world and is a component of major market indices such as the S&P 500. Over the years, Intel has been known for its dominance in the computer microprocessor market and has consistently been a major player in the tech industry. The stock price of Intel has experienced significant gains, reflecting the company’s financial performance, industry trends, and various external factors such as global economic conditions. Investing in Intel’s stock is considered a good option due to the company’s strong financial strength, dominant market position, diversified product portfolio, and strong brand recognition. Intel offers a wide range of products, including computer microprocessors, data center products, Internet of Things (IoT) solutions, and artificial intelligence (AI) products. The diversified product portfolio helps to increase the revenue streams.

This article provides the financial and technical evaluation of Intel’s stock price to help long-term investors determine the next buying opportunity. Intel’s share price increased by 475%, from February 2009 low of $12.05 to the January 2020 high of $69.29. This significant increase in Intel’s stock price is attributed to the company’s solid financial position and new technological advancements. The company’s revenue has increased by 49.92% from $52.708 billion in 2013 to $79.024 billion in 2021. However, the revenue decreased by 20.21% in 2022 compared to the previous year. Intel’s share price also dropped by 64.51% from the January 2020 high of $69.29 to October 2022 low of $24.59. Intel has had robust financial strength during the last few years, but the decline in revenue for 2022 indicates financial weakness. The emergence of a bearish pennant indicates a further decline in the stock price, but the bottom is very close.

Financial Evaluation

Due to economic uncertainty and a decline in PC sales, Intel has experienced a decline in revenue. The revenue dropped by 20.21% from $79.02 billion in 2021 to $63.05 billion in 2022. The revenue for the second, third, and fourth quarters of 2022 was $15.32 billion, $15.34 billion, and $14.04 billion, respectively, compared to $18.03 billion in the first quarter. The operating income for 2022 was only $2.33 billion as compared to $22.082 billion in 2021. A decline in revenue is indicative of deteriorating financial performance, which causes investors to be concerned about the company’s future profitability and growth prospects. Consequently, investors sell shares, causing a decline in the stock price. In addition, a decline in revenue affects a company’s ability to pay dividends and invest in growth opportunities, which in turn impacts the stock price.

Therefore, Intel has taken a positive step by curbing the pay rates of employees, including the CEO, Executives, Senior Managers, and Mid-level Managers, in order to reduce the financial gap and maintain its competitiveness in the existing challenging economic environment. The company also announced a $3 billion cost-reduction program with a $10 billion cost-reduction objective by 2025. The employee pay cuts will potentially impact Intel’s revenue in the short term.

Technical Evaluation

Historical Analysis

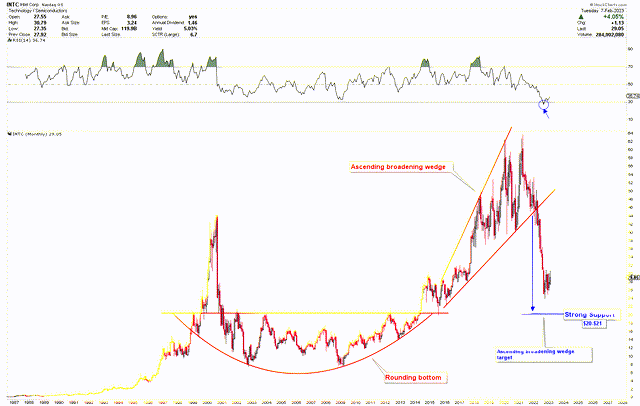

The chart below portrays the weekly outlook for Intel’s stock price. The price produced a rounding bottom from January 2001 to April 2014. The rounding bottom was broken with a monthly close above $20 in May 2014. The stock price increased after the breakout, and in August 2015, a market correction back to $20 was a strong buying opportunity in Intel stocks. Following the execution of a buy signal at $20 in 2015, the price reached a record high of $69.29 in January 2020.

Intel Weekly (stockcharts.com)

The above chart reveals that a rally from the May 2014 breakout to all-time highs resulted in the formation of an ascending broadening wedge, with both bulls and bears taking control of the market. The appearance of an ascending broadening wedge caused a large price swing, increased volatility, and a possible trend reversal. As the ascending broadening wedge was broken in April 2022, the trend was reversed, and the price is currently attempting to trade lower. The target of a breakout of an ascending broadening wedge is $20 as seen by the blue arrow on the above chart.

Current Market Condition

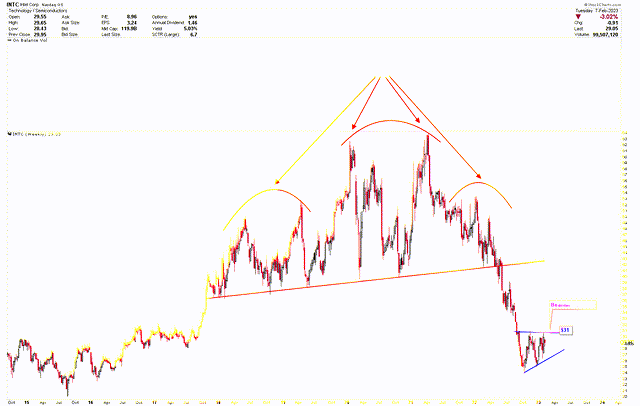

This discussion is elaborated in the chart below, which explains the high volatility within the ascending broadening wedge. Intel’s weekly chart displays substantial fluctuations from 2017 to 2022. The stock price emerged an inverted head and shoulders with the neckline from December 2017 to May 2022, despite volatile price movements. In June 2022, the neckline was breached, and the price fell sharply toward the strong support of $20. Currently, the price is trading in the $29 region and forming a bearish pennant between $24 and $31 as indicated by the blue trend lines in the following chart. The pennant is a bearish pattern because it is a continuation pattern that follows a downward price movement and indicates a possible continuation of the decline. The pattern consists of a flagpole and a symmetrical triangle, which acts as a consolidation period and represents market indecision. When the price breaks below the triangle’s lower trendline, it indicates a possible continuation of the downward trend, resulting in a bearish prognosis for Intel. The trend line for the downward breakout is at approximately $24-$26. On the other hand, if the pennant breaks higher, Intel’s share price will continue to increase. The pennant’s upper trend line is located around $31.

Intel Weekly (stockcharts.com)

Based on the preceding analysis, it has been found that Intel is exhibiting bearish patterns, but $20 remains a solid support level. The price is likely to break lower toward $20, whereby the support is essential due to the broken neckline of the rounding bottom in May 2014. Therefore, any move toward $20 represents an opportunity to buy Intel shares. Moreover, RSI is also oversold and bottoming on the monthly chart, which indicates that the bottom is very close.

Upside Potential for Intel

As the world becomes increasingly digital and data-driven, demand for computing power is likely to increase, potentially providing an opportunity for Intel to expand its market share and increase revenue. On the other hand, Intel is a leading player in the semiconductor industry, and advancements in technology will create new opportunities for the company to innovate and stay ahead of the competition. Moreover, Intel has a strong presence in the traditional PC and server markets, but it has been working to expand into new markets, such as the IoT and AI, which provide revenue streams.

Technically, Intel’s stock price is trading within a bearish pennant with an upper limit of $31 and a lower limit of $24. Any breach above $31 will invalidate the short-term bearish implications and upside potential. If the stock price of Intel breaks out to the upside from the pennant’s trendline, this indicates a trend reversal from bearish to bullish. Typically, this breakout is accompanied by high volume, which validates the trend reversal.

Conclusion

Intel experienced a decline in yearly revenue for 2022, and as a result, the company has reduced employee pay rates to increase profitability in anticipation of the expected recession. The technical analysis also shows a bearish tone in the charts, with the emergence of a bearish pennant after head-and-shoulders patterns. Therefore, the share price is likely to break down in the short term. The decline in revenue and unfavorable market sentiments also support a bearish tone. However, $20 is a strong support, based on the stock’s rounding bottom, presenting an excellent buying opportunity for long-term investors. Therefore, traders who already hold long positions in Intel may hold positions until $20 is supported. Long-term investors must use $20 as a chance to buy shares. Intel has a solid financial reputation, and the company is likely to grow in the coming years due to strong technological development. Therefore, any weakness in Intel’s stock price must be viewed as a buying opportunity for long-term investors.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.