Summary:

- The market was disappointed when Microsoft’s executives shared that revenue growth from AI advancements would come slowly, with the stock having sold off sharply since its last earnings report.

- Short-sighted investors fail to recognize just how grand the revenue prospects are, with beautiful cross-selling opportunities compounding Microsoft’s growth potential.

- As weak hands sell their position in Microsoft stock, it creates a great buying opportunity for long-term investors.

Mat Hayward/Getty Images Entertainment

OpenAI’s ChatGPT success is one of the best things that has happened to Microsoft (NASDAQ:MSFT), propelling it into the AI leadership race. Over the past several quarters, Microsoft has been striving to incorporate AI across all of its products and services.

In a previous article, we discussed how despite Microsoft Azure‘s gradual revenue growth from AI, the cloud unit remains strongly positioned to capitalize on the generative AI revolution. This is thanks to new services like Microsoft Fabric that enable Azure to optimally monetize its growing customer base.

Now, let’s focus on Microsoft’s AI-related prospects in the ‘Productivity and Business Processes’ segment, which made up 33% of total revenue last quarter. This is the segment primarily consisting of revenue from Microsoft Office suite of apps (e.g. Word, Excel, Teams etc.), and is increasingly sold as Microsoft 365 subscription services.

Investors are now well aware of Microsoft’s plans to augment the value of Microsoft 365 apps with the addition of Copilot, which is a generative AI-powered tool enabling users to give commands to the assistant in natural language, easing the completion of various tasks. The tech giant is charging enterprises an additional $30 monthly per user for Copilot, that is on top of their existing Microsoft 365 subscription fees, reflecting strong pricing power.

While the initial revelation of Copilot pricing had sent Microsoft stock surging to new all-time highs, shares have performed poorly since last month after its quarterly earnings report and call. The major disappoint was indeed related to the slow revenue growth outlook for Azure. Though on top of this, CFO Amy Hood also highlighted that there will be a time lag before the tech giant can start to witness revenue growth from Copilot:

“As you know, we’ve — last week, we announced pricing, then we’ll continue to work through the paid preview process get good feedback. Then we’ll announce the general availability date, then we’ll get to the GA date. Then we’ll, of course, be able to sell it and then recognize revenue. And that is why I continue to say that I am just as excited as everyone else about this, and it should be more H2 weighted.”

Note that Microsoft’s financial year runs from July to June. Therefore, when she says H2, it means the first half of calendar year 2024. Let’s be clear, the stock price rally this year brought forward a lot of future returns based on anticipated earnings growth, and so it is understandable to witness a pullback as Microsoft gradually deploys its monetization efforts.

But this pullback does indeed create buying opportunities for long-term investors, especially given the strong demand for its Copilot preview, as the executives shared on the earnings call:

“Satya Nadella

We are now rolling out Microsoft 365 Copilot to 600 paid customers through our early access program, and feedback from organizations like Emirates NBD, General Motors, Goodyear and Lumen is that it’s a game changer for employee productivity.

…

Amy Hood

we are excited, too, by the demand signal, the customer reaction, really the requests we’re getting to be in the paid preview. It’s all encouraging.”

Now that being said, most investors already appreciate the strong earnings growth prospects from Copilot, but the growth does not stop there. Remember that Microsoft runs its own marketplace called Microsoft AppSource, which enables third-party developers to build and sell their own apps that integrate with the Microsoft 365 suite. Popular examples of such third-party apps include Slack (a collaboration app) and Box (a file sharing and storage app).

Now with the introduction of Copilot and Microsoft’s perceived leadership in the AI race, it should encourage more third-party developers to create a whole new breed of apps with generative AI capabilities that integrate seamlessly with Copilot. A thriving marketplace indeed incurs a network effect, whereby as the value proposition of Microsoft 365 grows thanks to the integration of numerous, valuable third-party apps, the more business customers are likely to use Microsoft 365, and as the number of customers continues to grow, the more third-party developers will be inclined to build apps for Microsoft’s ecosystem. This translates to a growing base of commission fees, with Microsoft charging 30% on app sales through its Microsoft AppSource.

Use of third-party apps integrated with Copilot not only generates additional commission-based revenue for Microsoft, but also further augments its own pricing power in the future for Microsoft 365 subscription plans and Copilot, as customers stay increasingly knotted to the Microsoft ecosystem.

And it gets even better. To enable third-party developers to build apps that integrate with Microsoft 365, the tech giant cross-sells various Azure services like SQL DB that power these apps, as the CEO proclaimed on the call:

“Satya Nadella

Yes. If I could just add to what Amy said, the platform effect here is really all about the extensibility of the Copilots. You see that today when people build applications in Teams that are built on Power Apps and those Power Apps happen to use something like SQL DB on Azure. That’s like a classic line of business extension. So you’ll see the same thing. When I have a Copilot plug-in, that plug-in uses Azure AI, Azure meters, Azure data sources, Azure semantic search. So you’ll see, obviously, a pull through not only on the identity or security layer, but in the core PaaS services of Azure plus the Copilot extensibility in M365.”

As third-party developers build more and more applications around Copilot, it will increasingly require more computing power and services from Azure. So as the ecosystem builds out around Copilot, not only will it drive greater adoption of M365 Copilot which boosts ‘Productivity and Business Processes’ revenue growth, but it will also subsequently drive ‘Intelligent Cloud’ revenue growth as these applications are powered by Azure. This is why investors must buy Microsoft stock on the dip, because the Copilot-driven growth opportunities are broader than what is perceived at first glance.

These broader Copilot cross-selling opportunities and revenue sources should start to kick in as the service rolls out more broadly next year. In the meanwhile, Microsoft is already winning from growing ecosystems around its productivity apps, such as the Microsoft Teams app, as the CEO pointed out:

“We continue to build momentum in Microsoft Teams across collaboration, chat, meetings and calling. We now have more than 1,900 apps in Teams app store. And companies in every industry, from British Airways, to Dentsu, to Eli Lilly and Manulife, have built over 145,000 custom line of business apps, bringing business process directly into the flow of work. Five months in, Teams Premium has already surpassed 600,000 seats as companies like BNY Mellon, Clifford Chance, PepsiCo and Starbucks chose the add-on for advanced features like end-to-end encryption and real-time translation.”

Therefore, while Copilot should certainly accelerate growth of Microsoft’s ecosystem and attached revenue sources going forward, note that Microsoft is already enjoying strong revenue growth in this segment as it ties customers into the Microsoft ecosystem, conducive to upgrades to higher plans. CFO Amy Hood shared on the call:

“Office Commercial revenue grew 12% and 14% in constant currency. Office 365 Commercial revenue increased 15% and 17% in constant currency, a bit better than expected with particular strength in E5 upsell renewal noted earlier.”

Furthermore, as CEO Satya Nadella mentioned (quoted earlier), the applications that third-party developers build around Teams (and other productivity apps) use services like SQL DB on Azure, therefore simultaneously boosting Azure revenue too.

Competition

While Microsoft’s growth prospects through Copilot are indeed bountiful, the tech giant faces competition from Google (GOOG) (GOOGL). Similar to Microsoft’s Copilot, the key rival offers its own generative AI assistant, called Duet AI, in Google Workspace apps, and recently revealed that it is also charging $30 monthly per user for this tool to enterprise customers. Note that it has not disclosed any pricing yet for smaller businesses and individual consumers.

From a Microsoft investor’s perspective, Google’s price tag is a sigh of relief in the sense that the two rivals are not engaging in price competition, allowing for optimal monetization of AI advancements, conducive to strong revenue growth prospects.

Similar to the Microsoft AppSource marketplace around Microsoft 365, Google also runs its own Google Workspace Marketplace, enabling third-party developers to build apps that integrate with its suite of productivity and collaboration apps. Hence, the rival will also be striving to strengthen the network effect around Google Workspace by attracting more and more third-party developers to build apps that augment the value proposition of Google’s services, in turn attracting more customers, and so on.

Hence, Microsoft faces competitive pressures in encouraging third-party developers to allocate more time and resources towards building around Microsoft 365 Copilot. Though keep in mind that Microsoft has a much larger user base for its Office 365 commercial offering (this relates to professional users, not individual consumers), disclosing an installed base of “over 382 million” in April 2023. Comparatively, the total number of Google Workspace users stands at 10 million paying customers. Therefore, Microsoft is indeed strongly positioned to attract third-party developers to its ecosystem given its wide reach to hundreds of millions of paid users.

Financials & Valuation

On the Q4 2023 earnings call, CFO Amy Hood shared:

“Revenue from Productivity and Business Processes was $18.3 billion and grew 10% and 12% in constant currency, ahead of expectations with better-than-expected results in Office Commercial, partially offset by LinkedIn… Paid Office 365 Commercial seats grew 11% year-over-year with installed base expansion across all workloads and customer segments.”

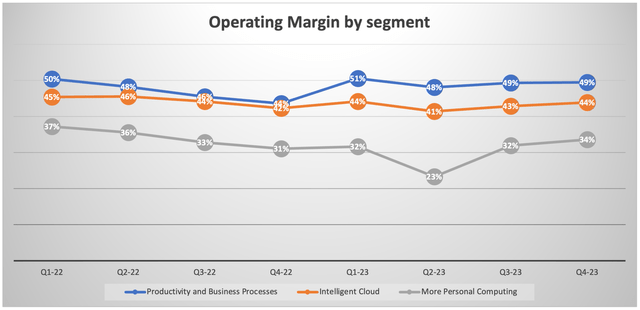

The ‘Productivity and Business Processes’ segment is indeed a key driver of Microsoft’s financial performance, as it made up one-third of total revenue last quarter, and remains Microsoft’s most profitable segment, with an operating margin of 49%.

We don’t know yet what the cost implications will be of running Copilot as part of Microsoft 365 subscriptions, which will be an important determinant of future profitability. However, what we do know is that the tech giant possesses immense pricing power at $30 monthly per user. As mentioned earlier, this pricing power could indeed augment further as users become increasingly attached to the Microsoft 365 ecosystem, not just due to the stickiness of Copilot, but also thanks to the growing number of third-party apps. Therefore, Microsoft is strongly positioned to not just pass on the computing costs of generative AI to customers, but also charge premiums to bolster profitability going forward.

Additionally, as third-party developers race to advance and produce new apps that integrate with Microsoft 365 Copilot in order to keep up in the generative AI revolution, it is conducive to more Azure meters being run as developers make use of various Azure services to build and run their apps. Therefore, the roll out of Copilot also presents cross-advantages in terms of also boosting revenue and profits for Microsoft’s largest segment, Intelligent Cloud.

Microsoft undoubtedly has multiple, massive growth opportunities across its products and services. According to Seeking Alpha data, the stock currently trades at a forward earnings multiple of 29.62x, which is lower than the valuation multiple it was trading at a few months ago at around 34x. Given the recent pullback in the stock price, it is now trading roughly in line with its 5-year average forward earnings multiple of 29.68x.

While there is the possibility of the stock falling lower over the near-term amid the broader market pullback due to rising yields, the stock is certainly worth buying at these levels. Given just how grand the growth opportunities are, Nexus Research believes investors should start buying the stock in order to start building a long-term position. Trying to guess the price level at which the stock will bottom is a fool’s game. It is more advisable to deploy a dollar-cost-averaging strategy to start building exposure and avoid missing out when the stock resumes rallying higher. Nexus Research maintains a ‘buy’ rating on the stock.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of MSFT either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.