Summary:

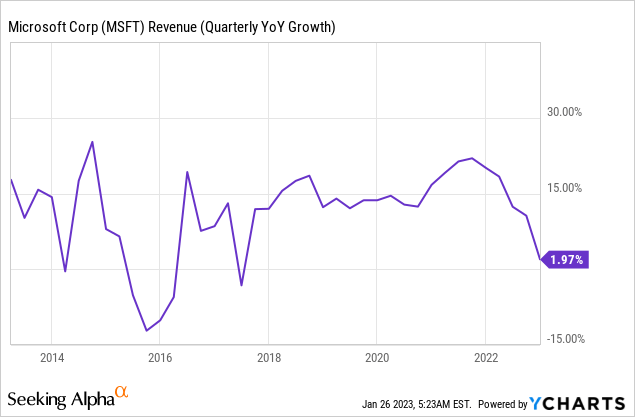

- Microsoft saw its slowest top-line growth in years in FQ2’23.

- PC market and Cloud downturn represent short-term challenges.

- Free cash flow prowess is a key asset for Microsoft during a recession.

HJBC

Microsoft (NASDAQ:MSFT) reported it weakest top line growth in six years as the company suffered from falling PC and chip demand in the Personal Computing division and is also seeing slowing growth in the Cloud segment which in recent years has been a growth engine for Microsoft. The software company also issued a light forecast for FQ3’23 and recently announced to lay off a significant number of employees due to macroeconomic headwinds. I believe that all of Microsoft’s problems are temporary and that the stock offers investors strong free cash flow value.

PC market downturn leading to moderation of Microsoft’s top line growth

Microsoft posted FQ2’23 revenues of $52.7B with growth slowing in all segments compared to the previous quarter. Microsoft generated just 2% consolidated top line growth in FQ2’23, which was the lowest in six years. Personal Computing revenues were especially affected by collapsing consumer demand for consumer electronics products, which resulted in a 19% year over year decline in revenues, or 16% in constant-currency rates.

Microsoft suffers like many software and hardware companies from the correction in the PC market which is resulting in sharply lower global PC, laptop and tablet shipments. According to Gartner, a consulting company, global device shipments declined a massive 28.5% in the December-quarter which represented an acceleration from the decline in the third-quarter. Gartner said that the market is seeing the worst decline in shipments ever since the company started tracking numbers in the mid-1990s. As a result, Microsoft is seeing a serious, but I believe transitory, moderation of its top line growth.

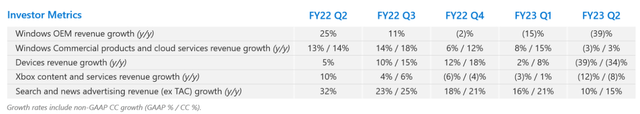

The downturn is primarily affecting Microsoft’s Personal Computing business which is seeing declining Windows OEM sales. Microsoft’s Windows OEM revenue growth declined 39% year over year due to weaker PC sales, and devices revenue growth, which includes the sale of Surface tablets, also decelerated 39% year over year.

Microsoft now also has a (short term) Cloud problem

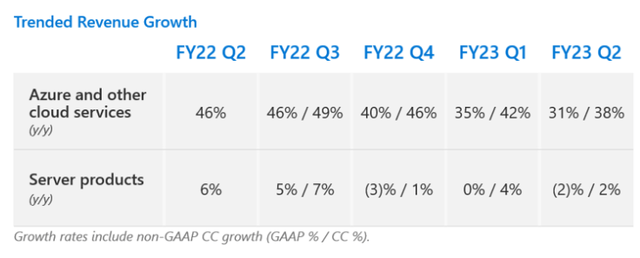

The biggest short term problem for Microsoft, however, is not the correction in the PC market, but rather the moderation of growth in the Cloud segment. Azure posted just 31% year over year top line growth in FQ2’23, marking a sharp slowdown from last year’s 46% year over year growth rate.

Growth is moderating due to a changing macro environment in which customers are less willing to enter into long term contracts and are cutting back on IT spending altogether. The pullback in spending on Cloud and software services is part of the reason why Microsoft’s CEO Satya Nadella last week announced the gutting of 10 thousand tech jobs.

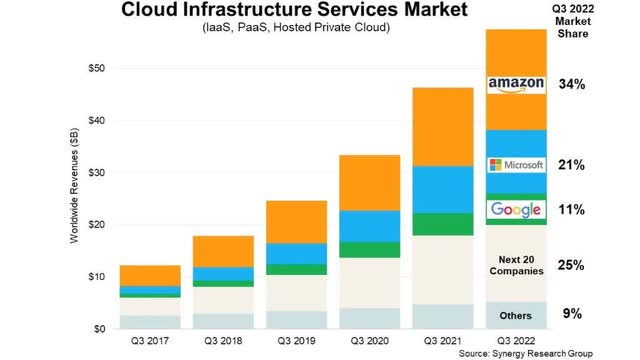

However, I believe customers are going to ramp up their spending on vital cloud infrastructure services in the long term as more workloads shift to the Cloud and macroeconomic uncertainty subsides. Microsoft’s Azure also has an incredibly strong market position as it is the second-largest Cloud service provider after Amazon Web Services with a market share of 21% (as of Q3’22).

Free cash flow

Slowing top line growth is a problem for Microsoft from a growth perspective, but the company’s free cash flow was still strong. Microsoft generated FQ2’23 free cash flow of $4.90B which translates to a free cash flow margin of 9.3%. While the 43% year over year decline in free cash flow is not great, it clearly is not an existential risk for Microsoft. The firm’s adjusted free cash flow — after adjusting for the tax implications of R&D capitalization (a one-time event) — was $7.3B, showing just a 16% year over decline.

Microsoft’s strong free cash flow position is part of the reason why the software company just stepped up its investment in ChatGPT-creator OpenAI. OpenAI’s artificial intelligence bot represents a massive growth opportunity for Microsoft long term as I discussed here, Microsoft: ChatGPT Could Be A Game Changer.

|

$billions |

FQ2’23 |

FQ1’23 |

FQ4’22 |

FQ3’22 |

FQ2’22 |

Y/Y Growth |

|

Revenues |

$52,747 |

$50,122 |

$51,865 |

$49,360 |

$51,728 |

2% |

|

Cash Flow From Operating Activities |

$11,173 |

$23,198 |

$24,629 |

$25,386 |

$14,480 |

-23% |

|

Capital Expenditures |

($6,274) |

($6,283) |

($6,871) |

($5,340) |

($5,865) |

7% |

|

Free Cash Flow |

$4,899 |

$16,915 |

$17,758 |

$20,046 |

$8,615 |

-43% |

|

Free Cash Flow Margin |

9.3% |

33.7% |

34.2% |

40.6% |

16.7% |

– |

(Source: Author)

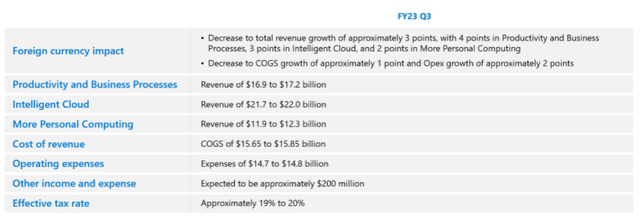

Outlook for FQ3’23

Microsoft issued a light outlook for the next fiscal quarter as the company expect consumer demand to remain weak and Cloud growth to continue to moderate in the near term. Microsoft projects FQ3’23 revenues in the Cloud business of $21.7B to $22.0B which translates to a year over year growth rate of 14%, so growth is projected to continue to slow down. Personal Computing is expected to see revenues of $11.9B to $12.3B, implying a year over year decline of 17% compared to FQ3’22.

Microsoft’s valuation

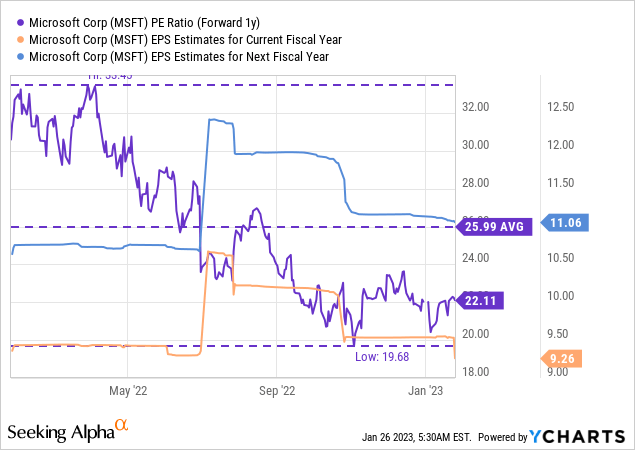

Microsoft’s shares remain attractively valued based off of earnings. Microsoft is projected to generate $11.06 in EPS next year, implying 19% year over year growth as analysts see Microsoft bouncing back from the PC market correction. I also believe that investors are too pessimistic regarding Microsoft’s EPS prospects: Microsoft is currently valued at 22.1x forward earnings which is not a high multiplier factor for a company that is set to generate billions of dollars each quarter in free cash flow even if the market contracts. Microsoft is also trading below its 1-year average P/E ratio of 26.0x. Considering that Microsoft generated $60B in free cash flow in the last twelve months, I believe that the software company represents strong recession value.

Risks with Microsoft

The biggest commercial risk for Microsoft, as I see it, is a slowdown in the Azure Cloud business which has in the past been a growth driver for the company. A prolonged slowdown in the firm’s fastest-growing business has the potential to repel investors that specifically want to invest in Microsoft because of its Cloud potential. What I don’t see as a risk is the drop in free cash flow. A recovery in the PC market as well as an increase in spending on Cloud infrastructure services would likely drive a profound free cash flow rebound at Microsoft.

Final thoughts

Microsoft is seeing a slowdown in its Cloud and its Personal Computing businesses, but I believe the market downturn is temporary. Microsoft’s free cash flow remained sufficiently strong in FQ2’23 and the company still brought in $7.3 billion in adjusted free cash flow that the company could either use to repurchase shares and make other AI-related investments. Considering how much free cash flow Microsoft still earns at this point, I believe the software company is well prepared to ride out an economic downturn.

Disclosure: I/we have a beneficial long position in the shares of MSFT either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.