Summary:

- Microsoft Corporation is a leading technology company that owns the second largest cloud provider, Azure, as well as its leading operating system Windows.

- The company reported strong financial results in Q1FY23, beating both revenue and earnings forecasts.

- Microsoft’s cloud segment has continued to produce solid financial results, while its gaming & PC segment is going through a cyclical downturn.

- Microsoft Corporation stock is undervalued intrinsically and relative to historic multiples.

Jean-Luc Ichard

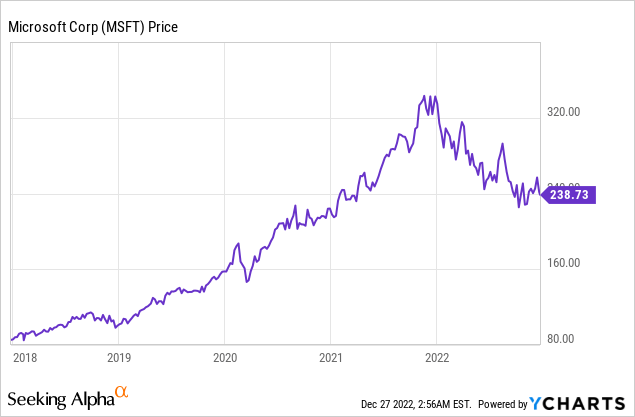

When tough economic times reign, we see who has the best and worst business models. Many of the so-called “FANG” stocks such as Facebook (now Meta Platforms (META)), Amazon (AMZN), Netflix (NFLX) and even Google (GOOG) (GOOGL), have reported relatively poor earnings and seen their stock price get decimated (see my other posts). However, Microsoft Corporation (NASDAQ:MSFT) continues to roar ahead and produced strong financial results, beating both revenue and earnings growth estimates in fiscal Q1 2023. In this post, I’m going to break down its financials and valuation. Let’s dive in.

Solid Financials

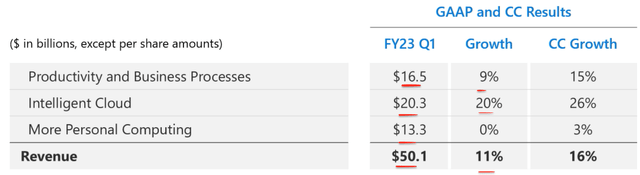

Microsoft reported solid financial results for the third quarter of fiscal year 2023. Revenue was $50.12 billion, which beat analyst estimates by $435.21 million and increased by 11% year over year. Its international revenue was impacted by foreign exchange headwinds from a strong U.S. dollar; thus, it increased by 16% year over year, on a constant currency basis. At a high level, the Productivity and Cloud segments drove the strongest growth with increases of 9% and 20% respectively. Both segments were impacted substantially by foreign exchange headwinds and reported much faster growth of 15% and 26% on a constant currency basis. The “More Personal Computing” segment was a laggard, with flat growth reported. This was driven by the cyclical decline in PCs and gaming. Although a positive is on a constant currency basis, even this segment was up by 3% YoY.

Segment Revenue (Q1,FY23 report)

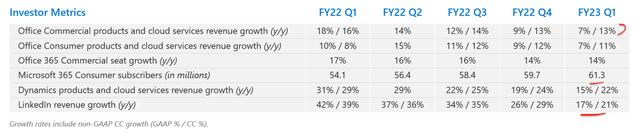

I will now break down its business segments in more granular detail, so we can really understand the winners and losers of this trillion-dollar company. Microsoft’s productivity and business processes segment reported solid growth across the board. Its Office consumer products grew revenue by 7% each for its commercial and consumer products respectively. Both products reported slightly declining growth from the 9% in the prior quarter. However, when we take foreign currency changes into account, its growth rate was 13% for commercial products which was level with the prior quarter. Microsoft 365 consumer subscribers continued to grow to 61.3 million, up from 54.1 million in the same quarter last year.

Productivity segment (Q1,FY23)

Microsoft Dynamics is a suite of enterprise applications used by the likes of Chevron, Coca-Cola, BMW, and many more. This product suite reported solid growth of 15% YoY or 22% on a constant basis. Again, this growth rate was slower than the prior quarter but still solid overall. I suspect the trend of slowing growth is more driven by the macroeconomic environment, as opposed to Microsoft’s market position specifically, as we are seeing a similar pattern across the board.

LinkedIn was a standout performer with 17% revenue growth reported, or 21% on a constant currency basis. LinkedIn is the world’s largest professional social network with approximately 822 million users. LinkedIn is substantially smaller than the likes of Facebook and Instagram with ~2.88 billion monthly active users across both apps. However, LinkedIn is an immensely valuable platform, as its users are highly valued by recruiters, those looking for a job, and B2B salespeople.

LinkedIn is one of the few places where you can connect with a CEO, or create a targeted list of Senior VPs at technology companies. This means many of its users are happy to pay for tools such as LinkedIn Sales Navigator and it is popular for Account Based Marketing, which is basically modern-day B2B marketing. LinkedIn also faces less competition from other social media companies, as I personally can’t think of another professional social network, can you? Whereas in the traditional social media landscape, we have TikTok which is fast eating Meta’s lunch and now has ~1 billion monthly active users. Then of course, there is Snapchat, Twitter, and even BeReal a new viral platform. If I could invest in LinkedIn alone, I would due to its dominant market position and huge untapped potential.

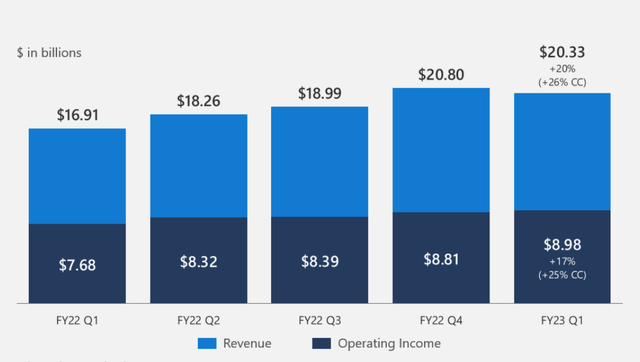

Microsoft’s second major segment is its “Intelligent Cloud” Azure which has grown to become the largest revenue driver of the company, contributing to 40% of revenue in Q1, FY23. The Intelligent Cloud segment reported $20.33 billion in revenue which increased by 20% year over year or 26% on a constant currency basis, this is the fastest-growing segment of the company.

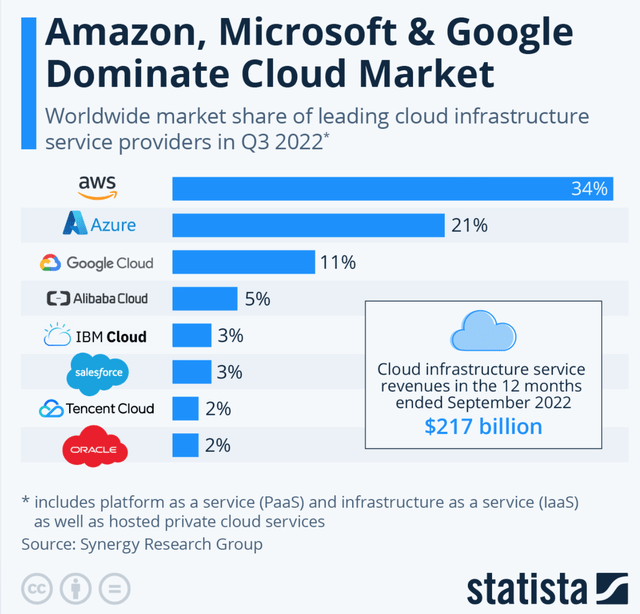

Microsoft Azure is the second largest cloud infrastructure provider in the world with 21% market share. This is behind AWS with a 34% market but is still well ahead of Google Cloud which has “just” 11% market share. Microsoft was late out of the starting blocks creating its Azure Cloud, which was released in 2008, two years after AWS which was launched in 2006. However, the company has rapidly gained market share and carved out a strong position as a favorite for a “hybrid cloud” setup. For some background, the “cloud” is basically just a data center that offers computing, storage, or databases as a service. A hybrid model generally involves keeping some IT resources onsite or using multiple providers usually for security or data residency reasons. According to a study by Cisco, 82% of IT decision makers are planning a hybrid cloud strategy. Therefore, Azure is well suited to benefit from this trend. In addition, online reviews indicate Azure has a better user interface than AWS and it is popular with those who want to use Windows for setup. The cloud industry is forecast to grow at a 19.9% compounded annual growth rate and reach $1.7 trillion by 2029.

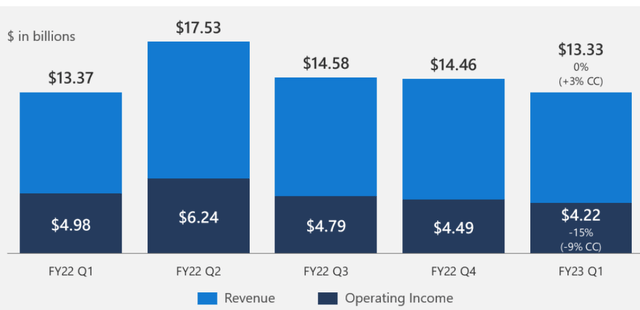

Microsoft’s third segment is its “More Personal Computing” which reported $13.33 billion in revenue, which was basically flat compared to the prior year.

More Personal Computing (Q1,FY23)

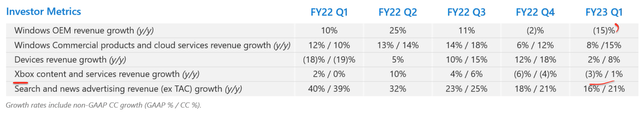

Breaking down this segment, we can see its flat growth was driven by a 15% decline in Windows OEM revenue. This was caused by a downturn in the PC market, after a boom in 2020 and 2021. A positive is the PC market tends to be cyclical by nature and thus I don’t deem this to be a long-term issue. Xbox also reported a similar trend with a 3% revenue decline year over year, again this was driven by a lower gaming engagement after a boom in 2020. The gaming industry is forecasted to continue to grow at a 12.9% CAGR and thus I don’t deem this to be a major issue long term. On a positive note, search and news advertising reported solid growth of 16% year over year or 21% on a constant currency basis.

More Personal Computing (Q1,FY23)

Profitability and Balance Sheet

Microsoft’s total business reported earnings per share [EPS] of $2.35, which beat analyst estimates by $0.06. Its Productivity business segment reported a 10% increase in operating income to $8.32 billion. While its Intelligent Cloud segment drove the majority of profits with $8.98 billion in operating income reported, up 17% year over year. As expected, the “More Personal Computing” segment reported a 15% decline in operating income to $4.22 billion.

Microsoft also has a fortress balance sheet with $107.24 billion in cash and short-term investments. The company does have fairly high debt of $77 billion, but the majority, $45.37 billion is long-term debt.

Microsoft’s guidance was not the best, as the company expects between $52.35 billion and $53.35 billion in Q2, FY23. This would represent a growth rate of ~2% and is lower than analyst expectations of $56.05 billion. This poor guidance looks to be mostly driven by the macroeconomic environment, but I don’t believe this is a major issue long term.

Advanced Valuation Model

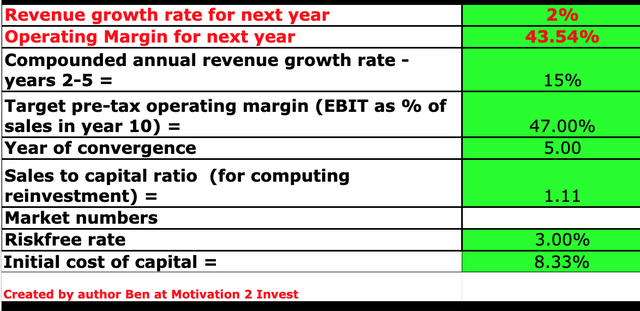

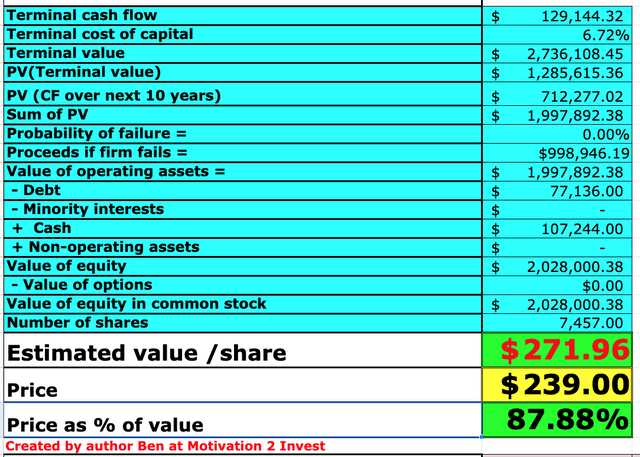

I have plugged Microsoft’s financials into my discounted cash flow (“DCF”) model. I have forecasted just 2% growth for next year, which is based upon an extrapolation of management guidance for the next quarter. In years 2 to 5, I have forecasted 15% revenue growth per year, based upon a cyclical rebound in the gaming and PC market, as well as continued growth in the cloud.

Microsoft stock valuation 1 (created by author Ben at Motivation 2 Invest)

To increase the accuracy of the valuation, I have capitalized R&D expenses which has lifted net income. In addition, I have forecasted the company’s operating margin to increase to 47% over the next 5 years, based upon profitability improvements in the “More Personal Computing” segment as it recovers.

Microsoft stock valuation 2 (created by author Ben at Motivation 2 Invest)

Given these factors, I get a fair value of $271 per share. Microsoft stock is trading at $239 per share at the time of writing and thus is ~12% undervalued.

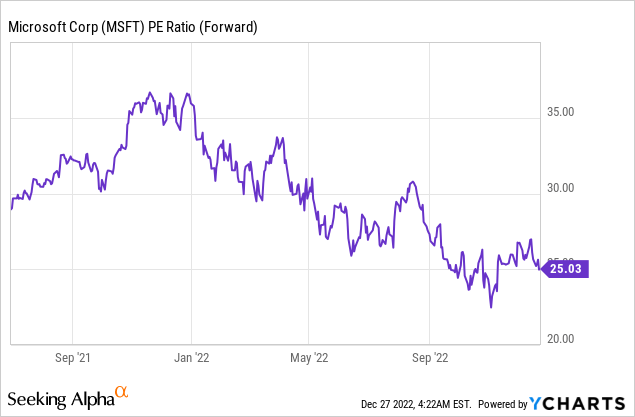

Microsoft is trading at a forward price to earnings ratio = 25, which may not seem cheap but is 18.77% cheaper than its 5 year average.

Risks

Recession/Lower Demand

Many analysts have forecasted a recession due to the high inflation and rising interest rate environment. This will likely result in lower demand and slowing growth across the board for most companies, including Microsoft.

Final Thoughts

Microsoft Corporation is a dominant technology company that has continually executed its “fast follow” strategy to a tee. The company has produced strong financial results for decades and even has performed well during a recessionary environment. Microsoft stock is undervalued intrinsically, and given a cyclical rebound in the PC & gaming market is expected, Microsoft could be a great long-term investment.

Disclosure: I/we have a beneficial long position in the shares of MSFT either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.