Summary:

- Modine Manufacturing’s stock has more than doubled in less than six months. Now, its upside potential looks limited – read on to find out why.

- Modine’s balance sheet has strengthened, and the company has efficiently managed operational costs and achieved significant bottom-line growth thanks to its 80/20 approach.

- I expect a P/E multiple of 25x by the end of 2026, giving a growth potential of only 25% for the next 3 years. That’s 7.7% when annualized.

- In the future, MOD should have to grow only thanks to the promised margin expansion and absolute growth in sales. As one of the growth drivers for the stock seems to be missing today, I’ve decided to downgrade it to “Hold”, albeit with a positive outlook.

Dewitt/iStock via Getty Images

Intro & Thesis

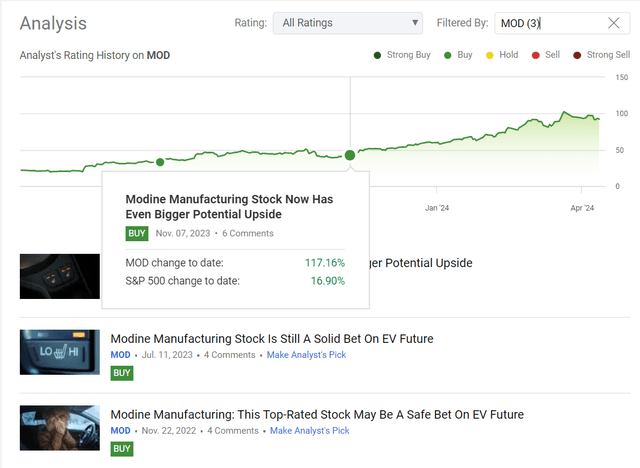

My last article on Modine Manufacturing (NYSE:MOD) stock was published in early November 2023. At that time, I argued that Modine management’s rather cautious guidance and the subsequent slight correction in the stock made the company even more undervalued. I calculated a medium-term upside potential of around 65% for the next 2 years, but in less than six months my target was far exceeded as the stock actually more than doubled:

Seeking Alpha, my coverage of MOD stock

After the rally, the margin of safety I wrote about earlier has evaporated – the stock’s upside potential appears to be limited. I’m therefore downgrading the stock to “Hold” today.

Why Do I Think So?

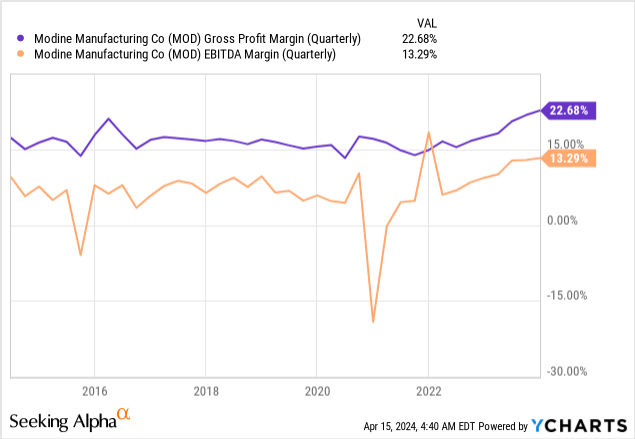

While MOD’s net sales remained relatively flat YoY in Q3 FY2023, the company’s EBIT surged by 56%, reaching $61.7 million. This remarkable increase was largely driven by a significant boost in gross profit, which soared by 30% to $127.3 million. As the management explained in the press release, this improvement in GP was attributed to ongoing initiatives like the 80/20 program and higher average selling prices, resulting in a notable gross margin improvement of 530 basis points to 22.68% – the highest of the past decade. Modine’s adjusted EBITDA also witnessed a substantial rise, climbing by 39% to $73.9 million compared to the prior year.

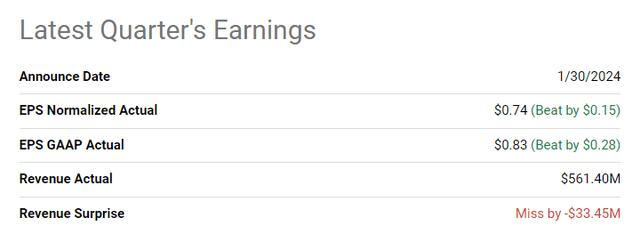

I definitely like Modine’s ability to efficiently manage its operational costs while driving its top-line expansion. Despite a $10.0 million increase in S&G expenses, primarily due to higher compensation-related expenses, Modine managed to achieve significant bottom-line growth: EPS more than doubled from $0.46 to $0.83 YoY, with adjusted EPS also showing a significant increase from $0.48 to $0.74, driven primarily by the higher gross profit and beating the consensus estimate by a healthy margin:

Segment-wise, Modine’s Climate Solutions, and Performance Technologies segments both demonstrated resilience and improvement. While Climate Solutions segment sales experienced a slight -2% decline YoY, the segment reported a notable increase in operating income, up by 28% from the prior year. On the other hand, Performance Technologies segment sales saw a modest YoY increase of 2%, with also a significant improvement in adjusted EBITDA of $38.9 million (+52% YoY).

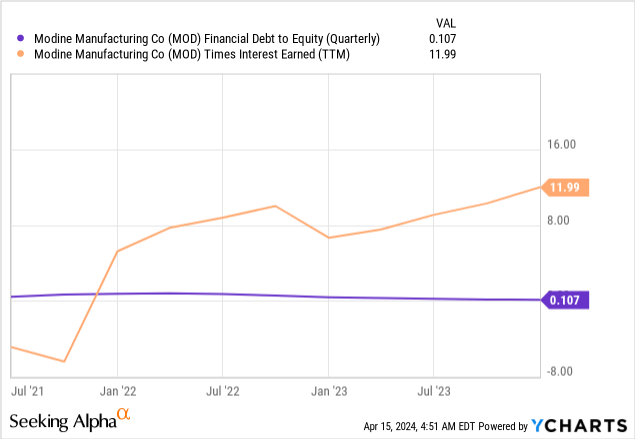

Modine’s consolidated FCF reached $131.2 million for 9M FY2023, while the leverage ratio decreased to 0.7x from 0.8x last quarter, according to the latest investor presentation. The debt-to-equity ratio kept falling, and the strengthening times-interest-earned (TIE) ratio of ~12x suggests, in my opinion, that Modine’s balance sheet has only gotten stronger in recent quarters.

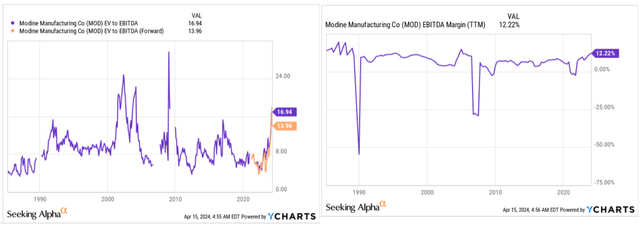

However, the growth of MOD stock that we have seen in recent months has robbed the company of the margin of safety, thanks to which I have repeatedly confirmed my “Buy” rating. We can clearly see that the EV/EBITDA ratio for the current and next year is close to previous 10-year highs – the expansion in the multiple has gone too far, in my opinion, and the growth in the EBITDA margin is not enough to justify it.

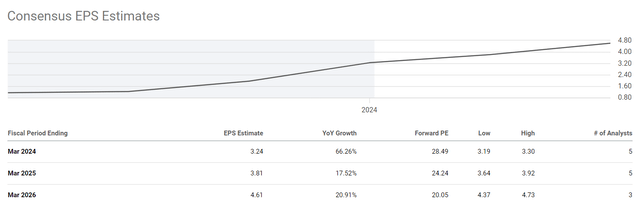

Yes, the 80/20 principle has brought Modine very good growth recently. And judging by analysts’ forecasts, MOD’s earnings per share will achieve a CAGR of 12.47% over the next 3 years, which is quite a lot (at the level of any growth stock):

Seeking Alpha, MOD’s EPS consensus

Given these market expectations, MOD’s implied P/E ratio for FY2026 is expected to fall to 20x. If we assume that the P/E ratio of Modine remains at the current level of 29x in 3 years from today (which is quite high and unrealistic, in my opinion), then the growth potential of MOD stock over that time frame should be ~45% in the most optimistic scenario. In the base case scenario, I expect a multiple of 25x by the end of 2026, giving a growth potential of only 25% for the next 3 years. So for this reason, I’ve decided to downgrade the stock to “Hold”: Modine definitely has room for growth, but this growth is likely to be much slower in the future than in the last 2 years.

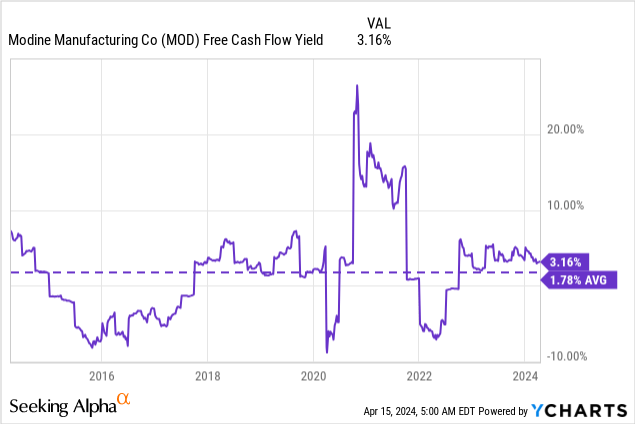

My conclusions are indirectly confirmed by the FCF yield. This metric for MOD is currently at 3.16%, which is above the average of the last 10 years, but on an absolute basis, it doesn’t provide investors with a margin of safety, even if we assume a 5-10% annual expansion of MOD’s FCF number.

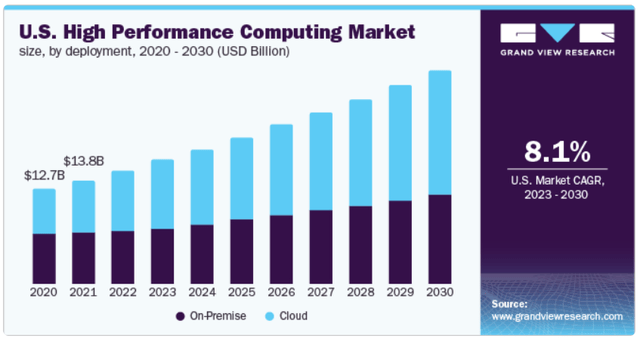

However, my argument about “the loss of undervaluation” as an argument for downgrading MOD, may prove untenable. As CEO Neil Brinker explained during the recent earnings call, Modine is not seeking large transformative transactions but is looking for bolt-on acquisitions that provide complementary products and technologies to key growth areas. Recent acquisitions such as Napps Technology and the assets of TMGcore are examples of this strategy. Adding TMGcore to Modine’s portfolio, for example, wasn’t just about expanding the company’s offerings in data centers; it’s about being able to meet the ever-changing needs of their customers who are diving deeper into high-density computing. TMGcore should enable “Modine to address evolving customer demands for high-density computing while complementing existing high-performance products.” According to Grand View Research, the TAM of the end market for this segment is likely to continue to grow at a CAGR of over 8% over the next few years at least, meaning that MOD’s growth potential could be much greater than analysts are currently forecasting.

High-Performance Computing Market, GVE

So overall, I’m quite positive about MOD’s growth prospects: If one has a long position in the stock, I wouldn’t add to it, but I wouldn’t sell it either.

The Verdict

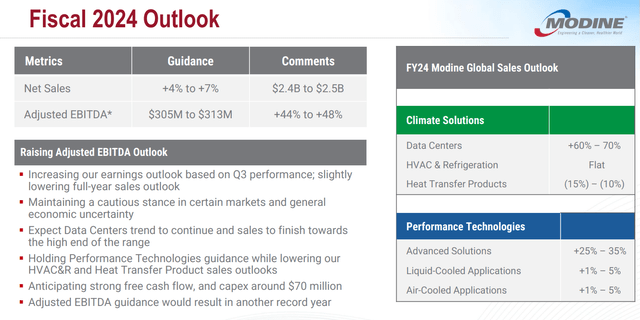

At the end of my article, I’d like to introduce readers to the company’s guidance, which is what I think investors should focus on in the foreseeable future. So, Modine Manufacturing plans to increase its sales by only 4-7% for FY2024, but at the same time, the process of margin expansion will not stop with a 44-48% year-on-year increase in adjusted EBITDA:

But the most important question here is: Where exactly is the margin ceiling for Modine Manufacturing? Investors should ask themselves this question after each of the company’s next quarterly reports. I’d focus primarily on the margin, as it seems to be the reason why the multiple is as high as it is today. But it is clear to me that the margin of safety in the valuation is left behind. In the future, MOD should have to grow only thanks to the promised margin expansion and absolute growth in sales. As one of the growth drivers for the stock seems to be missing today, I’ve decided to downgrade it to “Hold”, albeit with a positive outlook.

Thanks for reading!

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Hold On! Can’t find the equity research you’ve been looking for?

Now you can get access to the latest and highest-quality analysis of recent Wall Street buying and selling ideas with just one subscription to Beyond the Wall Investing! There is a free trial and a special discount of 10% for you. Join us today!