Summary:

- Q1 earnings beat expectations, with revenue at $15.14 billion and EPS at $2.04.

- Asset management fees and equity underwritings were the main drivers of revenue growth.

- The stock appears overvalued from its PE history, and PEG ratio, but fairly valued from its price to tangible book value history.

- Higher expected IPO and M&A activities are the catalysts that all together justify a buy rating on the stock.

Nikada

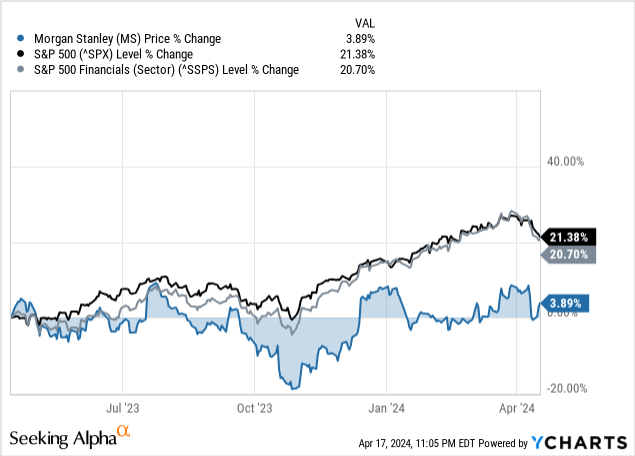

The stock of Morgan Stanley (NYSE:MS) has significantly underperformed both the S&P 500 and the financial sector by around ~17% over the past year. On Tuesday, they released blowout Q1 earnings, and ever since then, the stock has jumped 3.55%, opening me an opportunity to analyze the stock. In this analysis, I will go through the earnings segment by segment, identifying the major drivers of revenue growth, sharing my outlook, conducting an absolute valuation, together with displaying its underlying risks. I will also finalize with two major announcements that Morgan Stanley released one day after the earnings. All of these factors together lead to a BUY recommendation for the stock.

Revenue Sources

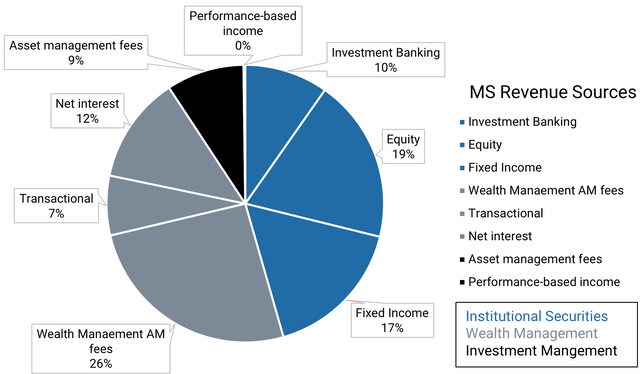

Author’s Compilations | Data: Company Q1 Earnings

I am sure that the vast majority of Seeking Alpha’s subscribers are familiarized with Morgan Stanley. Therefore, I won’t include a company overview and explain what the company does. Nonetheless, I find it important to quickly illustrate the revenue sources of the company. As seen above, the major segment is Wealth Management, colored in gray, that captures revenue from asset management fees, transaction fees, and net interest. Then it comes Institutional Securities, colored in blue, that drives revenues from equity, fixed income and investment banking, with the latter being further subdivided between advisory, equity underwriting, and fixed income underwriting. Last, it comes the Investment Management division, colored in black, that generates income from asset management fees and performance-based fees.

Perfect! Now we can get started and review the Q1 earnings.

Earnings

Morgan Stanley started the first quarter by beating both revenue and EPS. Analyst predictions were expecting the company’s revenue at $14.40 billion, but the company was able to deliver 5.1% more than the expectations at $15.14 billion. Same goes for the earnings, where normalized EPS was expected at $1.65 but ended 4.3% higher at $2.04.

These results allowed the company to keep improving year-over-year, after a 2023 of small growth. From Q1 2023 till Q1 2024, Morgan Stanley grew 17.2% in adjusted earnings and 4.2% in revenues with ALL divisions growing and being the Wealth Management division, the main driver of revenue growth.

Revenue Growth by Segment

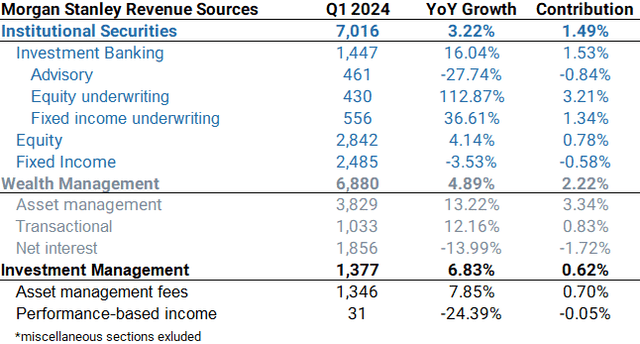

Author’s Compilations | Data: Company Q1 Earnings

Institutional Securities

Institutional Securities represented 46% of the company’s sources of revenue during Q1 2024. As a whole, it grew revenues at 3.2% compared to the same quarter of the year prior.

Even though M&A activity has improved compared to Q4 of 2023, the advisory part of the investment banking sub-segment, saw a considerable decrease of net revenues passing from $638 billion to $461 billion, which represents a significant decline of -27.7% and being the only revenue source within Institutional Securities to fall YoY. On the other hand, both the equity underwriting and fixed income underwriting, performed strong as compared to last year. Equity underwriting activities grew by a stunning 112.9% YoY due to higher demand for IPO exits, while fixed income underwriting also grew 36.6%, driven by higher bond issuances.

The equity sub-division, which is more of the sub-segment that includes sales & trading, and equity research, saw a revenue increase of 4.1%, with significant strength in derivatives sales. I recently published an analysis about CME Group, about how they could benefit from higher volume in derivatives contracts due to volatile changes in expectations around inflation, geopolitics and monetary policy. Well, it seems that Morgan Stanley’s equity sub-division benefited in Q1 of 2024 from these increases in hedging volumes.

Last, the Fixed Income sub-segment, or FICC in sales & trading, was the only sub-segment of Institutional Securities that decreased year-over-year by -3.5%. Management explained that the decrease was due to lower client activity in macro and credit, which was partially offset by higher activity in commodities.

Wealth Management

Again, the Wealth Management division was the one that grew the most, with higher AUMs coming from asset valorizations and positive net flows of $94.9 billion, thanks to elevated deposits coming from family offices. Nonetheless, new clients’ assets came in higher a year ago, when the company registered $109.6 billion, as investors were taking advantage of lower equity valuations. From there, revenue sources arriving from asset management and transactional fees did well by growing 13.2%, and 12.2%, respectively. While income from net interest fell -14%, as clients withdrew or transferred available cash from their accounts due to elevated money market rates or simply initiating positions on riskier assets.

Overall, the Wealth Management division was up 4.9% from a year ago.

Investment Management

Last, the Investment Management segment was also up YoY with asset management related fees growing by 7.9% as higher valuations increased total AUMs. From the other side, performance-based fees, that many come from private funds, remained lower for the year as gains from many investments have been postponed aiming higher valuations, or simply poor performances, particularly in Asia. Performance based fees were down -24.4% from the same quarter of the year prior.

In total, the investment management segment grew 6.8% for the year, making all segments of Morgan Stanley to be up YoY on these earnings results.

Outlook

In Q1, what explained the majority of the revenue increase was the great YoY performance of the fees arriving from asset management. Those alone explained 3.34% of the total increase. Next, and so close, were the equity underwritings that explained 3.21% of the gain.

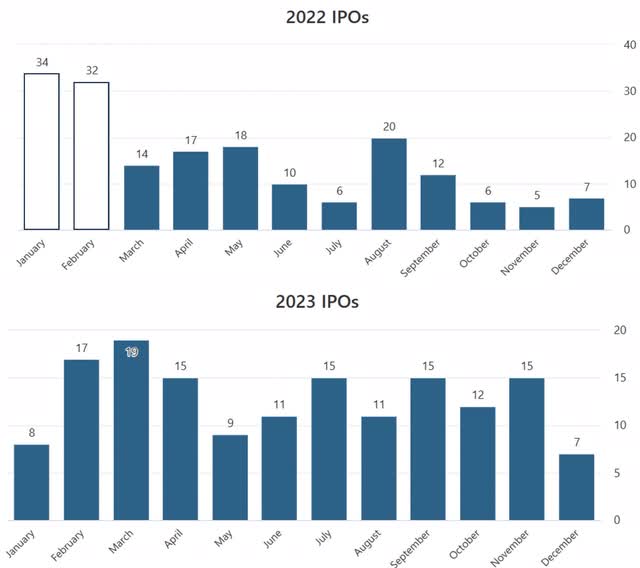

Author’s Editing | Data: Stock Analysis

With IPO financing plummeting after February 2022 as a result of lower equity valuations, in 2023 IPO exits started to pick up, and I believe that this rise in IPOs is just getting started, and Morgan Stanley is well-positioned to boost this revenue source going forward. On top of that, even though business income from advisory fell, M&A activity is also expected to rebound, and I expect this revenue source to be a big driver of growth going forward.

On the other hand, what contributed the most to offset the growth was the income generated from net interest, which had a negative effect of -1.72% in the growth. In my opinion, this is a revenue source that is simply not well positioned to recover in the next quarters or see any major improvements. Holding cash on investment accounts, and giving up attractive yields from money market funds, is a situation that few people are willing to give up. Also, even with rate cuts, the yields would still be attractive due to the elevated levels being encountered. It would be hard for investors to move from money market funds to cash, at least till the end of the year.

I would also be prudent in expecting growth to arrive from asset management fees going forward. These wrap fees from wealthy clients are, for the most part, dependent on the market’s upward movements. At least the stock market is trading in the upper percentiles of the last 52 weeks. I can’t predict the market’s direction, but what I am sure about is that the probability of a correction seems more likely than a further continuation of expanding multiples. The opposite could hold true for fixed income, but overall, I don’t see much growth potential in this revenue source compared to the investment banking division.

Valuation

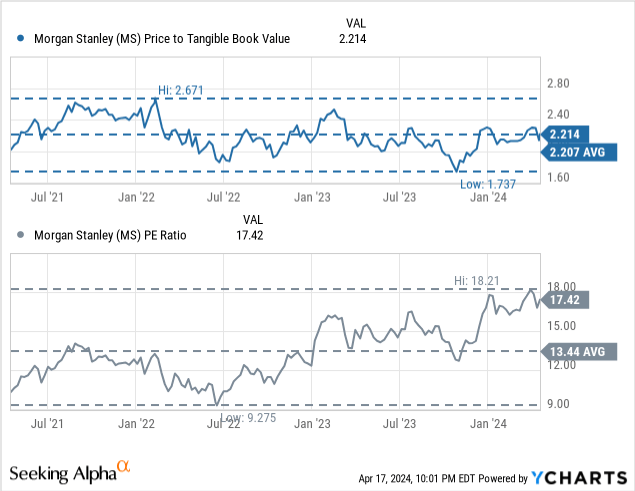

In terms of absolute valuation, Morgan Stanley currently trades at 2.2 times tangible book value, which has been exactly its average over the last three years. This multiple has improved rapidly since November of 2023, when the stock traded at its 3y historical low of 1.7x, and then mean-reverted back to the average. From the side of historical PE ratio, a different story holds true. The stock situates close to its 3y historical high at 17.4x earnings, with the average being 13.4x. On top of that, their PEG Non-GAAP (FWD) ratio stands elevated at 2.49, which is of more than twice the sector median.

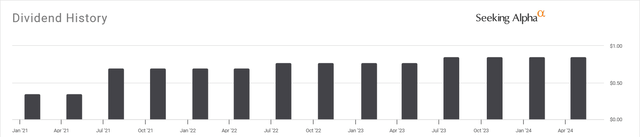

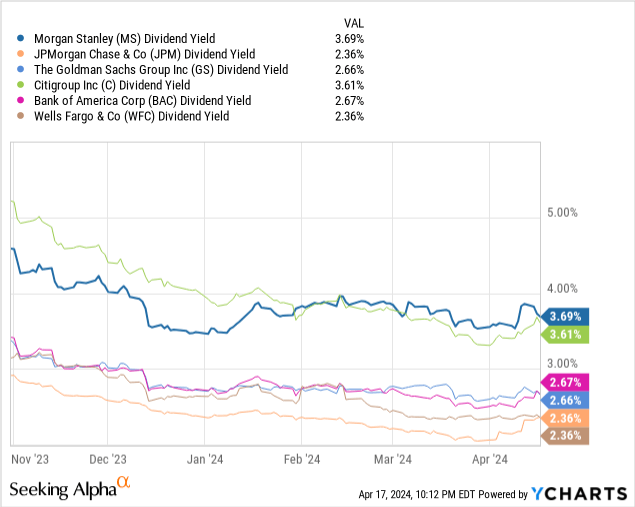

For income investors out there, Morgan Stanley currently offers the highest dividend yield when compared to other major banks in the US. Nonetheless, since November, it has seen its dividend yield to fall by -19.3%, when it used to have yields of around 4.6%, and now stands at 3.7%. Still desirable, but the golden opportunity has already been missed.

In the past 5 years the dividend has grown at an attractive CAGR of 23.7% and possess a handsome A- Seeking Alpha quant rating in terms of dividend safety. Even though their payout ratio has been above 40% since September of 2022, the available cash equivalent is extremely high that covers more than half of the company’s market cap, and therefore obtaining a high SA rating, despite the payout ratio. Also, to the benefit of investors, during Q1, they spent $1 billion in share buy backs.

Risks

Some weeks ago, Morgan Stanley was on the headlines after reporting that there is an ongoing investigation against them by the SEC on whether they have the right AML protocols to onboard new foreign clients to their wealth management services. Some of the questions came from the fact that some clients were rejected from using E-trade, but later got accepted to the financial advisory unit. Although this is just an investigation, this is a problem that Morgan Stanley would need to deal with and would probably be present for some time, until the issue gets resolved. The day the report came out, the stock dropped 6.5%, but it took just one week to recover following the positive earnings.

Although the set-up for rebounding M&A and IPO activity is my catalyst for the company to perform better, I could be completely wrong. In fact, the markets could get affected from continuing hotter than expected inflation that could make the FED to not even cut rates this year, and probably driving asset prices lower. The aforementioned scenario would likely affect all of its revenue sources with the exception of trading volume coming from sales & trading, with market participants driving demand for derivatives contracts.

After Earnings Announcements

As breaking news to complement this analysis, on Wednesday, Morgan Stanley announced two major releases.

- The company sold bonds worth $8 billion to use for general corporate purposes, following competitors such as JPMorgan (JPM) and Wells Fargo (WFC)

- Morgan Stanley decided to reduce 13% of its investment banking workforce in Asia, due to lower activity in that region (as mentioned before in this analysis).

Takeaway

Earnings were fantastic, with revenue growing in all segments compared to a year ago, and there are fundamental catalysts such as higher expected M&A and IPO activity that gives ample room for the company to perform even better. Even though the forward PEG ratio, and historical PE ratio illustrate an overvaluation in the stock price, the price to tangible book value seems fair and gives me the confidence to like the stock, and still rate it as a buy. Also, from a technical point of view, the stock price hasn’t encountered any clear trend since February of 2022, and has rather been trading within a range ever since that date.

I also don’t think it’s a coincidence that the stock hit all-time highs, especially in the month when IPO activity was still high, and then halved the month after.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in MS over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.