Summary:

- Morgan Stanley’s preferred stock, the PFD A 1/1000, has a floating coupon with a floor rate to prevent it from floating to zero.

- The issuer, Morgan Stanley, is a financial holding company that provides various financial products and services.

- The coverage ratio of Morgan Stanley’s preferred stocks to total common equity is over 10X, indicating a strong level of protection for investors.

- While FOMC cut rates seem to be getting delayed, I dropped my rating on the preferred from Buy to Hold, with a preference for locking in today’s yields using fixed-rate preferred stocks.

Nikada

Introduction

Last December, I touched on the Morgan Stanley PFD A 1/1000 (MS.PR.A), though the article focused on a different Morgan Stanley preferred stock (article link). What is uncommon for the series A is that while it has a floating coupon, it also comes with a rate floor. Before the recent actions of the FOMC, that floor prevented the coupon from floating to below 1%. While there is the potential that the FOMC might not cut the FFR as soon as expected, that positive is not enough to maintain my prior Buy rating when I compared yields against the Morgan Stanley fixed-rate preferreds that mostly show similar yields, thus my new Hold rating for the series A issue.

Morgan Stanley reviewed

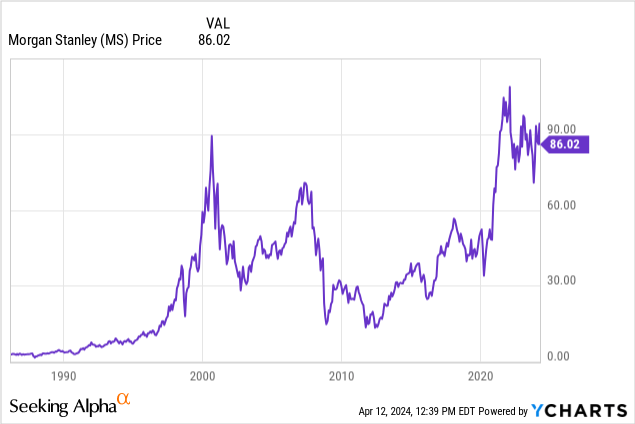

Before reviewing the preferred stock, it is required to examine the issuer and try to determine what the default risk level is for the Morgan Stanley (NYSE:MS) preferred stocks. Any coupon is meaningless if the investor loses most or all the principal they invested.

Seeking Alpha describes this issuer as (edited):

Morgan Stanley, a financial holding company, provides various financial products and services to corporations, governments, financial institutions, and individuals in the Americas, Europe, the Middle East, Africa, and Asia. It operates through Institutional Securities, Wealth Management, and Investment Management segments. The Institutional Securities segment offers capital raising and financial advisory services. This segment also provides equity and fixed income products. The Wealth Management segment offers financial advisor-led brokerage, custody, administrative, and investment advisory services to individual investors and small to medium-sized businesses and institutions. The Investment Management segment provides equity, fixed income, alternatives and solutions, and liquidity and overlay services to benefit/defined contribution plans, foundations, endowments, government entities, sovereign wealth funds, insurance companies, third-party fund sponsors, corporations, and individuals through institutional and intermediary channels. The company was founded in 1924 and is headquartered in New York, New York.

Source: Seeking Alpha.

The key data piece preferred stockholders want to know is if there are enough assets available to pay back all preferred stockholders after the other liabilities are paid. Here is a list of all the preferred stock issues currently available to investors.

| MS-A | Morgan Stanley Floating Rate Dep Shares Series A Non-cumul Preferred Stock | NYSE |

| MS-E | Morgan Stanley, 7.125% Dep Shares Fixed/Floating Non-Cumul Preferred Stock Ser E | NYSE |

| MS-F | Morgan Stanley, 6.875% Dep Shares Fixed/Floating Non-Cumul Preferred Stock Ser F | NYSE |

| MS-I | Morgan Stanley, 6.375% Dep Shares Fixed/Float Non-Cumul Preferred Stock Series I | NYSE |

| MS-K | Morgan Stanley, 5.85% Dep Shares Fixed/Float Non-Cumul Preferred Stock Series K | NYSE |

| MS-L | Morgan Stanley Dep Shares 4.875% Non-Cumulative Preferred Stock Series L | NYSE |

| MS-O | Morgan Stanley 4.250% Depositary Shares Non-Cumulative Preferred Stock, Series O | NYSE |

A common feature is they are all non-cumulative, but that doesn’t concern me at this time, nor was it invoked anytime during the Covid or GFC crisis events. Morgan Stanley did offer investors a choice between fixed-rate and floating-rate preferred stocks, but if I read it correctly, all the preferred shares other than the series A were converted to fixed-rate with the cessation of the LIBOR rate being available. According to the Morgan Stanley press release, the series A, since it was not listed, will convert from LIBOR to the CME Term SOFR Reference Rate plus a risk adjustment of 26.161 bps. The CME Term SOFR Reference Rates benchmark is a daily set of forward-looking interest rate estimates, calculated and published for 1-month, 3-month, 6-month and 12-month tenors. The current yield offered by the series A indicates that is the case.

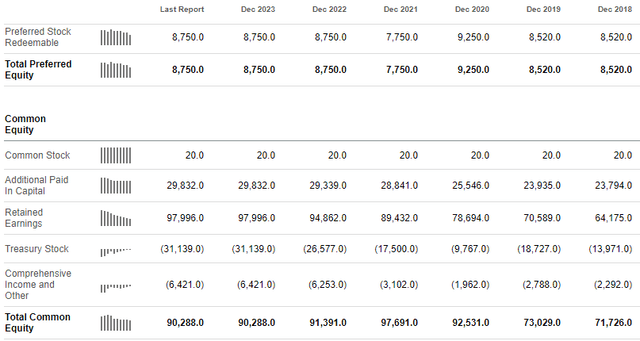

Looking at the latest Morgan Stanley Balance sheet, investors can get an idea of their protection level.

seekingalpha.com MS Balance Sheet

Dividing the total value of all preferred stocks issued by the Total Common Equity, the coverage ratio is over 10X, a very strong ratio. Plus, if Morgan Stanley stops paying any of their preferred stockholders, this country would be in serious financial trouble!

MS PFD series “A” reviewed

seekingalpha.com homepage

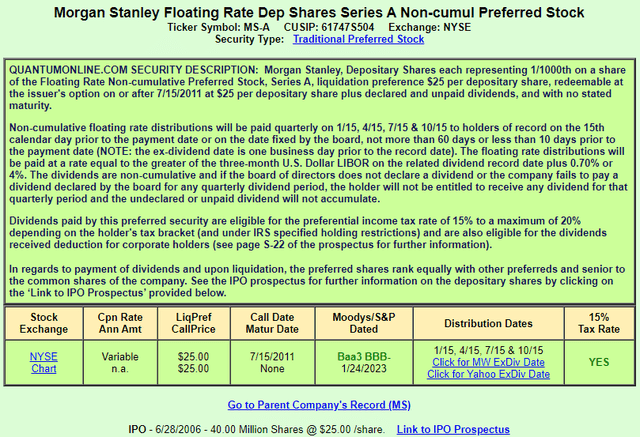

My go-to source for basic preferred stock data is QuantumOnline.com.

This issue as low as it can be and still be rated as investment grade. That matters, as investment-grade funds would need to sell if it gets downgraded one notch. Granted, it would then be eligible for other funds to purchase.

The new floating rate formula is the CME Term SOFR Reference Rate + 26.161bps risk adjustment compensation + 70bps, which is a tiny fixed component compared to most preferred shares I have recently reviewed. As mentioned, it is non-cumulative, but that is not a concern with the 10X coverage ratio and the fact that past crises did not result in missed payments. Since the common stockholders get a dividend, that adds to payments being made on this issue. Investors also benefit from the 15% tax rate applying to payouts.

Series “A” 4% floor’s value

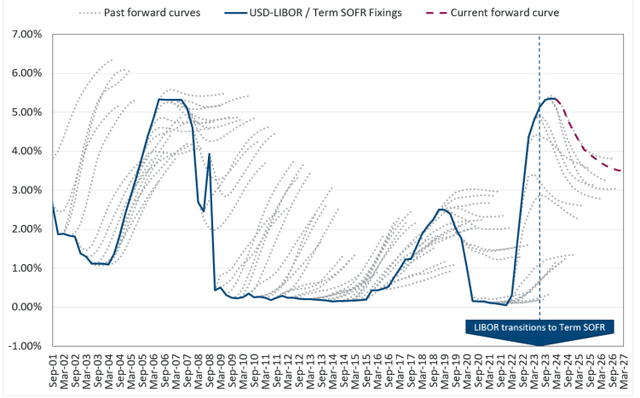

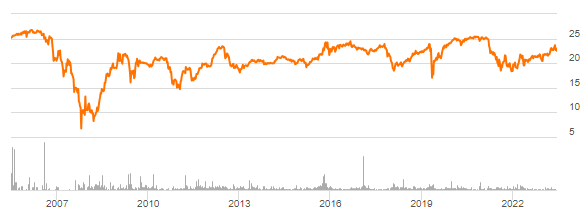

As the next chart shows, with only 70bps guaranteed, the 4% floor protected investors for many years before recent FOMC rate increasing actions.

Since floating from 2011, the series A was protected by the floor until late 2022, when LIBOR, then SOFR, provided a better coupon. When the CME SOFR drops and approaches 3%, once again the floor would take over. A good question is: How did the series A compare against MS fixed-rate preferreds in terms of performance since rates started climbing?

The one that held up best was the Morgan Stanley DEP SHS 1/1000TH (MS.PR.F), with its 6.875% coupon until it started floating last January. That said, the series A has had the best price movement since the start of 2023.

Portfolio strategy

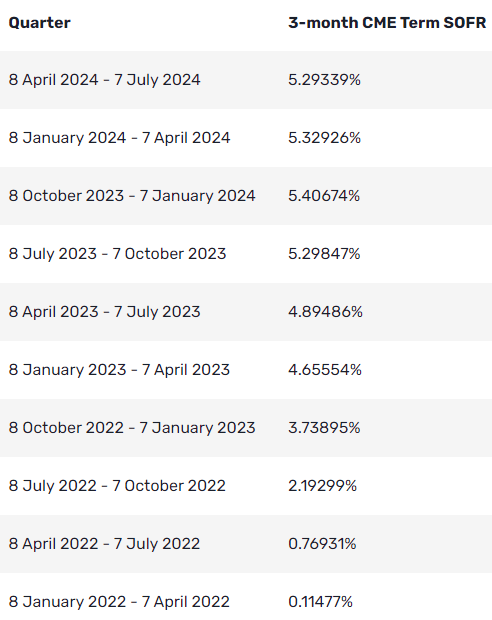

The next table shows the CME rate, while down from a January peak, it is still at levels reached last summer.

prodigyfinance.com/legal/sofr

Based on the most recent floating-rate value, the current coupon is around 6.26%, with the series A yielding just under 7%. One would expect the price to fall once the floating rate drops, but some support could be provided by what the other, all now fixed, MS preferreds are yielding at the time. I listed some in the next table.

| MS series | Yield |

| A | 6.94% |

| E | 6.97% |

| F | 6.82% |

| K | 5.92% |

Ignoring the Series K, which seems overpriced based on the yield, then while I hold the Series A, based on this yield comparison against the others with their fixed-rates being so close, I would consider those better buys eventually, with Series A better near term if the FOMC indeed postpones any reduction in the FFR. That said, I’m lowering my prior Buy rating to a Hold for MS.PR.A, which is a downgrade from my last rating of a Buy.

Final thoughts

To me, some key questions for potential investors are the following:

- When do you want to hold issues that let you lock in today’s coupons, meaning switching from floating- to fixed-rate coupon preferred stocks?

- Despite what the series A BBB- implies, are you willing to own lower rated issues and get higher coupons? Huntington Bancshares (HBAN), a Midwest regional bank, offers higher yields for a similar rating (article link).

- Want a much higher yield but with Call risk? Citigroup has a 10% yielding issue but at a current price over $29 and callable, investors are betting it not being called (article link).

- Not an expert on preferred stocks, or rather spend your research efforts elsewhere? Instead of doing your own evaluation, pick funds that provide that for you. Various funds are constantly being reviewed by numerous Seeking Alpha contributors.

Conclusion

This was my reasoning for giving the MSPR.A a Buy rating when compared to a Stifel and another Morgan Stanley preferred stock last December:

With MS-O losing its Tier 1 status, that eliminates one, maybe main, reason MS issued this preferred. With it now Callable due to that rule change, for conservative investors wanting their coupon not to change, I would now give the nod to SF-D with a Buy rating.

For those willing to risk interest-rate movements and the effect that has on the price of the preferred, then the MS-A with it higher current coupon and YOC would earn a Buy rating. If MS hasn’t Called this preferred now with is 6+% coupon, odds are against it happening.

Despite potential delays by the FOMC to cut short-rates, I am dropping my MS.PR.A rating from Buy to Hold as I have a preference for locking in today’s yields using fixed-rate preferred stocks. Others might want to wait until the FOMC makes their first cut in rates, keeping in mind the long-end of the curve that has greater influence on preferred stock prices is less affected by FOMC actions.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of MS.PR.A either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Alex Pettee is President and Director of Research and ETFs at Hoya Capital. Hoya manages institutional and individual portfolios of publicly traded real estate securities. Alex leads the investing group known as the Hoya Capital Income Builder, which uses the investment knowledge of several Seeking Alpha analysts provide members with insightful articles covering mostly individual stocks or funds. Occasionally an article cover will cover an investing strategy or other topic that investors need to be aware of, such as law changes that might effect their long-term strategy.

For more information about this Investors Group, click on this link: