Summary:

- Morgan Stanley’s preferred shares offer a reasonable risk/reward ratio and have a strong preferred dividend coverage ratio.

- The financial results for 2023 were weaker than expected, but this was mainly related to non-recurring items.

- The Series E preferred shares offer a fixed dividend yield, but may be called at any time. Despite that, it could create a potential opportunity for investors.

Michael M. Santiago

Introduction

Although I like generating capital gains, a substantial portion of my investment portfolio also is geared toward fixed income and similar investments. The monthly or quarterly cash flow from incoming dividends provides firepower to either reinvest in other stocks or income securities right away or just to hoard cash and wait for the right investment opportunity to come along.

Last year, I had a closer look at Morgan Stanley’s (NYSE:MS) preferred shares, as I liked the dividend coverage ratio as well as its seniority over the common shares. While the preferred dividend yield definitely wasn’t the highest on the market, the risk/reward ratio appeared acceptable even though the preferred shares are non-cumulative in nature (the issuer does not have to catch up on missing payments if it skips a preferred dividend payment). Fortunately the reputational damage for a Tier-1 company in the finance space would likely be a good deterrent and even during the difficult COVID times all financial institutions that survived continued to pay the preferred dividend.

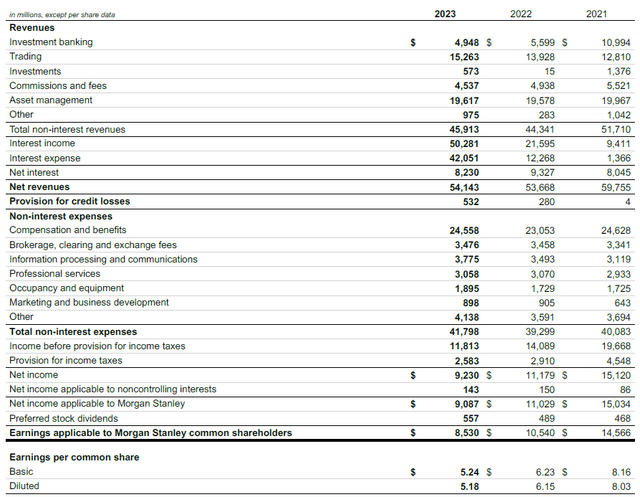

The financial results underpin the strong preferred dividend coverage ratio

2023 wasn’t the best year for Morgan Stanley. And although it would be easy to point a finger at the disappointing evolution of the net interest income, that would be “too easy.” While the income statement for 2023 indeed confirms the net interest income fell by in excess of 10% to just $8.23B, this represents a decrease of just $1.1B in absolute numbers while the financial institution’s pre-tax income decreased from $14.1B to $11.8B which is a $2.3B decrease.

Morgan Stanley Investor Relations

As the income statement shows, while the non-interest revenue increased from $44.3B to $45.9B, the non-interest expenses increased by approximately $2.5B. Not only did the “compensation and benefits” increase by approximately $1.5B, there was a very noticeable increase in ‘other’ expenses, which increased by in excess of $0.5B. And that $0.5B increase could be explained by two specific elements. First of all, the investment bank has earmarked $249M in legal charges to what it describes as “a specific matter.” And on top of that, the FDIC special assessment weighed on the results to the tune of $286M. This indeed means these two elements had a negative impact of $535M or approximately $0.28 per share as the charges related to the legal matter are non-deductible.

Fortunately those two charges are non-recurring and excluding those two items the pre-tax income would have come in at approximately $12.35B. While that’s still a bit lower than the $14.1B in FY 2022, the lower net interest income and higher loan loss provisions would explain the majority of the difference.

As the income statement shows, the net income generated by Morgan Stanley was approximately $9.23B of which $143M was attributable to non-controlling interests. And of the $9.09B in net income attributable toward Morgan Stanley, $557M was used to cover the preferred dividend payments which means the net profit attributable to the common shareholders of Morgan Stanley was $8.53B or $5.24 per share.

The most important takeaway for an investor in Morgan Stanley’s preferred shares is the preferred dividend coverage ratio. As the income statement shows, the $557M in preferred dividends represented just 6.1% of the net income. While that’s higher than the 4.4% in FY2022, the payout ratio is still very reasonable, especially given the pressure on the net interest income (and margins) and the non-recurring items recorded in the fourth quarter of the year.

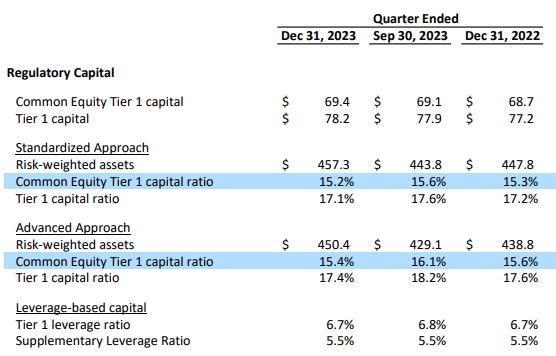

Morgan Stanley Investor Relations

At the end of 2023, Morgan Stanley’s capital ratios remained very strong with CET1 ratio of 15.2% which means there are no capital-related reasons why Morgan Stanley wouldn’t continue to buy back its own shares ($1.3B spent in Q4, $5.3B spent on share buybacks during FY 2023) and to pay its quarterly dividend (currently $0.85 per share per quarter). Despite spending in excess of $5B on share buybacks, Morgan Stanley’s CET1 capital ratio remained relatively stable compared to FY 2022 when the investment bank ended the year with a CET1 ratio of 15.3%.

I focused on the Series E preferred shares last time

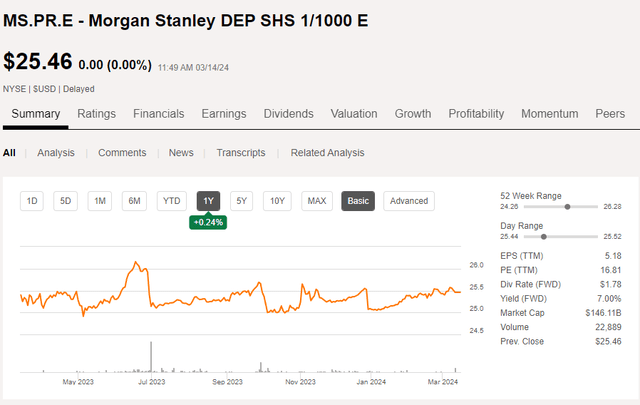

As explained in my previous article, most fix-to-float preferred shares where the floating dividend rate was based on the LIBOR made the conversion to a SOFR-based floating preferred dividend rate. Interestingly, Morgan Stanley decided to keep the Series E preferred shares “fixed” at the preferred dividend rate of 7.125%.

This means Morgan Stanley will continue to pay the quarterly preferred dividend of $0.4453125 (for an annual dividend of $1.78125) but keep in mind this preferred security can be called at any time. This means it wouldn’t be smart to pay too much over the principal value of $25 exactly because of that call risk. And as the interest rates on the financial markets start to move down, it may become increasingly interesting for Morgan Stanley to effectively call the shares.

Seeking Alpha

The call risk obviously also is the reason why the share price tends to trade around the $25 call price plus the equivalent of approximately 1 quarterly dividend payment.

Investment thesis

These are interesting times for preferred shares with a fixed-to-floating feature, but fortunately, Morgan Stanley decided to “fix” the preferred dividend yield when the LIBOR ceased to exist. This creates an interesting preferred security that is currently offering a yield of approximately 7% based on the current price, and the risk is obviously to see the security being called right away. In a way, you could see this security as some sort of speculation on the interest rates decreasing slower than anticipated.

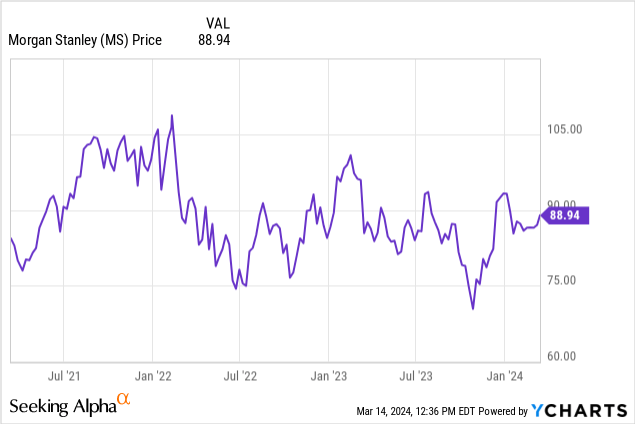

I currently have no position in Morgan Stanley’s preferred shares Series E, but I may dip my toe in the water by initiating a long position after the next ex-dividend date to pay as close to the $25 call price as possible. I also like the common shares of Morgan Stanley and I have been writing (out of the money) put options for a few quarters now, but all of those options have expired out of the money. While I currently have no options on the common shares of Morgan Stanley,

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I may initiate a long position in the Series E preferred shares, but it will depend on the share price and how close to the $25 call price I can pick up stock.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Consider joining European Small-Cap Ideas to gain exclusive access to actionable research on appealing Europe-focused investment opportunities, and to the real-time chat function to discuss ideas with similar-minded investors!