Summary:

- Morgan Stanley is expected to benefit from AI automation in the white collar workspace, leading to more predictable revenue and higher stock valuation.

- The bank’s revenue growth and cost efficiency are being driven by AI, with layoffs and the use of AI tools in wealth management.

- Despite concerns over government probes and competition, the bank’s investments in AI and wealth management position it for long-term success.

Maria_Ermolova

Investment Thesis

Heading into Q1 2024 earnings, I believe Morgan Stanley (NYSE:MS) is set up to be one of the early beneficiaries of AI automation in the white-collar workspace. With the firm leaning heavily into the asset management and wealth advisory space, the results are more sticky and durable cash flows that allow the bank to have more long run predictable revenue. This, in-turn, has allowed the market to reward the stock with both a higher price to sales multiple and higher P/E ratio.

However, these revenues haven’t been without their costs. Specifically, the cost to income ratio for wealth management is higher than other lines of business in the financial giant, standing at 77.2% for the industry as a whole.

This is where AI and automation savings are coming in.

Strong AI developments, and a durable business model, I believe are setting up Morgan Stanley for long run success. I believe their Q1 earnings are going to start to show the fruits of their labor. With this, I think the stock is now a strong buy (rating upgrade).

Why I Am Doing Follow-Up Coverage

Last November, I wrote how Morgan Stanley is using AI to help power growth by being one of the first major US banks to leverage AI in a firm wide effort by developing their own fine-tuned GPT4 for internal usage.

Since then, the market has rewarded Morgan Stanley stock, with the total return reaching 18.07% since when I wrote in late November. This compares to a 12.74% return in the S&P 500.

I am writing a follow-up piece because I think what we are starting to see now with Morgan Stanley is that not only is their revenue growth benefitting from AI (see my research from November) but their costs are coming down. The bank announced a series of layoffs in Q1 that tells me the bank is getting more efficient. AI is helping to drive this. With this, we can see costs come down in the bank’s wealth management revenue stream. Stable revenue from wealth management coupled with improving margins is a great recipe for long-term growth.

Earnings Preview

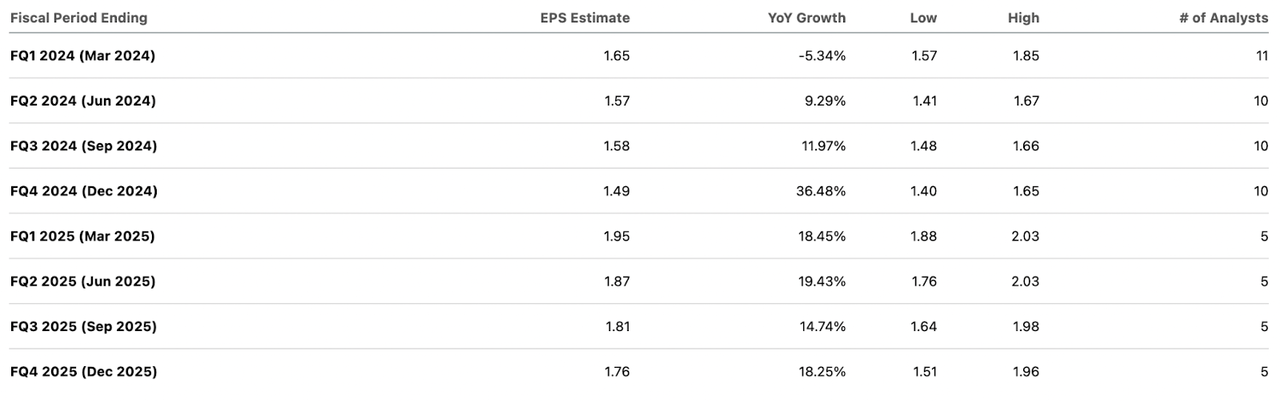

Heading into the Q1 report set for April 16th pre-market, estimates are calling for a $1.65/share in EPS and $14.39 billion in revenue. This would represent a YoY EPS decline of 5.34%. Revenue is forecasted to decline 0.84% as well. While I’m not excited that the bank’s EPS is set to decline if estimates hold true, I think this quarter’s potential profit declines will be short-lived.

If we look at longer-term forecasts for both EPS and revenue, we can see that the bank is set to see really strong, almost tech stock like growth over the next few years as (I believe) the impacts of their wealth management strategy takes hold.

Morgan Stanley Forward Q4 Estimates (Seeking Alpha)

What I’ll Be Watching: How Morgan Stanley Is Using AI To Control Costs

As I mentioned in the investment thesis, AI is key to the Morgan Stanley investment story.

Morgan Stanley is leveraging AI to optimize cost efficiency, particularly in its wealth management sector. The launch of the “AI @ Morgan Stanley Assistant” powered by OpenAI’s GPT4 solidifies this strategy. Their in-house tool enhances the productivity of financial advisors by quickly providing them with concise summaries of complex data, enabling them to access and utilize the firm’s extensive knowledge base more effectively. With the bank leaning heavily on the adoption of AI, this not only streamlines processes but also aims to lower operational expenses by minimizing the time and resources needed for information retrieval and analysis.

With this, the bank made some tangible moves to control costs in Q1, with Morgan Stanley implementing workforce reductions, particularly in its wealth management division, eliminating several hundred positions.

This aligns with the firm’s objectives to consolidate operations post-acquisition of E*Trade, aiming for operational efficiency and cost savings. While the layoffs affect less than 1% of the wealth unit’s personnel, I believe this demonstrates a strategic reshaping of the workforce to align with the firm’s new tech-driven operational model. By reducing redundancy and focusing on core operational efficiency, Morgan Stanley is attempting to maintain its competitive edge in the wealth management space.

On the call, I will be looking more for how they are leveraging AI to optimize this high stability revenue business. What’s interesting is that while the firm has leaned so heavily into AI, it’s been seldom mentioned on both the Q4 earnings call and in the transcript of a conference Morgan Stanley management recently attended. I think this is interesting and implies that management is waiting to announce big changes. I expect this to be a bigger topic on the upcoming conference call given their recent promotion.

Last month, the firm promoted Jeff McMillan to the head of AI. I am expecting the firm to even include him on the earnings call as a way to show the significance of AI within their firm.

Valuation

While Morgan Stanley’s forward valuation metrics make the bank appear like they trade at a premium, I believe this signals market confidence in the company’s growth trajectory and strategic initiatives. The firm’s forward P/E Non-GAAP is at 14.43, compared to the sector median of 10.08.

However, I think it’s key to look at this in context to where the company’s EPS growth is heading. Like I outlined before, EPS growth (by looking at Q4 YoY growth over the next few years) is set to accelerate. Even just this year, data provided by Seeking Alpha shows that the bank is set to grow its EPS by 6.19%, almost double the sector median EPS growth of 3.19%.

In my opinion, paying double the EPS growth for only a 40% higher P/E ratio with a clear plan for the bank to see robust growth and cost efficiencies going forward makes total sense. In fact, I believe we could see the bank trade at a forward P/E as high as 20x forward earnings as the market starts to appreciate how optimized the bank is getting with the new wealth management/AI business model. This is not like smaller banks, which drive most of their revenue through loan growth. This is more software like margins and stability. With a 20x forward P/E compared to the current P/E of 14.43, this would represent 38.6% growth in the firm’s share price.

Where This Fits In With My Previous Valuation Estimate

In November, I wrote how the bank could have a 61% share price upside if the market started to price in the AI potential and capabilities of the firm. Since then, the shares have returned about 18%. If we take the current share price and apply 38.6% growth from here to the shares, we get a share price appreciation total of ~63% since I initiated coverage on Morgan Stanley in November.

In essence, I am raising my upside estimate slightly due to the firm now working on cost savings with AI. If we see the results of this strongly appear during the earnings call next week, I may raise my upside estimates more from here.

Risks To Thesis

As evident with how I have written this piece, I believe the investment thesis for Morgan Stanley is heavily predicated on its wealth management sector. Wealth management, like any other sector in finance, is not perfect and has had some notable headwinds come up recently. Notably, the industry is becoming increasingly competitive, with many banks, including Morgan Stanley, aggressively pursuing this high-margin sector. This competitive landscape could lead to market saturation, potentially pressurizing Morgan Stanley’s profit margins. The firm’s wealth management division, which oversees about $5 trillion in assets, has already shown signs of deceleration, with net new asset growth decreasing by 8% year-over-year in a recent quarter.

On top of this (and as I was writing this piece) news broke that Morgan Stanley is under investigation for its wealth management practices, according to the WSJ. Investigators are concerned that the bank may be hiding clients’ identities and allowing money laundering to take place inadvertently by not checking the sources of wealth.

However, this isn’t necessarily new news, and I’m not super concerned about it. Keep in mind that the Federal Reserve already has a probe open on Morgan Stanley from last November related to similar claims. Given the market reaction to this news, I am surprised. I expect most of this to be priced in, given previous news from November.

I believe probes like this bolster the case even further for the firm to implement more AI tools, furthering the efficiency push. AI can detect illegal practices, like money laundering, and help the bank combat bad behavior by employees.

Bottom-Line Heading into Earnings

As Morgan Stanley approaches Q1 earnings, I believe the bank’s investments in AI and wealth management set the stage for potential long-term success, despite the premium valuation and concerns over government probes. The bank’s uses of AI to streamline operations and control costs, especially within its wealth management division, are expected to enhance profitability and drive growth. The anticipated earnings growth, backed by AI efficiencies and wealth management strength, supports my strong buy. As always, investors should remain cognizant of the risks associated with increased competition and regulatory challenges, but ironically, I believe AI (which the bank is leaning into) can solve both of these.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in MS over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Noah Cox (account author) is the Managing partner of Noah’s Arc Capital Management. His views in this article are not necessarily reflective of the firms. Nothing contained in this note is intended as investment advice. It is solely for informational purposes. Invest at your own risk.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.