Johnson & Johnson: Doubling Down On This 2024 Dog Of The Dow

Summary:

- Johnson & Johnson (JNJ) is positioned to gain on the upside due to solid financials, consistent dividend streak, and potential increase in healthcare spending.

- JNJ is included in the Dogs of the Dow list for 2024 and I plan to capitalize on the opportunity.

- JNJ’s financials show impressive growth in both the Innovative Medicine and MedTech segments. The FY24 outlook is strong with continued growth on the runway.

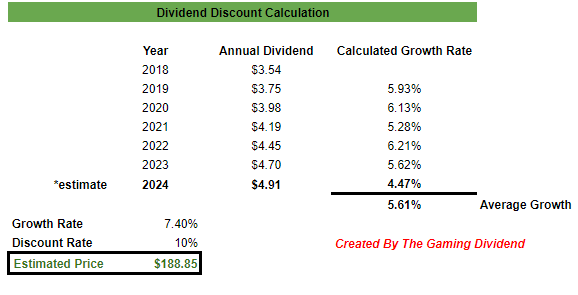

- Running a dividend discount calculation gets us to a fair estimated stock price of $188.85 per share. This indicates a double digit upside.

- The dividend has been increased for over 61 consecutive years. The current dividend yield is 3%, which sits above the 4 year average yield of 2.66%.

JHVEPhoto

Overview

Johnson & Johnson (NYSE:JNJ) has always been one of those companies that has a product and service offering so wide and large that JNJ can be considered its own healthcare ETF. Johnson & Johnson operates within the healthcare space with focus on some of the following segments: immunology, infections, neuroscience, and oncology to name a few. In addition, they also operate a segment called MedTech, that provides interventional solutions. With solid financials, a consistent dividend streak, and perseverance within an industry that’s been lackluster for some time now, I believe JNJ is more attractive than ever and the price is positioned to gain on the upside.

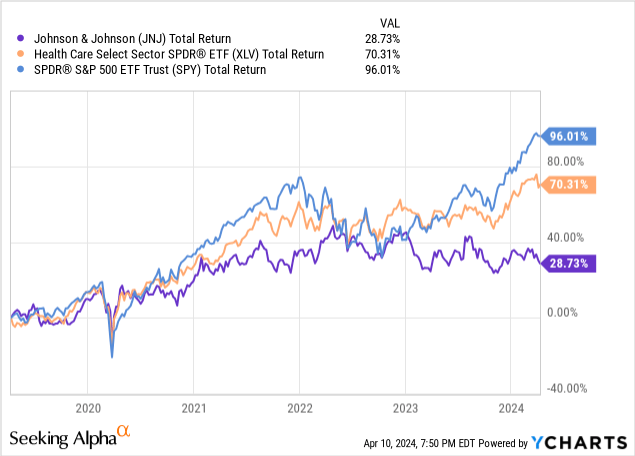

The real disconnect has from the Healthcare Sector (XLV) started back in the pandemic drop of 2020. Despite some ongoing headwinds, I believe we are set to see a very profitable future ahead of us with with interest rates eventually being cut and a large increase of healthcare spending throughout the US. I believe there is a current price connect and I am doubling my position after this recent price drop to the $150 per share level. This is because I think that JNJ is undervalued in terms of valuation. For instance, the current P/E ratio (price to earnings) sits at 17.36x, which sits below the 5 year average P/E as well as the sector median.

JNJ has already reported their Q4 earnings in January to close off their fiscal year 2023. They are set to report their upcoming Q1 earnings on the 16th of April so I will also cover some rough estimates of mine alongside what my future out look is for the company. The current dividend yield is slightly over 3% and JNJ is one of the most reliable dividend stocks in history. They have managed to increase the dividend for over 61 consecutive years, making JNJ a member of the elite Dividend Kings club. Lastly, I wanted to share something that’s probably already known, but JNJ has made 2024’s Dog’s Of The Dow list so I look to take advantage of this opportunity as well.

Dog Of The Dow

The Dogs of the Dow strategy is something that is super simple to implement in practice. It focuses on selecting companies within the Dow Jones 30 index that has the highest current dividend yields. A higher yield in this blue chip context can be for a variety of reasons; maybe the fundamentals have weakened, the industry as a whole is suppressed, or the company is performing badly. Either way, making this list usually means that the price has fallen below its usual trading range.

Since price and dividend yield are inverse of one another, the drop in price causes the yield to spike to levels higher than the normal range. By using this strategy, I aim to capitalize on this elevated dividend yield as I believe the fundamentals of the company are strong enough to bring the price back to the highs. For context, here are the current Dogs Of The Dow:

| Symbol | Company | Yield |

|---|---|---|

| (VZ) | Verizon | 6.51% |

| (MMM) | 3M | 5.45% |

| (WBA) | Walgreens | 5.21% |

| (DOW) | Dow | 4.68% |

| (CVX) | Chevron | 4.02% |

| (IBM) | IBM | 3.51% |

| (AMGN) | Amgen | 3.33% |

| (KO) | Coca-Cola | 3.25% |

| (CSCO) | Cisco | 3.20% |

| (JNJ) | Johnson & Johnson | 3.13% |

Like I said, companies can make this list because of their recent poor performance in the short term. For example, Walgreen (WBA) has struggled to continue growing sales for an extending period of time. As a result the share price collapse by approximately -50% over the last 1 year period. Even with a recent dividend cut of -48%, the yield is still inflated to over 5.2%. The same story here for 3M (MMM) has caused the price to struggle for an extending period of time; lower growth metrics, slump in meaningful growth prospects, and a decreasing level of free cash flow. As a result MMM’s dividend yield is historically high at 5.4%.

However, some companies make the list due to factors outside of their control. For example, Dow (DOW) has struggled to gain any meaningful momentum due to a combination of higher interest rates, poor macro environment for their industry, and lower profit margins outside of their control. However, they have strategically and efficiently managed their cash to navigate these rough times. As a result, they have a great future ahead once pricing and margins become more attractive. I wrote all about it in depth in my previous article titled: ‘Dow: Q4 Earnings Reinforce Great Cash Management For This Stock‘.

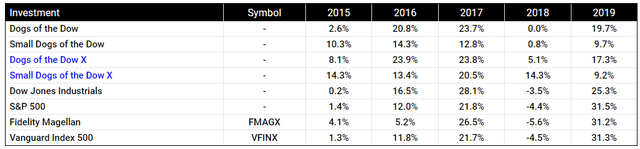

I wanted to highlight this strategy because it has seen impressive results in recent history. We can see how the Dogs outperform the S&P 500 in return for 4 out of the 5 years listed. Similarly, the Dogs outperform the Dow Jones for 3 out of 5 years listed. While its by no means a perfect strategy, it does offer a bit of a defensive stance as the Dogs typically held up better during down years.

Dogs Of The Dow

Financials

JNJ operates in two main segments: Innovative Medicine sales & Worldwide MedTech sales. Both of these segments have seen impressive growth metrics with the Innovative medicine segment growing sales by 9.5% for 2023, excluding Covid-19 vaccine related sales. Similarly, the MedTech segment experienced a 9.1%% operational sales growth. Growth in these segments can be attributed to increases in surgery, orthopedics, interventional solutions, and vision.

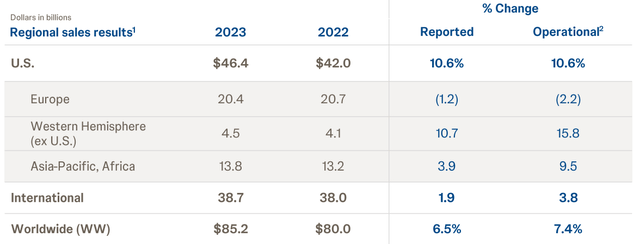

JNJ reported their Q4 earnings in January to close of their fiscal 2023 figures. As a result we can see that growth was achieved worldwide. JNJ closed off 2022 with $80B in sales worldwide and this has now increased to $85.2B. The only region that experienced a decline was the European market but even then, it was slight a slight decrease from $20.7B to $20.4B which is negligible. Reported sales great by 6.5% to close the year.

Q4 JNJ Presentation

Adjusted earnings per share [EPS] for the full year also saw impressive growth of 11.1%, increasing from $8.93 at the close of last year up to $9.92. Between the two segments, Medtech is where the most impressive growth has taken place. The segment has operational growth of 13.4% for Q4 with Interventional Solutions growing by a whopping 52.3% due to new products such as QDOT and OCTARAY having success in the markets they launched within. The other segment, Innovative Medicine, also saw growth of 4% for the quarter. In this segment there was a large decrease in profits from the infectious disease category but this is completely understandable since this mainly consisted of Covid-related revenue.

Q4 JNJ Presentation

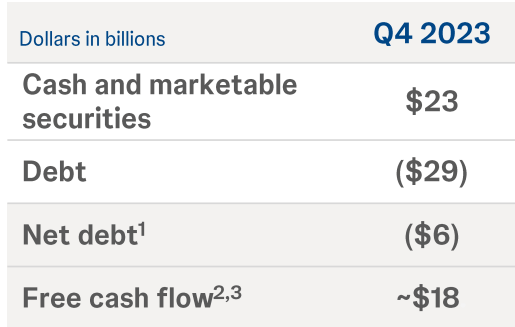

The financial picture here supports the fact that management cares about using capital is the most efficient way possible. They closed out Q4 with a free cash flow of $18B and have successfully used their capital management skills to continue pouring cash back into the business. Cash and marketable securities total $23B while debts total $29B.

Their capital allocation strategy first prioritizes the organic growth needs of different channels within the business. As a result of this, they continue to grow FCF. This FCF can then be used to either invest, growth, research, or develop other areas of their business. Or it can be used to further increase dividend payments and initiate share repurchases.

JNJ closed out their 2023 with over $15B invested into research and development. Over the course of last year they also completed $2.5B worth of share repurchases while paying out a total of $11.8B in dividends to shareholders. This is a company that knows how to handle their cash.

Valuation & Outlook

In terms of valuation, I think that we have a great opportunity for entry at this level. The average Wall St. price target sits at $175.36 per share. This represents a potential upside of 16.75%. I feel highly confident that we are capable of surpassing this price target based on the growth experienced across segments as well as some following valuation metrics. The current P/E ratio sits at 17.36x compared against the sector median P/E of 26.34c. In addition, the 5 year average P/E of JNJ is 20.87x. In addition, the current Price to Book ratio is 4.68 compared to the 5 year P/B ratio of 5.61x.

According to management, adjusted operational sales are estimated to grow at a rate between 5 – 6%. Reported sales are estimated to grow between 4.5% – 5.5% while earnings per share are estimated to grow between 6.4 – 8.4%. Seeing the recent growth delivered over the course of 2023, I think these are highly realistic and likely numbers tat will be achieved. Therefore, I think it would be appropriate to run my own dividend growth model to get another estimated fair stock price.

First, I started by compiling all of the annual dividend payouts for the last few years. Next, I used the estimated annual payout of $4.91 per share for 2024 and inserted it into the calculation. We can see that the dividend has grown at an average of 5.61% per year since 2018. Earnings are expected to grow between 6.4 – 8.4% so I decided to go with a middle of the road input of 7.4% EPS growth. As a result, I determine a fair stock price of $188.85%. This would represent a large potential price upside of approximately 25.7%.

Author Created

Earnings for the full year of 2023 amounted to $10.43/share. Since the growth estimates for each segment are strong, I anticipated a bump in earnings for the full year of 2024. JNJ is set to report their Q1 2024 earnings reported on April 16th. To get a rough estimate, I compiled all of the EPS metrics reported since Q1 of 2019. I took every year’s EPS report and calculated out an average EPS growth of 15.74% per year. While this is abnormally strong, I wanted to remain more conservative in my estimate so I want to slice number in half.

Dividend

JNJ has been able to grow their dividend payments for over 61 consecutive years. This puts them in an elite class of dividend kings! As a result they’ve earned the respect of dividend investors since the income has been so consistent for so any decades. As of the latest declared quarterly dividend of $1.19 per share, the current starting dividend yield is slightly over 3%. For reference, the average dividend yield over the last four years has been 2.66% so you’d be getting a higher yield than normal. The dividend remains well covered with a healthy payout ratio of only 45%. For reference, the average payout ratio of the last 5 years is also 45%. JNJ has about $22.8B in cash from operations to cover any potential headwinds or lack of growth.

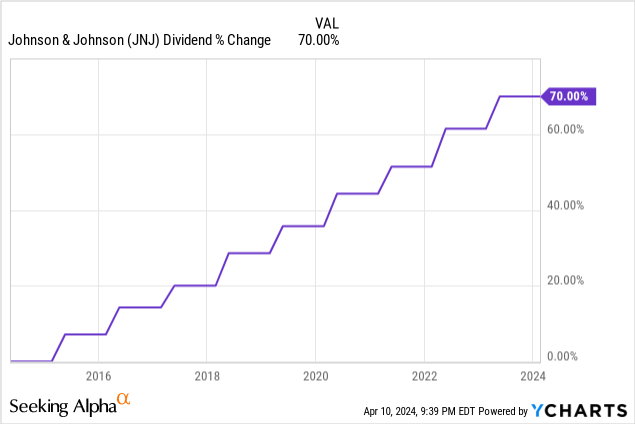

We can see how the dividend has grown by 70% over the last decade. Over this time period, this growth equates to a CAGR (compound annual growth rate) of 6.07% over the last ten years. Over a smaller time horizon of 5 years, the dividend has increased at a CAGR of 5.75%. While the yield is only 3%, a larger rate of growth would be more ideal. However, I am thankful that JNJ has not increased the dividend too much since the pandemic because it means they have more cash on hand to ride out the subpar performance of the entire sector and invest in further growth initiatives, acquisitions, and research. For example, JNJ is to acquire Shockwave Medical (SWAV) for $13.1B. Continued moves like this are ways to continue boosting profitability.

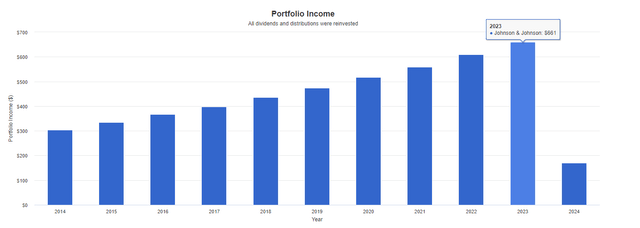

The income growth aspect of JNJ truly makes this such a great choice for dividend growth investors. Using Portfolio Visualizer, we can see the growth of income from an original investment of $10,000. This chart assumes that no additional capital was deployed and only dividends were reinvested. Your dividend income would have started out as $300 in 2014 and you’d now be receiving over $661 annually in 2024. Now imagine if you dollar cost averaged into JNJ a few times a year? Your income would grow substantially faster!

Portfolio Visualizer

Risk

While I believe strong in my thesis that JNJ is undervalued, there are some risks and factors to consider. With the release of the March CPI Report, the chances of interest rate cuts are less likely. The probability that the federal funds rate will stay the same is now 73.2%. Higher inflation levels can impact consumer spending and reduce all around segment sales and profitability for JNJ. In addition, a higher federal funds rate can mean higher interest payments on debt obligations, although JNJ is currently AAA rated this is less of a worry.

Most important, JNJ has been plagued with ongoing fines and lawsuits. While this has almost always been the case for the company, large lawsuits and settlements chew into profitability. Cough syrup was recently recalled in Nigeria over toxicity concerns. Although early in the process, who knows how far these things can go. Sometime it seems like the abundance of negative news over powers the financials of the company. For example, JNJ may have to pay $700M to settle a talcum powder lawsuit due to marketing this controversial product. In addition, there is also a baby powder suit for $75M that JNJ has to settle with the state of Mississippi. However, $75M is essentially immaterial for JNJ so this is a win.

Takeaway

Johnson & Johnson (JNJ) has had their stock price beaten up for the better part of a year. While the entire healthcare sector has also lacked growth to keep up with the S&P 500 (SPY), I believe this to present a great opportunity to initiate a position or add more shares at these price levels. From a valuation perspective, the stock remains cheap with an average Wall St. target of $175 per share and my own personal dividend discount calculated estimate fair value of $188.85 per share. This presents an opportunity for appreciation anywhere between 16 – 25% after the recent price drop. This becomes even more attractive when you consider that you will also be collecting one of the most reliable dividend streams out there, with a current dividend yield of 3%.

I feel that JNJ has a lot of strong indicators aligned at the moment. Under valuation, a strong dividend, excellent revenue growth across segments, and a current Dog of the Dow. The Dog of the Dow strategy is by no means failproof, but it has historically offered greater downside protection and potential to outperform the greater indexes. On going lawsuits and settlements may disrupt the price movement in the short term, but the fundamentals are strong so I believe will succeed and provide long term growth. As a result, I rate shares of JNJ as a Strong Buy.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of JNJ either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.