Summary:

- Chevron’s acquisition of Hess Corporation in a $53 billion all-stock deal was met with negative market reaction, with shares of both companies dropping.

- The deal has been pitched by Chevron as a major move aimed at significantly boosting cash flows and keeping production growing into the 2030s.

- Irrespective of the $1 billion in proposed synergies, the transaction is not as clear-cut as management makes it out to be since a lot of forecasts are questionable.

- Energy price volatility also creates uncertainties regarding just how positive this move will be.

- In all, this is a controversial deal that dents my previous bullish view of Chevron.

jewhyte

Normally when one company announces that it will acquire or absorb another, shares of one of the firms increases while shares of the other drops. This is because the market typically judges that the acquire is paying a premium for the company that’s being acquired compared to what that company is worth. But in rare instances, you will see share prices of both companies follow the same trajectory. When both increase in price, it’s the market view that the deal will make so much sense from a synergy perspective that the price being paid is well worth it for both parties. And when the opposite occurs, the market is signaling that the deal is not great for either one.

It was this last type of movement that we saw on Oct. 23 when news broke that energy behemoth Chevron (NYSE:CVX) had agreed to acquire Hess Corporation (NYSE:HES) in an all-stock deal valued at $53 billion on an equity basis and $60 billion on an enterprise value basis. In response to the news, shares of Chevron closed down 3.7% for the day, while shares of Hess Corporation dropped 1.1%. The market clearly does not like this transaction from either perspective. And I understand why insofar as Chevron is concerned.

The fact of the matter is that the price being paid for Hess Corporation is awfully high. The company is being acquired at a very lofty multiple. The management team at Chevron goes to rather great lengths to explain that, on a forward basis, the transaction will be much more affordable. This is based on the idea that production, particularly in Guyana, can be expected to ramp up over the next few years. And the margins associated with output there are some of the best on the planet. But even this assessment is based on third party estimates, and cash flow projections for the company do you not do a great job of breaking out just how much upside is caused by this particular acquisition. A bird’s eye view suggests that there’s a marginal improvement in overall cash flow from this acquisition. But management has been a bit opaque in this regard.

The big question is whether or not this deal dents my previous view of Chevron. Earlier this month, I wrote a bullish article about the company wherein I discussed the legal troubles it’s facing in California and elsewhere. My argument at the time is that while those problems could be very significant in the long run, they are not guaranteed to come to fruition and they will take years to work out. Meanwhile, the conglomerate will spend years generating strong cash flows. As pricey as this transaction is, the all stock nature of this deal does mean that additional cash flow can be generated at that time. So even though management is paying quite a bit for Hess, there’s some benefit on that front. One thing that investors should absolutely expect is for management to provide a more substantive assessment of the deal when earnings come out in the coming days.

A mega-deal in the oil patch

The oil and gas space is filled with companies of all sizes and types. But two of the largest happen to be Chevron and Hess Corporation. Chevron is a major integrated company in the space with operations all across the globe. It boasts Upstream and Downstream operating segments and, as of this writing, the company has a market capitalization of $311.5 billion and an enterprise value of $324.4 billion. Truthfully, multiple articles could be written about the significant network of assets that the company has established for itself in recent years, but the bottom line is that this is the very definition of a world class oil and gas company.

By comparison, Hess Corporation is considerably smaller. But that doesn’t mean that it’s small. Management describes the company as a global exploration and production firm that has operations not only in the US, but also throughout Guyana, the Malaysia/Thailand Joint Development Area, and Malaysia on its own. The company also has operations in the Gulf of Mexico, as well as other offshore operations in Suriname and Canada. While the company largely is an exploration and production firm, it also does have a Midstream segment that’s comprised of its 41% ownership interest in Hess Midstream LP. That particular business provides fee-based services like gathering, compressing, and processing, for not only natural gas and fractionating NGLs, but also for other activities.

The management teams of both firms clearly have been working on a deal for some time. Finally, on Oct. 23, they announced that the two companies would be merging together in an all-stock deal valuing Hess Corporation at $171 per share. This is a 10.3% premium over the 20-day average closing price of Hess Corporation. This is not that large a premium. But usually, major deals like this don’t see massive premiums like what you can often see in much smaller companies. And this is because the market typically values these larger firms more appropriately.

One big question would be whether there are any antitrust issues regarding this transaction. It’s hard to imagine that regulators will be fine with such a large deal going through without at least applying significant scrutiny. However, Chevron Chairman and CEO Mike Wirth argued that he does not see antitrust issues preventing this transaction from being completed. Because there’s no refining and no marketing activities and because the oil markets are so large, he does not think that there will be any issues on the regulatory front. As he put it when discussing the transaction, “we have a 2% market share in the global oil markets. Our portfolios have very little overlap at all, so we don’t really believe there are any competition issues here.” Assuming he turns out to be right, shareholders of Hess Corporation will receive 1.0250 shares of Chevron for each share of Hess Corporation that they currently own when the transaction closes sometime in the first half of the 2024 calendar year.

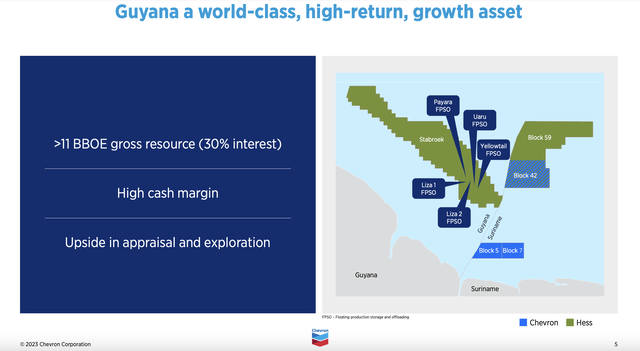

There are a couple of reasons why this deal is appealing according to the management team at Chevron. First and foremost is the exposure to Guyana. As the management team at Hess Corporation made clear in its latest annual report, its presence in Guyana has proven to be highly profitable. Back in 2020, it’s offshore operations were responsible for only 7.46 million barrels, or 11.5%, of oil output by the company. That number has almost quadrupled to 28.53 million barrels, or to 40.4% of total oil output, achieved by Hess Corporation in 2022.

Chevron

At this time, Hess Corporation, which has a 30% stake in what’s estimated to be over 11 billion boe (barrels of oil equivalent) worth of reserves, is believed to be sitting on a tremendous amount of wealth. There have been multiple developments in that region in recent years. In fact, the operator of the 6.6 million acre Strabroek Block that Hess Corporation has ownership over has made more than 30 discoveries since 2015. The potential for that area is so significant that management believes that it could eventually have 10 floating production, storage, and offloading vessels dedicated specifically to that block. At present, the first six are estimated to be able to grow output to 1.2 million boe per day in 2027. That’s triple the 400,000 boe per day currently estimated. There’s also potential for the Kaieteur Block, which Hess owns 20% of. The reason why I say there’s potential here is because it’s adjacent to the Strabroek Block and the company is still in the process of evaluating those assets and planning for them.

Chevron

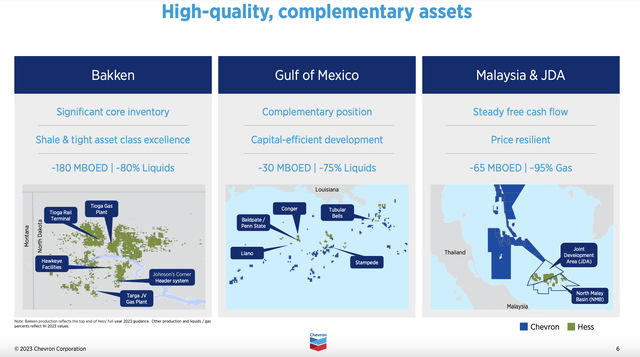

There’s some overlap here when it comes to Chevron. In Suriname, the company has a 40% interest in Block 5, a 33.3% non-operated working interest in the deepwater Block 42 area, and an 80% owned and operated working interest for the shallow water Block 7. Any chance to cluster assets opens the door to generating synergies. Another big win for Chevron is the exposure to the Bakken that Hess brings – the company has significant acreage in the area, with 180,000 boe per day of output, 80% of which is in the form of liquids. There will definitely be some overlap in the Gulf of Mexico where both companies have a nice presence. And like Hess Corporation, Chevron has complementary assets around Malaysia and Thailand.

Chevron

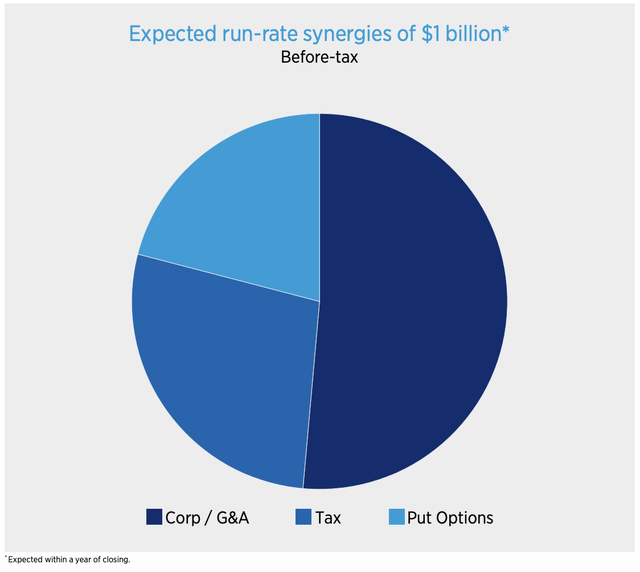

If everything goes according to plan, this acquisition will have a major positive impact on the combined company. Management is forecasting around $1 billion worth of annual run rate synergies, on a pre-tax basis, by the end of the first full year of this deal being completed. Over half of those synergies will come from cost cutting at the corporate level and when it comes to general and administrative costs. But management also is expecting to save on taxes and to be able to benefit from put options that come with the deal. To reward investors more fully, the company will, effective the first quarter of next year, increase its dividend per share by 8%. While continuing to fund capital expenditures at between $19 billion and $22 billion per year, the company also will aim to buy back around $20 billion worth of stock annually. That’s $2.5 billion above what management previously was targeting.

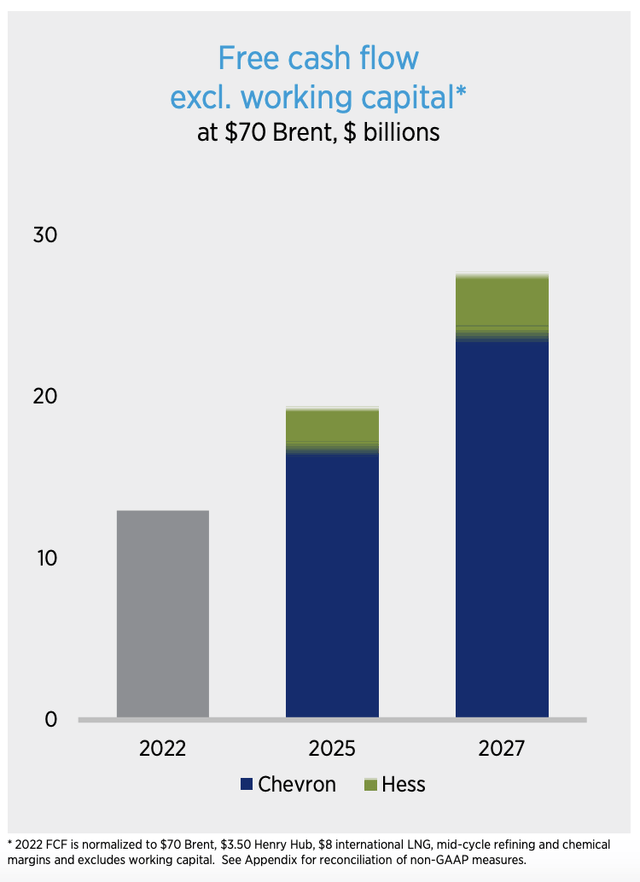

Of course, this does not mean that the company is only focused on growth. As is often the case with major deals like this, there also will be the potential to offload certain assets that are redundant or that otherwise don’t make sense. In fact, management is hoping to sell off between $10 billion and $15 billion worth of assets from the time the deal closes through the end of 2028. This acquisition, when combined with existing assets that Chevron currently owns, is expected to result in free cash flow more than doubling by 2027 while simultaneously fueling production growth sometime into the 2030s.

Chevron

According to management, this acquisition will help the company more than double free cash flow by 2027. But this is definitely something that investors should take with a grain of salt. For instance, this assumes that Brent crude prices average $70 per barrel. We’re currently higher than that now, so this assumes a normalization that brings cash flow down. But there also are other factors to take into consideration that we do not have enough information on at this time. For instance, in its September presentation, management forecasted annual free cash flow growth from 2022 through 2027 of at least 10%. That would imply a 61% increase in free cash flow without this purchase.

But that scenario called for Brent crude prices of $60 per barrel. There’s also some uncertainty regarding the company’s $7.6 billion acquisition of PDC Energy that was completed in early August. Like this much-larger Hess Corporation purchase, the PDC Energy purchase brought with it complementary assets, including 275,000 net acres with an estimated 1 billion boe of reserves in the DJ Basin and another 20,000 net acres in the Permian Basin. That deal alone is forecasted to bring in annualized free cash flow in excess of what Chevron on its own was forecasted to of $1 billion. When you factor in the significant volatility that we should see in this space solely because energy prices are volatile, it really is anybody’s guess what the free cash flow picture for the company might be in 2027.

Chevron

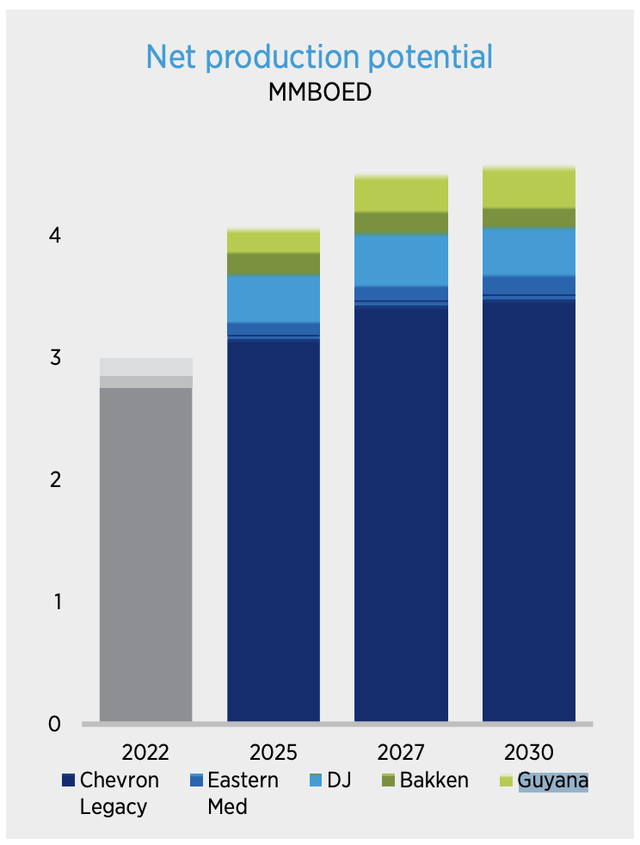

One issue that I have regarding the transaction is that it does look to be rather pricey for Chevron. Even ignoring the complications brought along by the relatively small PDC Energy purchase, we have two companies with two significantly different levels of cash flow and indebtedness. Chevron is paying $53 billion for the equity of Hess Corporation. Last year, that company generated adjusted operating cash flow of $5.12 billion. This implies a price to operating cash flow multiple of 10.3. By comparison, the multiple for Chevron comes out at 6.6. Using the EV to EBITDA approach instead, these multiples are 15.4 and 5.7, respectively. This doesn’t necessarily mean that there’s a mismatch. I would argue that, because of its growth prospects, Hess Corporation does deserve a premium of sorts over Chevron. As you can see in the image above, the management team at Chevron had been forecasting a small production increase between 2022 and 2030. But now management believes that production can continue to rise past that point. Though to be honest with you, it doesn’t seem like much of an increase.

Chevron

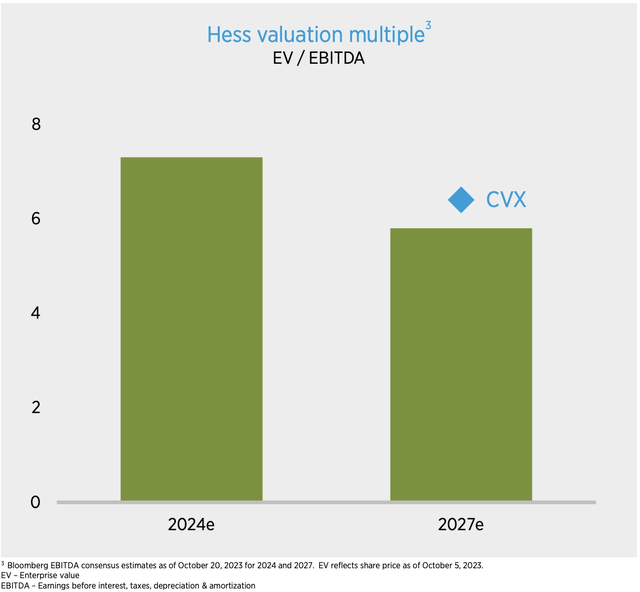

In its investor presentation, Chevron paints this in a different light. They’re clear that the premium being paid for Hess Corporation exists. Using forward estimates for 2024 and 2027, it shows that the valuation being paid for Hess Corporation should be substantially lower. They don’t give specific numbers, but the EV to EBITDA multiple for Hess Corporation for 2024 looks to be somewhere around 7.5. And by 2027, it should be just under 6, which would place it lower than the valuation of Chevron at that point. If this does come to fruition, then the deal would be more sensible. But it’s also important to be cognizant to the fact that the EBITDA estimates are not even coming from either of the companies. Rather, they’re consensus estimates provided by Bloomberg. And that far out, analysts don’t exactly have a great track record.

Author

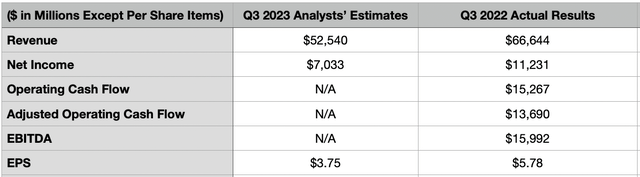

One thing that I’m hoping for is that we get some better clarity when management reports financial results on Oct. 27. On that date, the company will be covering results for the third quarter of its 2023 fiscal year. Because of a big decline in energy prices year over year, analysts don’t have the best expectations. They are forecasting, for instance, revenue of $52.54 billion. That would be down considerably relative to the $66.64 billion generated one year earlier. Earnings per share of $3.75 should be well below the $5.78 reported last year, resulting in net profits declining from $11.23 billion to $7.03 billion. Estimates were not provided when it came to other profitability metrics. But investors should be aware of those for context. In the third quarter of last year, operating cash flow was $15.27 billion, while the adjusted figure for this came in at $13.69 billion. And finally, EBITDA for the company came in at $15.99 billion. In all likelihood, all three of these profitability metrics will worsen as well.

Takeaway

Beyond any doubt, I would argue that this is an intriguing transaction. The growth potential from Guyana, not to mention the benefits from other assets, is definitely great to see for Chevron. It’s really impossible to know what kind of free cash flow investors should expect from this transaction in the years to come. But the one thing that I will say is that, as matters stand right now, I’m not the biggest fan. Chevron is paying a tremendous amount to acquire Hess Corporation. To put this another way, Hess Corporation is bringing in only 6.4% of the EBITDA and 9.7% of the adjusted operating cash flow of the combined company, but its investors are receiving 14.5% ownership of Chevron. Even if we count in the $1 billion in synergies have been forecasted, these numbers increase only modestly to 6.5% and 9.8%, respectively. I hope that we do get some additional clarity when management reports financial results in the next couple of days. But unless something bigger comes out of the woodwork, I see this as a neutral transaction for Chevron at best and, most probably, a net negative.

As for why this transaction does not result in an immediate downgrade from me, it really boils down to how I view different firms. I see ratings on a spectrum. So a company that’s rated could be a “solid buy,” a “buy,” or a “soft buy” in my book. They all indicate upside potential that should result in outperformance relative to the broader market. But the extent of that outperformance can vary. For context, a “solid buy” is a rating that I designate for a firm that I’m close to upgrading to a “strong buy,” while a “soft buy” is one that I’m on the fence about between a “hold” and a “buy” rating, but ultimately tilted positive. Decisions made by management and data that comes out from the firm in question can shift a company along that spectrum before ultimately resulting in a formal upgrade. For some time now, I have considered Chevron to be a “buy.” But this transaction does compel me to be less bullish than I was previously. While not worthy of a downgrade, it does certainly move the company more into the “soft buy” end of the spectrum. Obviously, this picture can change based on additional data that comes out. And when the firm reports financial results for the final quarter, I will be particularly sensitive about the prospect of down grading it should the rhetoric from management do more harm than good.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Crude Value Insights is an exclusive community of investors who have a taste for oil and natural gas firms. Our main interest is on cash flow and the value and growth prospects that generate the strongest potential for investors. You get access to a 50+ stock model account, in-depth cash flow analyses of E&P firms, and a Live Chat where members can share their knowledge and experiences with one another. Sign up now and your first two weeks are free!