Summary:

- Mullen has rallied from its November 2022 lows on the back of a raft of soft operational developments.

- The company’s Form-10K, quietly released ahead of a 3-day weekend, paints a dire picture for the near-term future of the EV upstart.

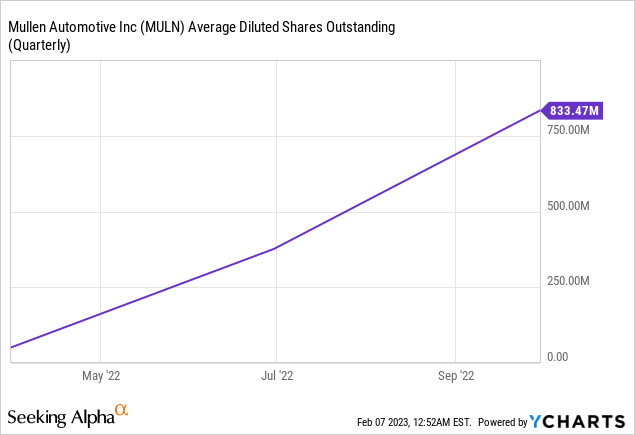

- With the shareholder vote to increase its outstanding shares to 5 billion from 1.75 billion passing, current longs are set for dilution.

- This is as the current liquidity position at $54.1 million is insufficient to meet near-term capex needs.

zoff-photo/iStock via Getty Images

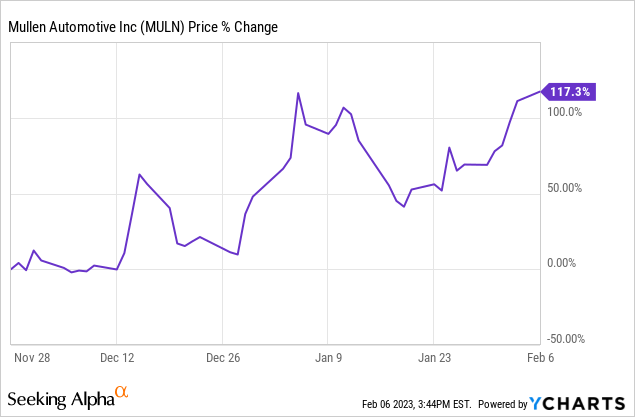

Mullen Automotive (NASDAQ:MULN) is rallying strongly after a near year-long decline of its commons. The reasons for the decline were clear; cash burn, dilution, and rising Fed fund rates. However, this narrative is quickly changing, especially from a macro perspective. Interest rates are only set for two 25 basis point hikes and an unbelievably resilient US economy has set the backdrop for a soft landing. The IMF is now stating US GDP will grow by at least 1.4% this year.

Mullen’s commons are up around 117% from their November lows, reflecting broadly energized stock market sentiment and EV animal spirits. This has placed in view the year ahead and whether the EV upstart will be able to hold current gains and build on the momentum. The bulls have quite a lot to be excited about here with Mullen recently closing its $105 million acquisition of the assets of Electric Last Mile Solutions, a recently bankrupt EV upstart. The $700 million market cap company now faces the Sisyphean task of starting production of the Mullen FIVE and Class 1 and Class 3 commercial delivery vehicles.

Trying To Build On Partnership Momentum In 2023

To be clear here, my opinion is that Mullen’s rally is now being built primarily on speculation and a marked change in stock market sentiment from lows in the fourth quarter of 2022. The company’s December shareholder vote to increase its share count to 5 billion from 1.75 billion passed, paving the way for what could be a 2.85x increase in outstanding shares. The company also recently filed its Form 10-K with the SEC last month on January 13th, the last possible day to meet its deadline and aftermarket on the Friday before a three-day weekend.

It’s unfortunate that the company did not hold an earnings call with analysts to explain the figures and that there was such a strong delay in releasing the numbers covering its fourth quarter ending September 30, 2022. Mullen’s upcoming eight-vehicle production lineup is expansive, owing to the consolidation of what was essentially three different companies. The company’s EV development portfolio includes the Mullen FIVE EV, an electric crossover slated for delivery in 2024. It also includes the Mullen Commercial Class 1-3 EVs and Bollinger Motors, which counts the B1 and B2 electric SUV trucks and Class 4-6 commercial vehicles.

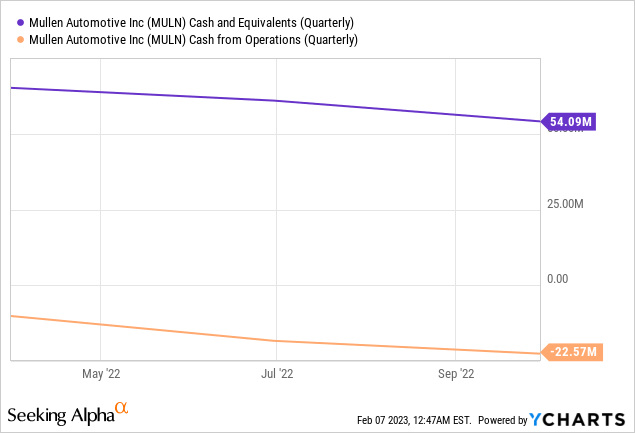

As the company is pre-revenue, the core takeaway from the filing was expenses, cash flows, and liquidity. Cash and equivalents declined to $54 million from $60.9 million in the prior third quarter, a decline of just under $7 million even against negative cash flow from operations of $22.57 million during the quarter. The liquidity gap was closed by the issuance of new shares.

The company’s SG&A expenses grew to reach $22.1 million in its fourth quarter, up from $10.7 million in the prior second quarter. Capex of just $600,000 looks low against an ambitious eight-vehicle roadmap. Fundamentally, Mullen will have to issue significantly more shares to fund its plans to start production and deliveries of its crossover EV in 2024. Hence, the near-term future is an unsustainable short-covering rally facing a wall of dilution as the company looks to shore up its declining cash position against aggressive growth plans.

Longs Should Tread With Caution But Shorts Face Risk

Bulls can be happy though around the company’s partnerships with Mullen recently signing a deal with Loop to provide co-branded EV charging solutions to a range of customers including businesses and residential drivers. Whilst Mullen’s balance sheet is currently broadly insufficient to meet the capex required for this, the deal could provide access to up $300 million in financing through the Loop-as-a-Service financing program. However, there are a few uncertainties around the deal, namely what the initial near-term financial commitment from Mullen and its liabilities will be, the roadmap for deployment, and the underlying cost of the LaaS financing program. The planned charging network is slated to support level 2 and level 3 DC fast charging and might possibly be made open to other non-Mullen brands. This came as the company disclosed a $200 million purchase order for 6,000 Class 1 EV cargo vans from Randy Marion Isuzu. There was no information provided on timelines or whether it was a non-binding commitment.

Mullen’s short interest of 11.88% is down from 14.8% in the last week with its cost to borrow also rising markedly with the year-to-date rally significantly increasing the risk posed to bears. However, the company still runs the risk of being delisted early next month as the deadline to regain compliance with NASDAQ’s minimum listing requirements comes up. Critically, the return of momentum to the high shorted names on the back of dovish sentiment from the Fed poses a near-term risk to shorts, especially if retail traders look to crowd into specific tickers to spark rallies.

Whilst I’m bearish on the company’s prospects I’m not short. My core reasons for being bearish coalesce around three factors; the lack of focus, the limited liquidity position, and intense shareholder dilution. Mullen is targeting solid-state batteries, producing two different trucks, an SUV, and a range of commercial EVs against a cash position that provides less than one year of runway for its SG&A expenses. That said, short-term momentum could trump the fundamental weakness in its strategy so I won’t recommend this as a short.

Editor’s Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.