PayPal: Up Over 20% Since Our Last Trade, Here Is How We Are Trading It Now

Summary:

- We now believe that PayPal stock is a ‘Hold’ rather than a ‘Buy’ after the recent move higher.

- However, we are increasing our Put trade in order to book profits and maintain that exposure – and the large premiums minimize our downside from current prices.

- Even if PayPal shares head lower, we have downside coverage and have structured the trades to still maximize cash inflows while minimizing cash outflows.

franckreporter/iStock Unreleased via Getty Images

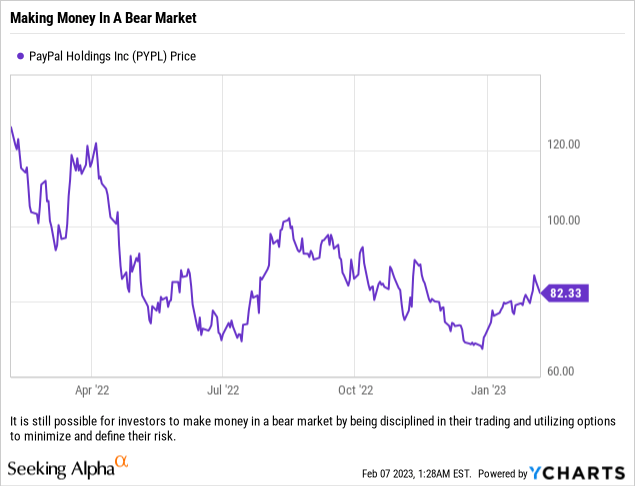

A lot of life is about being in the right place at the right time – and sometimes having a little luck sprinkled in for good measure. We always joke that it is better to be lucky than good, and although we have been in precisely the right places at the exact right times as it pertains to PayPal’s stock (NASDAQ:PYPL) over the last year, we have to admit that the positive returns we were able to lock in during a down year in 2022 had a lot to do with luck. Elliott Capital Management showed up when our initial trade had us underwater, which helped us exit via a covered call at a profit. We had a pretty decent entry point on that trade, but the key was Elliott and the decent quarterly results PayPal reported.

Our next bullish call, which was published on December 21, 2022, saw us set up two trades around PayPal in two different types of accounts. We focused on two types of portfolios; Long-Term Accounts and Aggressive Income/Growth Accounts. For the Long-Term Account, our trade was as follows:

“For the long-term accounts we manage, that have a slant towards growth, we are going to simply purchase the shares at these levels. With the stock trading at $69.30/share, one can comfortably tuck this name away for a while and ride the economic storm out.”

Our trade for Aggressive Income/Growth Accounts was to utilize unused margin to sell puts on PayPal in order to generate what appeared to be nice option premiums at an attractive entry point for the shares. Essentially, rather than own the shares on margin and incur interest, we instead looked to sell a put which not only provided cash upfront but also had the added benefit of providing a premium which would cover the first $11+ per share in potential losses.

What Are Our Thoughts Now?

We still like PayPal. We do not LOVE it, but the stock has not ventured outside of what we perceive its fair value range to be, so we still have interest in having exposure to the name. The company reports earnings Thursday after the market close, and while we do not anticipate any blow-out results, we think the company could be positioned to consolidate some of the recent gains simply by providing further updates about cost-cutting measures and plans to drive profitability higher.

With earnings coming up, the stock price having risen pretty strongly since we sold puts and having pretty decent profits on our positions, we decided to take advantage of recent volatility, as well as the expected volatility around earnings, and reposition our PayPal trades.

So What Did We Trade?

Late Friday, we entered ‘buy to close’ trades for the puts we were short; purchasing both the:

- PYPL 4/21/2023 $72.50 Put at $2.23, or $223 total

- PYPL 1/19/2024 $67.50 Put at $5.40, or $540 total

The January 2024 Puts with the $67.50 strike price were discussed in our article on December 21, 2022 and were traded that same day. We received $11.10 in premiums, or roughly $1,100 in total. The April 2023s with a $72.50 strike price was another trade we entered into back on December 12th and generated a premium of $6.25, or roughly $625 in total. So both trades had decent profits/gains.

We then sold the following puts:

- PYPL 4/21/2023 $85 Put at $6.25, or $625 total

- PYPL 1/19/2024 $85 Put at $11.70 or $1,170 total

What Was Our Logic For Risking More Capital?

Without a doubt, we increased our exposure to PayPal here, but with the stock having risen sharply in less than two months’ time, we looked to book some profits while also looking for a way to continue to play this. We believe that the shares anyone purchased back in late December are a ‘Hold’ now, and would not fault anyone for selling and booking these gains. As it relates to the puts, though, we believe that the option premium provides sufficient cushion for a move lower and can enable us to profit even if shares move lower.

For each set of contracts traded on a 1:1 ratio, we are risking an additional net of roughly $3,000. However, we will not lose money on the April 2023 Puts unless shares fall below roughly $78.75/share and the January 2024 Puts are profitable until falling below roughly $73.30/share. While we do not exactly want to be buyers of PayPal shares at $85/share, adjusting our puts higher makes sense for our portfolios that we have traded these contracts in because they have no direct exposure to PayPal (although they do have exposure via ETFs) and if these shares were put to us, being a buyer below $80/share, and even $75/share in the case of the January 2024s seems like a deal.

Note: The average cost for shares if both contracts were to be put to us would be about $76/share and if operating results hold up, we have no qualms with actually taking delivery of the shares.

Final Thoughts

Our last article saw us enter trades via direct purchases of the stock and via the sale of puts. In hindsight, it would have been better to purchase the stock across the board, but right now we are trying to generate some income and reduce margin debt in some portfolios, so there is a purpose to these trades. With PayPal’s big run since late December, we have locked in the 50% of the premium from the 1/19/2024 Puts that we were entitled to and over 71% of the premium from the 4/21/2023 Puts which we were entitled to as well. We made about 8% in profit from these trades, but what we sold is key to potential profits moving forward.

The April 21, 2023 Puts with a strike price of $85 were sold for $6.25 each, which would generate a potential profit of 7.35%+ if held to the workout date, which is just over two months away. The January 19, 2024 Puts with a strike price of $85 were sold for roughly $1,170 each, which generates a potential profit of over 13.75% if held to the workout date just under a year away.

Being in the camp where we think earnings are going to be pretty boring for investors allows us to have a longer view on this name during earnings season. For those who also believe that we will be range-bound for a little while, trades similar to this might fit your profile. With the downgrade from Raymond James to start the week, along with a general tech pullback, investors might look at Puts, with $80 strike prices to rotate into as those are still out of the money and similar to the structure of our trade when we entered into it on Friday.

Again, rotating out of the original trade is not necessary, but we are doing it in an attempt to grab more performance while also creating additional cash inflows to hopefully lower our margin interest expense for the year.

Disclosure: I/we have a beneficial long position in the shares of PYPL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Long the shares and short certain put options (long position) in personal and client accounts.