Summary:

- I shifted my rating on Micron to a sell with an $85 price target due to several pricing and geopolitical headwinds that could lead to softer-than-expected 2025 guidance.

- To be specific, I foresee a possible selloff post-earnings if management provides softer Q2 FY25 guidance below the consensus of $9.04B in revenue.

- Western Digital’s comments on unexpected pricing headwinds in NAND flash products raise concerns, as NAND flash sales represent 29% of Micron’s total sales in FY 2024.

- I’m particularly concerned with the price consolidation around the $100 support level, which could break down to $85 if negative sentiment materializes post-earnings.

- I remain bullish long-term on Micron’s pivot to high-margin memory products, but I anticipate near-term volatility warranting a temporary sell rating.

Simon Webb and Duncan Nicholls

Over the past week, I’ve been planning a bold move on Micron Technology, Inc. (NASDAQ:MU), and today, Friday, December 13th, I finally pulled the trigger.

It’s a two-step play: first, I’m shorting the company with deep OTM puts expiring on December 20th (that’s two days following Q1 FY25 earnings). Then, if the bull case still holds after the potential post-earnings selloff, I’ll start a long position with the proceeds, likely using ATM calls expiring in January 2027.

Needless to say, this is a highly speculative play not recommended for the fainted-hearted or any rational investor out there. Why? Because I believe there is a high chance my puts will expire worthless and, even worse, I will lose the chance to buy shares at a good price (i.e., $100 / share). However, even though the probability of success is quite slim, this is a move with an asymmetric risk-to-reward ratio.

Why do I think so?

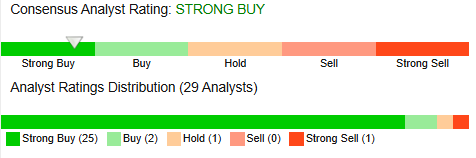

Well, the consensus on the street for Micron is a strong buy. In fact, if you read my last article on Micron, you may know that I was bullish on this stock. So, why did I downgrade my rating to a sell prior to Q1 FY25 earnings?

As you may know, the wildest moves in the market come from what I call a revision of beliefs – those moments when analysts say, “I didn’t see that one coming.” If you remember my thesis on Micron, the main pillar of my bull thesis was their progress in pivoting toward higher-margin memory products, particularly DDR5, LP5, and HBM. However, there are several external factors that I’ll discuss in this article that could slow down the company’s revenue growth, at least for the first half of 2025. Therefore, I see a high risk of management issuing soft guidance (despite beating Q1 earnings), which could trigger a panic selloff.

Nevertheless, my long-term view of this stock hasn’t changed. In the long run, I am still bullish. However, I can’t recommend a buy rating ahead of earnings, as I see potential downside risk with a price target of $85 if a selloff occurs.

A Make-or-Break Point

I know, I know… I’m not a big fan of technical analysis either.

However, my investment style uses price action to gauge the overall sentiment surrounding a stock. I care significantly more about investor sentiment than patterns and lines on a chart, although I don’t completely exclude them from my analysis.

The first factor that made me reconsider my Buy rating is the price consolidation around the $100 support level.

If you zoom in on the chart above, the consolidation is clear, particularly since the start of December. This is even more apparent in the RSI, which has been hovering around the 50 level for a couple of weeks.

When I wrote my analysis on Micron back in November, I noticed the share price testing the $115 resistance level for the third time in 6 weeks. I had a high conviction that the narrative of the company, particularly with management’s plans to gain market share in HBM, its good fundamentals (almost triple-digit revenue growth in Q4 FY24), and relatively cheap valuation ratios (a FWD P/E GAAP of just 12), would provide more than enough reasons for new investors to jump in, pushing the price past $115 and sparking a bull run toward the next resistance level at $160.

It turns out that didn’t happen and, to me, this raised some red flags, as it suggests there are other external forces that need to be considered.

Expect Pricing Headwinds in H1 2025

On December 12, Western Digital — a competitor of Micron in NAND flash memory products — took part in a Barclays investor conference. During the event, its CEO, David Goeckeler, made the following statements that raised some eyebrows:

But as we go through this quarter, I would say it’s fair to say in this quarter there’s more pricing headwinds than we expected when we entered the quarter. It’s an extraordinarily dynamic quarter. We’re not done yet. We’ll see how it all adds up in the end.

If we see two, three-quarters of this and we’re going to see this kind of choppy, more headwinds than we expected, then we’ll look at the production side of the business.

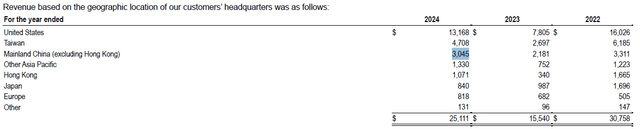

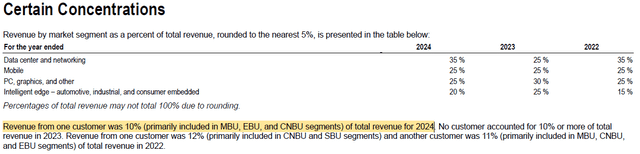

To understand the impact, these pricing pressures could have on Micron, we need to visit the company’s last 10-K.

As seen above, NAND flash product sales represented 29% of Micron’s total sales in FY24′, which is no small amount.

Nonetheless, it seems that DRAM products are not safe from pricing pressures either. According to Morgan Stanley and Edgewater Research, DRAM memory products, representing 70% of Micron’s total revenue in 2024, could experience price corrections in 2025 and 2026. Edgewater seems to be concerned with shrinking demand, particularly in the first half of 2025, while Morgan Stanley predicts a multi-year decline through 2026. Both firms also point to oversupply risks, with Morgan Stanley specifically forecasting that HBM supply will exceed demand by 66.7% next year. In fact, Morgan Stanley reduced its price target for Micron from $140 to $100.

Of course, if we zoom out and look at the overall consensus on the street, there is a vastly larger amount of analysts that maintain a positive outlook on this stock.

Stock Rover

In fact, the revenue consensus is targeting $38.15 billion in revenue for FY 2025. To put things in perspective, this would represent a 52% YoY increase, which is in line with the 62% YoY revenue increase in FY 2024.

Therefore, if the headwinds that Morgan Stanley and Edgewater Research materialize, this would lead to the “revision of beliefs” that I mentioned in the introduction of this article. If this happens, a panic selloff is quite likely to happen.

Export Control Restrictions

The US has recently escalated its technological restrictions on China through new semiconductor export control rules on December 2, 2024, that specifically target:

- HBM chips are critical for AI applications.

- 24 types of semiconductor manufacturing equipment.

- Advanced computing and supercomputing capabilities.

China responded swiftly with several countermeasures. I considered including below the two that make me sweat the most:

- Launched an investigation into NVIDIA for alleged anti-monopoly violations.

- Four major Chinese industry associations advised against using US chips, claiming they are no longer safe.

There is no doubt these export control rules will have a direct impact on Micron’s revenue growth in 2025. How significant?

Well, in FY 2024, more than 12% of Micron’s revenue originated in China (16% if we consider Hong Kong).

Furthermore, if NVIDIA stops selling their AI GPUs in China, this could further impact Micron sales, as I believe NVIDIA could be Micron’s top customer, which according to the last earnings report, accounts for 10% of the total revenue in FY 2024.

Lower Than Expected Guidance Could Lead to a Panic Selloff

Despite the headwinds mentioned above, I have no doubts that Micron will beat both EPS and revenue expectations in Q1 of FY25. In fact, they have consecutively outperformed projections for 6 quarters in a row.

However, beating earnings is only half the story. The other half is the guidance that management will provide moving into 2025. My main concern prior to the earnings release is soft revenue guidance due to the headwinds discussed above, with a growth rate for Q2 FY25 lower than anticipated.

So far, the consensus targets $9.04 billion in revenue and 1.96 in EPS for Q2 FY25. If management delivers guidance below these values, I believe the market will overreact, which could lead to a major selloff post earnings.

Considering the price consolidation that we are seeing in the charts today, if a selloff occurs, I wouldn’t be surprised to see a drop to the $85 price level, which is the next support level below $100.

The Move

Here is the move that I mentioned in the introduction.

If you read my previous articles, you know by now that I am not afraid to dabble with options. The 241220P92 contract looks particularly attractive to me, with a breakeven point at $90 (12% below today’s share price).

I have allocated a small amount of my portfolio (<5%) to this move. If management delivers soft guidance for Q2 FY25, and the share price drops to $85, then my puts would turn into a three-bagger.

At this lower price, I would reconsider buying ATM calls expiring in 2027? Why so late? Because the headwinds I mentioned in this article could last well into 2026. So I need time to be on my side, not against me.

How Can I Be Wrong?

You might have noticed the use of plenty of ifs in my article. Needless to say, there is a high chance I can be wrong with my sell rating, particularly if management ignores the pricing and geopolitical headwinds in their Q2 FY25 guidance and delivers EPS and revenue growth aligned with the analyst consensus.

If this is the case, I have no doubts the share price will jump upwards, breaking the $115 resistance level and starting a bull run toward the next resistance at $160.

As I said above, in the long run, I am bullish on Micron. Their move to DDR5, LPDDR5, and HBM makes total sense to me because these are high-margin products that take advantage of the strong growth in AI and data center applications.

As a final note, the timeframe for my sell rating should be between a few weeks to a few months.

Conclusion

To wrap up, I am planning a bold move on Micron ahead of the upcoming earnings release. I’m shorting the company with Dec20’24 92 puts, anticipating a selloff following the release of Q1 FY25 earnings. I believe the selloff could be driven by soft guidance, with EPS and revenue growth below what the street is anticipating due to several headwinds that, I believe, the market is not fully pricing in.

Among the headwinds that could slow down Micron’s growth in 2025, I consider that pricing pressures in the NAND and DRAM products, mainly due to oversupply and lower than anticipated demand from OEMs (not data centers), could weigh in their future growth.

Other factors to consider are the new export controls that limit China’s access to advanced semiconductor technologies (including HBM for AI data centers) and a potential NVIDIA (one of Micron’s largest customers) ban in China, as the country launched an investigation for alleged anti-monopoly violations.

Overall, I believe in Micron’s long-term prospects and I remain bullish in the long run. However, I am not buying this stock prior to the next earnings release as the downside risk for a panic selloff is quite high, in my view. Therefore, I rate Micron as a sell for the moment, but I will be revising this stock shortly after Q2 FY25 earnings.

Analyst’s Disclosure: I/we have a beneficial short position in the shares of MU either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.