Summary:

- We’re upgrading NetApp stock back to a buy.

- We think the current consensus expectation of a 4% YoY annual growth is fairly conservative.

- We believe NAND Flash’s strength and higher gross margins could support more upside surprises in 1H24.

- Additionally, we expect flash price recovery due to inflationary prices to help support top-line growth.

- We think the stock can still outperform through 1H24.

franckreporter/E+ via Getty Images

We’re upgrading NetApp (NASDAQ:NTAP) back to a buy. We think the current consensus expectation of 4% Y/Y annual growth is conservative. We’re more optimistic on NTAP due to better NAND flash demand and improved flash pricing due to inflationary pressures; we believe the NAND Flash strength coupled with higher gross margins will enable NTAP to show more upside surprise in 1H24 and outpace the annual growth consensus and the company’s own guide of FY sales.

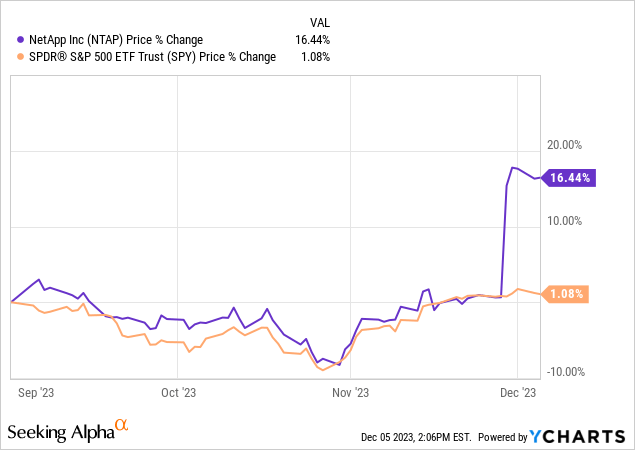

We downgraded the stock to a hold back in late November based on our belief that enterprise spending headwinds will persist through 1H24, but we now see a more favorable risk-reward profile for the stock based on NAND flash strength. We think our negative thesis played out for the most part; aside from the stock’s post-earnings run-up, the stock performed in line with the S&P 500 for the past quarter. We now think the stock has priced in an expectation of recovery, but we still think estimates are low enough for NTAP to continue showing an upside surprise. We recommend investors begin exploring entry points into the stock at current levels.

The following graph outlines NTAP against the S&P 500 over the past three months.

YCharts

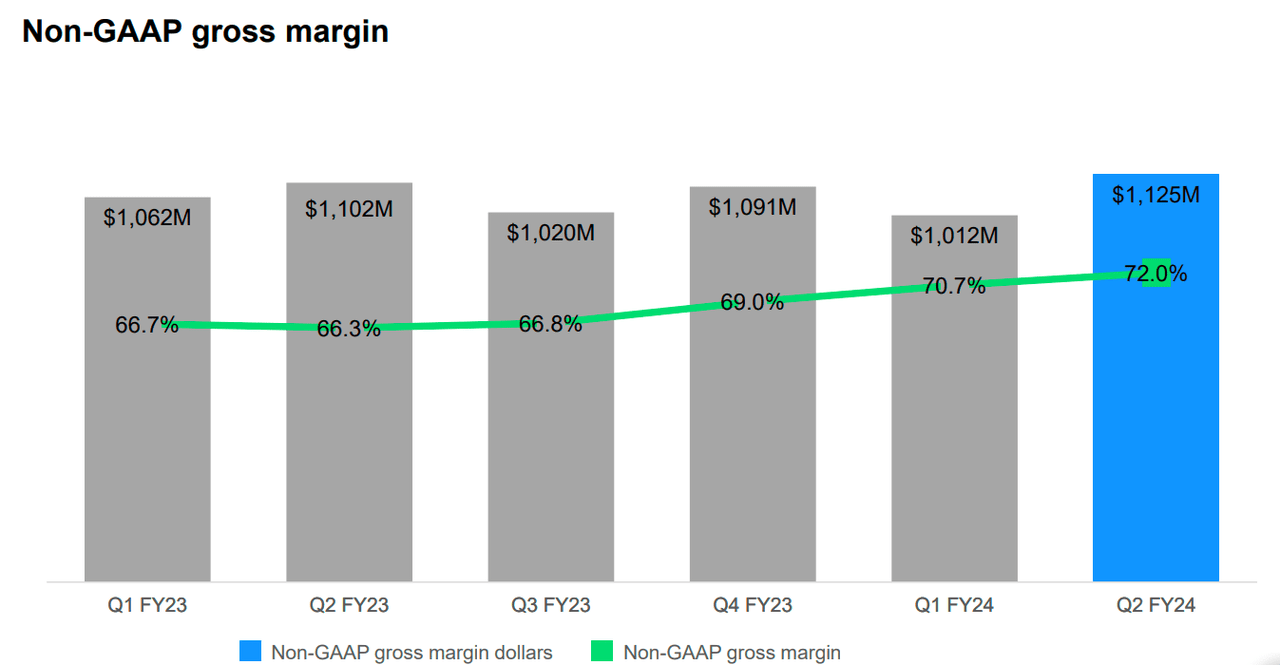

The company reported revenue down 6% Y/Y to $1.56B and Q2 Non-GAAP EPS of $1.58, beating by $0.19. Management reported revenue in the upper end of its guidance for 2Q24 from the guided range of $1.455B – $1.605B. Now, guidance for next quarter is between $1.51B-1.67B ahead of consensus at $1.55B for revenue and in the range of $1.64-$1.74 for non-GAAP earnings per share versus consensus of $1.53. We see revenue growth Y/Y exiting the negative percentage space in 2024 and see improved top-line growth driven by better flash pricing. We believe we’re seeing a recovery in flash pricing due to inflationary pressures necessitating a higher ASP. We’re already seeing indicators of a rebound from the memory/storage industries, with Micron (MU) and Western Digital (WDC) seeing bit of shipment improvement in NAND and projecting improved pricing dynamics. NTAP is also feeling the recovery, reporting a 1% Y/Y increase in all flash array annualized revenue run rates this quarter to $3.2B, up from $2.8B last quarter. Additionally, non-GAAP gross margins are expanding, at 72% this quarter, representing a two consecutive quarter break away from the late 60% range.

The following outlines NTAP’s non-GAAP gross margins as of 2Q24.

NTAP 2Q24 earning presentation

Valuation

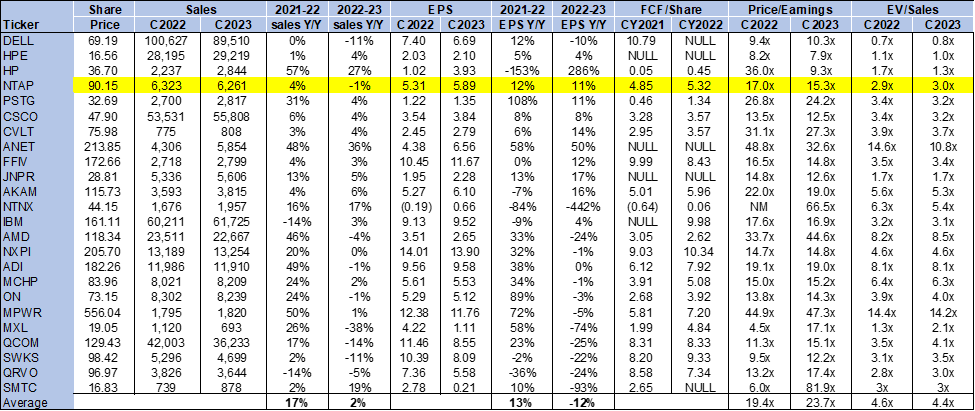

The stock is trading well below the peer group average; we think NTAP is a value stock at current levels. On a P/E basis, the stock is trading at 15.3x EPS $5.89 C2023 compared to the peer group average of 23.7x. The stock is trading at 3.0x EV/C2023 Sales versus the peer group average of 4.4x. We see attractive entry points at current levels cause we think NTAP is cheap relative to the peer group.

The following chart outlines NTAP’s valuation against the peer group average.

TSP

Word on Wall Street

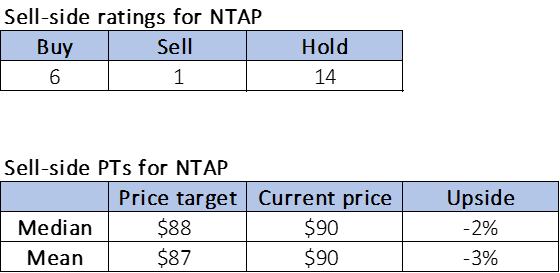

Wall Street is neutral on the stock. Of the 21 analysts covering the stock, six are buy-rated, 14 are hold-rated, and the remaining is sell-rated. We think Wall Street is leaning toward a more cautious sentiment on the stock in the near-term due to macro uncertainty and a still recovering IT spend environment. Our bullish sentiment is based on our belief that NTAP is better positioned to financially outperform now that we’re seeing a flash price recovery.

The following outlines NTAP’s sell-side ratings and price-targets.

TSP

What to do with the stock

We’re adding NTAP back to our buy list. We think the current consensus expectation of a 4% Y/Y annual growth is fairly conservative and think management’s FY24 guide of a 2% Y/Y decline in revenue and non-GAAP gross margins of ~71% is also conservative. We expect the company to show an upside surprise driven by NAND Flash’s strength. We believe the stock can still outperform through 1H24 and recommend investors begin exploring entry points into the stock on pullbacks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Our investing group, Tech Contrarians, discussed this idea in more depth alongside the broader industry and macro trends. We cover the tech industry from the industry-first approach, sifting through market noise to capture outperformers.

Feel free to test the service on a free two-week trial today.