Summary:

- Netflix’s Q3 earnings were exceptional, with a 15% revenue increase and an 800 basis point margin expansion, leading to a BUY rating reiteration.

- Netflix’s first-mover advantage and advertising growth are key drivers, allowing it to outperform peers like Disney and Warner Bros. Discovery.

- Advertising is a crucial future profit driver, with ad-supported subscriptions growing 35% quarter-over-quarter, and ad revenue expected to double by 2025.

- Despite increasing competition, Netflix’s high ROIC and strategic moves make it a superior investment, justifying its high valuation and positive outlook.

Marco_Piunti/E+ via Getty Images

Introduction

Netflix (NASDAQ:NFLX) is the global leader in streaming video on-demand or SVOD. The firm now has more than 280 million global subscribing households and reaching a total likely audience of over 600 million.

As I wrote previously, Netflix has a first-mover advantage in the streaming space and this head start has created the current landscape where Netflix has performed consistently while its peer group have moved slowly and struggled to figure out exactly what their strategies are. Peers like Disney (DIS), Warner Bros. Discovery (WBD) and Comcast (CMCSA) have all faced a balancing exercise as they try to grow streaming operations while minimizing the self-destruction of their own linear TV networks.

The proof as they say is in the pudding. When we evaluate the stock price performance of Netflix against its peer set, we see out-performance across every single time period. Netflix has had a free hand to grow its content, subscribers and technology while its peers face larger debt burdens and every year the cash generated from their historical linear networks dwindles.

Following a smash hit earnings release last week, I am reiterating a BUY rating on Netflix as I believe earnings have served to reinforce my confidence in the growth levers. At least for now the gap between Netflix and its peers looks to be stark and probably widening further. I expect Netflix’s first-mover advantage and growth of advertising to allow it to continue outperforming.

Best-of-Breed Earnings

Netflix reported Q3 earnings after the bell on Thursday and the market reaction on Friday was overwhelmingly bullish, with shares jumping over 11%. The results had many highlights as EPS beat analyst forecasts and grew 45% year-on-year and 15% sequentially. Revenue of $9.8B was up 15% from the prior year. Operating margins expanding by a whopping 800 basis points to 30% in the quarter, highlighting Netflix’s ability to grow the top line while also flexing up margins.

Streaming subscribers grew by 5 million in the quarter and now sits at 282 million. Starting in 2025 Netflix will stop reporting subs numbers as management encourage analysts to shift their attention from subs growth to business profitability.

Following this good set of numbers management raised expectations for the full year 2024, they now expect to hit the high end of their 14-15% revenue guidance and deliver an operating margin of 27% rather than the previously guided 26%. Given the tendency to guide conservatively to allow for earnings beats I think it’s reasonable to expect top line growth will be at least 16-17% for the full year, a very healthy number for a scaled streaming service like Netflix.

Wall Street analysts were effusive in their praise of the earnings release with multiple firms noting they were impressed with the execution despite a relatively modest slate of new content. Analysts at Jefferies believe Q4 will be a boomer as they are calling for over 10 million subscriber additional, buoyed by an attract content line-up including the much anticipated Squid Game 2 and the airing of NFL games on Christmas Day.

Morgan Stanley noted the following

“Netflix is poised to remain the largest and fastest-growing streaming service in the world as it heads into 2025. Its ability to grow earnings 20–30% annually over time stems from layering on additional growth levers—paid sharing, ads, live, games—while increasing its return on content spend” (Morgan Stanley)

Advertising Marches On

As I wrote previously when assessing Netflix, I believe that advertising will be an important driver of profits into the future. Prior to advertising, Netflix’s sole source of revenue was member subscriptions. As the firm grew subscribers rapidly through the years it was able to naturally grow its revenue at a substantial pace. However, now as the firm approaches 300 million subscribers the ability to continue growing at such a clip is no longer possible.

Hence shifting the strategy to include advertising makes sense to diversify revenue streams. Additionally having an ad-supported tier allows Netflix to offer lower monthly subscription fees which serves as a lower priced entry point for potential new subs and as a trade down price for budget conscious consumers who might otherwise cancel their service.

Q3 displayed clear progress towards a future where advertising is a key monetization driver for the firm. Advertising is still a relatively new feature for the streamer which historically generated revenue solely from member subscription fees. However as the firm matures, it makes sense for management to go after the vast global advertising market, especially in light of the generational shift of advertising from linear TV to streaming and other digital platforms.

In the earnings press release Netflix noted:

“Our ads plan allows us to offer a lower price point for consumers, which is proving to be popular: In Q3, it accounted for over 50% of sign-ups in our ads countries and membership on our ads plan grew 35% quarter over quarter. We’re on track to reach what we believe to be critical ad subscriber scale for advertisers in all of our ads countries in 2025, creating a strong base from which we can further increase our ad membership in 2026 and beyond” (Netflix Q3 Earnings)

In May of this year Netflix announced it would expand the buying capabilities for advertising to include The Trade Desk (TTD). Analysts at UBS believe that advertising revenue is set to double in 2025, given its low starting base it won’t be a main revenue driver for the whole company in 2025. However, I believe that continued growth of the platform coupled with improved technology provided via the Trade Desk partnership sets advertising up to be a robust growth engine for the future.

Valuation

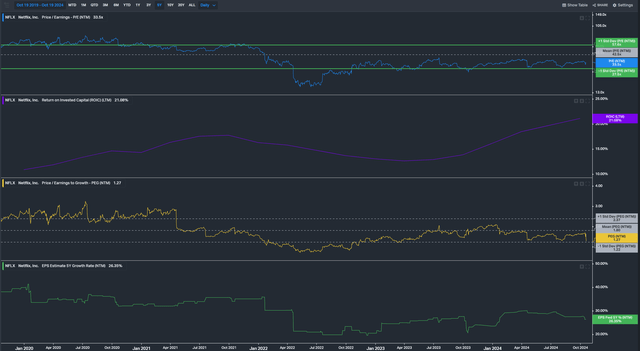

Taking a snapshot of Netflix’s current valuation, I believe the stock does not look unreasonable for its given quality. The firm is generating a ROIC of 21% which is the envy of other entertainment and media players. For context, Comcast generates about 10% and Disney less than 7%. Netflix remains attractive on a PEG basis as the relatively high forward P/E ratio I believe is justified by the medium-term expected EPS growth and the industry leading ROIC is indicative of a superior business worth paying a high multiple for.

Risks

The risks for Netflix remain as they were, investors ought to be aware that streaming is becoming a more competitive industry. Netflix won’t have it all its own way anymore but I believe it is clearly the best operator in the industry and it can deal with increased competition. As the streaming industry pivots to an advertising model Netflix will clearly be the destination of choice for advertisers given it has the higher subscriber count and the broadest geographic reach.

Conclusion

Last week’s Q3 earnings numbers for Netflix have only served to increase my existing confidence in the stock. The numbers were a clear home run as evidenced by the price reaction and the unanimous praise from street analysts. I am reiterating my BUY rating on the stock as with advertising revenue set to double in 2025, the future looks bright for Netflix.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.