Summary:

- Netflix’s subscriber growth rebounded in Q3’22.

- The subscriber outlook for Q4’22 is also strong.

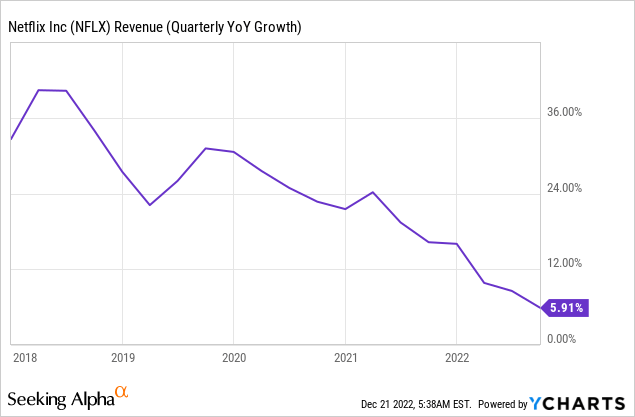

- However, overall growth is slowing, especially in countries with high average revenue per membership.

Wachiwit

Netflix (NASDAQ:NFLX) reported strong subscriber gains in the third-quarter and the outlook for the fourth-quarter is also upbeat. However, the streaming platform is seeing moderating growth overall, indicating that increasing competition from other streaming offers is making it harder to translate subscriber growth into revenue growth. Additionally, Netflix continues to predominantly grow in markets that have lower subscriber values than the US and Canada, like the Asia-Pacific market. Given that Netflix is still valued highly, the stock remains vulnerable and the risk profile remains skewed to the down-side!

Rebound in subscriber growth, but the top line remains challenged

Netflix added 2.41M subscribers in the third-quarter of FY 2022 and with that the streaming company reversed its negative subscriber trend which caused Netflix to lose 1.17M subscribers in the first six months of the year. Reported subscriber numbers beat Netflix’s own prediction of 1M new subscribers in Q3’22 by a significant margin as well. Subscriber growth rebounded chiefly due to streaming hits such as Stranger Things Season 4 (which had the best season ever for Netflix with 1.35B hours viewed), The Jeffrey Dahmer Story, or The Gray Man.

Netflix’s total net gain in subscribers in the first nine months of FY 2022 was 1.25M and the streaming firm also issued a positive outlook for the fourth-quarter… results of which are going to be presented on January 19, 2023.

Netflix’s projects 4.5M global subscriber net adds in Q4’22 which would represent the second straight quarter of positive subscriber growth rates after two consecutive declines in Q1’22 and Q2’22. The fourth-quarter is typically a good quarter for streaming companies and Netflix’s subscriber growth tends to level off in the following quarters which is what I also expect for the first half of FY 2023.

But even considering the strong forecast for Q4’22, Netflix’s growth is slowing dramatically. The total subscriber count at the end of the September-quarter was 223.09M, showing just 4.5% year over year growth and the forecast for Q4’22, despite a projected global net addition of 4.5M subscribers, reflects only 2.6% year over year growth in Netflix’s subscriber base.

On top of that, Netflix’s expected total subscriber growth conceals that Netflix is not growing nearly as strongly in the US and Canada which are, from a monetization perspective, the most lucrative markets for streaming platforms. While Netflix’s ARPU has trended up in the US/Canada market, I think the company’s fundamental revenue growth problem has not yet been addressed.

In the important US/Canada market, the streaming company added just 100 thousand subscribers in Q3’22… which calculates to just about 4% of Netflix’s global net add. On the other hand, of the 2.41M new global subscribers added to Netflix in Q3’22, 59% came from the Asia-Pacific region which is the fastest-growing market for Netflix.

The problem, however, is that a subscriber in Asia-Pacific is worth 49% less than a subscriber in the US/Canada market as measured by the region’s average revenues per membership/ARM ($16.37 per-membership in the US/Canada compared to $8.34 per-membership in APAC). In other words, Netflix continues to grow predominantly in low-ARM regions such as Latin America and Asia-Pacific while subscriber growth in mature streaming markets is much harder to come by.

|

in millions |

Q3’21 |

Q4’21 |

Q1’22 |

Q2’22 |

Q3’22 |

|

UCAN |

|||||

|

Paid Memberships |

74.02 |

75.22 |

74.58 |

73.28 |

73.39 |

|

Paid Net Additions |

0.07 |

1.19 |

-0.64 |

-1.30 |

0.1 |

|

Average Revenue Per Membership ($) |

$14.68 |

$14.78 |

$14.91 |

$15.95 |

$16.37 |

|

EMEA |

|||||

|

Paid Memberships |

70.50 |

74.04 |

73.73 |

72.97 |

73.53 |

|

Paid Net Additions |

1.80 |

3.54 |

-0.30 |

-0.77 |

0.57 |

|

Average Revenue Per Membership ($) |

$11.65 |

$11.64 |

$11.56 |

$11.17 |

$10.81 |

|

LATAM |

|||||

|

Paid Memberships |

38.99 |

39.96 |

39.61 |

39.62 |

39.94 |

|

Paid Net Additions |

0.33 |

0.97 |

-0.35 |

0.01 |

0.31 |

|

Average Revenue Per Membership ($) |

$7.86 |

$8.14 |

$8.37 |

$8.67 |

$8.58 |

|

APAC |

|||||

|

Paid Memberships |

30.05 |

32.63 |

33.72 |

34.80 |

36.23 |

|

Paid Net Additions |

2.18 |

2.58 |

1.09 |

1.08 |

1.43 |

|

Average Revenue Per Membership ($) |

$9.60 |

$9.26 |

$9.21 |

$8.83 |

$8.34 |

(Source: Author)

As a result, Netflix’s revenue growth is slowing and the company expects to generate just 0.9% year over year top line growth in Q4’22, despite adding millions of new subscribers. In part, Netflix’s revenue headwinds are affected by a stronger USD, but the longer term revenue trend clearly points in the wrong direction.

New ad-supported tier: risk of cannibalization

Netflix has recently introduced an ad-supported tier which costs subscribers $6.99 per month and is therefore $3 cheaper than the basic plan. The risk with the ad-supported tier is that subscribers down-grade from more expensive plans to the ad-supported plan to lower their overall subscription costs. While it is still too early to judge how many subscribers are going to take up this option, there is a risk that Netflix cannibalizes its own subscriber base… which could make Netflix’s revenue growth problems worse. According to a Wall Street Journal report, 43% of people that signed up to the ad-supported plan in November had pricier subscriptions before, so there is clearly a cannibalization effect taking place. In the long term, this could make Netflix’s revenue growth problem worse, not better.

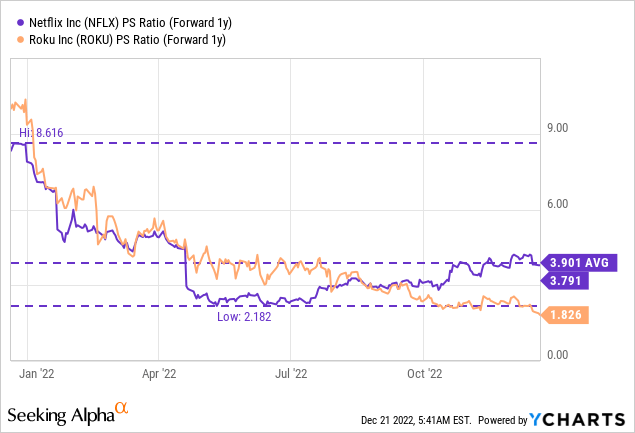

Netflix’s valuation is still high

Given the uncertainty about Netflix’s subscriber growth trajectory and the long term impact of the introduction of an ad-supported tier, especially in the US/Canada market, I believe Netflix’s shares are still valued too highly. The streaming firm’s stock is currently trading at a P/S ratio of 3.8 X, but shares are still significantly more expensive than Roku’s (ROKU), for example. Despite Netflix trading significantly below its 1-year P/E high of 8.6 X, I believe the risk profile is not yet attractive enough to buy shares of the streaming company.

Risks with Netflix

Subscriber growth rates are highly unpredictable and the company has seen everything this year from losing 1M subscribers a quarter to gaining more than 2M subscribers a quarter. The general trend, however, is those of moderating top line growth.

Going forward, Netflix faces two big challenges: (1) The streaming company needs to translate subscriber growth to revenue growth and if it fails to do so, investors are likely going to punish the stock, and (2) Netflix needs to grow more strongly in markets that have higher subscriber value, like the US/Canada and European markets. Since the majority of Netflix’s subscriber growth occurs in markets with weaker subscriber monetization, the streaming company faces long term profitability challenges as well.

Final thoughts

Netflix saw a strong rebound in subscriber net adds in the third-quarter and the outlook for the fourth-quarter — which is typically a strong quarter for streaming platforms — is solid. However, Netflix continues to struggle achieving growth in the US/Canada region which is the most important market for Netflix from a monetization perspective. For this reason, I expect Netflix to see a continuation of its moderating revenue trend in FY 2023 as well. Considering that Netflix’s valuation is still pretty high and that growth rates are no longer as attractive as they were during the pandemic, Netflix’s risk profile remains skewed to the down-side!

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.