Summary:

- Netflix delivered a phenomenal quarterly earnings call, which gave analysts, investors, and insiders hope in the company.

- The stock responded positively by +8% in the following session. We provide an update to our thesis upon reviewing all the data points from the sell-side and management numbers.

- We recommend the stock to our readers, as we initiate the stock at buy and offer a price target that’s 40% higher at $486 per share.

- We anticipate that revenue will return to high-single digits growth in FY’23 and mid-teen revenue growth in FY’24 due to advertising contribution.

- Video gaming could be a hidden call option that adds material upside and could change the cadence of news towards added M&A activity, diminishing some headline negativity.

JHVEPhoto

Has Netflix (NASDAQ:NFLX) gone into secular decline? Perhaps not, as the company was able to reassure many investors and analysts of the potential growth runway inclusive of ad-supported content. We think investors are underestimating the value premium for “best in breed” companies even in streaming.

While many critics of NFLX cite competitive threats taking market share as a persistent risk factor. We think NFLX trades at a premium because it’s still the market leader in streaming, and is the only company generating profits from streaming currently. Management commentary tied to revenue growth, and potential for some acceleration in revenue made investors excited about the stock, whereas analysts found the contribution from ad-supported tier in the form of paid subscriber additions reassuring on the quarterly earnings call.

We value NFLX on the basis of FY ’24 estimated $14.30 GAAP EPS and apply a 34x forward earnings multiple to arrive at a $486 price target, which implies greater than 40%+ upside from current price levels and offers some of the best risk/reward for growth minded large cap investors.

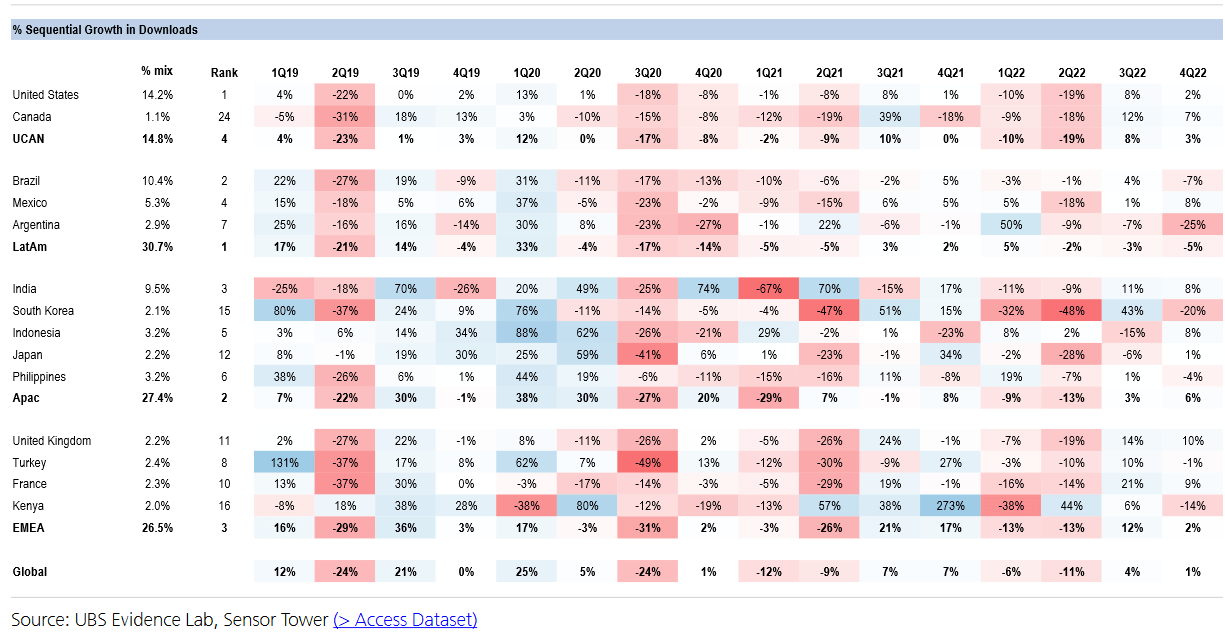

Figure 1. NFLX App Downloads – Sequential Growth

UBS (UBS Estimates)

Netflix saw some momentum, and some much needed relief in terms of sequential comps as illustrated in the UBS Q4 ’22 figures, the amount of red this quarter has diminished quite significantly, so the inflection in app downloads paired with better than expected subscriber additions were what drove the stock price following the earnings report.

The ad-supported subscription tier, paired with the modest recovery in subscribers/downloads drove the stock price this quarter. The $6.99 price tier appeals to price sensitive customers, and surprisingly it’s looking like it will have a net positive contribution on revenue/margins based on internal analysis done by various investment banks.

The job promotions were much needed

We also believe it was long overdue for Reed Hastings to transition the day-to-day management to Ted Sarandos as CO-CEOs along with Greg Peters. Though, we view Ted Sarandos being primarily the CEO, as Greg Peters was the CFO for much of the company’s history prior to the dual promotion. Basically, the two complement each other extremely well, and labeling Greg just the numbers guy doesn’t make a whole lot of sense because he provides a lot more managerial value following Spence Neumann’s promotion to CFO.

Greg Peters has made very solid contributions from our years of following and trading the company stock. At least, when turning profitable, and taking some of the heat as a co-captain of streaming, he’s done much more than what a conventional CFO is expected of. Furthermore, the introduction of new revenue generating opportunities will likely come from Greg Peters, so perhaps a new video gaming division, or game development studio and efforts to diversify NFLX’s revenue sources would be the top level priority for both Greg Peters and Reed Hastings.

However, Ted Sarandos has managed to make content budgets work, even the really lousy ones that Greg managed to slap together into the company’s quarterly P&L. In other words, we think Ted’s situation may have improved with this promotion as he might have more authority to work on certain film projects and spend liberally. We think without Netflix Originals and Ted’s foresight into content spend and investment, NFLX wouldn’t be a viable company currently.

We view Ted Sarandos ascension to the top of NFLX being instrumental to returning films and movies back to a golden age of production. NFLX’s primary goal over the past 10-years was to reach the global subscriber scale. And for the most part, the company has accomplished such a lofty goal with 230M subscribers. Upon having reached scale, we think it’s time for NFLX to invest more resources into developing an actual golden age of film, as opposed to making short-term business moves to make profits.

With the stock already down so significantly they might as well invest more resources into better originals and spend added time on storyboard, character development, special effects, and so forth. We can expect much more from NFLX, as consumers and subscribers, because the company’s actually valuable and has a lot more resources. Over the past decade we could argue that if NFLX didn’t have the best shows, or the best content, it was because they were more resource constrained.

However, we find the recent flatness in content spend inexcusable, and it’s why the perception of the stock is sinking among growth minded investors such as ourselves. When looking at the amortization of content spending over the past two fiscal years, the company reported $32.7 billion content assets in FY’22 versus $30.9 billion in FY’21 representing only a 5.8% increase in total content assets, which implies content spend was either flat or negative.

We think catering to investors who are addicted to profits has put NFLX in an unenviable position, as the company needs to bridge the gap in IP (intellectual property) when it pertains to content, as it’s very difficult to build a large enough portfolio in short time and produce enough volume for a non-linear audience.

NFLX’s ($152 billion) value shrunk tremendously to a point where NFLX is second to Walt Disney’s (DIS) $188 billion market cap at present while retaining a much larger subscriber base, and further into the cord-cutting transition than any other media company. We view NFLX’s value proposition to investors being driven by its subscriber base whereas Walt-Disney’s value proposition is driven by three pillars: depth of content library, resorts and theme parks, and Disney+ streaming.

Netflix trades at cheapest P/E multiple among the three major streaming studios

Ted Sarandos role as Co-CEO is to turn around the film division and to increase the competitiveness of NFLX to Walt Disney and Warner Bros. Discovery (WBD) in terms of IP and content. Basically, NFLX has to build a library, and a library of hits that can rival both the DC and Marvel universe, which is why we think a combination of content spending, and added effort, attention, and detail is needed by Ted Sarandos to rival his two largest competitors in streaming and production. We think the other studios have the talent and a wall of really valuable IP that gives them a valuation premium, or the hyper-multiples that retail investors often criticize.

But, with NFLX trading at 32x earnings, and DIS trading at 59x earnings, and WBD trading at a negative earnings multiple, valuations are sky high in the segment. It’s why we think arguing over valuation is almost irrelevant, as investors have biases. From what we’ve seen, the biases in investing into media companies almost border the mania of sports fans on DraftKings or FanDuel.

Basically, the SA boards on all three companies have truly a committed and loyal investor base that mirrors each other and seem to combat each other at every other opportunity. This is why we opt to say constructive things about all of our media coverage as opposed to diving into the deep-end of who’s better, i.e. bait spiraling the quality of discussion lower.

Rather, we think valuations are justifiably high. There will be multiple winners in the same exact segment, and the entire segment will continue to trade at a premium, because love for film eventually leads to continued investment into film, and with so few tech IPOs from last year, we think investors will double down on the existing media stocks they own.

Building new businesses at a late stage growth company?

We think Greg Peters’ number one goal and role in the CEO position is finding a new business to build or create on top of the advertising business Greg is building in-house. Should Netflix get into the theme park and resort business, or should it launch a more conventional video game publishing studio that makes AAA video game titles for next-generation consoles? We think Netflix could build a very powerful video game studio that leverages some of the next-generation GPU technologies packed into NVDA and AMD GPUs plus virtual reality ready with Meta’s (META) VR push with Oculus.

Netflix’s next major business is video game publishing, as the industry has consolidated to a point where there are fewer independent studios than ever before with both Bethesda Entertainment and Activision Blizzard (ATVI) getting absorbed by Microsoft Game Studios in the past couple years. We think NFLX’s entrance into an adjacency such as game software, and the possibility of acquisitions could scale NFLX away from being just a film, subscription based model and offers the potential for creating a separate video game service like Origin, Steam, PlayStation Store, Xbox Game Pass or Battle.net.

However, Netflix would need to make much larger acquisitions to make meaningful progress, and also hire, develop, and scale various video gaming divisions during a time when tech layoffs spiral like crazy. Basically, if NFLX wanted to start poaching video game developer talent – now would be the time to be digging through all the resume piles from the recent shuttered divisions at Microsoft (MSFT), Alphabet (GOOG) (GOOGL), Facebook, Amazon (AMZN) and so forth. There’s bound to be useful people in video game development on the short-end of an employment contract that could use a second, third or fourth career opportunity at Netflix.

Could Netflix acquire major game studios or does development need to happen organically?

Reed’s backseat role as Chairman of the Board sets up NFLX to be in acquisition mode primarily tied to video gaming IP. We hope NFLX is able to close a much larger transaction with a major game studio valued at $10 billion or more. Large cap game developers with an existing portfolio would get NFLX on the right path to scaling to a meaningful revenue/growth opportunity in the space. In order for NFLX to enter an M&A deal, we think the company has to look internationally to some of the larger studios that aren’t based in the United States. Paradox, Square Enix Entertainment, Ubisoft, Konami, and Nexon among many others are valued at sub $20 billion and could be major targets for NFLX.

This will diminish execution risk due to the unpredictability of title launch success and give NFLX a needed foothold on a new market opportunity to keep some pressure away from Ted’s subscription business, and help drive expectations toward new revenue opportunities, which is customary for a more mature tech/growth story to eventually transition into multiple product lines. NFLX has shown to be remarkably consistent at maintaining a singular product for the past 25-years with only one major corporate transition (delivering DVDs turns into streaming business).

The third major transition for NFLX is video gaming, game software, and mobile gaming. The streamer spent $16.84 billion on content in FY’22, whether it be internally developed originals, or licensed movies and shows. We think NFLX can scale a video game publisher’s budget quicker than analysts or speculators in the stock might anticipate, as most AAA game titles cost $80M on average to develop over the course of a 3-4 year development window absent marketing/distribution cost according to Rocket Brush.

Assuming NFLX’s content budget expands in FY’23 and FY’24, and they spent an incremental $1.5B – $2B on content spend in FY’23 and had to amortize the development cost of 30 AAA title games it would cost appx. $600 million per year, or $2.4 billion to develop a slate of 30 video games, which would likely be a combination of PC, console, and mobile gaming titles.

Perhaps $2.4 billion sounds way too optimistic, which is why the cost could be as high as $300 million per game title spread over 4 years, which would translate into the higher-end of the development range at $9 billion in video game specific content spending from FY’23 – FY’27.

Even if NFLX started work aggressively on a number of game titles, it’s not until FY’27 until we see a high quality AAA video game, much like investing into biotech – video games operate on a similar time scale, but rather than being threatened by governmental approval agencies, the likelihood of a game developer reaching completion of a project has much to do with whether they run out of money, and if the consumer actually wants the game after the end of a lengthy development cycle.

Value of the ad-supported business

According to the CFO, Spence Neumann on Q4’22 earnings:

So we’re over $30 billion of revenue, almost $32 billion of revenue. in 2022. And we wouldn’t get into a business like this if we didn’t believe it could be bigger than at least 10% of our revenue and hopefully much more over time in that mix as we grow.

Spence mentioned on the earnings call that there’s room to grow the ad-supported business to more than 10% of total revenue. It was worth noting that the impact on average selling prices was felt, but the addition of subscribers from the recent move helped push the stock +8% in the following Friday trading session.

Alicia Reese analyst from Wedbush Securities:

Of the survey respondents who said they are current Netflix subscribers, 20% stated that they “stayed with” the ad-supported tier while another 9% qualified as having switched to the ad-tier from the premium-tier. Including the respondents that stated they switched but didn’t change their ad-viewing, a total of 27% of current Netflix users are currently on the ad-tier according to our January survey.

Based on Alicia’s research, NFLX has managed to transition 27% of users onto the ad-tier, which is why we think there’s a meaningful runway to ad-themed revenue, as you need to have an abundant audience in order to market eyeballs to third-party advertisers.

With digital ads representing a massive opportunity, NFLX doesn’t have to sell the opportunity aggressively to arrive at greater than 10%+ revenue contribution.

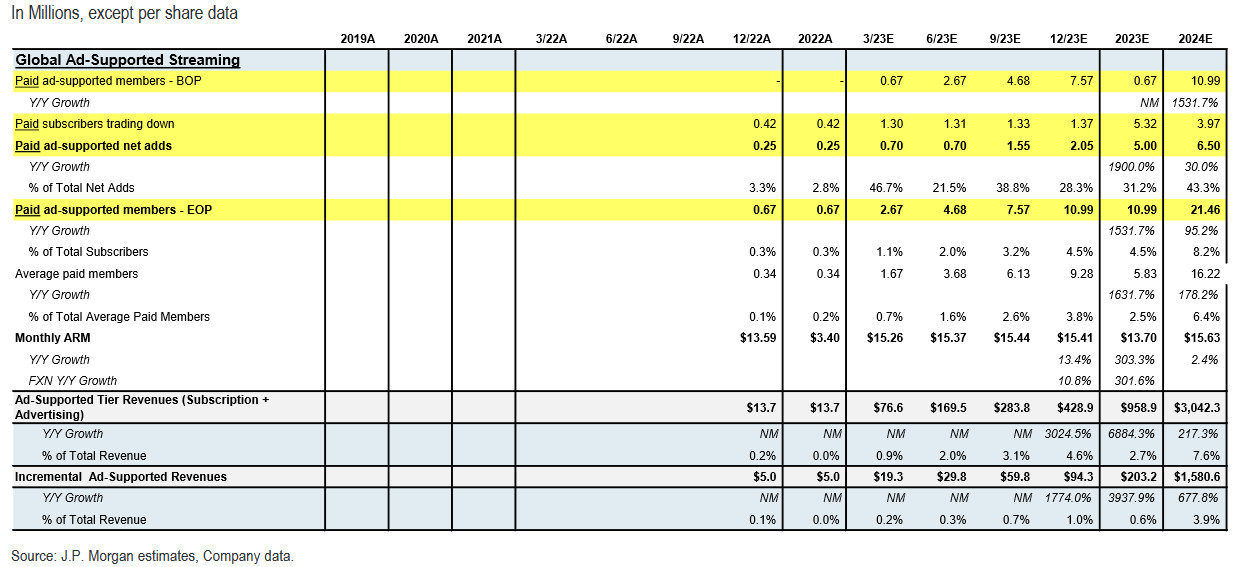

Figure 2. JPMorgan Estimate on Ad-Revenue for FY’23 and FY’24

J.P. Morgan (J.P. Morgan)

Doug Anmuth at J.P. Morgan mentions in his most recent NFLX sell side report that NFLX could in fact generate $3.04B in FY ‘23. This is assuming the environment holds up, and there’s still demand in various emerging markets for the entry-tier pricing level, which is likely what’s signaling to the rest of the consensus and the buy-side that there’s an opportunity to pick-up more subscribers on lower pricing, so the ad-supported tier could drive much of the subscriber contribution needed to keep the stock price at elevated levels.

Keep in mind, survey data implies that users have shifted more aggressively to the ad-supported tier perhaps 50M – 60M subscribers versus the 2024 J.P. Morgan estimate of 21.46M ad-supported members, meaning that if survey data from Wedbush is accurate and mix remains constant we’re in for a substantial surprise on the $1.5 billion incremental ad-supported revenue figure, which means that greater than 5%-10% revenue contribution assuming they build out a suite of tools and services for advertisers to bid on open auctions for strictly NFLX ads placement.

NFLX has to develop an advertising console, and provide the necessary tools to make ad-bidding intuitive for more conventional marketers. Amazon (AMZN) had to develop a back-end ad-suite for its e-commerce platform as well, and so there’s definitely the resources and capability to do this. We feel confident in NFLX’s ability to deliver surprises on revenue due to the introduction of lower priced-offerings, which goes counter to the usual price increase trend that has made subscribers cancel in recent years.

How do we value the business and what’s our upside target?

While subscriber growth has been lumpy, and even loss of subscribers has generated some panic among investors at the beginning of 2022. We’ve seen news cycles send the stock spiraling lower, and lower before the stock recovers on the realization that subscriber growth will continue… and likely continues for much longer.

We anticipate a massive advertising opportunity is forming in front of the world’s largest TV viewing audience, and NFLX’s commercials could become the next Superbowl ad for brands who need instant exposure at global scale.

As such, we think the model works with ad-supported content, and if they’re able to increase the value proposition of streaming products and return back to a golden age of film and production we’d have an ever-ending binge worthy catalog of content to keep investors, and global audiences wedded to their phones and screens.

As such, a simplified summary of our financial model follows: we anticipate NFLX revenue growth of 8% and 15% in FY’23 and FY’24, respectively. With the teen growth rates coming primarily from the build-out of ad-supported revenue, accompanying infrastructure expense (which is reflected in the R&D spend), and the need for a mature self-serve ad platform. Upon reaching advertising scale, we think margins will increase (not decrease) as gross margins on digital advertising tends to hover at 70%-80% in the internet space, maybe more assuming there’s no direct traffic acquisition cost. So, the inclusion of advertising could have a positive impact on profitability over time.

As such, we estimate FY’23 revenue of $34.14 billion, and FY ’24 revenue of $39.2 billion. We then apply a 14% net profit margin for FY ’23, and 15.5% net profit margin for FY ’24 to arrive at a GAAP net income estimate of $4.78 billion for FY ’23, and $6.08 billion for FY ’24. We estimate 450M share outstanding for FY ’23, and 420M share outstanding for FY ’24 to arrive at an $10.62 GAAP EPS figure FY ’23, and $14.30 GAAP EPS figure FY ’24.

We value NFLX at 34x FY’24 earnings, meaning we arrive at a market valuation of $207B, and a price target of $486 or +41% upside from current levels. We anticipate the stock to rally considerably from current levels given the positive fundamentals, and the inclusion of incremental revenue opportunities on some cost synergies and expansion into video gaming and self-serve ad platform build out. The added R&D may offset operating margin expansion, but we think it’s justifiable as investing into advertising tools can be costly.

We believe NFLX makes a strong fundamental case for bulls

Our view on NFLX seems somewhat differentiated from others who publish frequently on Seeking Alpha or the conventional news media. It has become very popular to bash the streaming app, whether it’s a video blogger ranting about the quality of shows, or the neighboring news website writing a vicious slam piece on NFLX.

It’s likely that news sentiment doesn’t do much to help the stock in the near-term and our efforts to clarify a positive stance on the company based on fundamentals will largely go ignored by the mainstream talking heads.

Even so, we like the underlying business fundamentals, as we think efforts to reduce pricing have gone over much better. Some prefer watching television with advertising whereas others would prefer to pay a bit more for a higher quality 4K stream. We understand how investors might have been disappointed with subscriber figures, but with a lower-priced offering we think subscriber growth returns to NFLX.

We also anticipate that the inclusion of video gaming creates a tantalizing call option that’s not even factored into consensus models. We think game software will put NFLX on a path to becoming a $500B+ company by 2027 based on our internal forecasts for both subscribers revenue, and the prospective value of TV subscriptions.

As such, we recommend NFLX as a buy to our readers, and find it the most attractive mega cap stock in our coverage thus far.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.