Summary:

- Netflix, Inc. reported strong Q1 earnings, but the stock price reacted negatively.

- Netflix stock price did not surpass the previous peak levels. This could attract the attention of the technical investors (and not in a positive way).

- Earnings may have used overly optimistic assumptions, which are allowed by GAAP.

- Future growth is unlikely to match the expectations strongly implied by the price-earnings ratio of the stock price.

- Revenue, cash flow, and free cash flow did not match earnings progress. That is a key warning sign to investors.

Marvin Samuel Tolentino Pineda

Netflix, Inc. (NASDAQ:NFLX) reported probably the best earnings in the company’s history for the first quarter. Yet, the stock price could hardly have reacted in a worse way. Exactly what caused this?

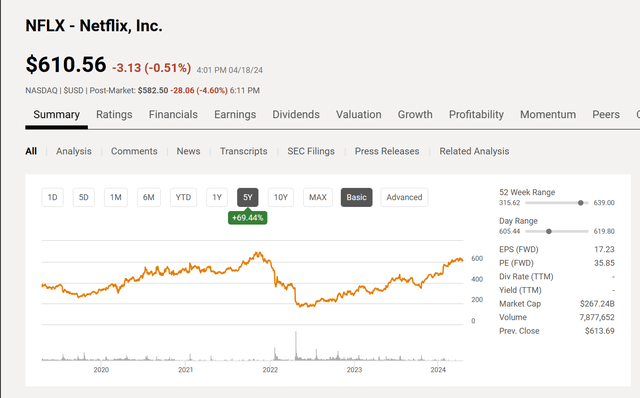

Netflix Common Stock Price History And Key Valuation Measures (Seeking Alpha Website April 18, 2024)

As shown above, ever since the huge price drop in fiscal year 2022 over some earnings disappointments, this stock has clearly been “on a tear” to higher levels. However, the latest action, if sustained, means that the stock price is not going to surpass the previous peak levels shown before the big price drop. That is going to get the attention of the technical crowd (and not positively, either).

It is definitely not the “end of the world,” as the company is profitable and did report some cash flow. However, the requirements for that rather generous price earnings ratio were really not met, and there were signs that the earnings reported may have used allowed — but in my view overly optimistic — assumptions.

“High flying” stocks often have very strict earnings requirements by the market. When those requirements are not met, then the stock responds as if the earnings were disappointing. In this case, that stock price drop after hours may well indicate that the future is not what that price-earnings ratio would seem to indicate.

Earnings

Just about any financial textbook on stocks would tell you that the proper growth rate for a stock with a price earnings ratio in the thirties is for the company to grow in the thirties. Yet, management guidance for revenue (for starters) is anything but that in the latest quarterly report. Also, cash flow growth did not come close to matching the earnings growth.

The Background

David Dreman, in any of his books from the “Contrarian Investing” series, further describes this issue. Louis Ruykeyser, in his book “How To Make Money In Wall Street” (among his several books), took the opposite approach. Mr. Ruykeyser stated that it is also possible to make money in high price-earnings ratio stocks because some stocks are “never” cheap. Therefore, the contrarian investing covered by David Dreman does not account for all profit opportunities in the market.

That is a fair enough assessment. However, as companies get larger, they find it harder to grow at a rate that justifies a price-earnings ratio in the thirties. Netflix is now very large by any measure. It may be time for that price-earnings ratio to finally adjust to the reality of at what rate Netflix can still grow. But that growth will not be as fast as the current price-earnings ratio indicates.

Long term, an adequate valuation is for the price-earnings ratio to equal the growth rate of the revenue because, eventually, earnings can only grow as fast as revenue. Companies cannot increase profit margins “forever.” So many times the market looks at margin increases as one-time events unless those margin increases will go on for some years for a verifiable reason the market accepts.

Summary Of Results

All of the above may well explain the market’s reaction to the Netflix Q1 earnings.

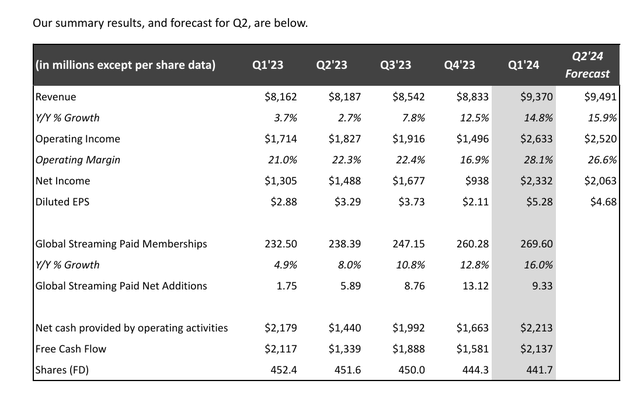

Netflix First Quarter 2023, Results Summary (Netflix First Quarter 2023, Earnings Press Release)

The per-share earnings nearly doubled from the previous fiscal year. The problem is that the revenue, the cash flow, and the free cash flow all failed to confirm that progress.

A report like that tends to point towards some allowed but aggressive management decisions that maximize the earnings reported. Oftentimes, the cash flow statement is a much better indication of the progress the company is making. In this case, the cash flow barely advanced from the first quarter of fiscal year 2023. This could indicate that expenses in developing programming are again exceeding long-term management expectations.

Confirmation of this is on the cash flow statement, where the investment in new programming virtually equals the amortization of programming. Such a situation calls into question the value of the programming assets shown on the balance sheet, because it may well mean without new programming the programming assets listed may well not have either the value on the balance sheet or any value.

Content assets listed on the balance sheet have a value of roughly $30 billion. Based upon the latest free cash flow, it would take about 4 years to recover that value from free cash flow. That appears to be too long given the size of the investment in new programming.

This was a company that went public on the promise of generating a lot of cash flow. But for the market value of the stock, the free cash flow yield is extremely low. More importantly, the free cash flow only recently became positive. The management reports show free cash flow negative as recently as quarters in fiscal year 2021. This was not the expectation when the company originally went public.

Streaming Market Share

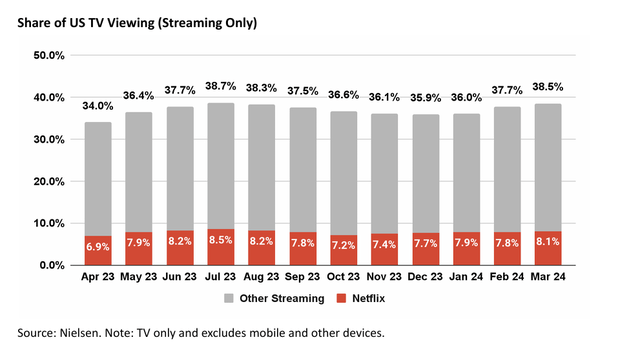

The company by no means dominates the streaming market, as shown below:

Netflix Share Of Streaming Market As Determined By Nielsen (Netflix First Quarter 2023, Earnings Press Release)

Furthermore, the company has no franchises like a Disney (DIS) or a Warner Bros. Discovery (WBD) that help to insure the success of programming investments. This company is, therefore, dependent upon making one hit after another “from scratch.” In that respect, the market attitude is likely “so far, so good.” However, a company like this without franchises is in a risky position.

Furthermore, Disney and Warner Bros Discovery are integrated so that they can earn income from other sources should there be an occasional bomb. Netflix, on the other hand, has been trying to catch up in this respect by making acquisitions periodically. But for many companies (not including Netflix) that reduces free cash flow further. This is yet another way in which the company aggressively (again, it is allowed by GAAP) reports another key measure.

Valuation

Probably the conservative way to value the growth here is using management guidance for revenue growth. However, if cash flow does not follow revenue growth as was the case in the current quarter, then that stance could be revalued to cash flow yield and cash flow growth. The cash flow situation has long not met the original goals of management when the company went public.

This definitely needs to be considered a maturing company that is likely too large to grow at the speed of “yesterday” anymore. Eventually, this realization hits any growth company because growth cannot continue forever.

Therefore, management guided to roughly 13% revenue growth for the fiscal year. To me, that means at best the price-earnings ratio should in the long run reduce to 13. If cash flow continues essentially flat, as management noted in the management letter for the current quarterly comparison, then that price earnings ratio could easily be reduced to six.

Summary

This whole situation implies a Netflix, Inc. stock price that is way overvalued for the future. Experienced traders who know how to handle a volatile stock like this one may well consider trading the stock. However, as a growth stock, the price is far too high now for a buy and hold investor. For such an investor, the stock is now probably a sell. It would be time for that investor to find another growth story.

Also note that debt approaches about twice the free cash flow. In many areas of the market, that debt ratio is on the high side. This is yet another reason that investors should think at least twice before investing in this stock.

The last consideration is that growth stories do not last forever. Whatever growth happens in the future is unlikely to match the growth numbers obtained when subscribers numbers and revenue were much lower.

All companies have a limit to how large they can grow. That limit varies with the ability of management. Therefore, the investor needs to decide for themselves how much longer this company can grow at all, as it is already large.

When “the party is over” is always difficult to determine. But clearly this particular party has gone on “late into the night.” Trying to time an exit is dangerous. It is often best for investors to take profits “out of the middle” rather than waiting until the end. That makes this one a strong Sell — and do not look back, either.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of WBD DIS either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Disclaimer: I am not an investment advisor, and this article is not meant to be a recommendation of the purchase or sale of stock. Investors are advised to do their own research that includes the review all company documents, and press releases to see if the company fits their own investment qualifications.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Long Player believes oil and gas is a boom-bust, cyclical industry. It takes patience, and it certainly helps to have experience. He has been focusing on this industry for years. He is a retired CPA, and holds an MBA and MA. He leads the investing group Oil & Gas Value Research. He looks for under-followed oil companies and out-of-favor midstream companies that offer compelling opportunities. The group includes an active chat room in which Oil & Gas investors discuss recent information and share ideas. Learn more.