Summary:

- Netflix’s recent earnings beat expectations, but guidance emphasizes investing for growth, requiring investor patience for profitability improvements.

- Despite intense competition, Netflix’s stable subscriber base, diverse content, and strategic pricing plans project strong future growth.

- Netflix’s valuation at 25x next year’s operating profits is sensible, given its proven ability to navigate competitive pressures and monetize effectively.

- With mid-teen revenue growth rates and strategic investments, Netflix offers a compelling long-term growth opportunity despite a cautious profitability outlook for 2025.

Wachiwit

Investment Thesis

Netflix (NASDAQ:NFLX) delivered investors with a strong Q3 2024 earnings results. Given that expectations were already high, with the stock near its all-time highs, investors needed to be blown away by these results.

And instead, even as Netflix delivered a beat on the top and the bottom line, its guidance was one that put the notion of ”investing for growth” back on the table.

Therefore, investors will have to be patient to see further improvements in profitability.

However, given this set of results, I believe that investors will give Netflix a pass. After all, paying 25x next year’s operating profits is not a rich multiple for Netflix.

In conclusion, there’s a lot to like here.

Rapid Recap

Back in April, I said,

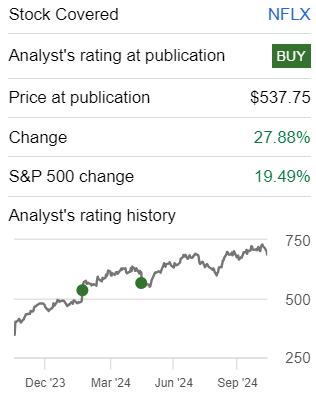

I believe that in the coming few quarters, investors will look back to $581 per share as a cheap price for Netflix.

Author’s work on NFLX

In hindsight, it turns out that Netflix was an ”easy” call. However, allow me to be absolutely clear. Nobody can invest in hindsight. And in fact, Netflix’s stock had plenty of challenging periods since my bullish calls on this name.

Netflix’s Near-Term Prospects

Netflix’s value proposition to users lies in its ability to deliver an engaging, high-quality entertainment.

Obviously, some people make the case that there’s an approach for diversity rather than ”high-quality content”. But the facts are in, and there’s really no other leader in this space.

Netflix’s goal is rather simple. Keep users engaged and to raise the price on their subscription.

For Q3 2024, Netflix saw steady subscriber growth and maintained high engagement levels, averaging around two hours of viewing per member per day in 2024.

With a major content slate and consistent programming, Netflix is projected to reach around 600 million global viewers by 2025. Subscriber growth continues to be driven by both new memberships and strategic pricing plans, including lower-priced, ad-supported tiers.

However, Netflix faces intense competition in the streaming sector. Rivals like Disney+ (DIS), Amazon Prime (AMZN), are competing fiercely for both content and viewers, putting pressure on Netflix’s growth and market share.

Meanwhile, Netflix is fighting back by offerings live events and expanding into gaming, as well as through its ad-supported services.

Given this balanced background, let’s now delve into its fundamentals.

Revenue Growth Rates Set A Positive Tone

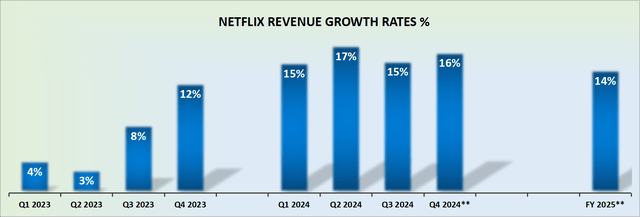

Netflix came out with its 2025 guidance. Investors should expect to see around 13% to 14% y/y revenue growth rates in 2025.

Since analysts following Netflix had expected to see a sub $44 billion in revenues in 2025 and Netflix believes that even before 2024 is wrapped up, that $44 billion could be possible in 2025, this leaves Netflix with substantial room to upwards revise their guidance.

In sum, the outlook here looks positive. After all, keep in mind that Netflix was already priced very close to its all-time highs. Hence, expectations heading into this report were hot.

For Netflix to point towards mid-teens growth after delivering mid-teens revenue growth rates in 2024 is a rather remarkable feat, particularly given that the industry today is so mature and has so many competing offerings.

With this in mind, let’s discuss its valuation.

NFLX Stock Valuation — 25x Next Year’s Operating Profits

As an Inflection investor, I like to buy businesses with a net cash position. That’s my preferred setup, although I can be flexible on occasion. On this front, Netflix scores poorly, with very roughly $7 billion of net debt.

However, given the stability of its business model, with its stable subscriber base, there’s an argument that could be made that Netflix could have even more debt on its book. Something to keep in mind for the bull thesis.

Moving on, Netflix is aiming for approximately $12 billion of operating profits in 2025. This leaves the stock priced at 25x next year’s operating profits. A very sensible valuation that makes sense for fresh capital to back.

Meanwhile, investors’ after-hours reacted in a somewhat muted fashion since Netflix just reported close to 30% operating margins, and for the year ahead there’s a discussion around balancing increased profitability with further investments in the business.

Now, here’s the thing. Generally speaking, investors hate, positively hate, any discussion of investing now, for more profits in the future.

However, certain companies, including Netflix, which have in the past hand full of years gone from being meaningfully unprofitable businesses, towards providing an indication that more than 30% operating margins could be on the cards in the next couple of years, are giving more leeway.

After all, Netflix has clearly proven themselves highly capable of being the leaders in this space, and astutely monetizing their platform.

So while investors would be somewhat put back by the discussion that 2025 won’t be a year for substantially increased profitability, the fact remains that Netflix demonstrated in the past decade that they can successfully invest for growth. And are therefore, given a pass.

Altogether, there’s a lot to like here, particularly considering the mid-teen growth rates, and paying 25x forward operating profits.

The Bottom Line

I find myself optimistic about Netflix’s trajectory.

Despite the cautious tone around profitability growth in 2025, Netflix has repeatedly shown its ability to navigate competitive pressures and emerge stronger. With a proven model, a massive user base, and steady subscriber engagement, I believe the current valuation offers a sensible opportunity for long-term growth.

The company’s blend of strategic investments and profitability should keep investors ”entertained”. Ultimately, it looks like Netflix provides a ”stream” of a great investment opportunity.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Strong Investment Potential

My Marketplace highlights a portfolio of undervalued investment opportunities – stocks with rapid growth potential, driven by top quality management, while these stocks are cheaply valued.

I follow countless companies and select for you the most attractive investments. I do all the work of picking the most attractive stocks.

Investing Made EASY

As an experienced professional, I highlight the best stocks to grow your savings: stocks that deliver strong gains.

-

- Deep Value Returns’ Marketplace continues to rapidly grow.

- Check out members’ reviews.

- High-quality, actionable insightful stock picks.

- The place where value is everything.