Summary:

- The cheaper tariff will help to avoid high churn rates soon – the new strategy allowed the company to restore the growth rate of the number of subscribers.

- Due to a bigger share of “cheap” accounts, ARPU growth rate will slow down, but this will still not affect revenue.

- The company’s spending on content will increase at a slower pace, and its ad expenses will decline in the medium term, which will have a positive impact on profitability.

- Netflix is finally starting to generate, albeit small, steady, and rising cash flow, which will facilitate M&A activity and allow its shareholder compensation policy to take hold.

- Despite strong stock gains over the past 8 months, Netflix is still undervalued (~30%), so we maintain a BUY status.

Wachiwit

Investment Thesis

Netflix (NASDAQ:NFLX) reports excellent results for the third consecutive time. The implementation of the new strategy is already proving to be successful, and the potential for organic growth in financial performance remains. The implementation of new tariffs in emerging markets will be a strong driver of subscriber’s base growth in the medium term, and although ARPU growth will subside, in the future the company will be able to actively monetize low-cost subscribers through higher value of online ads. Last I covered Netflix was in November 2022.

Acceleration of user base growth through lower ARPU growth

In November, Netflix introduced a new plan with a lower cost but built-in ads. Considering that Netflix had a successful season in terms of content (TV series “Wednesday” became the third most popular show on Netflix, and the movie “Glass Onion: Knives Out Mystery” was the fourth most popular film), the net addition of subscribers amounted to 7.66 million users, which was much above the expectations of the management (4.57 million) and our forecast ( 2.40 million).

We believe that this success of the company is attributed not only to the popularity of fresh content, but also the introduction of a cheaper subscription tariff in November 2022, as well as the creation of a paid account sharing function in some regions.

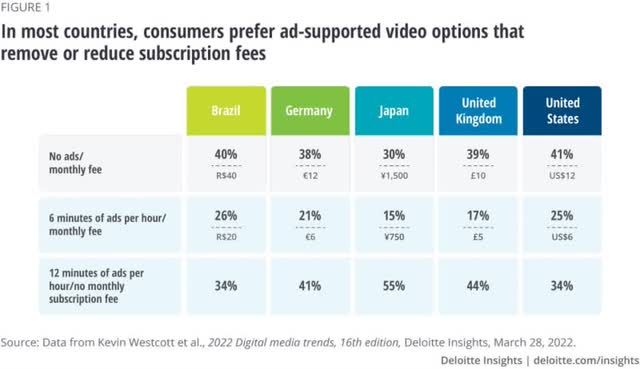

According to Deloitte, consumers in most countries prefer streaming services with ads, but cheaper subscriptions, so the new Netflix tariff opens a large market for the company and significantly enlarges the target audience. According to a study by Dentsu, in 2023 the AVoD market will overtake the SVoD market in size.

The cheap subscription tariff is not yet available in all regions – Netflix will gradually adapt the strategy in world markets, but we believe that the implementation of the strategy in emerging markets will also be successful because of the relatively low income level of the population and the consequent high demand for cheap entertainment.

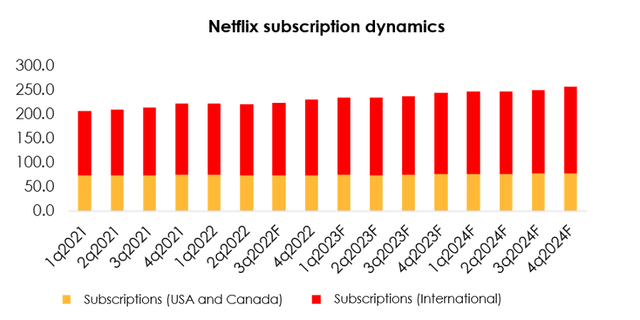

Thus, we have revised our account growth forecast from 3.69 million to 13.74 million for 2023 and from 8.26 million to 12.78 million for 2024 on the back of the successful implementation of low-cost subscription versions. We had previously projected a strong slowdown in growth in 2023 due to the expected slowdown in the global economy, but now believe that the allocation of sub-accounts and the creation of ad-tier subscriptions will help fully offset the increased churn-rates due to lower real income, as users will be able to switch to a cheaper tariff in the event of financial hardship.

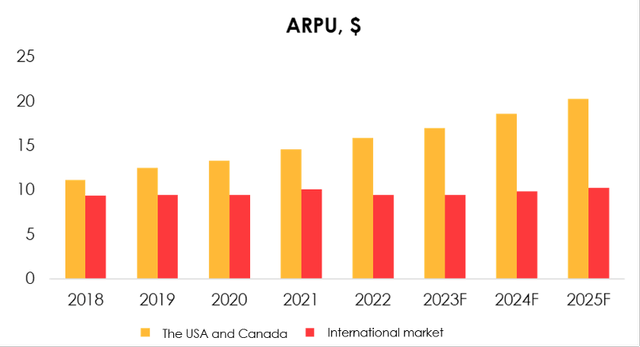

Meanwhile, the strong growth of the subscriber base will be offset by lower ARPU, especially in developing regions. The effect of ad-based subscription and account sharing option was immediately apparent – in EMEA the annual change in fixed-currency ARPU was 5% against our forecast of 7%, in Latin America it was 7% against the forecast of 14%, and in Asia it was 4% against the forecast of 0%.

We attribute the discrepancy to three factors:

- Netflix’s continued expansion in international markets. In addition to actively investing in content, the company will continue to increase the cost of basic subscriptions in regions at a slower pace than in the U.S. and Canada.

- Increased rate of subscriber uptake from low-rate plans. The online advertising market is experiencing tough times, so Netflix cannot fully offset the increase in the share of “low-cost” accounts at the expense of corporate customers.

- The share of shared accounts is higher internationally than in the US. We believe that sub-accounts still are counted as new users, but with a lower subscription cost, which negatively affects ARPU.

Given the factors listed above we have revised our international ARPU forecast from $10.09 to $9.59 for 2023 and from $10.53 to $9.96 for 2024. We expect growth to slow over the next three quarters (especially internationally), but at the same time there will be support in the form of dollar depreciation in the future.

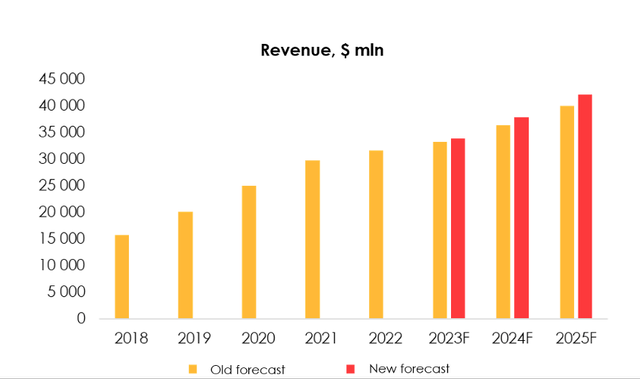

With the updated user forecast, we have revised Netflix revenue forecast upwards from $33 277 mln (+5.0% YoY) to $33 866 mln (+7.2% YoY) for 2023 and from $36 694 mln (+9.4% YoY) to $37 905 mln (+11.9% YoY) for 2024.

We believe that the allocation of low-cost accounts will fully offset the effect of increased rates of abandoned subscriptions amid a slowdown in the economy. In the future, the company will manage to accelerate monetization of active audiences by increasing both prime rates and the cost of ads in the online ad market.

Though lower ARPUs, profitability will likely to increase

In terms of business margin, Netflix still looks attractive, and we don’t see any major challenges in the foreseeable future.

We now see two realistic drivers of Netflix’s margin growth:

First, the rate of growth in content spending will slow down significantly. According to the Q4 Earnings call, content spending in 2023 is expected to be ~$17 bn. We estimate the budget for 2023 at $17,361 mln (51.3% of the company’s annual revenue), which is in line with management estimate of $17 bn. Both the overall lower investment rate and the increased share of shows and movies produced in emerging markets (where production costs are lower) have a positive impact.

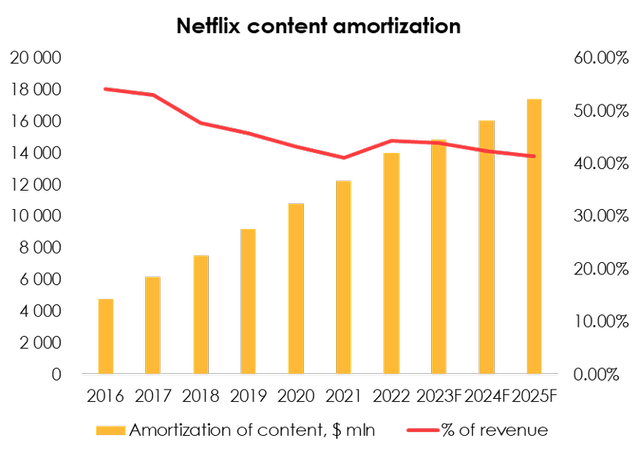

Because of the decline in the growth rate of content spending, the growth rate of depreciation, the largest item in the company’s COGS, will also fall. According to our estimates, the figure will decrease from 44.4% of revenue to 41.3% by 2025 due to a more modest spending growth rate.

We also see potential in reducing ad spending. From 2015-2021, ~11.8% of revenue went to marketing, but the company significantly cut spending to 8% in 2022. The recession hit the online ad market earlier than other sectors, as we’ve written about in other articles. We expect the company to spend ~8% on revenue next year due to the low cost of user engagement but will have to increase budgets to 8.8% of revenue thereafter due to higher ad costs.

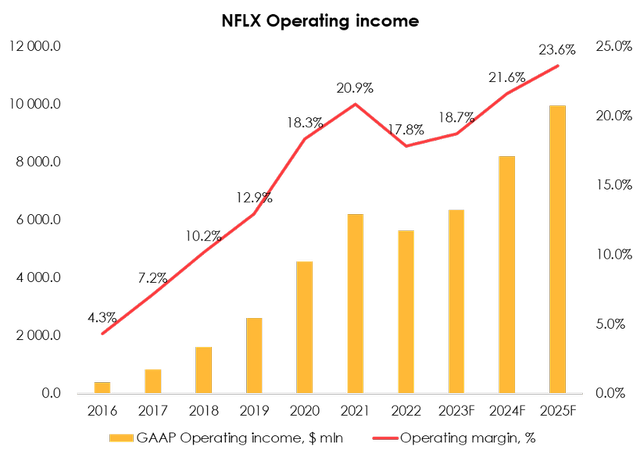

Thus, we expect GAAP operating income margin to increase by ~90 bps in 2023 (given the continued impact of the strong dollar exchange rate with weakening starting in Q3), and the figure increase by 2025 by 580 bps.

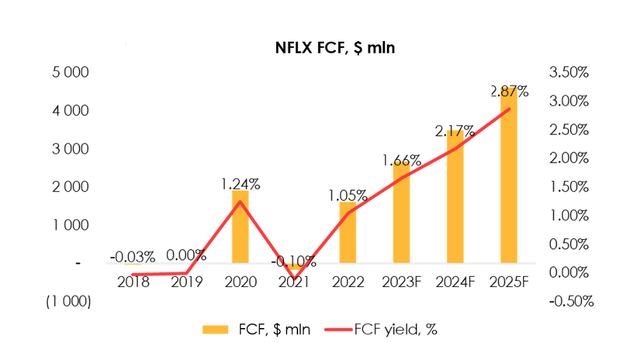

Cash yields making NFLX more attractive

An important factor for Netflix is that the company has finally started generating positive cash flow. In 2022, it reached $1.62 bn, a return of ~1.05% based on current market capitalization. Next year, the company plans to generate at least $3 bn FCF, which is also not much at current valuations, but it is an additional positive factor when evaluating the company’s investment potential.

The time horizon is now insufficient to draw conclusions about the required premium to FCF yield and take the indicator into account in the valuation. Nevertheless, the company has opportunities for further expansion through M&A deals (in Q4 it completed the takeover of animation studio Animal Logic and game studio Spry Fox), which will somewhat mitigate further growth of content production budgets.

We project FCF to be about $2.7 bn in 2023 and $3.5 bn in 2024, but the forecast could be affected by the difference in the effective tax rate for Netflix as well as a $300 mln variance in expected content spending (we project a budget of $17.3 bn compared to the management expectations of $17 bn).

The company also announced a stock buyback program worth ~$2.5 bn (buyback yield = 1.6%). Given that Netflix is reaching a stable and growing cash flow, it is likely that the company will continue to buy back shares in the future

Valuation

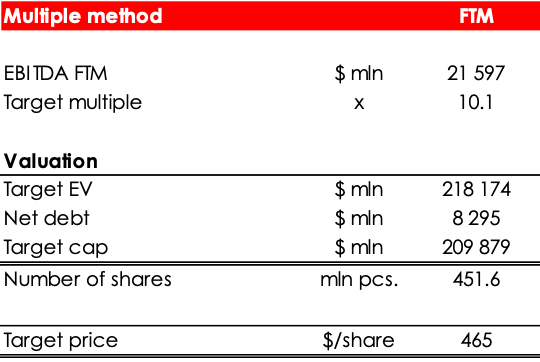

We are evaluating NFLX fair value price based on FTM EV/adj. EBITDA multiple. Adjusted EBITDA doesn’t include content assets amortization. Fair value price is $465. Upside is 27%.

Invest Heroes

Conclusion

Netflix’s updated strategy did not take long to see results – the company solved the problem of high churn-rates and accelerated growth in the number of subscribers. Meanwhile, there is still great potential for organic revenue growth and international business development. Although due to the growing share of cheap subscriptions the ARPU growth rate will slow down, the fast-growing number of subscribers will fully compensate for the effect on revenue.

The stock is up 118% since our first article about Netflix was released, but there is still a ~30% undervaluation in the stock. Nevertheless, we expect the market to decline soon, which could create an opportunity to buy the stock at more attractive prices.

For those investors considering buying Netflix now, we recommend opening a position in small installments. To manage your position, we suggest keeping an eye on Netflix’s financial statements and industry research (JustWatch, Nielsen, Parrot).

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.