Summary:

- Google missed earnings, causing the stock price to drop. We anticipate that negative sentiment will suppress the stock price near-term.

- Investments into YouTube and focus towards subscription opportunities drives growth going forward.

- Alphabet trades at a discount to forward earnings and growth, but at a bigger discount than some of the other tech conglomerates.

- We also anticipate that the stock will reach $138+ by year end given a summer recovery in advertiser spend, thus asserting +32% upside from where the stock is trading.

- Alphabet only trades at 18x FY ’25 earnings given our even more conservative growth inputs, which means there’s a high margin of safety owning the stock.

JHVEPhoto

Heading into Alphabet’s (NASDAQ:GOOG) (NASDAQ:GOOGL) quarter, we were skeptical of ad-results, and took the sidelines before developing our take on Alphabet, and what a fair intrinsic value should be. Despite the weaknesses tied to the ad-business model we like the product portfolio as emphasis on AI, YouTube content and TV bundles, and strengthened ad portfolio keeps us optimistic on long-term revenue/earnings growth.

Given the overwhelming complexity of Google and its earnings results, we take a step back, and take a holistic approach on valuing the business. We believe that the weakness in financial results reported by the company are strictly temporary, though the growth headwinds will average into an overall lower growth figure for the year when compared to historical growth rates across various business segments.

However, we become constructive on valuation, as we anticipate that even with quarterly results suggesting weakness, we estimate Alphabet will report revenue of $294 billion, and Dil. EPS of $5.34, which compares to consensus estimates of $303 billion and Dil. EPS of $5.19. We anticipate that Alphabet will deliver a bit more on total profitability than the consensus given the reduction in job positions, slower hiring, but also the amortization of content costs tied to its other bets segment (YouTube which we discuss more later) likely slows over time, which will translate to better profitability as we anticipate the business to continue growing at 15%+ over the next 3-years.

We value Alphabet at $138.85, or 18.51x FY ’25 earnings, which is comparable to our forward valuation on Apple discussed here where we value AAPL at 18.79x FY ’25 forward earnings. The only discrepancy is that in our upside scenario, we anticipate that Alphabet will generate +32% to achieve our price target, whereas AAPL will generate +11% upside using the same exact valuation method. However, we find both stocks to be the best in the group among big tech, as we would avoid Microsoft (MSFT) and Amazon (AMZN) in this environment.

Why Alphabet among big tech stocks?

If we have to choose between the big four tech stocks, we think Alphabet possesses upside on the basis of accelerated share buybacks, and also the continued growth and execution following a pause in advertising during a weak 2022 winter. We anticipate that summer ad results will improve, and eventually advertisers will adjust to the new normal of full employment, inflation continuing to trend higher, weak property prices, and higher interest rates. We also anticipate that the macroeconomic concerns skewed towards recession seem exaggerated, and tied to the fear plus war driven cycle.

Historically speaking, wars tend to trigger global inflation, and we think the new normal is higher interest rates and cold-war era price spirals, which is why it’s important for Alphabet to sustain a $60 billion dollar annual share repurchase plan to combat inflation by reducing the number of available shares.

We anticipate that global governments will continue to print cash due to the Ukrainian crisis. As a consequence it’s likely inflation spirals on the basis of global shortages tied to various war themed supply chain risks.

Whereas Alphabet sells mostly digital services (with the exception of the Google Pixel phone which isn’t a meaningful revenue category yet still growing), which are still macro exposed, but not to the extent that a shortage of production in China could suddenly render Alphabet in a situation where it wouldn’t be able to supply enough physical products to customers, because it mostly earns money from ads, subscriptions, and app store purchases. Its advertising partnership network also generates cash flow assuming the global economy doesn’t grind to a halt due to some unforeseen risk factors like some mass malware that damages Google’s ad network or even more antitrust fines and fees in other parts of the world or in the United States for that matter.

We think Alphabet is resistant to the supply chain risks of the current environment, as its advertising business can weather war-like conditions given the lack of physical components and hardware tied to the Asian supply chain. Furthermore, we like the fact that the business is trading at a discount due to weakness in business results that wasn’t foreseen by Wall Street analysts.

Earnings headline summary

-

Google reported revenue of $76.05B and dil. EPS of $1.05 a share

-

Analysts had forecast Google to earn $1.20 dil. EPS and revenue of $76.5B

-

Google missed headline revenue figures by -$450 million and dil. EPS by -$0.15

-

Google stock fell -3.29% in the following session

We anticipate that the pullback on advertising spend was concentrated in a number of categories, particularly, home services, and various real estate tied sectors have been reporting weakness near universally based on our prior research on Angi (ANGI). To gain an appreciation on the poor stock performance among housing exposed sector stocks, we believe the drop in advertising was macro driven, but mostly driven by different sectors of the economy, which gets broadly “classified” as macro weakness. But, we really think weakness is concentrated in technology ad-spending, and housing related ad-spending, which are two major categories that have pulled back meaningfully over the prior-year due to poor business results, which has necessitated a cut in ad budgets.

We’re not certain how well the real estate market will perform this year, but if we see housing trends continue to slip we have to anticipate further weakness on the advertising front, because we think these two areas are heavily correlated. Despite weakness across some of the ad segment, we find that the broader investment narrative on Alphabet is positive, as we like the growth areas of the business, and that the growth mix will start to improve, which we discuss in more detail in the valuation section of our report.

YouTube Music, Premium and Television

We anticipate that YouTube results will remain a hotspot in its other best segment, and while growth did slow to 8% for the quarter, we anticipate that as the year progresses the subscriber base will increase, and so as consequence the revenue growth will eventually accelerate. We think investments into content like music and Internet TV bundles are where costs have increased, but the areas where Alphabet has managed to make reductions also help with the overall narrative of cost-disciplined growth.

Sundar Pichai references the results tied to YouTube Music and Premium,

Our subscription business continues to grow, with YouTube Music and Premium surpassing 80 million subscribers, including triallers. Together with YouTube Primetime channel subscriptions and YouTube TV, we have good momentum here. YouTube’s NFL Sunday Ticket will accelerate that by helping to drive subscriptions, bring new viewers to YouTube’s paid and ad-supported experiences and create new opportunities for creators.

YouTube subscription revenue whether it be music, ad-free viewing, linear-TV upgrades, we think this is where the focus has been. We don’t anticipate YouTube wants to miss out on the Internet TV transition and has managed to position itself in the music channel similarly to AAPL. We anticipate that Alphabet’s market position is equally compelling given the 80 million music subscribers, 2.6 billion MAUs or monthly active users which contributes to Google websites ad-revenue along with the prospects for recurring subscription revenue tied to the YouTube TV bundle. We anticipate that with the content investments made to acquire rights to all the sports leagues, which we discuss in more detail in a prior Walt-Disney report.

But, basically, YouTube is a phenomenal launch point for the Internet TV transition given the already impressive installed base of active users on the platform where generating conversions from the YouTube app is as simple as asking a customer to click on the top left bar and to scroll down to purchase a TV subscription. But, because Alphabet has such a large network of applications, it’s a bit difficult to sell a customer on even more Google apps and services, ironically. Mainly because users have access to a lot of different Google products already, so simply discovering, or using even more might be causing some decision fatigue, which is why the growth hasn’t been so spectacular off of a low user base. However, we anticipate that despite the reported figures of YouTube TV only having 5 million subscribers or so from the middle of 2022, Alphabet pays $35/subscriber on content costs, according to estimates from third-party analysts – the business is still on the right track.

YouTube TV is a $2.1 billion revenue business based on the run rate of $65/month per subscriber at 5 million paying subscribers. So, the business doesn’t generate a whole lot of revenue, and it’s not profitable either. Despite not being profitable, it’s early days for the service and we have to give this segment a chance, because sports programming is the last piece of the puzzle that Alphabet bundled for the internet.

So, assuming those figures are accurate, YouTube TV is a relatively small business and it doesn’t have the subscriber base to support the content cost of NFL at $2.5 billion annually according to Variety. Despite this fact, we think Sundar Pichai hinted at a key point on the Q4 ’22 earnings call, which is quite reassuring, “YouTube’s NFL Sunday Ticket will accelerate that by helping to drive subscriptions, bring new viewers to YouTube’s paid and ad-supported experiences and create new opportunities for creators.”

Currently, the NFL Sunday Ticket only has 2 million subscribers DirecTV subscribers, but given where YouTube TV only has 5 million subscribers, the subscriber base has 7 million subscribers for the 2023-2024 session, perhaps more assuming the $300 price appeals to 10 million to 20 million incremental households given the significant reduction in pricing, and the significant uptake in sports wagering and gambling, which we also discuss separately in our DraftKings report.

But basically, if YouTube TV markets aggressively towards sports gamblers with an NFL Sunday Ticket package – it might work wonders on converting customers, as opposed to people dining out at expensive restaurants to watch sports and place bets, it’s more likely that they could stay in on YouTube TV and place bets from home instead.

We anticipate though, that with the addition of NFL Sunday Ticket, we think YouTube TV will become the preferred destination for watching sports. This also means that we anticipate that YouTube will generate the bulk of the revenue from sports broadcasting when compared to peers with the exception of Walt-Disney.

Cost savings driven by the need to prioritize towards subscription businesses

Given the heightened content investments we’re not surprised to see Alphabet also reduce headcount recently. It’s likely that software engineers will be the bedrock of Alphabet’s labor force going forward, but we think investments into core subscription products that have meaningful growth have been limited to areas such as YouTube Music, YouTube TV, Google for Work, Google Cloud Products.

The enterprise subscription, enterprise cloud along with the YouTube TV and Music bundle is where costs will continue to ramp, but also sales will grow at 15%-20% annualized rates as well. It’s why we think the strategic decision to reduce headcount was made in software engineering in more mature areas of the company because the company simply didn’t need the added workers. If it’s not a growth area of the company, cuts were made in response to a weak advertising environment, and instead the business is prioritizing investment into the areas where it can grow subscription revenue instead.

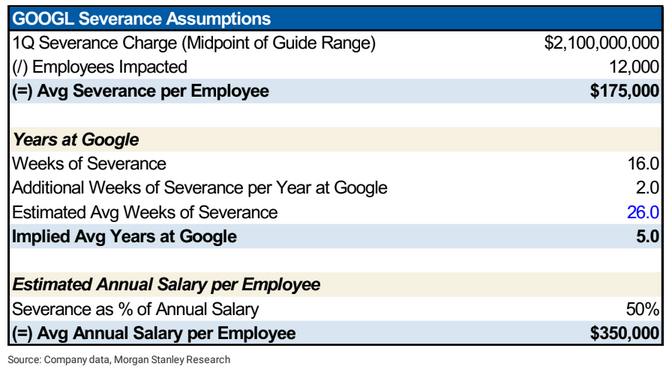

Figure 1. Alphabet Severance Estimate

Alphabet severance charge offs (Morgan Stanley)

A Morgan Stanley analyst, Brian Nowak anticipates that the severance will cost about $2.1 billion in Q1 ’23 operating expense impact. It’s why we anticipate that with the impact from the temporary cost headwind from the overall reduction on SG&A will be felt more in 2H ’23 and FY ’24, which contributes modestly towards profitability. We expect heightened revenue from subscriptions driving towards a higher profit margin figure will further contribution to net profit margins as well.

Furthermore, we anticipate that the technology workers at all of the major technology companies who lost their jobs will likely find work in other parts of the technology sector at large cap tech companies or shift towards other sectors. Despite the difficult environment, we find it hard to believe that tech workers will actually contribute to the national unemployment rate to a meaningful extent thus signaling the beginning of a large-scale recession.

Mainly because tech workers can transition into other parts of the economy like financial services, aerospace and defense, healthcare, biotech, cryptography, telecoms among many other areas. We think there’s too much engineering talent tied to the development of advertising algorithms, as opposed to the development of new technologies like autonomous vehicles, cryptographic algorithms, or advanced trading algorithms.

We think there’s a lot of talent trapped at big tech companies that would do better in other areas of the economy as opposed to advertising tech. Therefore, we’re not necessarily thrilled with the environment, or the charge off financially, or the prospects that company morale could be negatively affected.

However, we also acknowledge that the macroeconomic effect will likely be more limited, and that the pedigree these workers have after working at big tech companies will translate to employment in other areas of the economy that could be disrupted by the brain power flowing out of silicon valley.

Financial model discussion and overview

We think we’re more conservative with our inputs than other analysts, and we come away with the impression that upon valuing the company similarly to other large tech companies that the stock is heavily undervalued.

We think some of this is driven by the conglomerate-like structure, and the heavy headlines tied to big tech companies. Despite the near-term headwinds we like GOOG Class-C stock, which this model reflects our price target assumption on.

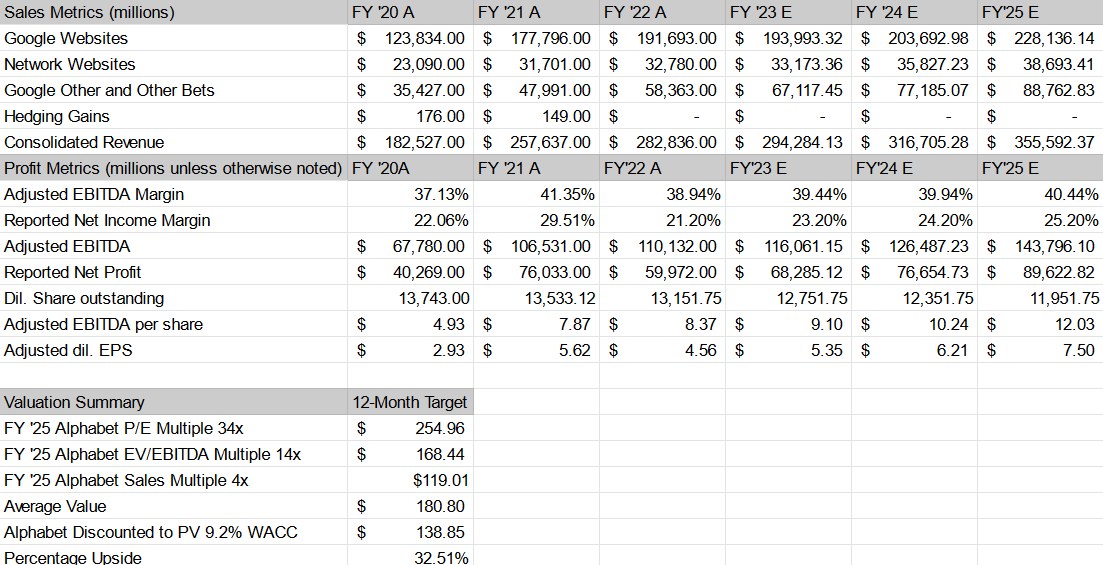

Figure 2. Alphabet Financial Model

Google Financial Model (Trade Theory)

We anticipate that Alphabet will sustain revenue growth from its ad-network, and advertising business tied to its Search and display ads following a flat year with limited ad growth. We expect 2H ’23 results will likely recover in-line with the commentary of management, and our understanding of advertising trends. Assuming we don’t head into a recession we think advertisers start to get more aggressive in the second half of the year, and holiday seasonality paired with the continued subscriber growth tied to its subscription businesses grow at a steady pace throughout the year.

We anticipate that adjusted EBITDA margins (38% to 40%, and net income margins will gradually improve, probably returning to a 25% level following the heightened investment on content, and some amortization related charges tied to Google Cloud Products. We anticipate that this is the year where cost charges reduce profitability the most, but will improve to a 25%+ net profit margin figure by FY ’25.

As such, we arrive at the conclusion that on balance the ad business will grow at 5%-10% upon demand recovery from advertisers, and the subscription (other bets) segments will grow at 15% over the forecast period. Keep in mind, the ad business grew by 10% on average for the past 3-years, and the other bets segment grew by 20% per year over the same period. We think certain factors could drive growth back to 20%+ such as the unexpected growth of YouTube TV with the sports bundle adding up to a meaningful TV subscriber base.

We anticipate that Alphabet will repurchase 400 million shares per year, based on an average stock price of $150 per share, and that’s assuming the buyback continues at $60 billion per year, or $180 billion over the next 3-year period.

We anticipate that Alphabet can buy back 1.2 billion shares assuming it returns the bulk of its earnings via buybacks, which seems highly plausible given the environment. The core growth areas while demanding capital have very minimal impact on margins or CapEx with the exception of GCP (Google Cloud Products).

Because Alphabet’s projected to generate $68 billion profit FY ’23, $76.6 billion profit FY ’24, and $89 billion profit FY ’25 – we expect a lot of capital returns given the on-going profit ramp. Also, Alphabet has $359 billion in total assets, so returning capital at this pace doesn’t impact the cash position, instead we think Alphabet’s going to add cash to its balance sheet while returning $180 billion over the next 3-years regardless.

We value Alphabet using a combination of 34x earnings, 14x Adjusted EBITDA, and 4x sales for FY ’25 and discount the valuation by 9.2% (or the firm’s WACC) to arrive at our price estimate of $138.85. We believe our conservative FY ’25 estimate and forward tech valuation justifies a deep value thesis.

Alphabet is the best overall value investment in big tech

We want to end our thoughts positively on Alphabet despite the negative presentation of the earnings results given the headline figures and corporate layoffs. It’s not a value trap, as we think the macroeconomic backdrop will eventually improve thus diminishing the weakness in ads tied to macro.

Furthermore, we expect advertising spend to eventually improve as advertisers adjust to the higher interest rates, and home buyers eventually realize that higher inflation is here to stay for a while longer. Waiting on interest rates to drop might not work given the war-themed inflation and shortages going on. We eventually think the property market will reactivate even if interest rates are at more elevated levels, which should flow through to the rest of the economy, including advertisers.

Alphabet also has more upside potential when compared to some of the other tech names. As such, we recommend Alphabet at Strong Buy to our readers, as we think the stock’s conservative inputs, paired with the low growth hurdle required to reach our $138 price target makes this a compelling stock. We think value investors will appreciate how much of a value this growth stock still trade at. We anticipate growth investors to come back into the stock as other bets segment translates to financial momentum and earnings beats as we progress through the next couple of years.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.