Summary:

- There is speculation that Lucid Group would be acquired by Saudi Arabia’s Public Investment Fund.

- This made the stock price tick upwards although LCID stock is still trading low compared to its 52-week highs.

- Lucid Group is quite a risky investment, given its fundamentals.

- It is still not a value stock.

- Yet, stockholders may make plenty of money if this acquisition actually comes true.

David Becker

Lucid (NASDAQ:LCID) stock has been recently pressurized. But investors were somewhat comforted when the rumors appeared Saudi Arabia’s Public Investment Fund may be about to buy the rest of Lucid Group’s business it does not already own. Lucid’s stock weakness and volatility fully reflect the company’s current state of affairs. At the same time, the current stockholders may be generously rewarded should the acquisition dream come true.

Lucid Group’s news

Lucid Group rallied on speculation that Saudi Arabia’s Public Investment Fund (PIF) may be about to acquire the rest of the electric vehicle company it does not already own.

No new announcements have been made just yet. But some analysts think that the relationship between the Kingdom of Saudi Arabia and Lucid could go beyond a controlling shareholder status.

The reason for this acquisition is the energy transition story that aligns with the Kingdom of Saudi Arabia’s long-term reforms of Vision 2030, including its EV manufacturing plans. All this suggests Lucid will be a useful buy for the PIF. However, my fellow Seeking Alpha contributor The Asian Investor says the rumors might not turn out to be true because of PIF’s lack of strong takeover history.

At the same time, if the PIF’s acquisition of the EV maker does indeed take place, it will be a wonderful piece of news for the company’s stockholders because Lucid Group does indeed have some problems. I will explain these below.

Lucid stock’s fundamentals

It is very hard to judge a start-up company with a relatively short history, which is the case with Lucid Group. After all, there are too many speculations behind its future. Electric vehicles are a relatively new industry. As is often the case, investors get very excited about the future of a new sector that seems to have plenty of growth potential. That is why companies operating in these sectors that do not have a sound earnings history get plenty of attention and excitement. Lucid Group seems to be one of these.

But due to the general tech sector’s decline and falling EV prices, speculators are not as excited as they used to be. Plenty of market players are unwilling to buy these megapopular stocks for the long term. Instead, many of them try to profit from either buying for the short term or short-selling. At the same time, showing hope and patience if the company gets acquired may allow Lucid’s stockholders to make a fortune.

But provided no acquisition occurs, let us look at the purely fundamental factors.

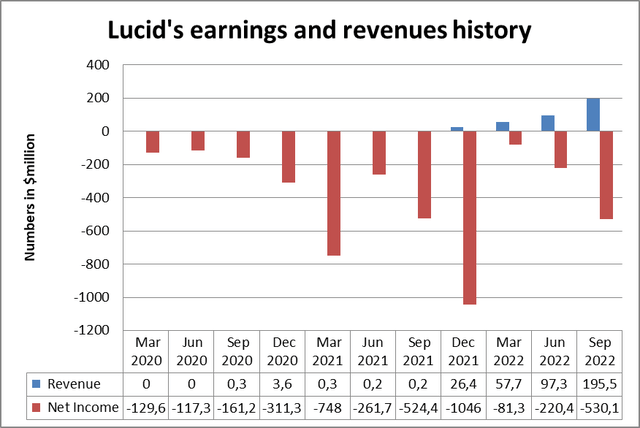

I will start with Lucid’s quarterly earnings and revenue history.

From the diagram below you can see that the company’s earnings have consistently been negative since March 2020. In fact, the losses have risen since then in spite of the excellent rise in Lucid’s revenues.

Source: Prepared by the author based on Seeking Alpha’s data

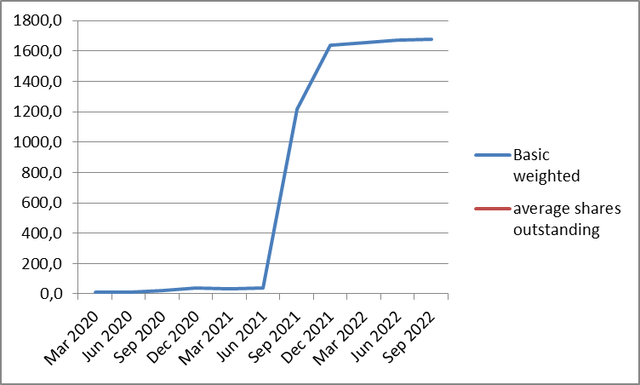

That is why it is not surprising that the company was forced to issue shares in order to raise more cash, thus diluting its existing stockholders. The surge in the shares outstanding was particularly high between June 2021 and December 2021.

Source: Prepared by the author based on Seeking Alpha’s data

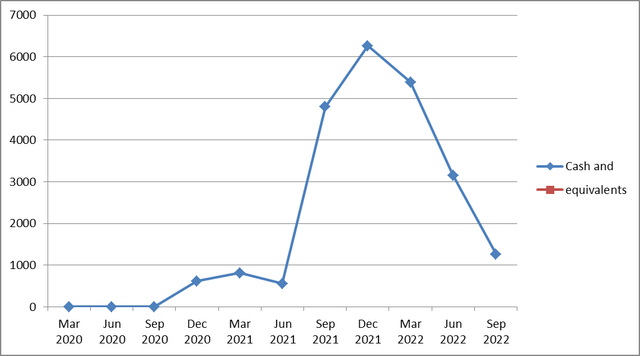

Cash and equivalents increased only at the time when the largest number of shares was issued. Immediately after that, the liquidity dropped dramatically.

Source: Prepared by the author based on Seeking Alpha’s data

The company is loss-making and is therefore burning plenty of cash.

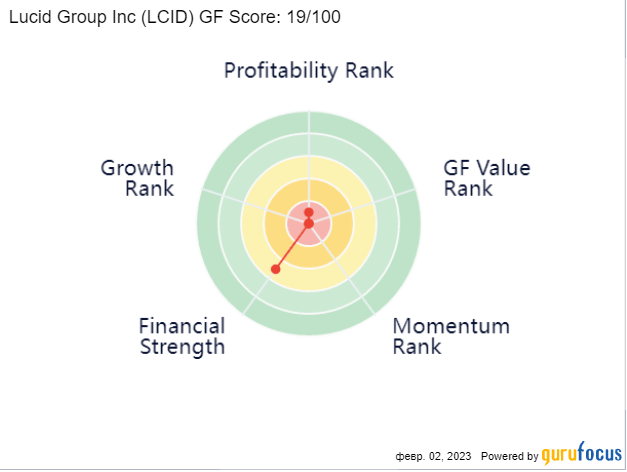

So, from that perspective, Lucid is a classic risky investment. As reported by Gurufocus, it has an investment score of 19/100.

Guru Focus

But it is quite explainable because it operates in a relatively new sector. That is why I would like to compare Lucid to its fellow electric vehicle peers.

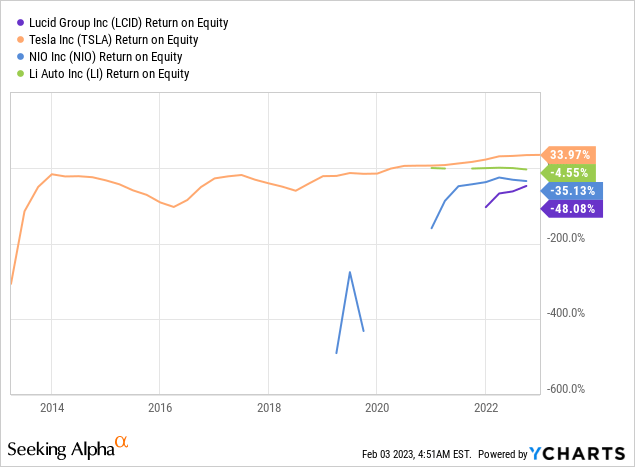

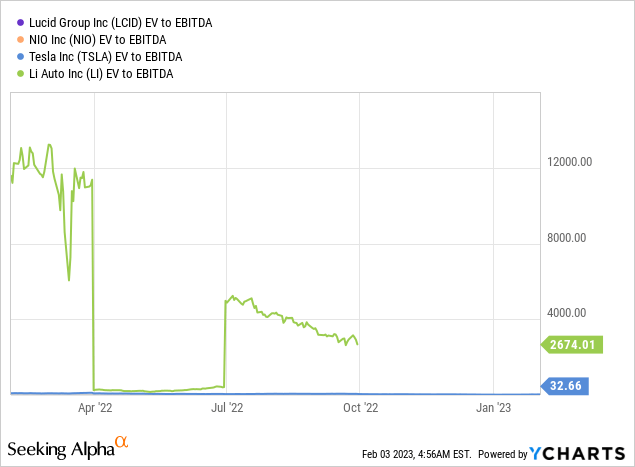

When we take pure electric vehicle companies, we will see that Tesla (TSLA) has substantially better indicators than its newer competitors. Earlier on I wrote an article on why Tesla is not a good investment in spite of the fact its stock depreciated. That being said, other smaller companies, Lucid included, have much poorer financial indicators, especially profit ratios, including return-on-equity (ROE). Lucid even generate negative EBITDA. So, I was unable to generate any EV/EBITDA graph.

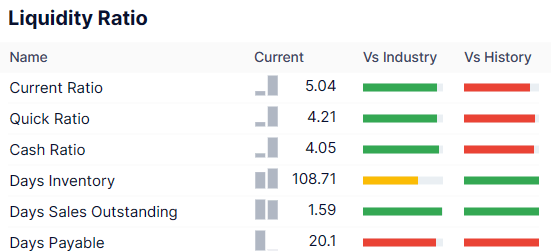

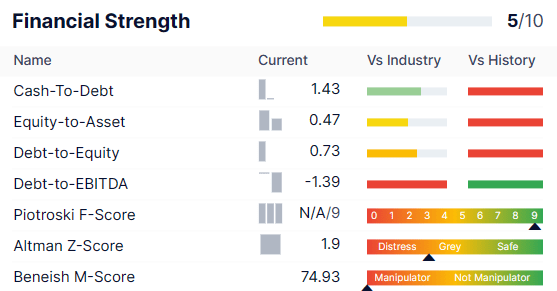

Below I will present the excerpts from Lucid’s Guru Focus page. Here are the general liquidity and financial strength indicators.

Guru Focus

Overall, we can say that the company’s general liquidity position is quite strong, especially if we look at the quick and current ratios above. Yet, the cash level fell substantially if we compare the current figure to the one the company had just after the share dilution. I explained this above.

Guru Focus

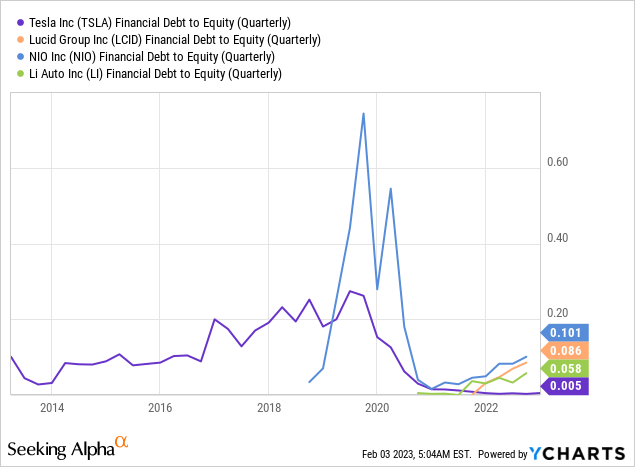

The overall financial strength is quite poor. If you have a look at the equity-to-asset and the debt-to-equity indicators, they are not brilliant but at least acceptable. The company does have debt. At the same time, if you look at the debt-to-EBITDA indicator, it is even negative because of the company’s negative EBITDA.

As I have mentioned before, all this might even be reasonable for a company that has not been existing for a long time. But let us see if the stock’s valuation indicators reflect that.

Lucid Stock Valuations

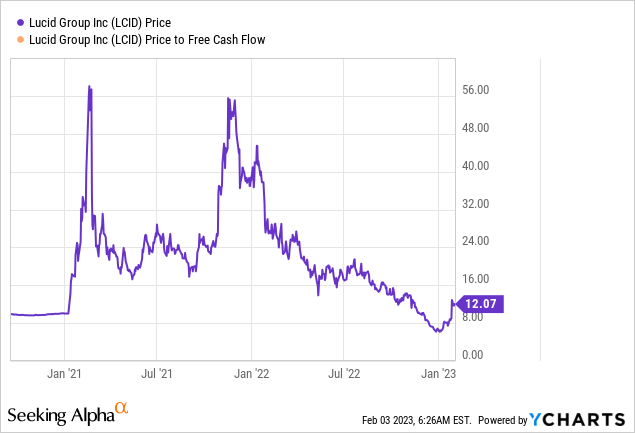

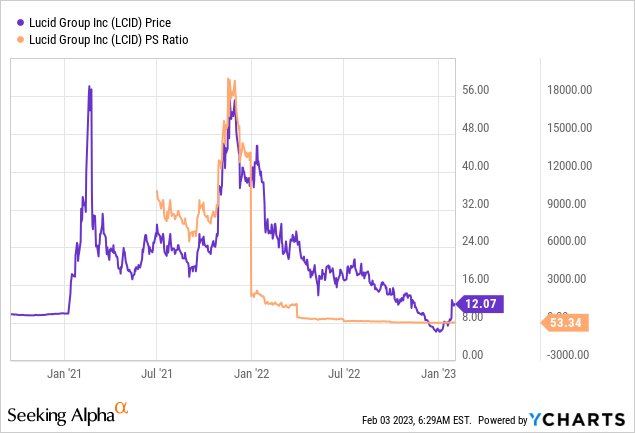

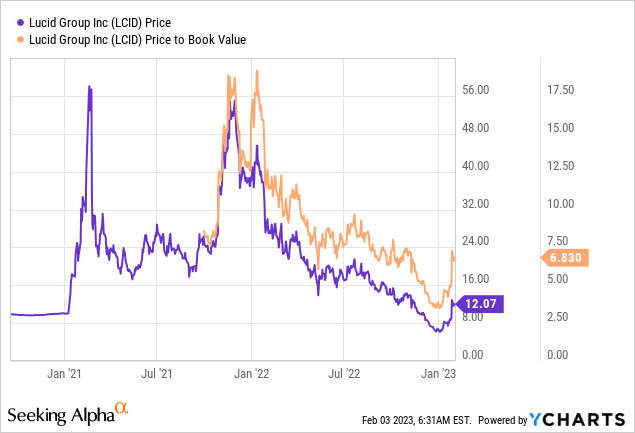

Sure, Lucid is somewhat overvalued. Let us value the company according to the following metrics: price-to-sales (P/S), price-to-book (P/B) and price-to-cash flow (P/CF) ratios. I decided to avoid the price-to-earnings (P/E) measure because Lucid Group has never been profitable.

Lucid’s P/FCF ratio is negative. That is why it does not show up on the graph above. We all know that free cash flow is not the same as profit and yet the company has not managed to achieve free cash flow over the last 5 years.

Lucid’s P/S ratio is far too high right now even though the stock price has recently corrected. A good P/S should be between 1 and 3. Now it is above 50 according to Y-Charts, quite high, I would say.

Moving on to the P/B ratio that should also ideally be between 1 and 3 or even below. Lucid’s P/B is almost 7, quite high, indeed.

So, in spite of the recent stock price correction, Lucid still is not good value for money as far as its fundamentals are concerned.

Risks

The risks of Lucid Group are quite numerous.

- First of all, there is a risk the acquisition deal will never come true. After all, Saudi Arabia’s Public Investment Fund may not acquire the rest of the stake at Lucid Group.

- Lucid Group heavily relies on share dilution for its cash reserves.

- The company is not profitable and has plenty of competitors.

- The group’s valuations are really high in spite of the recent stock price correction.

- Finally, my biggest source of concern is a likely recession ahead. I keep mentioning this risk in many of my articles. But it is really significant for loss-making companies.

Conclusion

In my view, Lucid Group’s acquisition would be a blessing for its stockholders. It is logical for a relatively new company operating in a growth sector to have quite poor financial indicators and unreasonably high valuations. Yet, Lucid’s stock should not perform well if there is a substantial recession. So, an acquisition by a large player should be a piece of very good news for the company’s stockholders.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.