Summary:

- Netflix’s deal to add WWE programming could boost its advertising business and attract more subscribers, especially in international markets.

- The company’s strong Q4 performance and growth in revenue and paid memberships indicate continued success in the streaming industry.

- However, the stock is currently trading at a high valuation and may be close to being fairly valued.

Giuliano Benzin

Netflix’s (NASDAQ:NFLX) deal to add WWE programming should be a nice lift for the firm, but the stock is looking pretty close to fairly valued at the moment.

Company Profile

NFLX is a streaming service that offers TV series, films, and games to its subscribers across various genres and languages. The company has over 260 million paid subscribers in over 190 countries.

Its revenue primarily comes from monthly membership fees. It also makes a small amount on advertising. NFLX produces its own original content, as well as licenses content from third parties.

Opportunities & Risks

The streaming industry has been in flux over the past few years, as traditional media companies with large linear assets have been shifting to streaming. For most of these companies, this has been a difficult transition. It started with a push to bring in subscribers and create strong content, while more recently these companies have been looking to make these efforts profitable. However, among Disney (DIS), Comcast (CMCSA) with Peacock, Paramount Global (PARA) and Warner Bros. Discovery (WBD), only the latter looks like its streaming service may be EBITDA positive in 2023, and just barely (~$200 million though the first 9 months of 2023).

Despite the increased competition in streaming, NFLX has proven it can be a nicely profitable business. For 2023, the streaming giant generated EBITDA of around $7.3 billion and free cash flow of $6.9 billion.

The business is also still growing nicely despite NFLX’s size and increased competition. Revenue accelerated in 2023 to 12% from 6% in 2022, while it grew its paid memberships by nearly 13% during the year to 260.28 million. Even in its more mature U.S.-Canada market, it added 2.81 million memberships, in Q4, while Europe continues to be its biggest growth market, adding 5.05 million memberships in the quarter.

Part of NFLX’s success in 2023 was due to its crack down on shared accounts. It added features and plans to monetize account sharing, which worked. However, this boost is now behind the company.

Going forward, though, NFLX still has a number of growth opportunities. The growth of its ad-supported tier remains a big opportunity. Its ad business is still small, but 40% of new subscribers are choosing this option in supported markets. The company saw 70% sequential growth in ad memberships in Q4. Meanwhile, it will retire basic plans in the U.K. and Canada later this year, pushing members to this more profitable tier. At the same time, as NFLX gets more subscribers of its ad tiers, it will be able to better scale and monetize the business. It should also continue to see improvements in ad targeting and measurement down the line, which will also help.

NFLX has also shown pricing power over the years. And while some subscribers complain and some do ultimately cancel, this has also been a boost to the company in the past. Given its tiered offerings, including ad supported options, the company should be able to retain more customers when it decides to increase prices, as some will just move to a lower-priced ad-supported option.

Another big potential driver in 2025 will be the introduction of WWE content on the streaming service. Starting January 2025, NFLX will become the exclusive home to WWE’s flagship program Raw in the U.S., Canada, U.K. and Latin America. Other countries are expected to be added later. Meanwhile, NFLX will also serve as home to other WWE programming and premium live events outside the U.S. in 2025 as well.

Discussing the deal on its Q3 earnings call, co-CEO Ted Sarandos said:

“I’m going to say instead that we are thrilled to bring this WWE Live programming to our members around the world. WWE Raw is sports entertainment, which is right in the sweet spot of our sports business, which is the drama of sport. Think of this as 52 weeks of live programming every week — every year. It feeds our desire to expand our live event programming. But most importantly, fans love it. For decades, the WWE has grown this multigenerational fan base that we believe we could serve and we can grow. We believe that WWE has been historically under-distributed outside of North America. And this is a global deal. So, we can help them and they can help us build that fandom around the world. And I should add that this should also add some fuel to our new and growing ad business. We’re very excited about this deal.”

Love it or hate it, the scripted sports entertainment programs that WWE provide have a huge global audience. In the U.S., Raw tends to draw between 1.5 to 2.0 million viewers each week. WWE also has a huge international following. For example, Saudi Arabia pays WWE a reported $50+ million for each live event they host in the country.

WWE has one of its most stacked rosters in a long time with the recent returns of CJ Punk and Randy Orton that could increase fan interest. These are also mostly live events that draw in huge audiences and a lot of advertisers as well. I would expect that this deal will help add subscribers both in the U.S. and abroad, but the advertising element may be even more attractive, and can help as the company scales up this part of its business.

Meanwhile, NFLX should continue to benefit from the continued trend of cord cutting. While it may have slowed, this dynamic is still going on. Meanwhile, as live sports and events move to streaming services, it could hasten it even more.

Gaming is also another nascent area for NFLX. This is very small at the moment, but could become a growth driver in the future.

When it comes to risks, saturation in some markets is one of them. Netflix has 80 million memberships in the U.S. and Canada, while there are an estimated over 131 U.S. households and around 16 million Canadian households. That’s over 50% of U.S. households that have NFLX, so growth should be more of a grind in this market.

And while NFLX has run circles around the competition, it is still a risk. Expect some continued consolidation in the space as traditional players look to scale their businesses and better compete. NFLX has an advantage with no linear legacy assets, but these companies are working hard to make this transition to streaming, including looking to transition sports over to their streaming services.

With only monthly memberships, the economy can also add risk. When times get tough, subscribers can certainly use tactics such as moving from one service to another each month to save costs. And as advertising becomes bigger, that comes with its own macro-sensitive risks.

Valuation

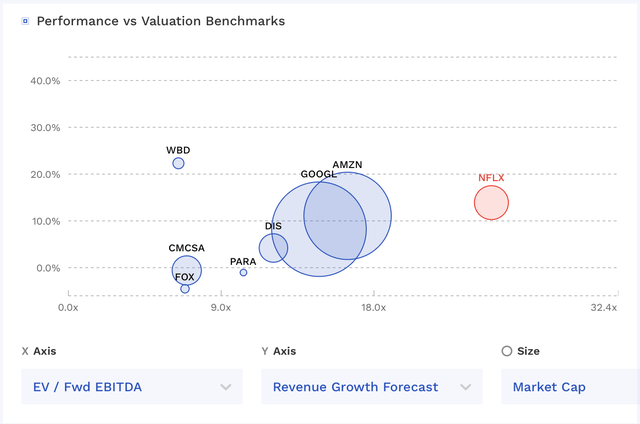

NFLX currently trades at just above a 26x 2024 EBITDA estimates of $9.9 billion. Based on the current 2025 EBITDA consensus of $11.9 billion, the stock trades at just under a 22x multiple.

Revenue is projected to grow nearly 14% in 2024 and 12.6% in 2025.

NFLX currently has a free cash flow yield of about 2.8% based on FCF of $6.9 billion in the last trailing twelve months.

NFLX is the most expensive media company, although it does not have the linear TV legacy issues of many of its rivals.

NFLX Valuation Vs Peers (FinBox)

On a subscriber basis, NFLX trades at $1,000 per subscriber. ($260 billion EV and 260 million subscribers). ARPU is about $136 a year. With about 41.5% gross margins, that’s a big value for its customer base in my view.

I’d value the company between 20-25x 2-25 EBITDA given its growth and leadership position. That places a $515-$650 value range on the stock, with the middle around $582.50.

Conclusion

NFLX reported a strong Q4, showing it remains the dominant player in streaming. Meanwhile, the company is still in the early innings of its supported tier, which should help drive subscriber additions, as well become more profitable over time as it scales this part of the business.

The WWE deal, meanwhile, plays nicely into this, and I think it should help give it more scale in advertising given its 1.5-2.0 million weekly viewership numbers. At the same time, I think it should help in international markets where wrestling is very popular.

That said, given its current valuation, even with the potential of some outperformance to the consensus numbers, the stock looks pretty close to fairly valued at the moment. I’d be more interested in the stock around the $500 level.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of WBD either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.