Netflix: Upside May Be Exhausted (Rating Downgrade)

Summary:

- Netflix has rebounded strongly from its crash low outlined in May 2022.

- Valuations are getting extended again, which should limit long-term upside.

- A major price gap lower on the daily chart from April has been filled. The $350 to $370 area may now prove stiff resistance, especially if a recession is next.

- I am downgrading my rating from Buy to Hold. Smarter risk-adjusted buy ideas exist for your capital.

hocus-focus

I wrote my last Netflix (NASDAQ:NFLX) article in April here, after price collapsed to $200 per share and large hedge fund owners gave up on the stock (my cyclical sentiment mark to consider buying the company). The lowest valuation since 2013, and pressure on management to start a new ad-supported tier were other arguments to change to the bullish camp. Well, price has rallied +55% vs. an S&P 500 loss of -11% over the latest 9-month span.

Seeking Alpha – Paul Franke Article, April 20th, 2022

However, Netflix’s strong rebound is getting tired. Given the lackluster Q4 earnings report last week, a valuation not as positive as last year, and major technical resistance around current pricing, I am downgrading my Netflix view to Hold/Neutral. New capital should be allocated into other names with better risk/reward characteristics.

Mixed Earnings Report

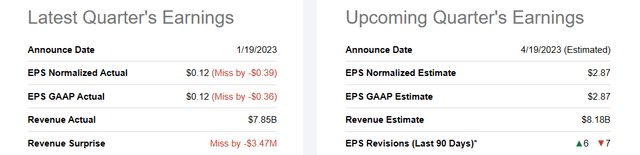

The December Q4 numbers for sales and income actually missed analyst estimates. A picture of this result and forecasts for Q1 2023 are drawn below, using Seeking Alpha data. Wall Street focused on slightly stronger-than-expected subscriber growth, bidding shares 8% higher on Friday (January 20th,2023). I feel this spike higher may pinpoint a good time to lighten up on holdings (for traders), while convincing me to downgrade my rating from Buy to a less enthusiastic outlook for the next 12 months.

Seeking Alpha – Netflix, Q4 2022 Earnings Results, Q1 2023 Forecast

The good news is Q4 results include costs for getting the new ad-tier product up and running. Analysts are projecting better income starting in early 2023, although more analysts have revised estimates down (7) than up (6) for March.

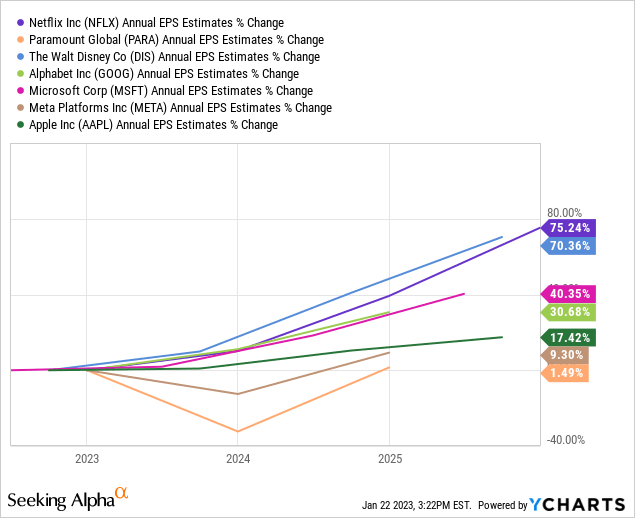

In addition, Wall Street is forecasting Netflix to deliver one of the highest growth rates into 2025 out of the major entertainment and information companies with streaming/online business focus. My peer/competitor group includes established, large-cap companies with normal balance sheets and earnings power including Paramount Global (PARA), Walt Disney (DIS), Alphabet/Google (GOOG) (GOOGL), Microsoft (MSFT), Meta Platforms (META) and Apple (AAPL). Netflix’s expected operating growth is the primary reason I am not comfortable with a Sell rating.

Seeking Alpha – Major Streaming & Social Media Stocks, EPS Growth Forecast for 2023-25, Jan 22nd, 2023

So-So Valuation

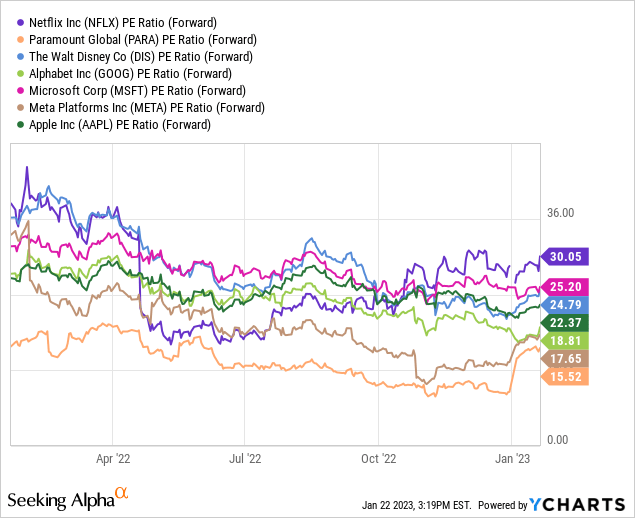

For sure, the Netflix ownership argument has flipped from undervalued to fairly valued territory with the +55% price gain from my last story and +105% jump from its 52-week low.

The forward price to earnings ratio is up to 30x from 17x at the May low. And this statistic has moved from one the cheapest in the peer group to the most expensive today.

Seeking Alpha – Major Streaming & Social Media Stocks, Price to Forward Earnings Estimates, 1 Year

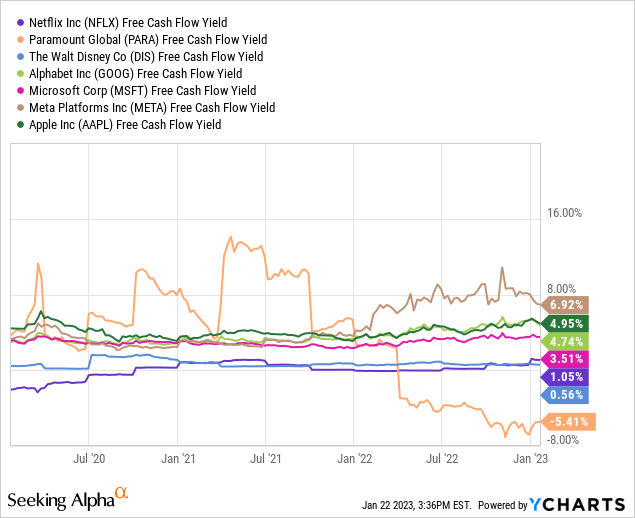

The most bearish data point is free cash flow remains MIA (missing in action), as Netflix reinvests large sums to keep on a revenue growth path. Ever higher rates of movie and television spending to stay competitive is the here and now problem. It is quite possible free cash flow will be lacking for another year or two. The 1% free cash flow yield is low vs. the peer group, and far away from basic 6.5% YoY CPI inflation increases in the macro economy. I prefer to own companies with earnings and free cash flow yields HIGHER than current inflation rates. Using this valuation idea, only Meta Platforms (with its huge virtual reality spending problem), Google and Apple are worth consideration for new buys today.

Seeking Alpha – Major Streaming & Social Media Stocks, Free Cash Flow Yield, 3 Years

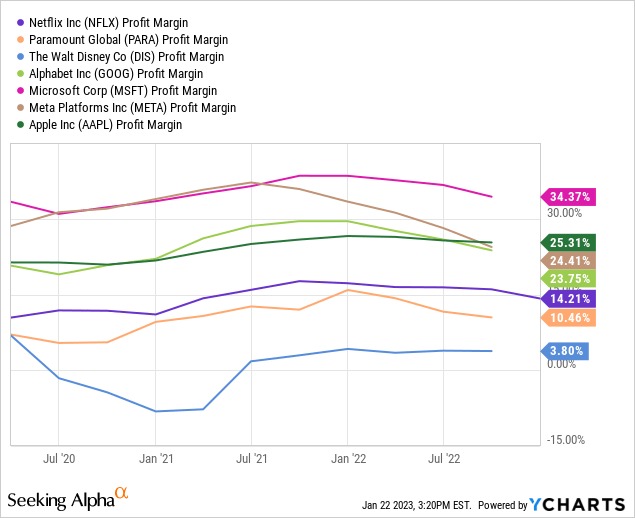

Because of rising entertainment spending and competitive forces keeping a lid on future subscription price hikes, profit margins will remain under pressure. The 14% net income margin on trailing results is below average for the peer group, and may be capped for years around 15%.

Seeking Alpha – Major Streaming & Social Media Stocks, Net Income Margin, 3 Years

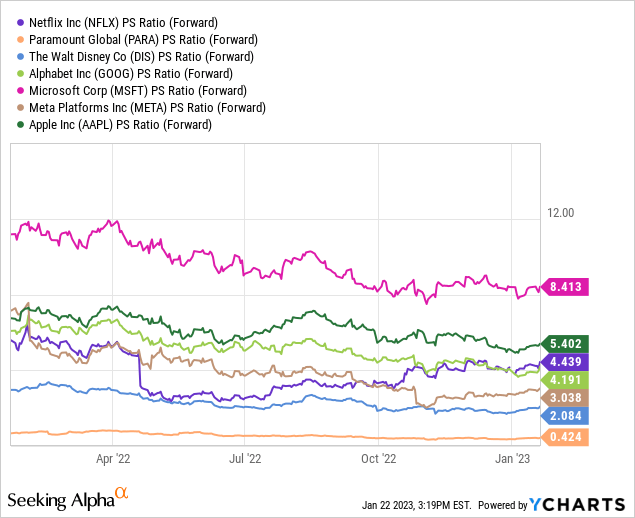

Lastly, price to forward sales estimates have risen from 2.8x in May to 4.4x today. Given sliding growth rates vs. Netflix’s 10-year averages, and weaker profit margins vs. competitors, I believe the company is no longer undervalued on revenue calculations.

Seeking Alpha – Major Streaming & Social Media Stocks, Price to Forward Estimated Sales, 1 Year

Technical Trading Pattern

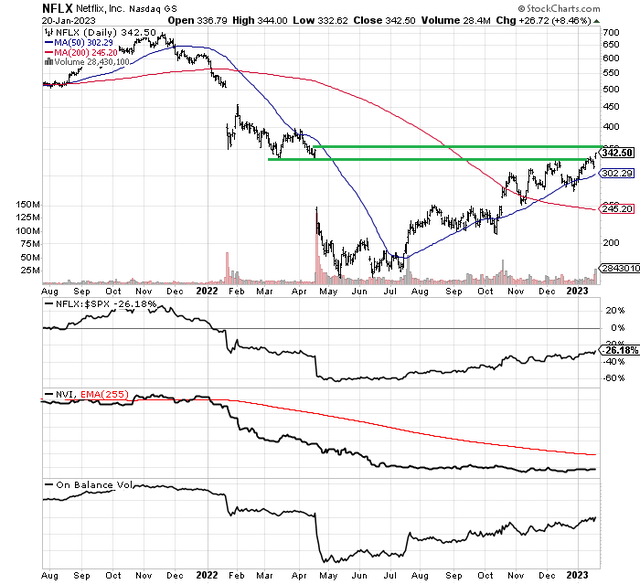

One more piece of the whole investment puzzle is Netflix’s technical trading chart. Shares have basically recovered to the monster price gap created in April. I have drawn several green lines below that may represent significant resistance, as long-term owners become sellers at this psychological inflection zone for price.

Over 18 months, you can also review Netflix’s “underperformance” of the S&P 500 by -26%, alongside rotten Negative Volume Index and On Balance Volume trends. My guesstimate is price may be stuck in the $300 to $370 range over the next 3-6 months.

StockCharts.com – Netflix, 18 Months of Price & Volume Changes, Author Reference Points

Final Thoughts

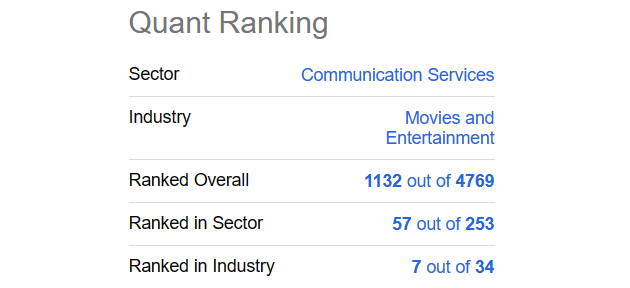

Do I suggest Netflix as a Sell idea today? No, an “average” market performer or Neutral rating is where I stand. Seeking Alpha’s computer-sorting Quant Ranking is more optimistic than I am, with a Top 20% position in the entertainment industry and Top 25% score out of a total universe of 4,769.

Seeking Alpha Quant Ranking – Netflix, January 22nd, 2023

With a market capitalization of $152 billion (almost the same as entertainment giant Disney) and slowing long-term growth projected in operating results the next 3-5 years, Netflix’s 40% per annum stock growth rate into 2022 is almost surely a story in the rear-view mirror. Consensus analyst estimates are projecting 20% annualized compounding in EPS into 2030. Solid, but not exceptional growth is the new normal for Netflix shareholders.

For a 2023-24 projection, I am thinking $300 to $425 per share will capture the vast majority of trading. Two wildcards for operations include the opportunity to merge with a large competitor (I have recommended Paramount Global in the past to gain a major network for content), and the potential rollout of a completely ad-supported plan (on top of the new plan started in November with an inexpensive monthly subscription setup partly supported with ads). Perhaps putting half the Netflix library on a free to consumer version will not take away the incentive for paid subscriptions and access to its full entertainment library.

Thanks for reading. Please consider this article a first step in your due diligence process. Consulting with a registered and experienced investment advisor is recommended before making any trade.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: This writing is for educational and informational purposes only. All opinions expressed herein are not investment recommendations, and are not meant to be relied upon in investment decisions. The author is not acting in an investment advisor capacity and is not a registered investment advisor. The author recommends investors consult a qualified investment advisor before making any trade. Any projections, market outlooks or estimates herein are forward looking statements and are based upon certain assumptions and should not be construed to be indicative of actual events that will occur. This article is not an investment research report, but an opinion written at a point in time. The author’s opinions expressed herein address only a small cross-section of data related to an investment in securities mentioned. Any analysis presented is based on incomplete information, and is limited in scope and accuracy. The information and data in this article are obtained from sources believed to be reliable, but their accuracy and completeness are not guaranteed. The author expressly disclaims all liability for errors and omissions in the service and for the use or interpretation by others of information contained herein. Any and all opinions, estimates, and conclusions are based on the author’s best judgment at the time of publication, and are subject to change without notice. The author undertakes no obligation to correct, update or revise the information in this document or to otherwise provide any additional materials. Past performance is no guarantee of future returns.