Summary:

- New Oriental’s stock has surged 181% this year due to the recovery in China’s education and domestic travel market.

- The company has successfully navigated regulatory changes and is poised to benefit from industry consolidation.

- New Oriental is expanding into the booming study abroad and overseas education market, as well as the senior tourism market.

- Despite current valuations being below 2020 highs, the company’s strong fundamentals and diversification into tourism indicate potential for further growth.

SW Photography/DigitalVision via Getty Images

New Oriental’s Stock Surge and Market Recovery

New Oriental’s (NYSE:EDU) stock has skyrocketed 181% so far this year, primarily benefitting from the recovery in China’s education market. As the top dog in China’s tutoring space, New Oriental stands to win big thanks to shifts in the competitive landscape, making it a stock worth watching for investors.

Investment Thesis

Our bull case on New Oriental boils down to three key pillars:

First, the company has adeptly navigated turbulent regulations to likely emerge as a winner as the tutoring industry consolidates.

Second, it displayed strong execution in expanding into new travel verticals by leveraging existing capabilities.

Finally, profits and revenues rebound sharply to drive record free cash flow generation, even as shares remain depressed.

With a bright growth outlook as New Oriental penetrates the massive tourism market, we see substantial upside potential. So with fundamentals inflecting up even as valuations seem attractive, we rate shares a Buy.

Shift in Regulatory Approach and Impact on Major Players

Since Xi Jinping secured leadership for a historic third term, seismic changes are underway in how China structures its economy. From what we can tell, many American investors fail to fully appreciate this transformation, instead sticking to outdated views of Chinese capital markets.

One huge shift in how Chinese regulators are aggressively intervening in a way that’s upending the old winners. Former dominant players may struggle as upstarts challenge them — just look at Alibaba and Tencent. Since communist party chapters set up shop inside those companies, their stock prices tanked.

The Case for PDD Over Alibaba

That’s why we’re bearish on Alibaba (BABA) but bullish on PDD (PDD). PDD aligned itself to Beijing’s priorities by focusing on agriculture and rural development. So despite economic headwinds, it saw explosive growth by satisfying consumer demand and government preferences. Lots of US investors love Alibaba because of its reverence for Munger and Ali’s fundamentals. No doubt Munger is a sharp judge of quality businesses. But Munger lacks on-the-ground expertise in navigating China’s culture and political system. He largely delegates China investments to his guy Li Lu.

The key thing to understand is communist regimes have way more sway over private firms compared to US oversight. So while Alibaba boasts strong fundamentals, regulatory whims carry more weight in determining success here versus in a free market economy.

New Oriental’s Strategic Moves Post-Pandemic

The same dynamic is at play with New Oriental here. When Beijing cracked down hard on the education industry in 2021, they aimed to increase control – not destroy it altogether. A key change is that regulators mandated all tutoring companies register as non-profits. And their operations now require government approval rather than just filings. As a result, tons of players failed to get licenses.

But New Oriental emerged as a policy winner, even if management was subtle about it on the earnings call. For investors who understand the Chinese system, this regulatory overhaul handed New Oriental a golden ticket to cement dominance given drastically reduced competition.

And on supply side, after the COVID and the policy, we have seen a lot of players disappear from the market. So that means we’re facing less competition. So I think the existing business, including the overseas related business and the adult and college students business, I think we will generate the top line growth very good in the next two to three years.

In our view, despite communist rhetoric around equality, officials pick favorites all the time to further policy goals. New Oriental fits Beijing’s vision to consolidate the fragmented tutoring space under a few big banners that are easier to oversee. So government directives that look destructive on the surface can solidify the position of well-connected companies like New Oriental.

New Oriental founder Yu Minhong’s extensive political ties likely grease the wheels too. He holds prestigious positions like National Committee Member of the Chinese People’s Political Consultative Conference, executive with the Communist Youth League, vice chairman of the All-China Youth Federation, and more. For investing in China, whether founders have backing from Beijing is crucial intel.

Expanding into the Booming Study Abroad and Overseas Education Market

For starters, China’s study abroad industry bounced back to RMB $310 billion this year, rising 12% after the pandemic gutted it. As flight routes reopen post-COVID, overseas applications should continue recovering.

Just look at US universities – for the 2022-2023 season, nearly 750,000 students applied for undergrad, up 25% over pre-pandemic levels. With over 65,000 international applicants, China remains the top source country. As US-China travel restrictions ease, we could see the growth rate in Chinese students heading there pick up pace.

New Oriental called out robust demand growth in education, especially for overseas learning services. With an appetite for tutoring rebounding post-COVID, it’s bullish on expansion. Specifically, management looks to boost learning center capacity by 15-20%.

With regards to the learning center and classroom space, we plan to increase our capacity by about 15% to 20%, by which a reasonable amount of new learning centers is expected to be opened.

East Buy Live-streaming Success and New Ventures

In addition, New Oriental is executing a multi-platform strategy for its East Buy Selection live-streaming program via Douyin, Taobao, and its app.

A year ago, East Buy shot to fame overnight for its bilingual sales pitches and knowledge-sharing model. It finally gained traction after previous false starts in live commerce for New Oriental. Back then East Buy focused on farm goods and daily necessities.

But it gradually shifted outdoors – wandering scenic areas while live-streaming and peddling local specialties. Then tourism products entered the mix. On July 19th, New Oriental formally launched a culture and tourism subsidiary, followed by an announcement on July 21st to officially pursue this new vertical. The goal is to tap into heritage tourism and cultural travel. New Oriental backed this new initiative with a RMB $1 billion capital injection, showing its commitment.

Well before its recent tourism subsidiary launch, New Oriental already expanded East Buy Selection’s live-streaming sales to cover travel products. Last November, it kicked off an East Buy spinoff channel called “See the World.” In just three months, See the World has nearly 3 million followers, over 1,000 posts, and 173 million likes. It’s hosted close to 90 live-streaming sessions already. So clear early traction.

Tapping into the Senior Tourism Market

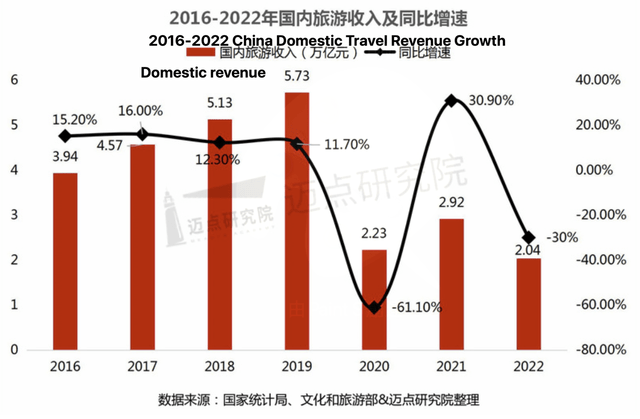

With its tourism push, New Oriental is wisely targeting seniors – a demographic with major wanderlust and money to burn. Surveys show Chinese travelers aged 60+ have averaged 23% annual spending growth on tourism since 2016. Last year alone they dropped over 1 trillion yuan on trips. Seniors now account for over 20% of Chinese travelers. Their continued demand expansion makes them a lucrative focus area. Although the market isn’t short on senior travel products, more customized, experiential mid-to-high-end offerings remain sparse. New Oriental’s fledgling tourism unit has already established local branches across provinces like Shaanxi, Gansu, Zhejiang, and Xinjiang. It dropped various tour packages priced from $4000-6000 RMB. Take Xinjiang – its western region saw a red-hot 90% government spending budget increase for travel in 2022. As Beijing pushes domestic consumption, New Oriental might bet big on properties here. Aligning with government tourism aims also helps mitigate regulatory risk should new tightening arise.

Competitive advantage

New Oriental wants to be their go-to for aspirational excursions across China and abroad. Early data suggests East Buy’s hosts and curated local insights resonate with older viewers. As an educator, New Oriental is well-positioned to deliver more interactive, enriching excursions. Its teachers bring communicative flair and extensive knowledge to animate tour guide roles. Their deeper dives into local history, culture, and nature help the brand stand out. The live-streaming format also enables two-way engagement unseen in traditional packaged tours. New Oriental can leverage its agricultural and rural roots here too – combining live-streamed farm and village tours with its budding tourism play.

Given its RMB 1 billion capitalization, heavy asset investments seem likely beyond guided excursions. Most Chinese attractions still lack robust commercial planning, so New Oriental could leverage its storytelling skills for destination development.

Valuation

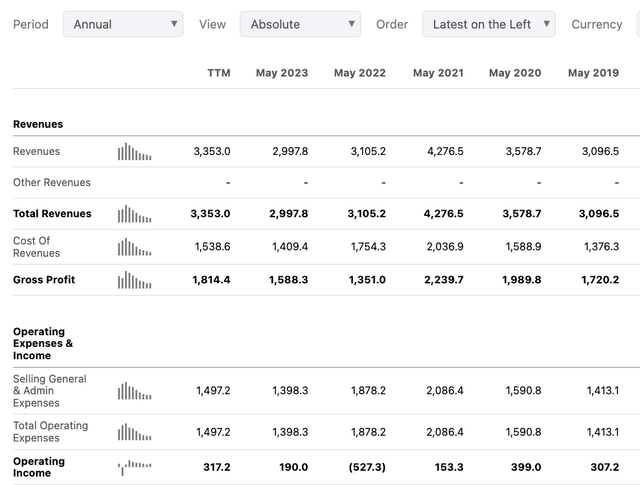

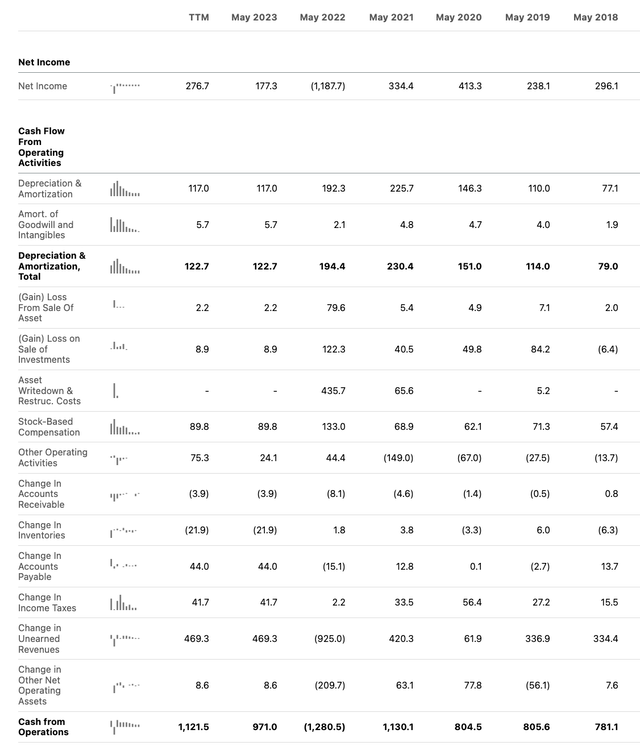

New Oriental still trades below its 2020 highs.

But with profits bouncing back to pre-pandemic levels and free cash flow reaching new highs, recent share price gains make sense. Still, further upside seems likely given a couple of key tailwinds:

First, New Oriental emerged as an apparent regulatory favorite based on Beijing’s industry consolidation agenda. Management sees ample runway to keep gaining market share and pushing earnings higher amid lessened competition.

Second, domestic tourism in China totaled RMB $2 trillion last year – over 6x tutoring’s market value. So if New Oriental leverages its teaching talent to carve out a slice of surging senior travel demand, substantial value could still get unlocked. So at ~36x forward earnings, New Oriental still looks reasonably priced given the dynamics at play.

National Bureau of Statistics of China, Ministry of Culture and Tourism of PRC

Risk

Tourism ventures typically take years to pay off, so picking winning projects and building standout in-house IP pose tough tests.

Delivering quality travel hinges on securing extensive offline resources – attractions, hotels, transport, and dining. Moreover, as the sector shifts from resource-driven to creativity-driven, visitors want more unique, experiential offerings. That pressures talent needs in product design where New Oriental is unproven.

Right now its advantage lies more with teachers turned tour guides or guest services via training. However, teachers don’t make great sales reps to negotiate partnerships across the fragmented travel supply chain.

So in the near term, New Oriental must still rely on established online travel agencies and veteran suppliers to assemble components. Integrating the full value chain is no small feat for any new entrant. Industry veterans with over a decade of network building maintain an edge that could take years to replicate.

The key uncertainty is whether New Oriental can inject enough educational creativity to offset its backend weaknesses in areas like operations and distribution. While senior travelers present a target demographic sweet spot, extracting that value profitably demands comprehensive tourism capabilities.

Conclusion

With Xi reshaping markets, investors need to pick stocks with minimal regulatory risk. New Oriental’s resurgence despite the turmoil signals it likely won official backing for its strategic direction.

We also see promising new growth shoots that showcase business diversification skills. On valuation, continued education share gains plus budding tourism traction should unlock substantial upside.

So for a quality brand that aligned itself to policy tailwinds, the current multiple looks attractive. Major competitive and sector developments could extend its rebound. That’s why we rate New Oriental a Buy.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of EDU either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.