Summary:

- In 2023, AI and the Magnificent 7 took the lead, leaving non-tech blue chip companies trailing behind in the rearview mirror.

- Abbott Laboratories had a difficult last three years, with its stock price trading sideways as sales driven by COVID-19 plummeted.

- Yet, Abbott operates a recession-proof business model with long-term tailwinds, its core business growing at double digits.

- I expect 2024 to mark a return to high-quality dividend growers as rates decrease and cash deposits no longer yield desirable returns.

- Abbott is a defensive business poised for high single-digit returns, boasting a 1.83% yield and double-digit DGR.

onurdongel

As we wind down to the end of 2023, it’s safe to say this year has been quite a ride. It caught many, myself included, by surprise in terms of market expectations and the performance of various companies. While the (SPY) has seen a 20% return this year, the discussion around interest rate hikes, recession fears, and a slowdown in consumer spending led to the equal weight index (RSP) delivering only a 6.6% return. It even went negative briefly a few weeks back before the November stock rally came into play.

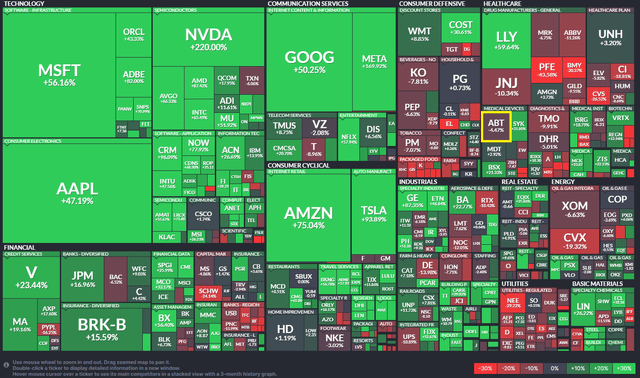

One standout this year has been the AI narrative, which gave a boost to the “Magnificent 7” companies: Microsoft (MSFT), Apple (AAPL), Nvidia (NVDA), Google (GOOGL), Amazon (AMZN), Meta (META), and Tesla (TSLA). Additionally, the buzz around diabetes drugs or GLP-1 agonists from Elli Lilly (LLY) and Novo Nordisk (NVO) has sent their stocks soaring. I won’t make any claims about these companies being overvalued, but take a look at the sea of green among the Magnificent 7 and a handful of other stocks in the chart below and judge for yourself the unequal returns this year.

YTD Returns (FINVIZ)

This leads me to the thought that while it’s not surprising to see a few great tech businesses dominating returns, I find myself in a position where I don’t anticipate the Magnificent 7 replicating their stellar performance next year. Instead, I’m gearing my portfolio towards high-quality companies that stand to benefit from potential rate cuts while also being well-prepared in case of a mild recession. If the rate cuts come through as early as Q2/Q3 2024, the days of getting a 5% return on short-term cash deposits might be behind us. In that scenario, I anticipate investors to flock back towards the dividend aristocrats (NOBL) which have returned only 2.4% this year, but are an attractive option for investors in search of yield.

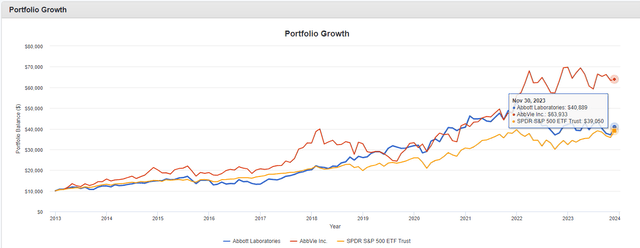

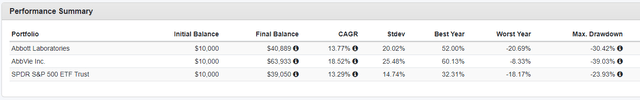

Speaking of companies topping my list as a good investment for 2024, Abbott Laboratories (NYSE:ABT) is among the top few. It’s all about that high-quality, recession-resilient business model. Not only does it wear the crown as a dividend king with 51 consecutive years of dividend increases, but it’s consistently outperformed the market over the past decade. Consider this: if you had invested $10,000 in Abbott back in January 2013 and reinvested the dividends, you’d be sitting on a hefty $40,889 today. That’s a solid 13.77% CAGR return over the period. And here’s the cherry on top: if you held the stock before January 1st 2013, you would’ve even received stocks from the AbbVie spinoff (ABBV), which has seen an impressive 18.52% CAGR growth, thanks to its blockbuster drug Humira. That’s how great Abbott’s leadership is in unlocking shareholder value.

Growth of $10,000 Invested (Portfolio Visualized)

You could make the case that over that period, the market returned a 13.29% CAGR, just a tad lower than Abbott’s $40,889 total return, while also showing slightly lower volatility. But it’s worth considering that the market had a robust 2023, whereas Abbott faced a downturn with its stock down 4.47% Year-to-Date. Historically, Abbott has outperformed the market in most years, so there’s more to the story than just the recent performance.

% Returns (Portfolio Visualized)

As of today, Abbott is trading at a Forward PE Ratio of 23.54x its FY24 earnings, roughly 5% below its five-year average. This gives investors a bit of a margin of safety. Add to that the 1.83% dividend yield, and it becomes quite an enticing prospect for anyone building a dividend growth portfolio or seeking a defensive addition to their investments.

Let me show you why I like this sleep-well at night dividend king today.

Well-Diversified Business With Long-Term Tailwinds

Abbott isn’t your typical healthcare company focused solely on pharmaceuticals. Instead, it’s more of a hardware tech company within the healthcare sector, earning most of its revenue from diagnostic products and medical devices, particularly in areas like cardiovascular devices such as stents and heart rhythm equipment like defibrillators. Abbott also specializes in diabetes care with its glucose monitoring systems and offers other devices in diagnostics, neuromodulation, and eye care.

| Sales Q3 2023 | Sales | % Of Total |

|---|---|---|

|

Medical Devices |

4,249 | 41.9 % |

|

Diagnostics |

2,449 | 24.1 % |

|

Nutritional Products |

2,073 | 20.4 % |

|

Established Pharmaceuticals |

1,368 | 13.6 % |

Abbott’s business is riding the wave of long-term shifts, especially as our population ages and new health challenges arise, demanding better solutions for heart disease, cancer, and chronic illnesses. Luckily, Abbott’s diverse lineup puts it in a prime position to tackle these upcoming healthcare needs.

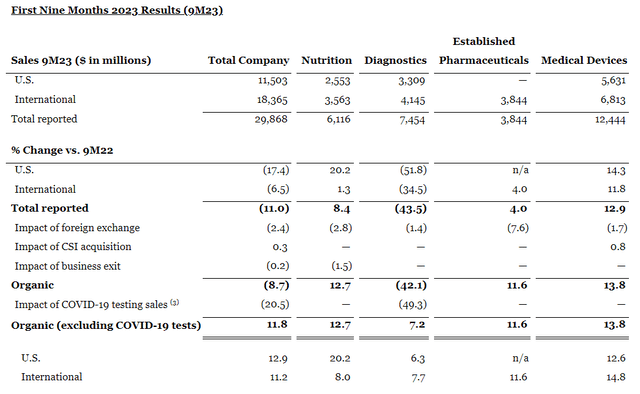

However, after the peak of the COVID-19 pandemic, Abbott saw a drop in sales. They had been running hot with their lab-based COVID-19 tests, but as things normalized, sales dipped by 8.7% on an organic basis in 2023. That decline mainly came from the expected reduction in COVID testing-related sales.

Yet, if you take out the COVID-related sales, Abbott’s core business showed impressive organic growth of 11.8% over the first nine months. That’s a solid indicator of a strong foundational business with most of the business segments showcasing double-digit growth.

9-month ended Earnings ABT (ABT IR)

Some analysts argue that the new GLP-1 drugs might threaten Abbott’s diabetes devices business. But it’s unclear how effective these drugs will be in the long run and what impact they’ll have on Abbott’s sales. Abbott actually analyzed how people use both its FreeStyle Libre continuous glucose monitor and the popular GLP-1 drugs from big pharma companies like Novo Nordisk and Eli Lilly for Type 2 diabetes management and weight control.

From what Abbott found in insurance data and their own analysis, they believe there’s a mutual benefit between CGM devices and GLP-1 drugs. Users seem to stick more to both methods when they use them together. Abbott suggests that this combo could work well because CGM devices, like their own, provide vital health information, helping users understand how their lifestyle affects their glucose levels.

In Q3, sales of the FreeStyle Libre continuous glucose monitor surged by almost 31% to reach $1.4 billion. The number of global users has climbed to 5 million, with 2 million in the U.S. alone, showing nearly a doubling of the user base over the last two years. This growth happened despite investor concerns about the potential effect of weight-loss medications on demand.

Thanks to a robust Q3 performance, Abbott adjusted its full-year 2023 earnings forecast, expecting earnings per share between $3.14 to $3.18 and adjusted EPS ranging from $4.42 to $4.46. This upward trend represents an increase around the middle of their projected range.

For the entirety of 2023, Abbott maintains its anticipation of low double-digit organic sales growth, excluding any sales related to COVID-19 testing.

“Long Live The King” of Dividends

Abbott has been a dividend payer since 1924, clocking in an impressive 399 consecutive quarterly dividends. That streak places it among the companies with some of the longest-running dividends, trailing slightly behind Colgate-Palmolive’s (CL) streak of 128 years.

This means Abbott not only survived but continued paying dividends through major historical events like The Great Depression, World War II, the Cold War, the Great Financial Crisis, and numerous other challenging times when naysayers were calling the end of the world.

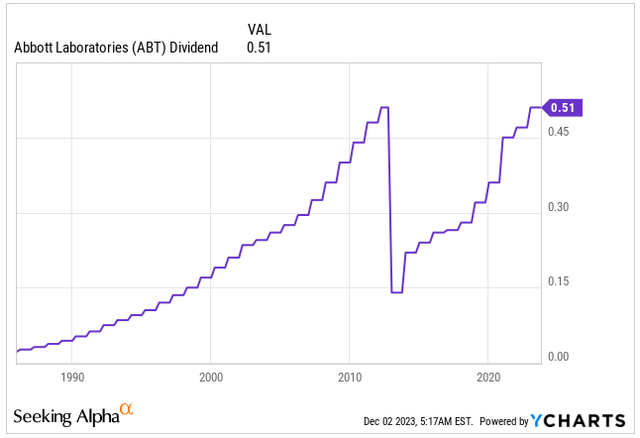

Currently offering a 1.83% dividend yield or $0.51 per share, Abbott might not have the highest yield, but its solid 47.6% payout ratio ensures the dividend is well secured. Over the last five years, Abbott has consistently raised its dividend at an impressive rate of 12.74%.

You might be wondering about the dividend drop in 2013. That drop was a result of the AbbVie Spin-off mentioned earlier. AbbVie currently yields dividend around of 4%.

Even in the midst of a challenging 2023, Abbott committed to its shareholders by increasing the dividend by 8.5% last December. This signifies a dedication to returning cash to investors, despite the difficulties faced.

I’m expecting the next dividend increase to be announced in the upcoming week. Based on recent trends, I anticipate an upper single-digit raise, possibly hinting at a return to double-digit increases by the end of 2024.

Dividend per Share (Seeking Alpha)

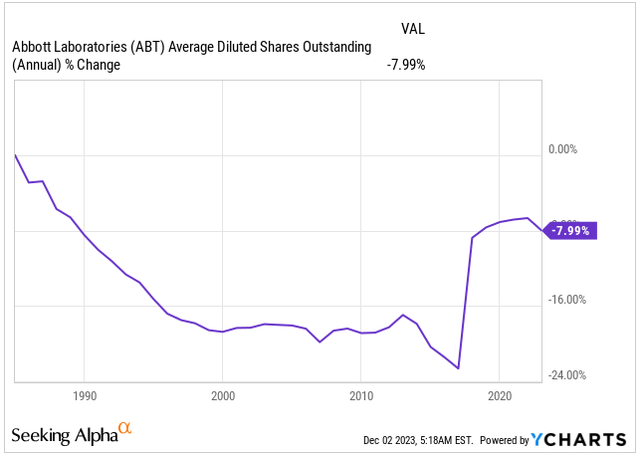

When it comes to buybacks, Abbott has a history of repurchasing shares, but it tends to also employ shares for M&A activity. A notable instance occurred in 2017 when Abbott acquired St. Jude Medical, a move aimed at expanding its chronic pain management business and significantly strengthening its cardiovascular device offerings.

However, this deal resulted in dilution for existing shareholders as roughly half of the $25 billion deal was financed using stock. As a result, the impact of buybacks on long-term stock appreciation might not be as substantial due to this utilization of shares for strategic acquisitions.

Shares Outstanding (Seeking Alpha)

Not Cheap, But Recession-Proof

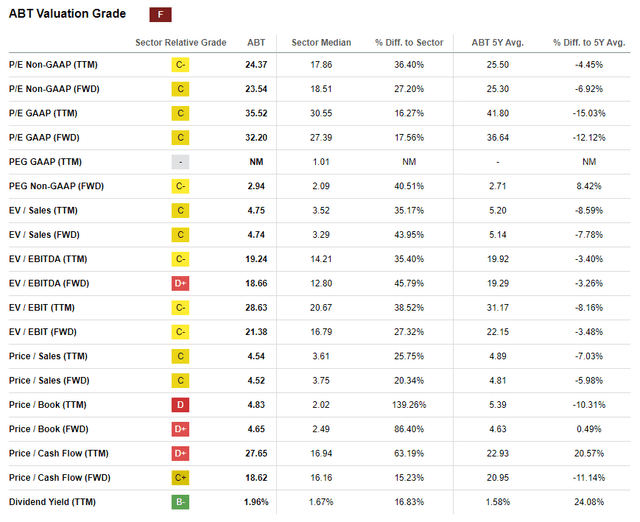

Abbott isn’t exactly a bargain when you stack up its valuation against the healthcare sector, hence the “F” Valuation grade from Seeking Alpha.

The healthcare sector’s median PE ratio sits at 17.86x, while Abbott’s clocks in at 24.37x its FY23 earnings, presenting a hefty 36% premium.

However, it’s crucial to assess Abbott’s valuation in the context of its unique business model, which isn’t as heavily threatened by patent cliffs compared to more traditional drug makers like Pfizer (PFE), Johnson & Johnson (JNJ), or Merck (MRK).

While Abbott does grapple with some patent expirations and risks of certain business areas becoming outdated (such as the possible long-term impact facing its diabetes portfolio from GLP-1 drugs), I still see it as a top-tier, resilient business that’s defensive even in recessions. That’s why I believe it deserves a premium.

The Forward PE Ratio currently stands at 23.52x, a modest 7% dip compared to its 5-year average. Similarly, the Forward EV/EBITDA is at 18.66x, about 3.5% lower than its 5-year average.

All things considered, Abbott is trading at approximately a 5% discount to its fair value. While it might not seem like a significant markdown, it’s pretty rare to find such high-quality business at any discount at all.

Valuation Grade (Seeking Alpha)

In 2023, Abbott faced significant challenges due to the sales plummeting since the COVID-19 pandemic. During the pandemic, the company saw a substantial boost in sales from lab-based tests detecting COVID-19 antibodies in the blood. As a result of normalization, 2023 resulted in a tough comparison, and it’s anticipated that the company will report an approximately 17% decrease in EPS, coming in around $4.43.

Looking ahead, 2024 is expected to mark a turning point toward a post-pandemic normal for Abbott. Analysts project a resumption of EPS growth, averaging around 6.5% annually until 2027. By the close of that year, the expected EPS could reach approximately $6.04.

If these analyst projections materialize and Abbott returns to trading at a normalized Forward PE Ratio of roughly 25x its earnings, it’s plausible to anticipate the stock reaching $151. This implies a stock appreciation of about 7.7% CAGR. Factoring in the approximate 2% dividend yield, a total annual rate of return around 9.5% between the present day and 2027 seems reasonable.

| Fiscal Year | 2023 | 2024 | 2025 | 2026 | 2027 |

| Revenue (b) | $ 40.1 | $ 41.7 | $ 44.7 | $ 47.3 | $ 50.1 |

| Revenue Growth | -8.2% | 4.0% | 7.1% | 5.8% | 6.1% |

| EPS | $ 4.43 | $ 4.62 | $ 5.13 | $ 5.56 | $ 6.04 |

| EPS Growth | -17.1% | 4.3% | 11.0% | 8.4% | 8.6% |

| Forward PE | 23.5 | 24.0 | 25.0 | 25.0 | 25.0 |

| Stock Price | $ 104 | $ 111 | $ 128 | $ 139 | $ 151 |

Conclusion

Abbott Laboratories is a dividend king, with a history of paying dividends for nearly a century. The company faced a challenging last three years, with its stock price largely stagnant despite surging sales during the COVID-19 period. However, the stock has been under pressure ever since the normalization of the sales.

Nevertheless, the company’s core business is thriving, demonstrating double-digit growth in Q3, a trend expected to continue through Q4 and the entire fiscal year.

The stock is currently trading at a Forward PE of 23.43x, which isn’t particularly cheap. Yet, considering Abbott’s high-quality business and recession-proof model, I believe investing in Abbott today is promising with expectation of high single digit gains for 2024 and beyond.

I’ve taken advantage of the opportunity and purchased shares as the stock price fell below $100. I don’t intend to sell, as I consider Abbott a solid core holding for any dividend growth portfolio. Its healthy dividends continue to grow at double-digit rates.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of ABT, ABBV, MSFT, GOOG, SPY either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.