Summary:

- NextEra Energy has experienced a volatile year, with a 30% decrease in stock price, presenting a buying opportunity for 2024.

- Despite negative market sentiment and a misunderstanding of its subsidiary’s impact, NextEra Energy remains financially strong and undervalued.

- Modeling NextEra Energy value reveals 40% expected appreciation across 2024.

pidjoe

Thesis:

NextEra Energy (NYSE:NEE) has had a surprisingly volatile 2023 for a blue-chip utility stock and is currently down 30% across the last year. This extreme weakness represents an opportunity to be greedy and accumulate shares for a promising 2024. Pairing strong dividend growth, a commanding positioning in the industry, and a picture-perfect macroeconomic backdrop for utilities make NextEra Energy a strong buy with significant upside for 2024.

Overview:

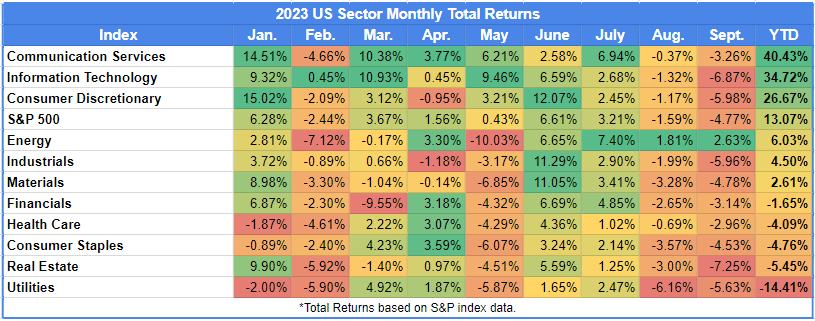

NextEra Energy is a utility sector giant that produces clean electricity through holdings in solar and wind energy. The company has over 6 million customer accounts, largely through its main business unit, Florida Power and Light, which has historically accounted for around 90% of its revenues. NEE is also a highly favored titan and has both the highest market cap of any utility and is the largest component in utility ETF offerings from Vanguard and Blackrock. However, 2023 has been a downright brutal bludgeoning for utilities.

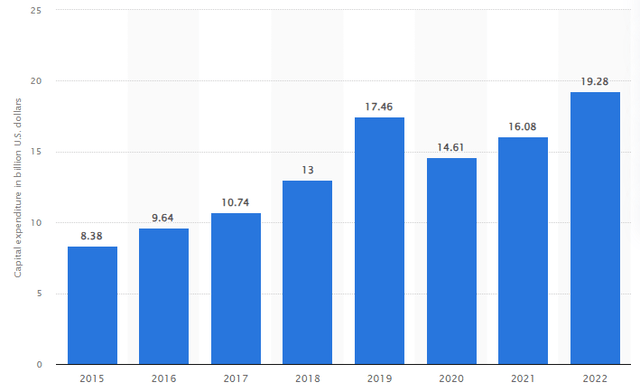

2023 Sector Returns (Novel Investor)

Ignoring the returns since the start of the break-neck end-of-the-year rally, utilities have underperformed every sector of the broader market- and have not just had a negative return, but also underperformed the market by almost 30%. The reason for this drastic price action is the rapid change in interest rates spurred by the Fed’s combat with inflation. The interest rate hiking cycle impacts utilities two-fold. Primarily, as yields rise, the marketplace for income investment becomes far more competitive, and demand for shares of dividend growth companies declines as the risk-free rate increases. Additionally, companies with significant amounts of debt payments to support their asset base, such as NEE, are hit again as interest expense balloons in reaction to the expansion of the fed funds rate.

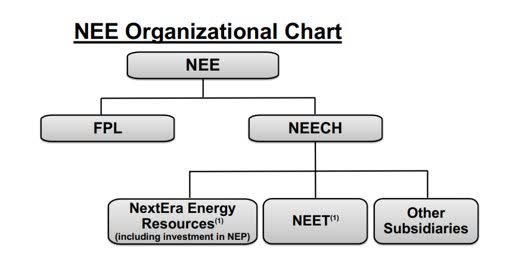

Further compounding the headwinds for NEE, important company-related news also clobbered the stock price in 2023. This fall, a subsidiary of the company, NextEra Energy Partners, LP (NEP) announced a cut on their forecasted dividend and EPS growth outlook. This news immediately collapsed the share price for NEP, and interestingly, the fear spread to NEE immediately and the stock fell more than 20%. However, looking at the actual corporate structure and revenue breakdown, it becomes clear that this was a fundamental misunderstanding of the market that repriced the stock far below the actual impact on the fair value.

NEE Corporate Structure (NEE Investor Relations)

NEE operates through multiple subsidiaries. This makes it possible for them to generate excess revenues through selling their production or storage capabilities. However, the bulk of their revenue comes from the operation of their retail residential market through Florida Power and Electric.

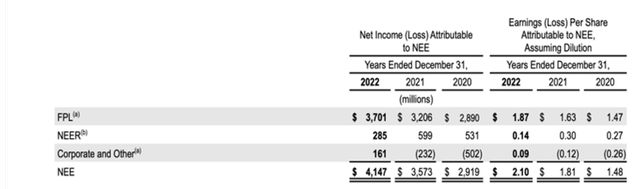

Revenue by Business Unit (NEE Investor Relations)

90% of the net income for the company was generated by FPL alone, and the actual business unit that includes the investment into NEP contributed a whopping 7% to the company’s bottom line. The market simply misunderstood the relationship between the subsidiary and NEE proper and discounted the future of NEE as if they themselves had slashed guidance. However, results and forward outlook remain strong- and this error by the larger market constitutes a buying opportunity. Investors who bought right after the downturn have already been rewarded with 20% returns in a few months, however, the valuation and financials for the company remain compelling.

Financial Analysis

As a utility, NEE has a massive asset base it uses to produce, store, and transport electricity. Currently, as of the last report filed, NEE has a staggering $120 billion in net property, plant, and equipment. So, while the company has no moat in terms of the product it sells, there are significant barriers to entry created by the massive asset portfolio that enhances the quality of the stock by reducing possible competition. However, the downside of this structure is the massive investment necessary to not just maintain these assets but grow production capabilities requires high yearly capex, high long-term debt, and minimizes the ability to buy back shares.

Capex has grown to a yearly outflow of almost $20 billion annually and historically has sat at around 2x the cash from operations, meaning that the company must issue debt to support their operations and pay shareholders dividends.

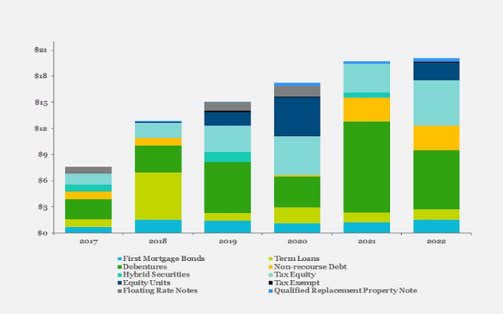

While this may seem to suggest a poor performative future for NEE, the company is strong, but these fundamental realities revolving around the sector are crucial to understand. A breakdown of the funding sources and debt obligations reveals that the company is quite adept at creatively keeping flexibility and remaining highly profitable.

NEE Funding Sources (NEE Investor Relations)

To support the debt burden and keep assets functional, the management team is able to access a wide variety of funding sources and has shown high levels of execution in order to proactively change the weights and debt structure to maneuver through a challenging and sometimes downright insane last five years.

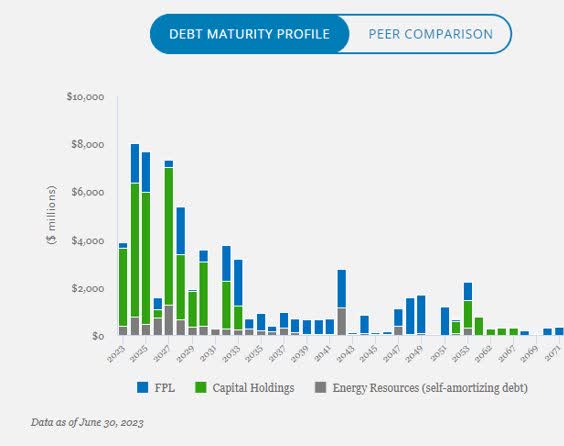

Debt Maturity for NEE (Investor relations)

Additionally, looking to ensure the company can remain solvent with the current debt commitments, the strong execution once again can be seen. Not only is the debt maturity for the next three years below the average repayment rate of more than $8 billion for the last five years but it also is structured in a way where 2023 is an outlier. So, the company has not just proved that they are capable of repaying the debt easily for the foreseeable future, but they have positioned themselves in a commendable manner. Due to the low debt repayments in 2023, the effect of higher interest rates should be partially mitigated in the future. Management will be able to control the amount of new issuance of debt, and using their unique mix of available credit, should be able to avoid material, long-lasting impacts from elevated interest rates.

Valuation:

Valuation to forecast share price or fundamental value of shares is essential and requires both an element of art and science. The common problem is that people tend to want to bend whichever common valuation technique they prefer and apply it to radically variable companies. To properly value then, the first step is to determine how the market values the company- and then to apply proper and conservative qualitative analysis to make the necessary projections.

In the case of NEE, it is clear that the main driver of value is the income generation the shares provide through the growing dividend. Additionally, as I have already shown, the massive asset base that drives high capex spend means that any valuation based on discounted cash flows will be extremely conservative. Therefore, in this case, the most accurate analysis will involve the growing dividend and some way of factoring in the macroeconomic backdrop that has shaped the returns for utilities across the past year.

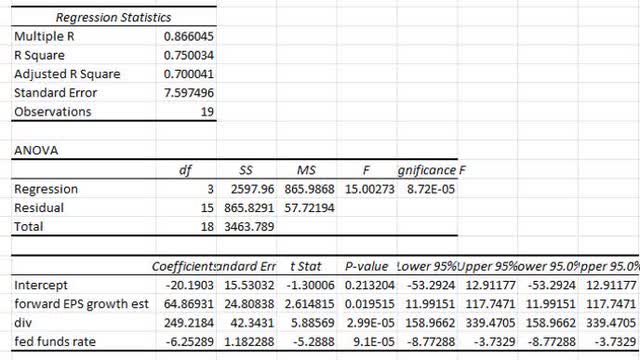

Using regression I created a model that can be predictive of an independent variable based upon various inputs. In this case, using just three variables- the EPS growth estimate, the quarterly dividend, as well as the fed funds rate, produces an equation predictive of around 75% of the price action.

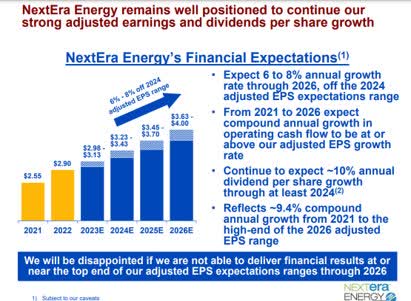

NEE Investor Presentation Guidance (NEE Investor Relations)

Using the forward guidance for next year provided during the latest investor presentation, it is now possible to put an end to 2024 price target. Additionally, the latest Fed meeting included forward guidance on rate cuts. The consensus of that meeting was for 75 basis points in rate cuts through the year. Combining this macro data, as well as the midpoint for growth rates provided by NEE, the target price for the end of 2024 is $86. Based on this target, NEE still has room to appreciate 40%, reaping the rewards of a macroeconomic setup perfect for utilities, as well as strong company performance and solid growth.

Risks to Thesis:

As an electric utility, NEE is positioned well to weather either a contracting or slowing economy in 2024. While particularly damaging economic conditions could be a headwind for the company, the core business would remain profitable and solvent. The true risk to the thesis then is potential changes to the projected dividend raises that would impact the valuation model.

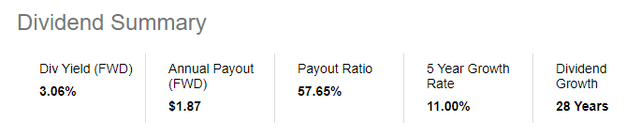

NEE Dividend Summary (Seeking Alpha)

The dividend history for NEE supports the core thrust of the thesis, however: that management has called for, and facilitated, double-digit dividend growth in the long term. Also, the growth has been supported by fundamentals and operations- and is not a goal that will cripple the company to achieve. For instance, across the last five years, cash flow from operations has averaged 13.2% growth, more than supporting the dividend expansion. In an extremely adverse situation for the entire economy, this growth could be negatively revised, and this would immediately change the valuation drastically, hurting the stock price and total returns. Additionally, monitoring the cost of funding, as well as the possibility of a goodwill impairment on the NEP investment would be prudent for any potential investor, though not as paramount to the fundamental value of shares as the dividend trajectory.

Conclusion:

NEE is a strong buy that is likely to see strong price action in 2024. Rate cuts will drive appreciation, and investors can comfortably hold a defensive blue chip with a market-beating dividend. NEE remains positioned to take advantage of any market conditions, and economic weakness would likely only act as a tailwind, as broad market weakness would spur additional buying of defensive names. With the valuation providing ample margin of safety, accumulating NEE at current prices is likely to generate strong returns in 2024.

Editor’s Note: This article was submitted as part of Seeking Alpha’s Top 2024 Long/Short Pick investment competition, which runs through December 31. With cash prizes, this competition — open to all contributors — is one you don’t want to miss. If you are interested in becoming a contributor and taking part in the competition, click here to find out more and submit your article today!

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.