Summary:

- JPMorgan Chase’s recent acquisition of First Republic is performing better than expected, contributing to a positive outlook for its Net Interest Income.

- The bank is experiencing strong growth in consumer credit card loans but expects more restrained performance on the wholesale side.

- JPMorgan’s asset and wealth management division is a lucrative sector, with consistent performance and a focus on technology investments for a competitive advantage.

champpixs

JPMorgan Chase (NYSE:JPM) recently presented at the Goldman Sachs conference. There were two important takeaways from the conference. Firstly, Net Interest Income is expected to be a positive tailwind for the bank as the First Republic transaction has performed better than modeled. Secondly, its focus on expanding its asset management business will continue to bear fruit and profitability for years to come. At current levels, JPM shares represent an attractive risk-reward for long-term focused investors.

Over the last decade, JPMorgan Chase has showcased remarkable strength in expanding its market share across key business segments, simultaneously honing its operations for consistent earnings. JPM’s growth has been cornerstoned by the “fortress like balance sheet” as defined by Jamie Dimon. JPM’s relentless focus on enhancing operational efficiencies has been a cornerstone of JPMorgan’s success story. By streamlining processes, optimizing resources, and leveraging technological advancements, the bank has positioned itself to operate more effectively and generate consistent earnings.

First Republic Acquisition Performing Better Than Expected

JPM’s recent acquisition of First Republic is expected to help provide a favourable tailwind to its business model. After finalizing a deal to acquire First Republic in May 2023, JPMorgan saw a 20% surge in deposits and managed to maintain relationships with 90% of their clientele, surpassing their projected performance. This success story from the deal contributes significantly to why JPMorgan’s forecast for their 2023 Net Interest Income (NII) has been optimistic. They’ve emphasized that while NII might experience a gradual decrease over the medium term, the outlook remains positive.

Furthermore, in 2023, JPMorgan is set to add 2 million net new checking accounts. Notably, around one-third of the gains in deposit shares have stemmed from new branches established within the last decade.

Consumer Remains Strong

JPMorgan highlighted the favorable momentum behind the expansion of credit card loans, which could positively impact Net Interest Income (NII). However, this growth would necessitate higher reserves for these new loans—a factor they emphasized as being underestimated by consensus models. Conversely, they anticipated a more restrained performance on the wholesale side.

In general, consumer well-being appears strong. JPMorgan hasn’t observed any unexpected weaknesses in particular sectors, and the normalization of consumer credit is slightly more positive than initially anticipated. While credit card trends have stabilized (projecting around 2.5% for FY23), home lending continues to reap advantages from write-downs originating from the Global Financial Crisis. However, the automotive sector exhibits signs of strain, indicated by increased delinquencies. Despite this, the supply chain’s ability to uphold prices suggests relatively limited losses in case of default. JPMorgan has adopted stricter measures, especially concerning auto loans with high loan-to-value ratios, even for borrowers with high credit scores.

Asset Management Set to Continue Growth

Although asset and wealth management (AWM) constitute a relatively modest portion, accounting for approximately 13% of revenues and 12% of earnings within JPMorgan, its significance transcends these figures. It plays a pivotal role in bolstering the entirety of JPMorgan’s operations and various other business segments. Moreover, AWM stands out as one of the most lucrative sectors within JPMorgan, boasting a Return on Equity (ROE) of 32% year-to-date, surpassing the management’s target of +25%. Its consistent performance is evident, averaging a 30% ROE since 2020 compared to the overall 18% ROE for JPMorgan.

The aforementioned investments in technology that JPM has made are also helping JPM’s AWM division. The management holds the view that technology investments throughout the organization will continue to provide a competitive advantage over its peers. Despite the majority of investments being smaller in scale, JPMorgan actively explores numerous deals and remains receptive to supplementing its organic growth through potential mergers and acquisitions (M&A).

During the investor day, management highlighted the long-term (3-5 year) targets set for the Asset and Wealth Management (AWM) division as of 2020:

- AUM flow growth of 4%, compared to 2% in 2022

- Revenue growth of 5%

- Pretax margin target exceeding 25%, YTD margin is 38%

- Seeking a Return on Equity (ROE) target above 25%, current 32% YTD

Valuations Remains Reasonable

Against the backdrop that paints a robust business that’s growing better than expected, JPM’s shares continue to trade at reasonable levels.

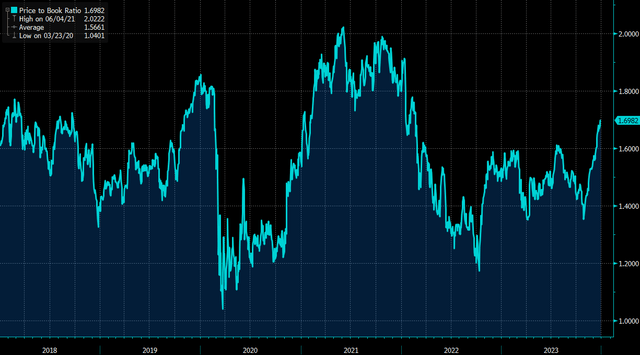

JPM’s price to book ratio has averaged around 1.56x over the past six years. It currently sits around 1.7x, which is slightly higher than average, but well off the highs of 2x price to book.

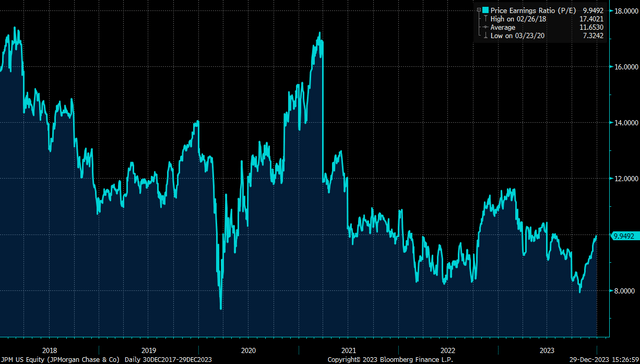

On a price to earnings ratio, JPM looks like a downright bargain.

It currently trades at 10x P/E, which is well below its 6-year average P/E of 11.7x.

It should also be mentioned that JPM has increased its dividend three times over the past five years. The current dividend yield stands at 2.5%. It is reasonable to expect that this yield will grow as the bank’s already gigantic business grows in the coming years.

As with most banks, the most important risk facing JPM is credit risk, market risk, and reputational risk. Credit risk increases occur when borrowers default on their loans, impacting the bank’s assets and profitability. Fluctuations in the financial markets can impact the value of a bank’s book value, creating market risk. For JPM, the probability of an outsized loss from the above is somewhat mitigated by its well-capitalized balance sheet. Perhaps the most important risk that JPM faces is reputational risk. Were it to occur, continuing negative publicity, scandals, or unethical practices could sour the confidence of the consumer towards JPM and damage a bank’s reputation and investor confidence.

In Conclusion

Over the last decade, JPMorgan Chase has showcased remarkable prowess in expanding its market share across key business segments, simultaneously fine-tuning its operations for consistent earnings. This has led to the creation of a robust balance sheet, aptly termed a “fortress” by its CEO. Anticipated ongoing market share increases and enhanced operational efficiencies are set to propel JPMorgan’s momentum further, sustaining the upward trajectory of its shares.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.