Summary:

- On top of a strong business model, NextEra also benefits from superior demographics in the sun-belt state of Florida, one of the fastest-growing states in the nation.

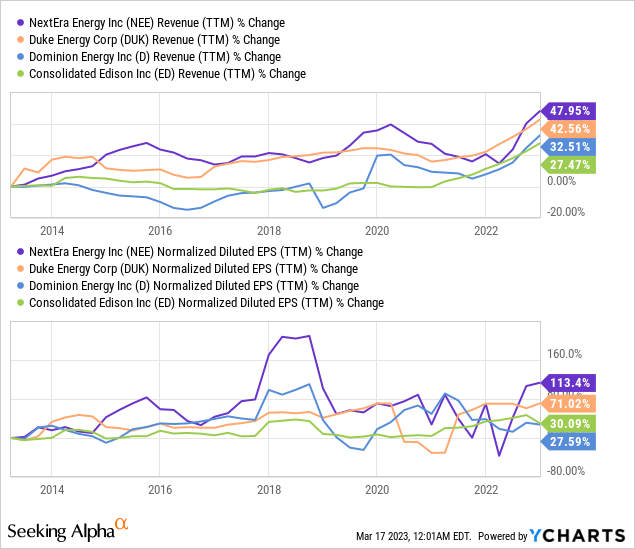

- NextEra has grown its revenues by roughly 48% over the last decade, though this might seem low, in the world of utilities, this is quite fast.

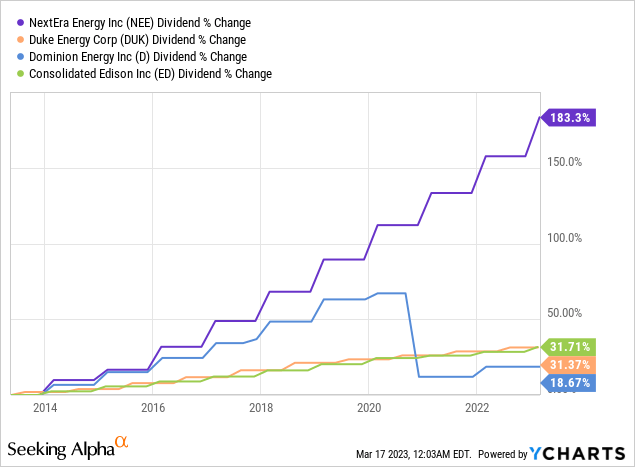

- Within the utility industry, high dividends are common, but what is often uncommon is fast dividend growth.

- NextEra is one of those rare exceptions that delivers on this metric having nearly tripled its payout over the last decade!

KeithBinns/E+ via Getty Images

Introduction

Florida, the sunshine state, is home to several icons, the Miami heat, and Disneyworld, but also, one of the best-performing utility stocks of the S&P 500, NextEra Energy Inc (NYSE:NEE).

NextEra energy is special within the utility industry boasting a growing regulated energy distribution network (Florida Power & Light) as well as a powerful stake in a growing power generation and transportation business through NextEra Energy Resources (NEP). Owning and controlling the regulated utility businesses provides predictable cash flow that the company can opportunistically deploy into higher growth investments such as solar farms through NEP.

On top of a strong business model, NextEra also benefits from superior demographics in the sun-belt state of Florida, one of the fastest-growing states in the nation.

Within this article, I’ll explore NextEra’s business performance from a strategic and financial perspective and provide my commentary as to where I believe shares could go from here.

Increased Demand = Higher Revenues

Let’s start with the fundamentals. Regulated utilities provide energy (gas, and electricity) to their customers at rates regulated by the local governments where they serve. The utility companies accept a lower price in exchange for, what amounts to, a state-approved monopoly.

With this arrangement comes pros and cons. On the pro side, you have very steady revenues in nearly all market cycles. On the con side, growth can be hard to come by. Steady revenues and low/no growth is why the industry is so attractive to many retirees looking for bond-like predictability.

But not all utility companies are devoid of growth, one company that has managed to buck that trend is NextEra. For the full year of 2022, NextEra grew its EPS from $2.55 to $2.90, over 13.7%! Considering how painful last year was for oh so many companies, 13.7% stands out as especially remarkable.

But How Did They Do It?

My view? Two reasons:

- An excellent regulated business

- NextEra Energy Resources.

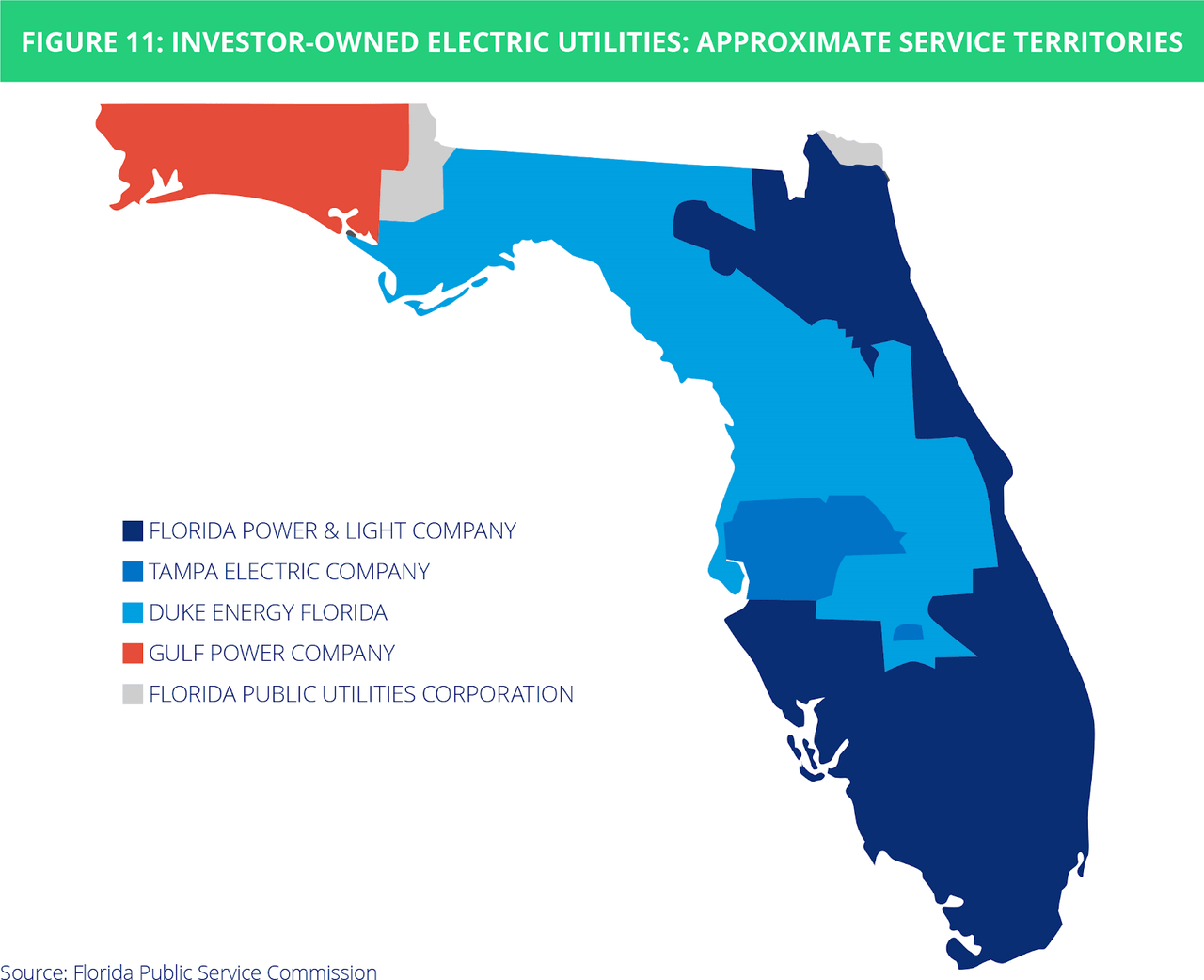

FP&L is the largest utility provider in the state of Florida controlling nearly the entire east coast of Florida, as well as a significant portion of South West Florida.

Florida Public Service Commission

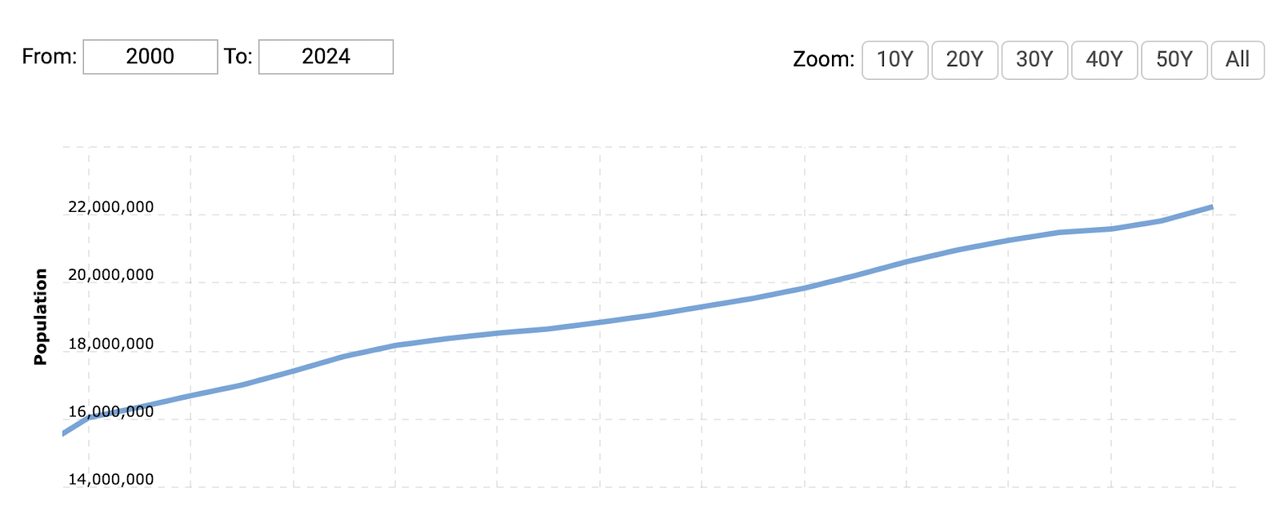

Since the start of the 21st century Florida’s population has grown like a weed soaring up from 16 million to over 22 million less than 25 years later. Florida’s population has grown so fast that in 2022 it took the top spot for population growth in the USA for its first time ever.

Florida’s low taxes and warm weather are attracting companies and retirees alike. It’s this author’s view that this trend can be expected to continue as Americans flee from high-taxed states like California and New York or colder areas more broadly, such as the northeast and the midwest. As more high-net-worth individuals relocate to low-tax states like Florida it may further strain high taxed states, leading to even higher taxes just exacerbating the problem.

Such population growth provides a rising tide of sorts, one that allows NextEra to earn more and more each year, driven by an ever-growing demand for electricity from the consumers and businesses moving in from other states.

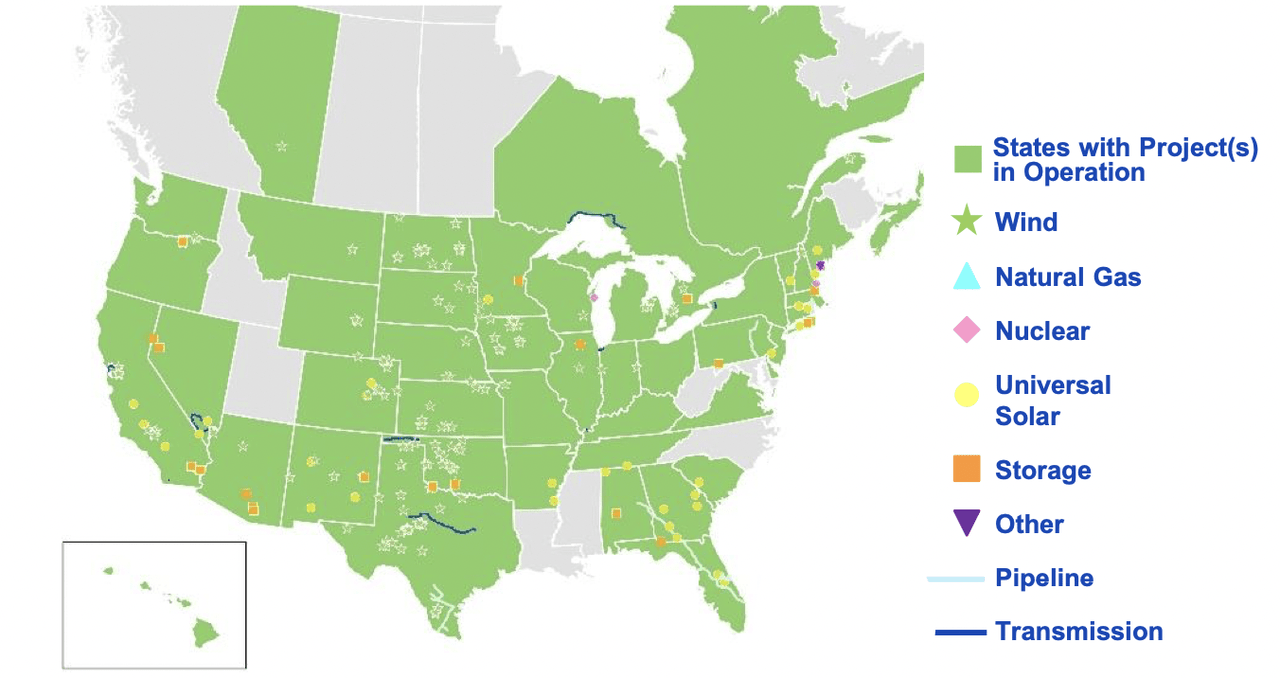

Further supporting NextEra’s growth are its initiatives at NextEra Energy Resources. While not the focus of this article, it’s worth noting that this subsidiary provides a substantial growth opportunity for the parent company through its different green energy projects.

NEP invests in wind, natural gas, nuclear, solar, storage, pipeline, and transmission projects around the entire country, not just Florida, allowing them to build where environmental and financial conditions are best.

These projects are often launched in tandem with a power supply arrangement whereby customers pay a predictable price for a set quantity of power over a long period. This provides financial predictability for the company and makes financing these large projects much more feasible. Its focus on green energy may allow them to sell its energy at a premium to companies and localities with a mandate to transition to green energy providing investors with additional upside.

Financials

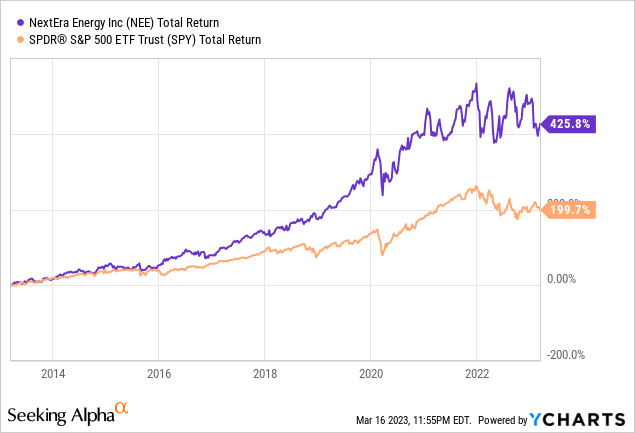

Speaking of upside, let’s take a look at how NextEra has performed versus some of its other peers. For this article, I want to highlight effectively these companies have been able to grow (both revenue and earnings), returns on invested capital, and dividend growth.

Revenue and EPS

Right off the bat, we start to see why NextEra is so popular as it has significantly outgrown compared to its peers. NextEra has grown its revenues by roughly 48% over the last decade, though this might seem low, in the world of utilities, this is quite fast. This 48% increase in revenue was enough to allow NextEra to double its earnings per share in the same period due to its operating leverage. Peers like Dominion (D) and ConEd (ED) were only able to generate 30% growth of their EPS in the same period highlighting NextEra’s relative strength.

ROIC

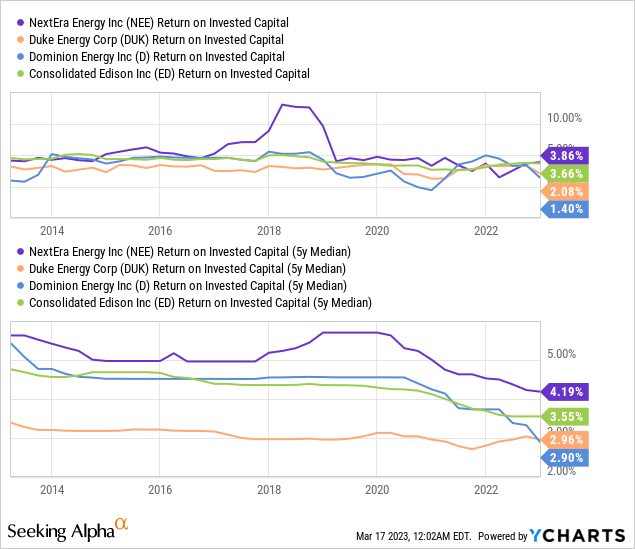

Shifting our attention to returns on invested capital we can see that all 4 of these companies score relatively low on this metric. This is due to the strong pricing regulations and the huge amount of capital required to invest in maintenance and new projects. Despite being lower overall, NextEra still boasts the highest ROIC among this peer group around 4% compared to its peers which are closer to 3%.

Dividend Growth

As a utility company, investors all but demand a dividend. Within the utility industry, high dividends are common, but what is often uncommon is fast dividend growth.

NextEra is one of those rare exceptions that delivers on this metric having nearly tripled its payout over the last decade! While this is impressive, I am expecting dividend growth to moderate going forward because over the long-term dividend growth should follow earnings growth, which appears to be closer to 10% based on its long-term track record.

Risks

No investment is risk-free, and yes, that includes steady growers like NextEra. To me, the greatest risk facing NextEra is the tightening financial conditions which are making debt and equity more expensive to issue. As the fed has raised rates banks have begun to slow lending, and investors are demanding greater returns forcing yields up. Higher interest rates drag asset prices lower making equity financing more expensive as well.

After last weekend’s bank failures, one might expect lending activity to remain lower than pre-covid levels, though this may be at least partially offset by the lower interest rates that have recently been priced in as investors doubt the fed’s ability to continue to raise rates given the extreme pressure exerted on several regional banks (KRE).

It’s hard to say what, if any, impact all of this will have on NextEra, but if the capital markets shut down, growth opportunities are likely to slow and would likely need to be funded with a greater mix of internal capital.

Valuation and Conclusion

In conclusion, NextEra Energy is a well-managed company that has shown some seriously impressive growth over the past decade. The company benefits from a strong regulated business through its subsidiary Florida Power & Light and a significant stake in the growing power generation and transportation business through NextEra Energy Resources.

Furthermore, the rapidly growing population in Florida provides a rising tide of demand for electricity, which is beneficial for NextEra’s growth. In terms of financial performance, NextEra has significantly outgrown its peers, generated strong returns on invested capital, and has best-in-class dividend growth.

These are all reasons why NextEra is a popular utility stock among investors, and the company’s growth trajectory suggests it might continue to be a solid investment…

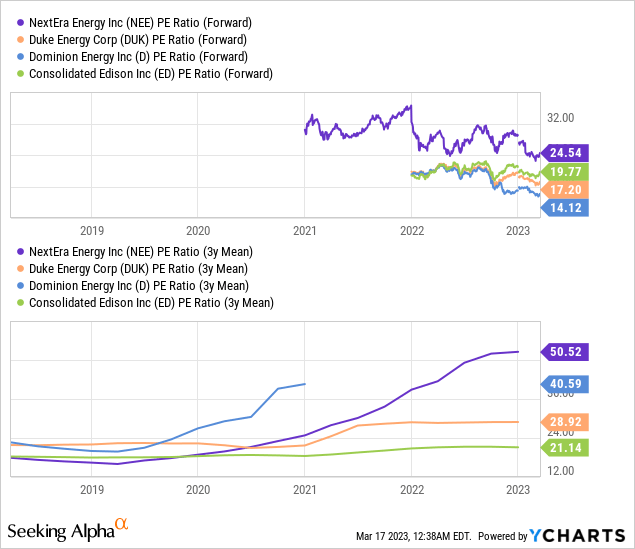

But looking at NextEra’s valuation compared to its peers it seems that the market has identified its superior business model by placing a premium multiple on its forward earnings at ~25x compared to its peers which trade between 14-20x forward earnings.

This puts investors in a difficult position, how much more is it worth paying for a great business versus a good business?

Given the heightened uncertainty in the market and the fact that 2-year treasuries yield more than 4% I’m not convinced that a 4% earnings yield growing in the low double digits is an attractive enough investment for me to consider making at this stage. If earnings came down to 20x forward earnings I would become much more interested in initiating a long position. For now, this company remains on my watchlist.

I rate NextEra Energy a Hold.

Thank you

I hope you enjoyed reading my article! If you enjoyed it or would like to discuss anything mentioned please let me know in the comment section. Cheers!

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Please note that this article is for informational purposes only and should not be construed as investment advice. It is important to do your own research and consult with a financial advisor before making any investment decisions.