Summary:

- NextEra Energy’s current dividend yield is way above its historical average, usually a sign for undervaluation.

- However, I will argue this signal is misleading in this case.

- The stock’s valuation is still trading at a premium compared to its industry.

- A consideration of its growth potential also shows it’s close to fair valuation and offers no obvious margin of safety.

Klaus Vedfelt

Thesis

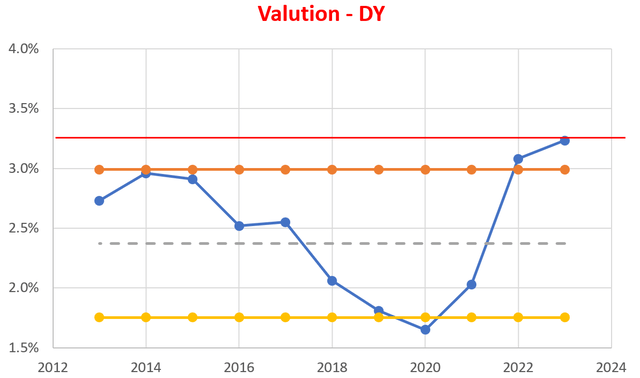

NextEra Energy, Inc. (NYSE:NEE) caught our attention in our monthly review of dividend stocks. In these reviews, we specifically look for stocks with yields out of their historical ranges. And NEE really stood out as you can see from the chart below. Its current yield sits at 3.23% (shown by the solid red line). It’s more than 1 standard deviation (shown by the orange line with symbols) above its historical average (shown by the gray dotted line). When something extraordinary shows up on our radar, we simply have to dig into it.

The goal of this article is to share what we’ve dug out. The results may be disappointing to investors who are looking for bottom-fishing opportunities. Our conclusion is that the stock has not found a bottom yet despite the large corrections in the past 1~2 years. In the remainder of this article, we will argue for this thesis based on the technical signs and business fundamentals.

Dividend yield and valuation

In a nutshell, we don’t think its current above-average dividend yield reflects discounted valuation. We view it as the deflation of its bubbling valuation in the past.

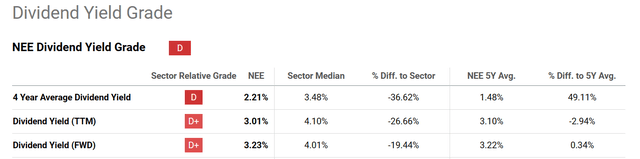

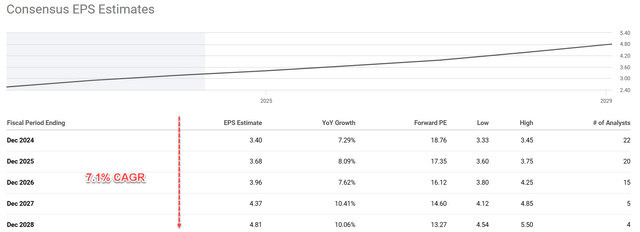

In years past, NextEra had been valued at a significant premium in terms of a much higher-than-average P/E multiple and much lower dividend yield, relative to its industry as you can see from the following two charts below. Its four-year average dividend yield was only 2.21%, more than 36% below the sector median of 3.48%. Even with the current the valuation, its shares are still trading at a large premium relative to the sector average by about 19.4% in terms of dividend yield and by about 21.5% in terms of P/E.

Of course, part of the premium can be justified given the quality of the business and its growth catalysts (more on this when I discuss the upside risks). My point is that there’s no obvious valuation discount here to offer any margin of safety. I will further elaborate on this when I evaluate its fair valuation in the next section.

Growth outlook and return projections

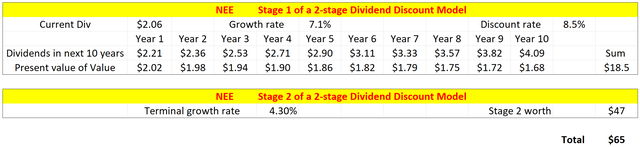

Given NEE’s consistent dividends (by the way, it boasts a dividend champion status), I will apply the discounted dividend model (“DDM”) to assess its fair price. In particular, I will use the following two-stage DDM model detailed in my earlier article:

There are a total of 3 key parameters in the 2-stage DDM: The discount rate, the growth rate in stage 1, and the terminal growth rate. For the discount rate, I relied on the so-called WACC, the weighted average cost of the capital model. The discount rate for NEE is about 8.5% on average in recent years following this model.

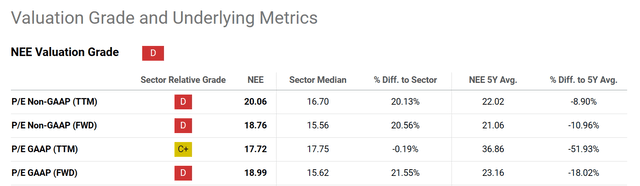

For the growth rate in stage 1, I will go with the consensus projections of 7.1% as shown in the next chart.

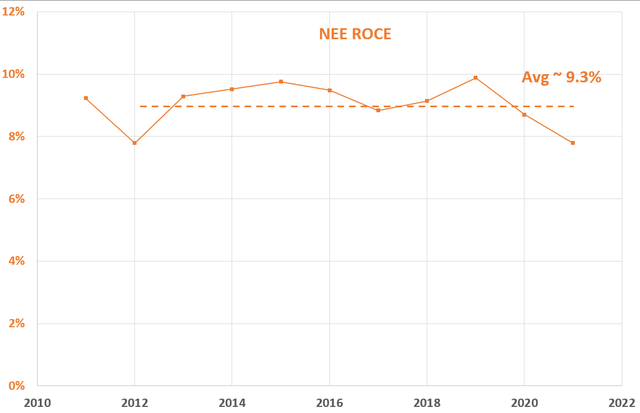

For the terminal growth rate in stage 2, my method involves the use of ROCE and reinvestment rate. The method is detailed in my other articles and I will just quote the end result here:

The method involves the return on capital employed (“ROCE”) and the reinvestment rate (“RR”). The ROCE for NEE is around 9.3% in the past as seen in the second chart below. Its RR is about 20% on average. With these inputs, NEE’s growth rate would be ~1.8% (9.3% ROCE x 20% RR = 1.8%). Note this number is the real growth rate without inflation. To obtain a notional growth rate, one would need to add an inflation escalator. Assuming an average inflation of 2.5% would bring the terminal growth rate to 4.3%.

Note that in this analysis, I excluded the results from the past two years. I consider those data points to be outliers due to sudden changes in NextEra Energy Partners, LP Common Units (NEP).

With all the parameters estimated above, the last chart at the end of the section summarizes my assessment of its fair price using the DDM model. Note I used its FWD dividend of $2.06. The bottom line shows a fair price of ~$65. It’s close to its current price of $64 as of this writing.

There’s nothing wrong with holding a solid stock like NEE at a fair price. It’s just there’s no margin for safety as I can see.

Technical signs

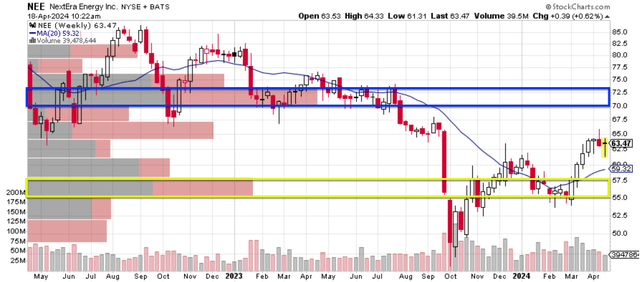

In terms of its technical trading pattern, I do not see strong signs of a definitive upward trend either. The chart below shows the price-volume information for NEE in the past two years, plotted on a weekly basis. The good news is that its prices have reversed the downward trend in October 2023, continuously making higher highs and higher lows since then.

But there are a few signs of weakness. First, the recent upward trend was not accompanied by strong trading volume. As seen, the trading volume was actually relatively low during periods of price rises. Secondly, the yellow box (around $57.5) and the blue box (around $70) highlight the two price ranges that, I think, are of particular interest in the near term. These are the ranges where the largest trading volumes have occurred in the past 1~2 years. I’m not sure if the stock has definitively overtaken the $57.5 range yet. Its current price is still quite close to $57.5 and again the recent rallies were not accompanied by large volumes. For its price to go up and challenge the $70 level, the large number of investors in the $57.5 range has to be first replaced by investors who are more enthusiastic about NEE.

Upside risks and final thoughts

I have been focusing on the negatives so far. But there are a few key upside risks too. The top two catalysts in my mind are Florida’s strong economy and NEE’s growth potential in renewables. Thanks to these catalysts, NEE’s utility subsidiary, Florida Power & Light (FP&L), saw strong growth driven by investment in the business. Regulatory capital employed increased by approximately 12.5% in 2023 and the utility’s return on equity came in at the top of its allowable range of 9.8%-11.8%. Meanwhile, NextEra’s power generation subsidiary grew its annual earnings by 12.9% as it continues to experience healthy nationwide demand for renewable energy and battery storage projects. Given Florida’s robust economy, I expect the state to keep attracting migration and growing its appetite for power, especially from renewable sources. Thanks to these secular tailwinds, I expect NEE to keep maintaining good profitability and a growing customer base in the long term (e.g., FP&L’s average number of customers increased by nearly 81,000 over the past year alone).

To reiterate, I see nothing wrong with holding a solid stock like NEE at a fair price or even at a slight valuation premium. However, potential investors need to be aware that its large price correction and high dividend yield relative to its historical record can be misleading. These developments only reflect the deflation of its bubbling valuation.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

As you can tell, our core style is to provide actionable and unambiguous ideas from our independent research. If your share this investment style, check out Envision Early Retirement. It provides at least 1x in-depth articles per week on such ideas.

We have helped our members not only to beat S&P 500 but also avoid heavy drawdowns despite the extreme volatilities in BOTH the equity AND bond market.

Join for a 100% Risk-Free trial and see if our proven method can help you too.