Summary:

- NextEra trades at a significant premium.

- The company is in a unique position in the industry due to the long-term decarbonization trend.

- NextEra increases dividends at a faster pace.

- I think NextEra’s valuation is justified, compared to other green companies, given its strong position in the market.

SergiyMolchenko

Main thesis

NextEra Energy (NYSE:NEE) is trading at a significant premium to the utility industry and the market. At first glance, it may seem that the company is overvalued. However, this is not quite true in my opinion.

I attribute this valuation by the market to the significant progress in the transformation that has allowed NextEra to capture a significant share of the US renewable energy market, as well as faster growth in shareholder payouts than the industry.

NextEra valuation

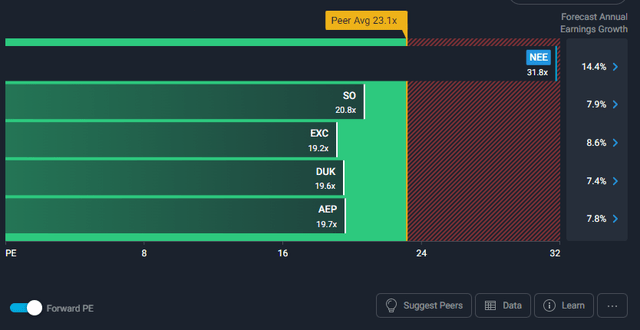

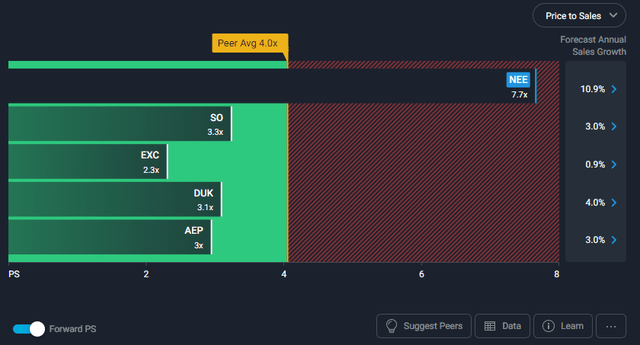

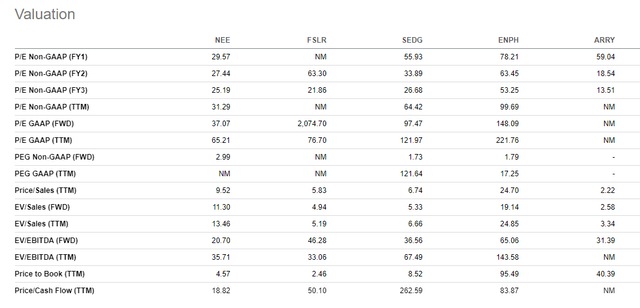

The market values NextEra at a forward P/E of 31.8x, which is much higher than its peers.

NEE stock also looks expensive in the forward Price-to-Sales metric.

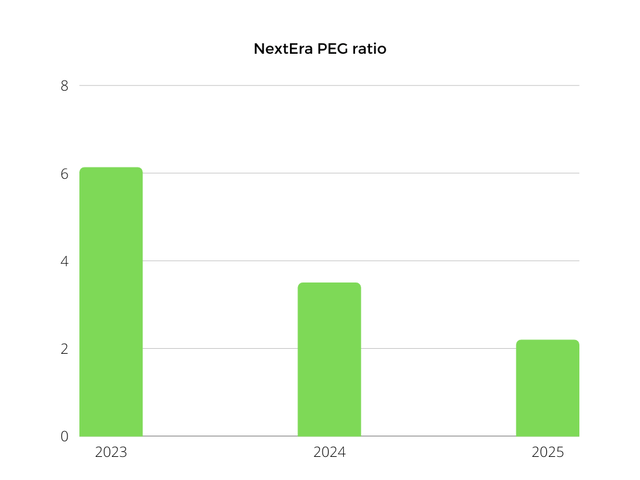

Talking about the earnings growth in the future, taking into account the upper limit of the EPS forecast provided by the company for 2023 and the P/E ratio of 66.8x, the PEG for 2023 will be 6.13x, and the PEG for 2025 will be 2.2x. This is quite expensive for a utility company.

NextEra position

Renewable energy sources are the most promising segment in the electric power industry due to the long-term decarbonization trend. This trend positions NextEra Energy as one of the leading players in the US alternative energy market.

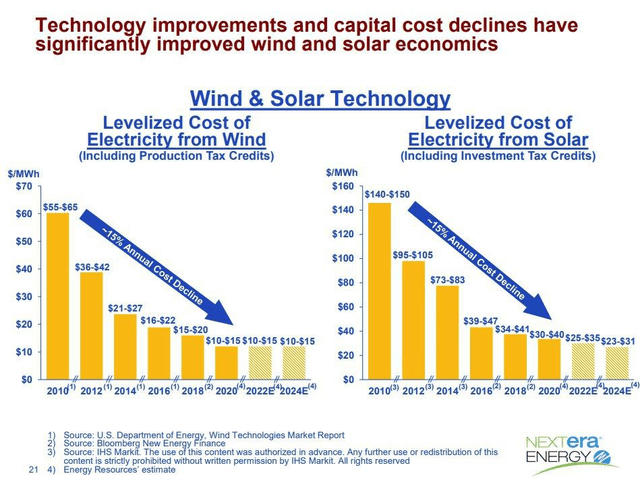

Green energy is a very efficient way to generate energy. The price per unit of electricity powered by renewable fuels is already comparable to its traditional counterparts. In 2021, the cost of coal ranged from $65 to $152, and the cost of a combined cycle plant only ranged from $45 to $74. As for renewable energy, the levelized cost of solar energy was in the $30-$41 range and the cost of wind energy ranged from $26 to $50.

Thus, the production cost of NextEra is lower than that of its competitors. The costs should continue to decrease for the next 10 years and by 2024, according to forecasts, NextEra will produce 1 kWh from wind at an average of $10-$15, and solar energy at $23-$31.

Low costs are reflected in lower prices. For example, as energy prices soared, the typical Florida Power&Light customer’s monthly bill increased by 18%. However, the price remains below the state average of $214/month for 1,566 kWh. For the same amount of power, the FPL customer paid $189.

To meet ambitious carbon reduction targets, the government plans to shift over time to alternative sources of industrial consumers, transport, boilers, and buildings. In addition, the company benefits from the favorable environment in Florida. Florida’s economic growth is supporting the operational and financial growth of FPL’s core business. The state is one of the main places for high-income migrant workers against the background of the rapid development of high-tech companies. The state ranks no. 40 in US “green” rankings. The state will likely have to move green at a faster pace in the future, which could have a positive effect on the company.

For a utility company, it is necessary to constantly increase capacity. NextEra plans to spend over $60 billion in CapEx to expand the business. This investment will add an additional 30,000 megawatts of renewable energy to the portfolio. By 2024, NextEra Resources plans to expand wind, solar, and battery holdings by 23 to 30 GW, or by about 150 percent.

The company also enters new adjacent markets, which allows it to expand its presence in the industry and provide growth points in non-tariff niches. Last year, the company formed a joint venture with FirstGroup to electrify 43,000 school and public buses in the US and Canada. In January, the company announced its plans to deploy a nationwide US electric trucking network.

Dividends

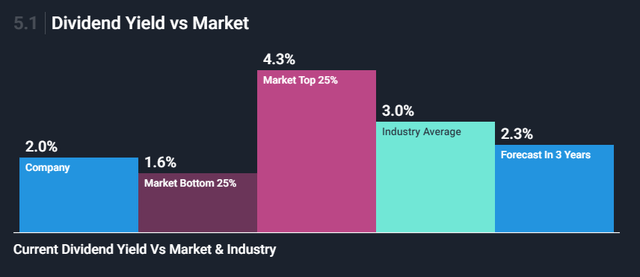

NextEra’s dividend yield is 2.1%, which is below the industry average of 3%.

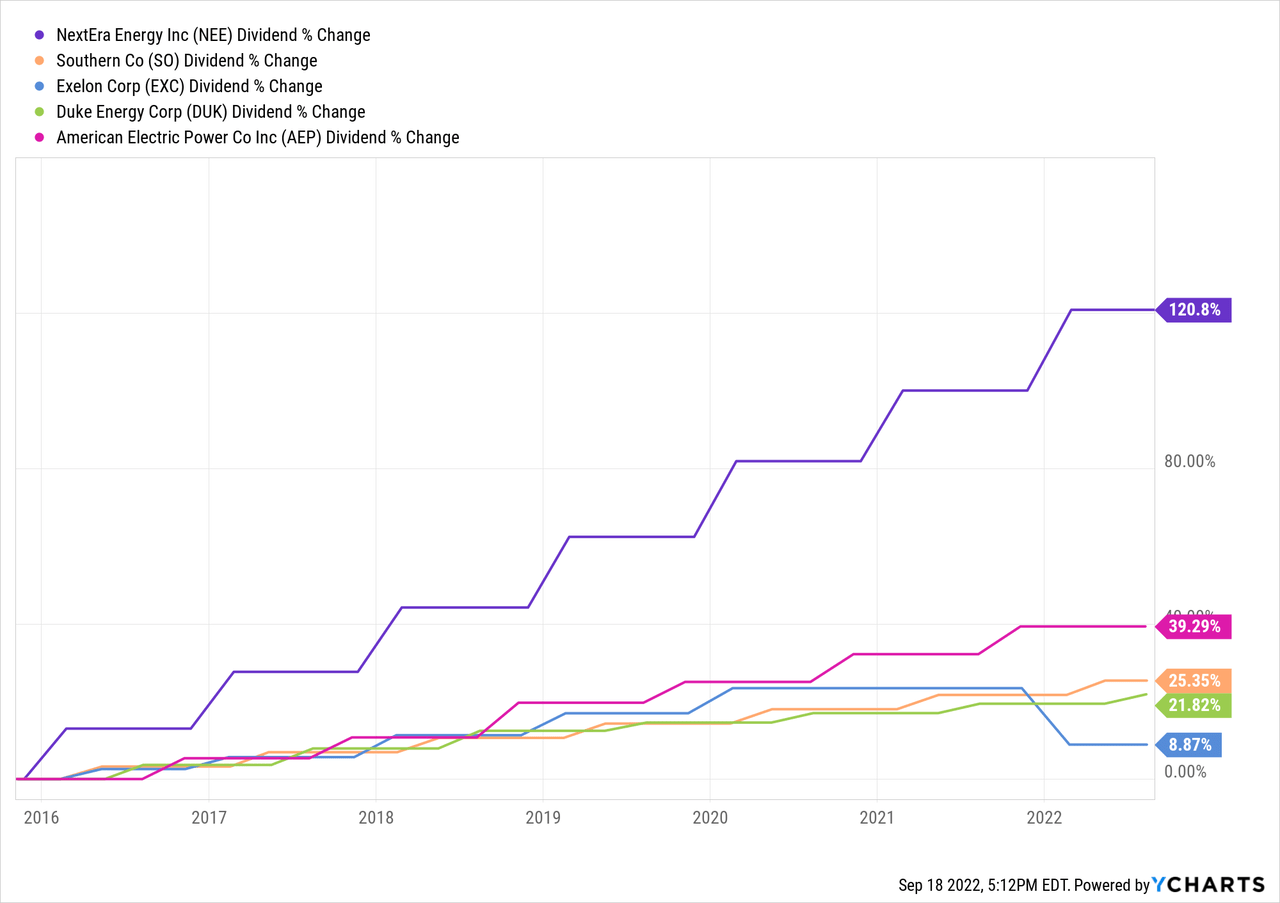

However, the company has been compared to more conservative and slow-growing utilities. NextEra, on the other hand, combines growth in market share and production capacity with good payouts. Its dividend has increased by 120% over the last 7 years.

NextEra is the only one in the industry to raise dividends at this rate. The company can be evaluated as a dividend growth story.

Why NextEra deserves a premium valuation

A comparison of NextEra with traditional US (partially regulated) utilities shows that NEE shares are trading at a significant premium. I attribute this to significant progress in transformation, which has allowed the company to capture a significant share of the US renewable energy market, as well as faster growth in shareholder payouts than the industry.

NextEra justifies a premium valuation as the company now has over 22GW of wind and solar generating assets, which are far more valuable than traditional energy assets in my opinion. I believe that the market evaluates the company as an industry leader, and most importantly, a green company.

I also believe that NextEra should be compared more with companies focused on the renewable energy market, like First Solar (FSLR), SolarEdge (SEDG), and Enphase Energy (ENPH).

It is becoming clear to me that these companies are being rewarded for their green business propensity.

Conclusion

NextEra is quite expensive compared to its traditional peers in the utility industry. Absolute leaders, distinguished by a special manner of doing business, are usually highly valued by investors.

NextEra is a green company and should be treated this way. Compared to green peers, the company looks quite adequately valued, given its strong position in the renewable energy market.

I expect further operational and financial growth through increased consumer demand for clean energy, cost control, and continued tax incentives. This should support the company’s results and allow the company to grow faster than the sector.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in NEE over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.